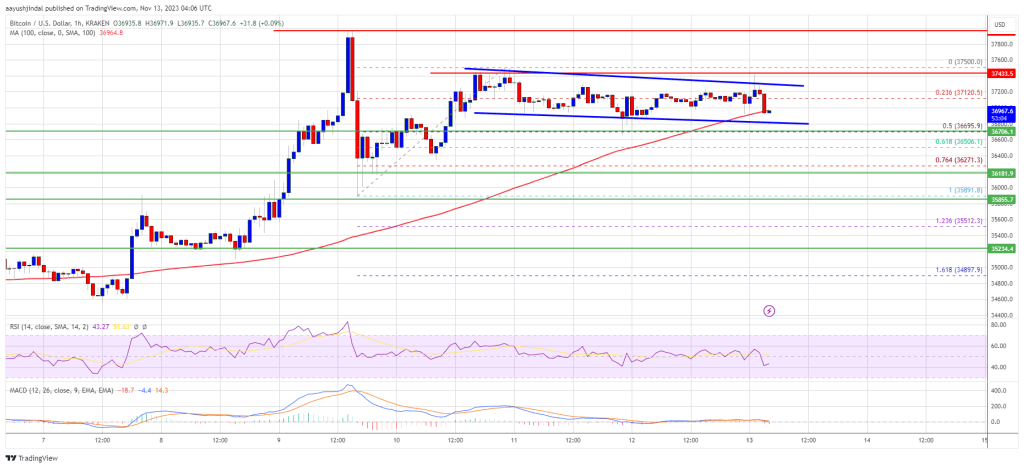

Bitcoin price corrects gains from the $38,000 zone. BTC is now consolidating and could aim for more gains above the USD 37,250 resistance zone.

- Bitcoin started a downward correction from the USD 38,000 resistance zone.

- The price is trading near $37,000 and the 100 hourly Simple Moving Average.

- A short-term descending channel is forming with resistance near $37,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is consolidating gains and could start a new rise towards $38,000.

Bitcoin price remains in rising trend

Bitcoin price started a new rise above the USD 36,800 resistance zone. BTC gained pace for a clear move above the $37,000 resistance zone to move further into a positive zone.

It even rose towards $38,000 before a downward correction to $35,850. Recently, there was a new increase above the USD 37,250 level, but the bears were active around USD 37,500. A high is formed near USD 37,500 and the price is now consolidating gains.

There was a decline below the USD 37,250 level. The price tested the 50% Fib retracement level of the upward move from the $35,891 swing low to the $37,500 high.

Bitcoin is now trading near $37,000 and the 100 hourly Simple Moving Average. On the upside, immediate resistance is around the $37,200 level. A short-term descending channel is also forming with resistance near $37,250 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

The next major resistance could be near USD 37,500, above which the price could accelerate further. In the said case, it could test the USD 38,000 level. Any further gains could send BTC towards the $38,800 level.

More disadvantages of BTC?

If Bitcoin fails to rise above the USD 37,250 resistance zone, it could continue to decline. The immediate downside support is near the $36,700 level.

The next major support is near the $36,500 zone or the 61.8% Fib retracement level of the upward move from the $35,891 swing low to the $37,500 high. If there is a move below $36,500, there is a risk of more downside. In the mentioned case, the price could fall towards the key support at USD 36,000 in the short term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major support levels – USD 36,700, followed by USD 36,500.

Major resistance levels – $37,250, $37,500 and $38,000.