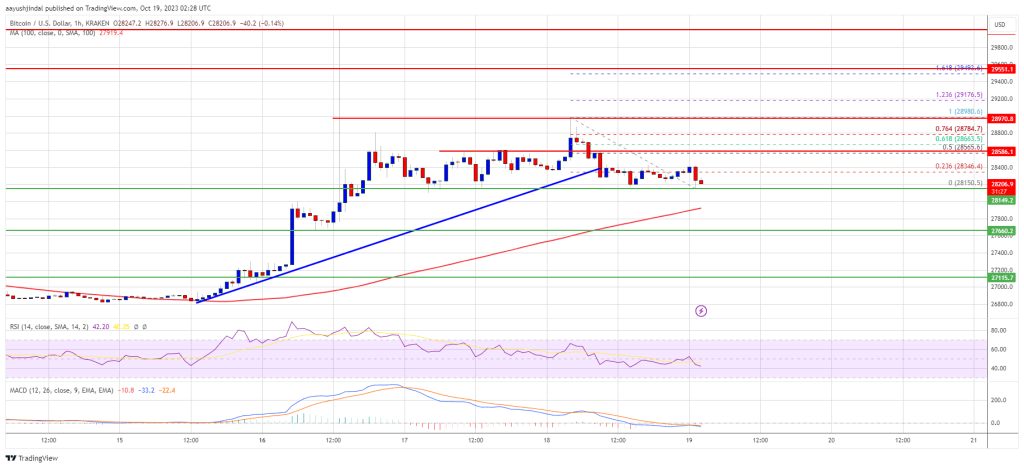

Bitcoin price is slowly falling below the $28,500 level. BTC could drop towards the $28,000 level or the 100 hourly SMA before the bulls take a stand.

- Bitcoin is struggling to gain traction on a move above the USD 28,500 level.

- The price is trading above USD 27,750 and the 100 hourly Simple Moving Average.

- There was a break below a key bullish trendline with support near $28,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could revisit the 100 Hourly Simple Moving Average before attempting another rise.

Bitcoin Price Extends Downward Correction

Bitcoin price started a downward correction from the USD 30,000 resistance zone. BTC struggled to stay in a positive zone and settled below the $28,500 pivot level.

Recently, the bears pushed the price below the USD 28,200 level. Additionally, there was a break below a key bullish trendline with support near $28,400 on the hourly chart of the BTC/USD pair. A low is formed near USD 28,150 and the price is now consolidating losses.

Bitcoin is now trading above $27,750 and the 100 hourly Simple Moving Average. On the upside, immediate resistance is around the $28,550 level. It is close to the 50% Fib retracement level of the recent decline from the $28,980 swing high to the $28,150 low.

The next major resistance could be near $28,800, or the 76.4% Fib retracement level of the recent decline from the $28,980 swing high to the $28,150 low.

Source: BTCUSD on TradingView.com

The main resistance is now near the $29,000 zone. A clear move above the USD 29,000 resistance zone could set the pace for a bigger rise. The next major resistance could be at USD 29,500. Any further gains could send BTC towards the $30,000 level.

Lose more in BTC?

If Bitcoin fails to rise above the USD 28,550 resistance zone, it could slide further. The immediate downside support is near the USD 28,150 level.

The next major support is near the $28,000 level and the 100 hourly Simple Moving Average. A downside break and a close below the $28,000 support could lead to more losses in the near term. The next support is at $27,660, below which $28,120 could test.

Technical indicators:

Hourly MACD – The MACD is now gaining speed in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major support levels – USD 28,150, followed by USD 28,000.

Major resistance levels – $28,550, $28,800 and $29,000.