- Market sentiment around BTC turned bullish.

- Selling pressure on the currency was relatively low.

Bitcoin [BTC] continued to trade above the $70,000 mark, and things could soon get better for investors. The latest analysis suggested that BTC rose a resistance level, allowing it to reach an all-time high.

Does this guarantee another bull rally for BTC?

Bitcoin is holding strong

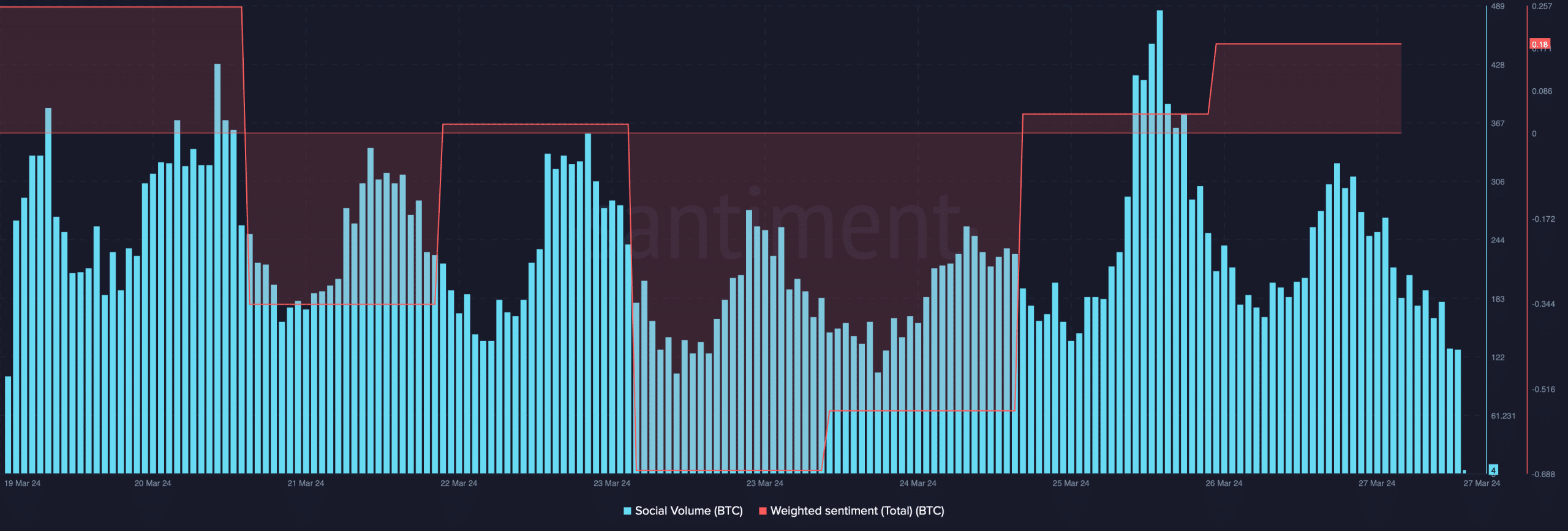

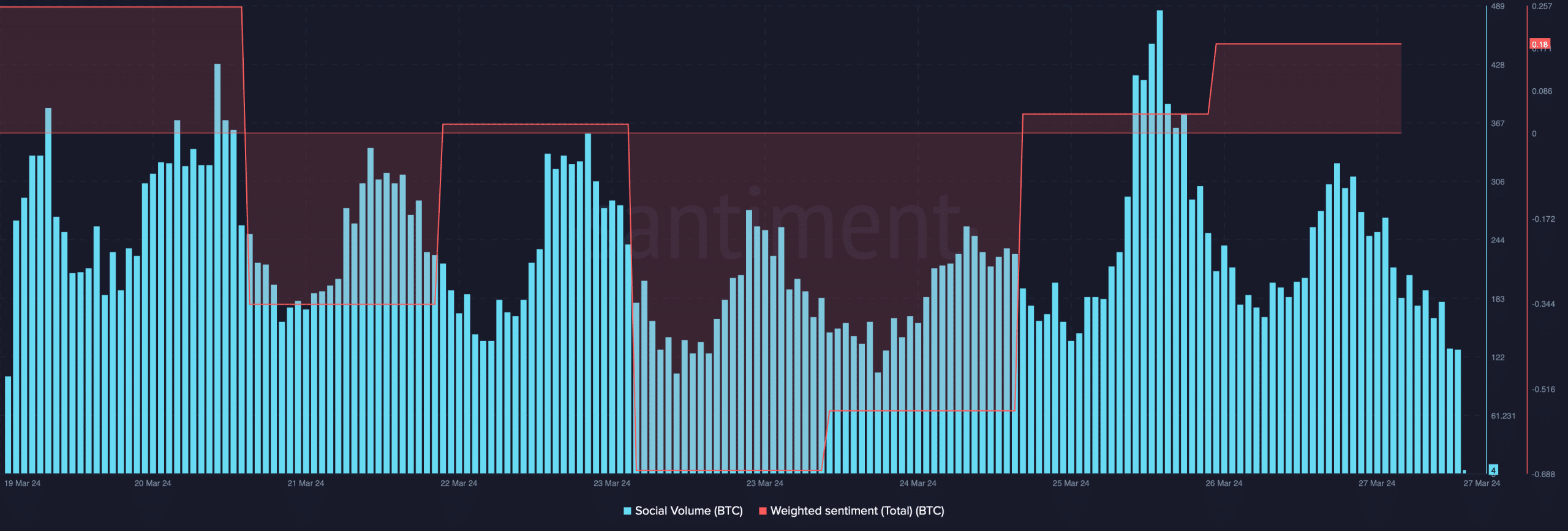

According to CoinMarketCapthe king of the cryptos has risen by more than 12% in the past seven days. Thanks to the recent uptrend, BTC social volume has soared in recent days.

Moreover, weighted sentiment moved into the positive zone, indicating that bullish sentiment around the token increased.

Source: Santiment

In the meantime, Ali, a popular crypto analyst, posted analysis to highlight an interesting fact. According to the tweet, the price of BTC rose above a key resistance level at $70.8k.

This indicated a further upward trend in the coming days. To check if the uptrend could happen, AMBCrypto checked BTC’s statistics.

Are Investors Selling Bitcoin?

As the value of BTC crossed a resistance level, AMBCrypto checked other metrics to find out if people are buying BTC.

According to our analysis of CryptoQuant’s facts, BTC’s foreign exchange reserves fell, keeping selling pressure on the currency low.

TThe miners’ position index showed that they were selling their assets within a moderate range compared to their annual average.

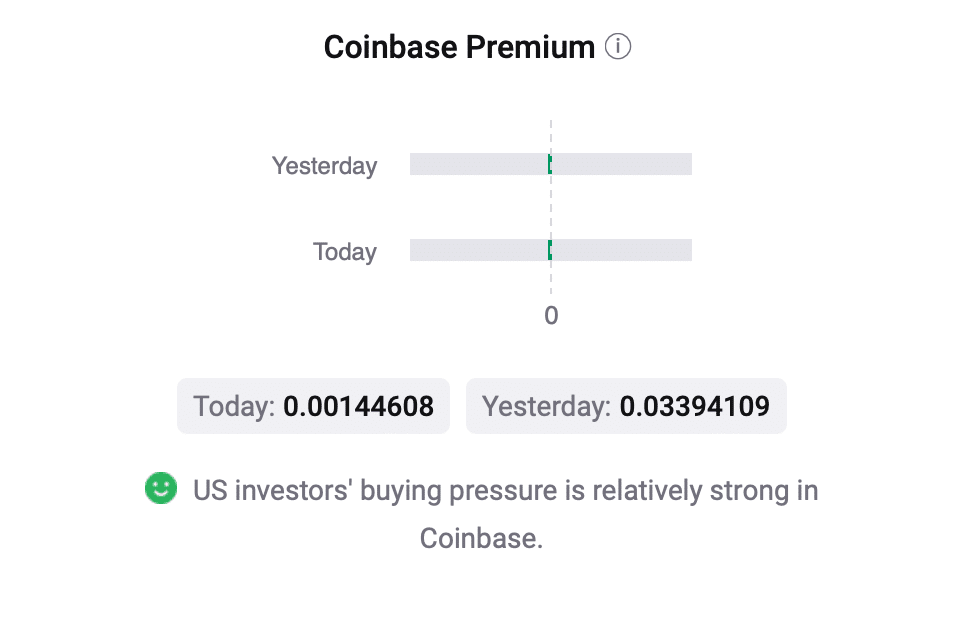

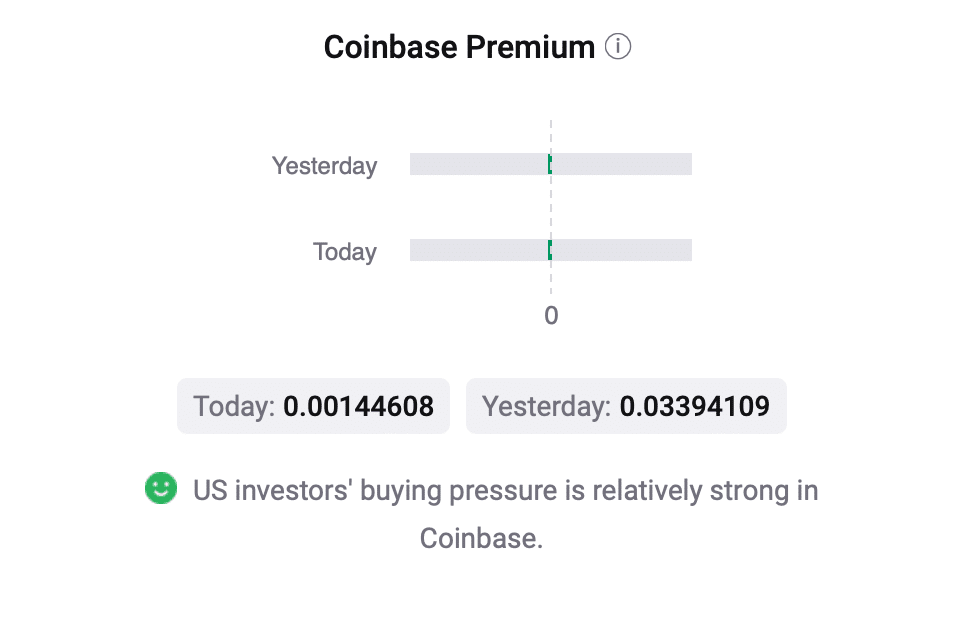

Moreover, buying sentiment among US investors was dominant, which was clearly reflected in the green Coinbase premium.

Source: CryptoQuant

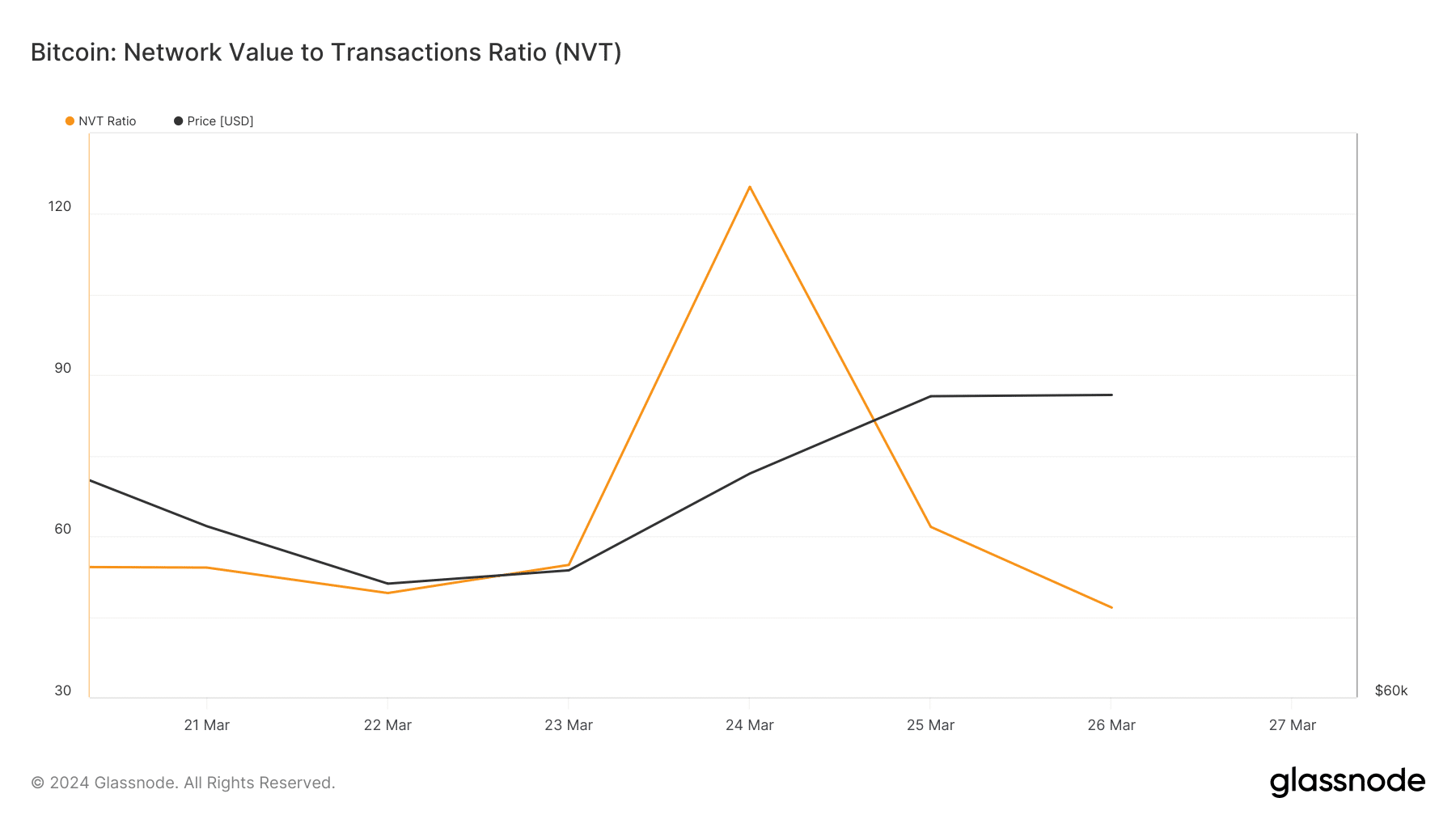

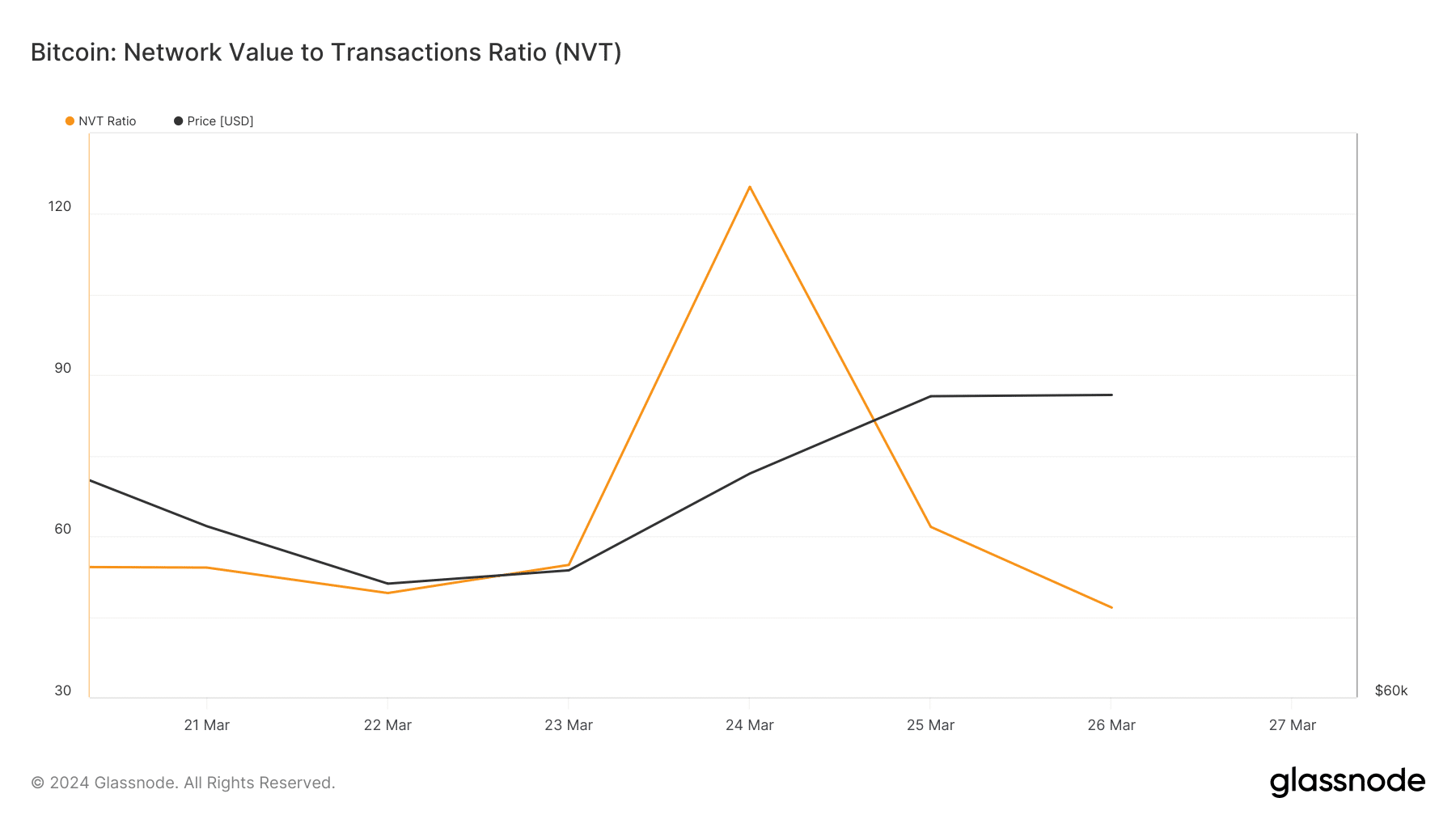

The chances of BTC continuing its uptrend were even higher when we analyzed Glassnode’s data. We found that BTC’s Network Value to Transactions (NVT) ratio decreased.

To start, the NVT ratio is calculated by dividing the market capitalization by the transferred on-chain volume measured in USD.

When the benchmark falls, it means an asset is undervalued. This indicated that BTC investors could soon witness another bull rally of the token.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024-25

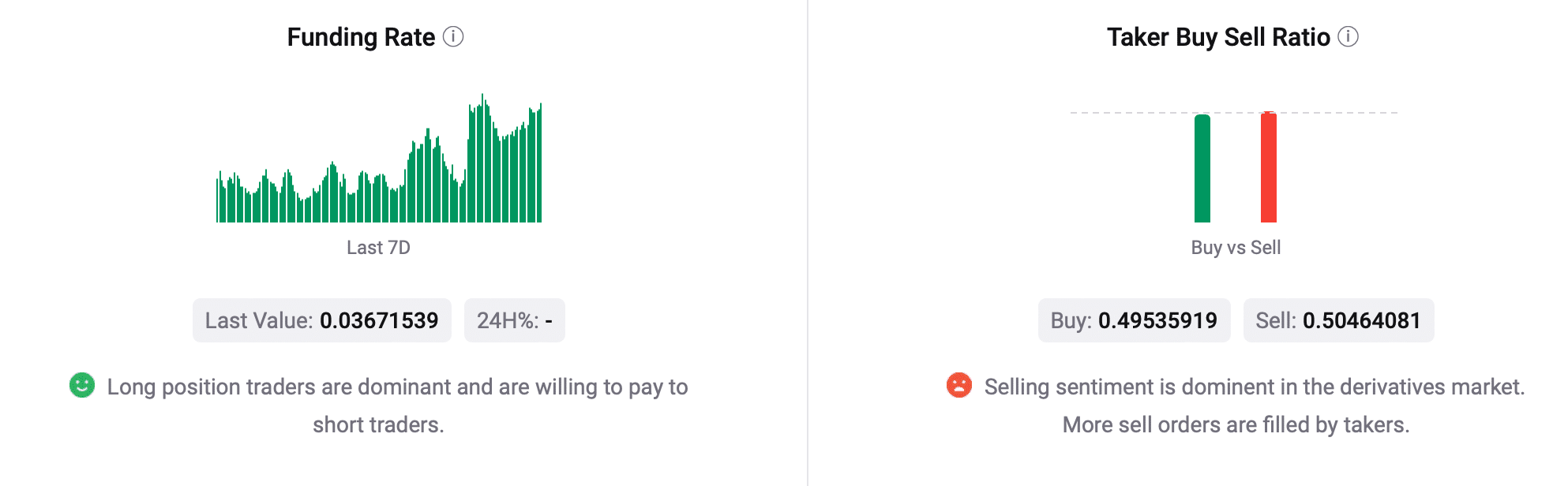

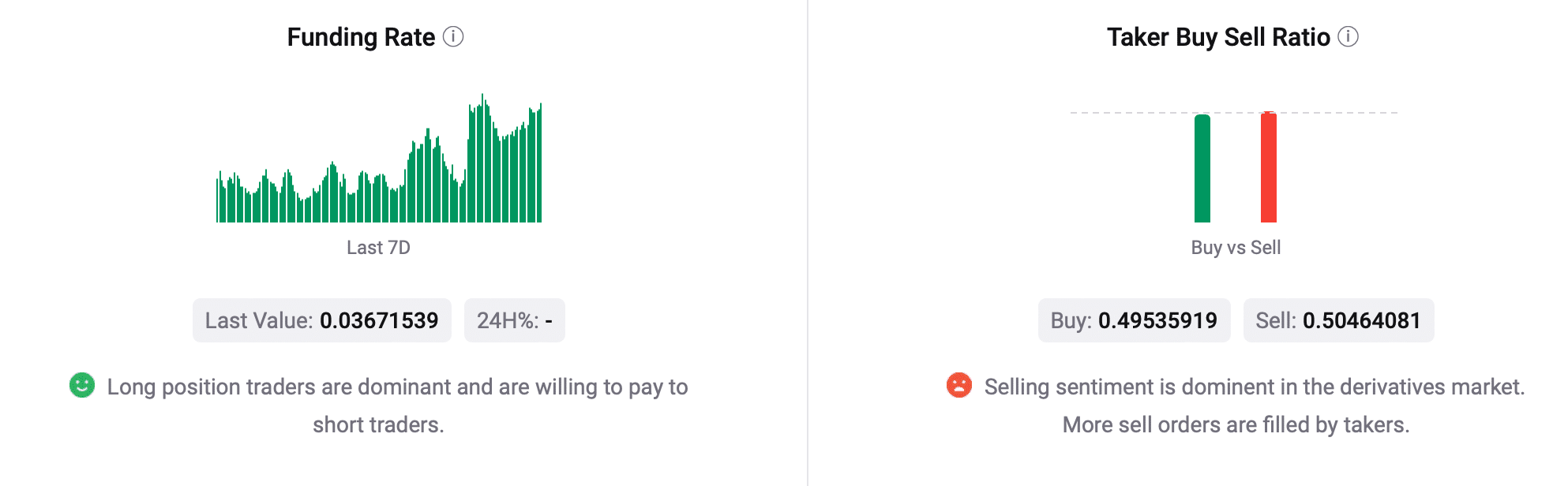

To better understand what to expect from BTC, we next looked at its derivatives metrics. They also looked quite bullish as the funding rate was high.

This meant that derivatives investors were actively buying the coin at the time of writing. However, the Taker Buy Sell Ratio was red, indicating that selling sentiment was still dominant in the derivatives market.

Source: CryptoQuant