A popular crypto analyst is updating his view on Bitcoin (BTC) as a major event approaches.

Pseudonymous crypto trader Rekt Capital tells Its 53,700 YouTube subscribers know that Bitcoin is likely to repeat the 2016 pattern and rise heading into the BTC halving in mid-April, when miner rewards are halved.

However, the trader warns that Bitcoin could take a nosedive in the short term as the crypto king is in a reaccumulation range.

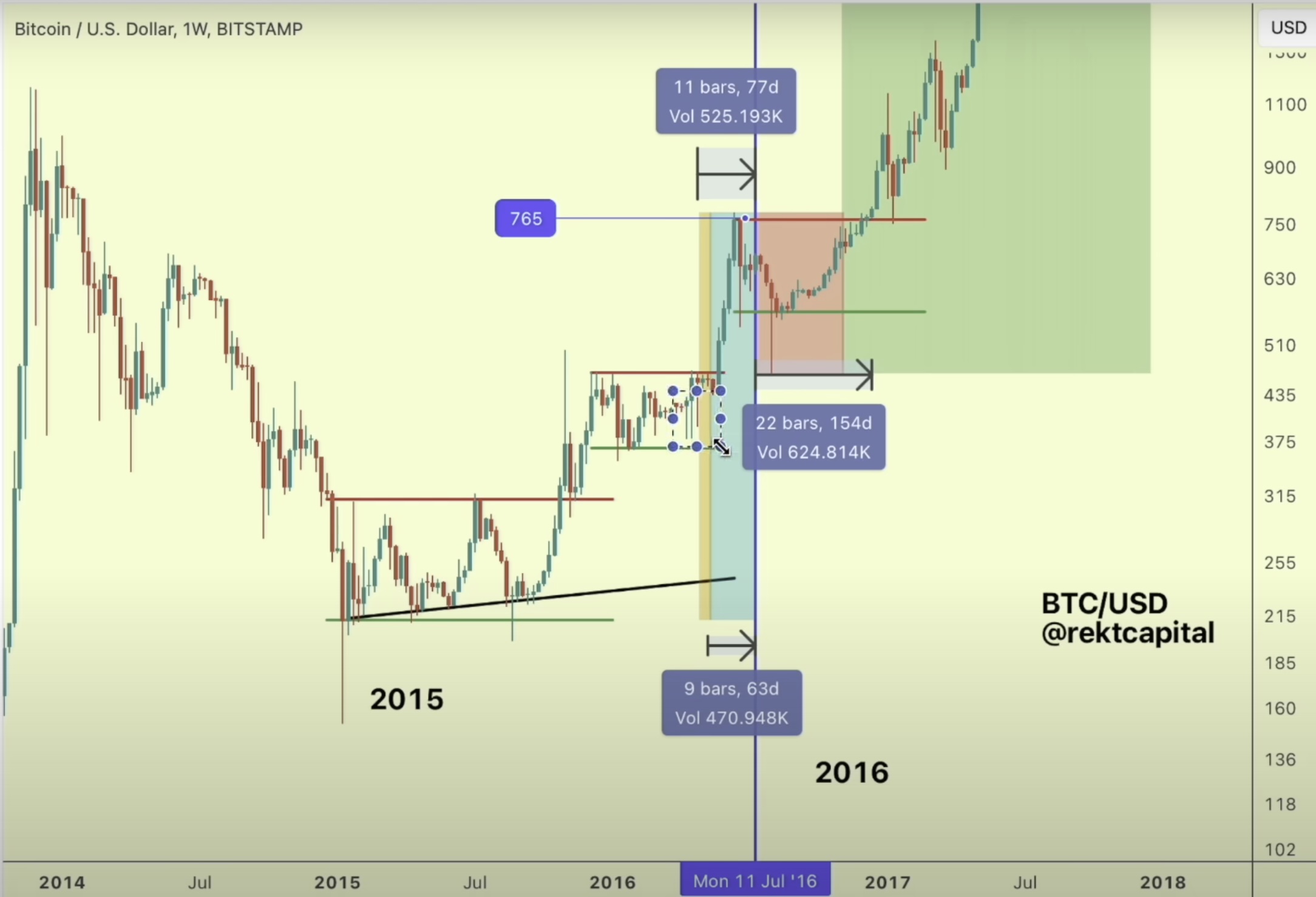

“So you can see that we are again in the reaccumulation range here, similar to 2016. And in 2016 we saw a downward deviation within the reaccumulation range.

What we see in this cycle is also downward absorption, but below the reaccumulation range, not within it, but just below it. Still, we pull back the retracement within this overall reaccumulation range and hold that reaccumulation range as we approach the halving.

So if history were to repeat itself based on 2016, we should see some sort of advantage in the pre-halving rally.”

Looking at his chart, the trader suggests that Bitcoin could rise to around $50,000 on the way to the halving.

The trader also believes that Bitcoin could fall and head back to the $38,000 level in the next two weeks.

“But the next two weeks will be quite interesting as they open up to potential still downside absorption below this reaccumulation range, as we saw in 2016. In 2016 you can see [in chart below] that there were several weeks of downward runoff within the reaccumulation range.

So if this is any indication, what if even in this cycle we still get sustained downward movement within the reaccumulation range, perhaps still a downward movement that deviates below that reaccumulation range.”

The trader also thinks there remains a small chance that the reaccumulation range will decrease, pushing Bitcoin below $38,000.

“Any downward deviation below this range in the current cycle is a possibility…

There are very specific conditions that Bitcoin simply has to meet to get below $38,000…

But as long as that reaccumulation range holds, we will only end up with a 21% pullback from the highs, and history suggests we will likely continue to maintain this reaccumulation range. in the halving.”

The trader suggests that a “worst case scenario” for a Bitcoin dip this cycle would be around the $32,000 level.

Bitcoin is trading at $42,938 at the time of writing.

I

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3