- Bitcoin was confronted with $ 106k resistance, with RSI near Overbought and BVV shows stuck purchasing pressure.

- Dense long positions between $ 101k $ 106k can activate liquidations if BTC falls under the key support.

Bitcoin [BTC] shows signs of a potential shift, because recent data emphasizes a remarkable increase in long positions that have been clustered between the range of $ 101k $ 106k.

Although a price racement could cause liquidations, indicators in chains reveal new accumulation of retail investors and large holders.

This growing trust suggests that the market may enter the early stages of a bullish reversal.

Bitcoin -portfolios enter the purchase mode

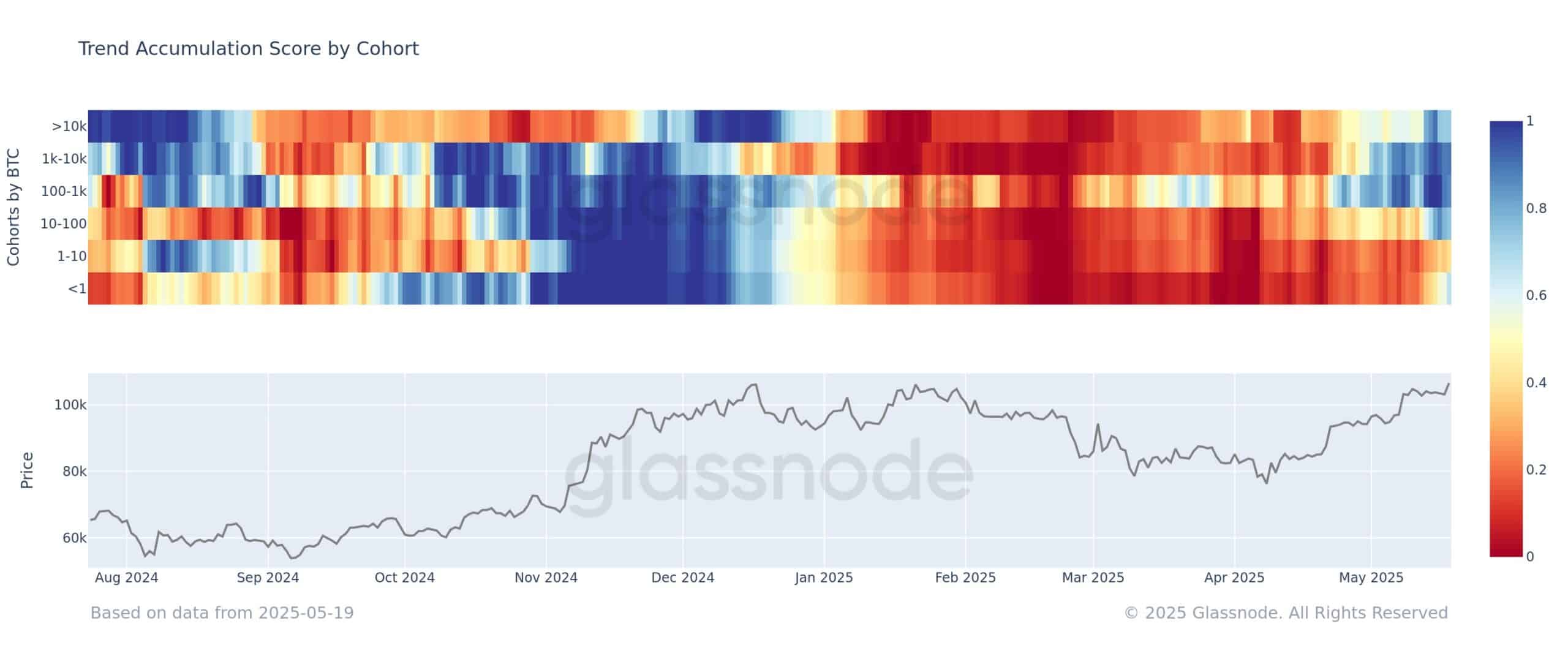

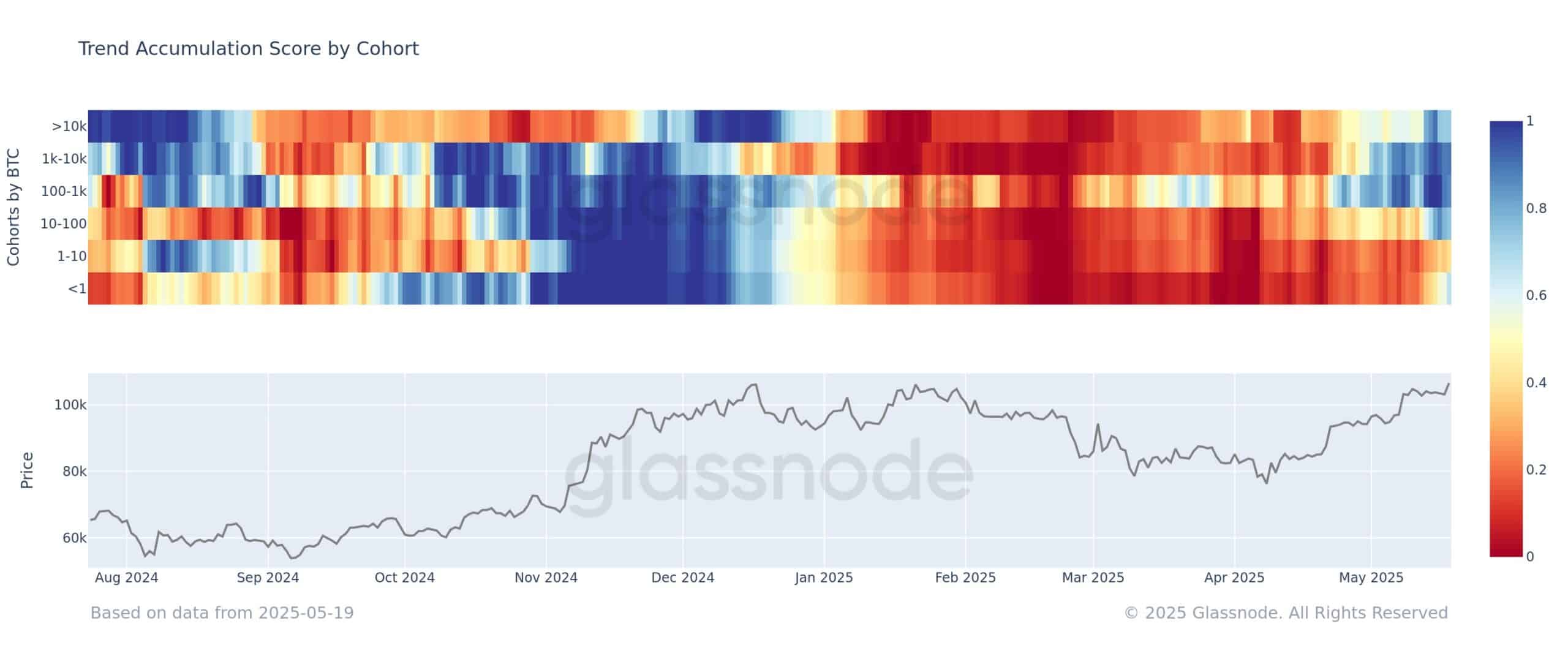

Recent data from Glassnode unveiled A clear change in market behavior, with accumulation trends that now include almost all wallets sizes.

Smaller holders with less than 1 BTC have reversed their earlier distribution trend and are now lightly collected, reflected in an accumulation score of approximately 0.55.

Source: Glassnode

In the meantime, larger wallet show cohorts – which exhibit between 100-1,000 BTC and 1,000 – 10,000 BTC – even stronger accumulation trends.

The only segment that is still in the net distribution mode is the reach of 1-10 BTC, which strengthens a broader revival in confidence compared to the Bitcoin price action.

Clustered long positions can strengthen the close volatility

An important concentration of long positions between $ 101k and $ 106k has formed a risky liquidity zone.

According to Alfractal dataThis setup increases the vulnerability of the market for competitive liquidation cascades, especially if the price of Bitcoin falls under the threshold of $ 100k.

Source: Alfractaal

The potential for short liquidations on upward movements, on the other hand, seems relatively limited. With a long exposure in this zone heavily stacked, all signs of weakness in BTC can quickly unravel in forced sales and increased volatility.

Price stalls near Resistance

As can be seen on the daily graph, BTC showed signs of exhaustion just below the level of $ 106k. Despite the short touch of $ 106,813, BTC did not succeed in closing above this key resistance, and slid a little to $ 105.504 on the press.

Source: TradingView

At the time of writing, the RSI was 69.42 – just under the overbough threshold – a sign of decreasing bullish momentum.

In the meantime, the OBV has been flattened around -86.6k and points to a break in Koop -side pressure.

If Bitcoin can retain support above $ 105k, an outbreak to $ 110k remains plausible. However, a dip below $ 101K could cause long liquidations and escalate the close volatility.