Bitcoin (BTC), the oldest and largest cryptocurrency network, is dealing with a controversial new feature that is dividing community opinion. Introduced in January 2023, the Bitcoin Ordinals protocol has caused an increase in transactions on Bitcoin. Described by some as Bitcoin NFTs, Ordinals bring a new type of utility to the Bitcoin network that has immediately resonated with users. It has, however, courted controversy because it is both leading to congestion on the network and is not designed to be a payment solution (check World Coin Stats for updated data and performance metrics on Bitcoin, as well as other cryptocurrencies).

Bitcoin is a decentralized, encrypted decentralized digital currency transfer network. Using blockchain technology, it allows for permissionless peer-to-peer transactions without needing to use intermediaries. It was created in 2008 by pseudonymous creator Satoshi Nakamoto and was released in 2009 as open-source software.

The Bitcoin network has utility as a medium to facilitate private transactions. It has been used for peer-to-peer payments, POS merchant sales, and online payments. It is also used for investments. The asset powering the network, bitcoin or BTC, has a digital gold-like value proposition. It has a limited supply of 21 million coins, so it has scarcity. It is also incredibly secure and has a hard-coded emission release schedule.

What Is A Bitcoin Sat?

Ordinals theory powers the controversial new Ordinals protocol. Ordinals theory defines satoshis (sats) as an atomic unit that can be identified and traded individually on the Bitcoin network. There are 100 million sats that makeup 1 Bitcoin. Bitcoin sats are ordered based on their sequence of mining, and this ordering number which uniquely identifies a satoshi, is the ordinal number.

These sats are uniquely identifiable, and can therefore be inscribed with digital content. This capability is the core of the Ordinals model. Once inscribed, an Ordinal-powered sat can become an immutable digital collectible. It can be attached to images, text, and a variety of other assets.

Ordinals were enabled by November 2022’s Taproot upgrade. Taproot enabled the Ordinals protocols and has opened the door for fungible or non-fungible tokens to be issued on the Bitcoin network.

There are a number of different use cases Ordinals can power. They have primarily been used to create non-fungible tokens (NFTs) but they are now gaining popularity as a way to issue fungible tokens. Ordinals power the BRC-20 standard which resembles Ethereum’s popular ERC-20 standard.

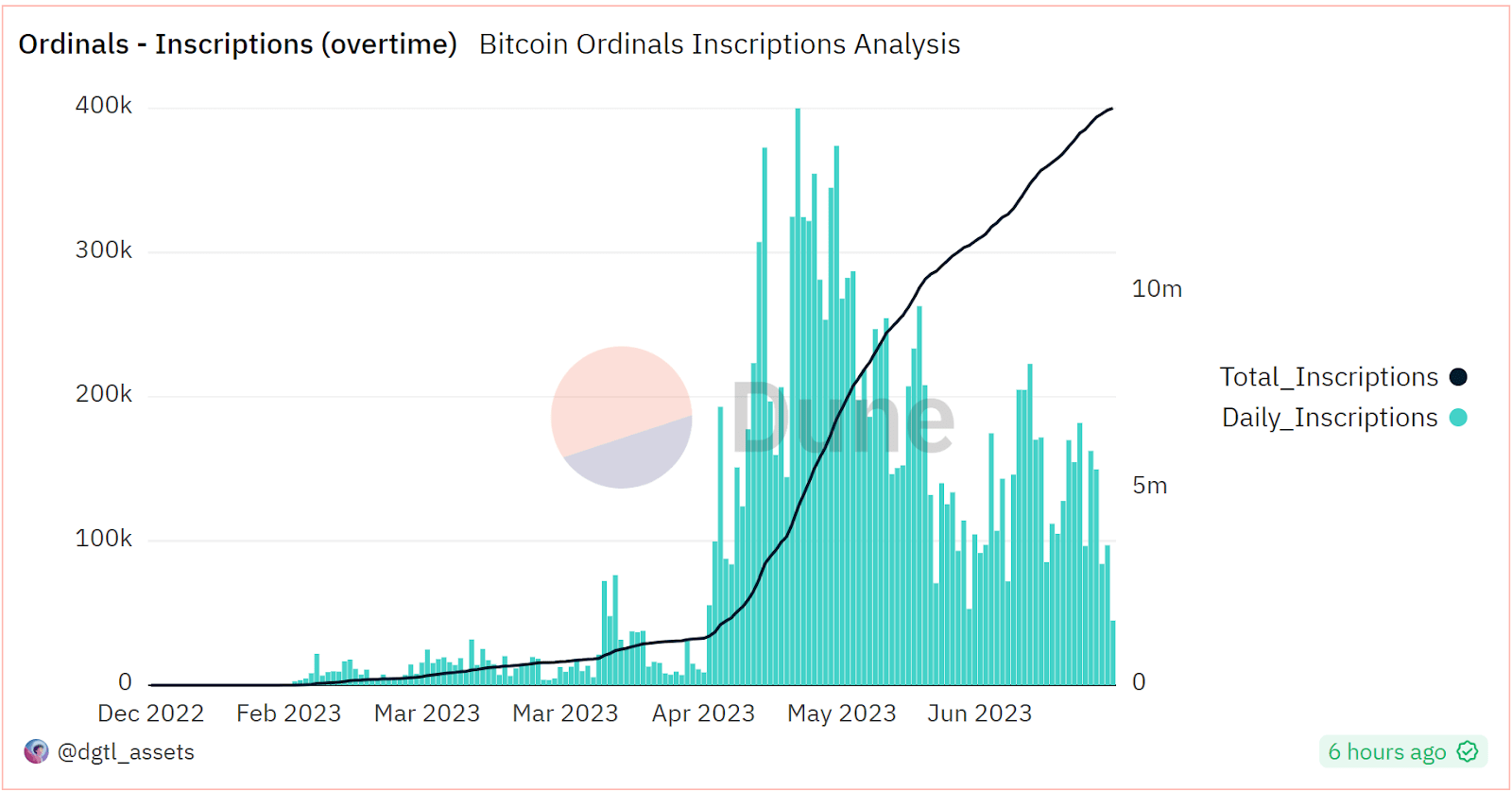

*Source: Dune Analytics, @dgtl_assets*

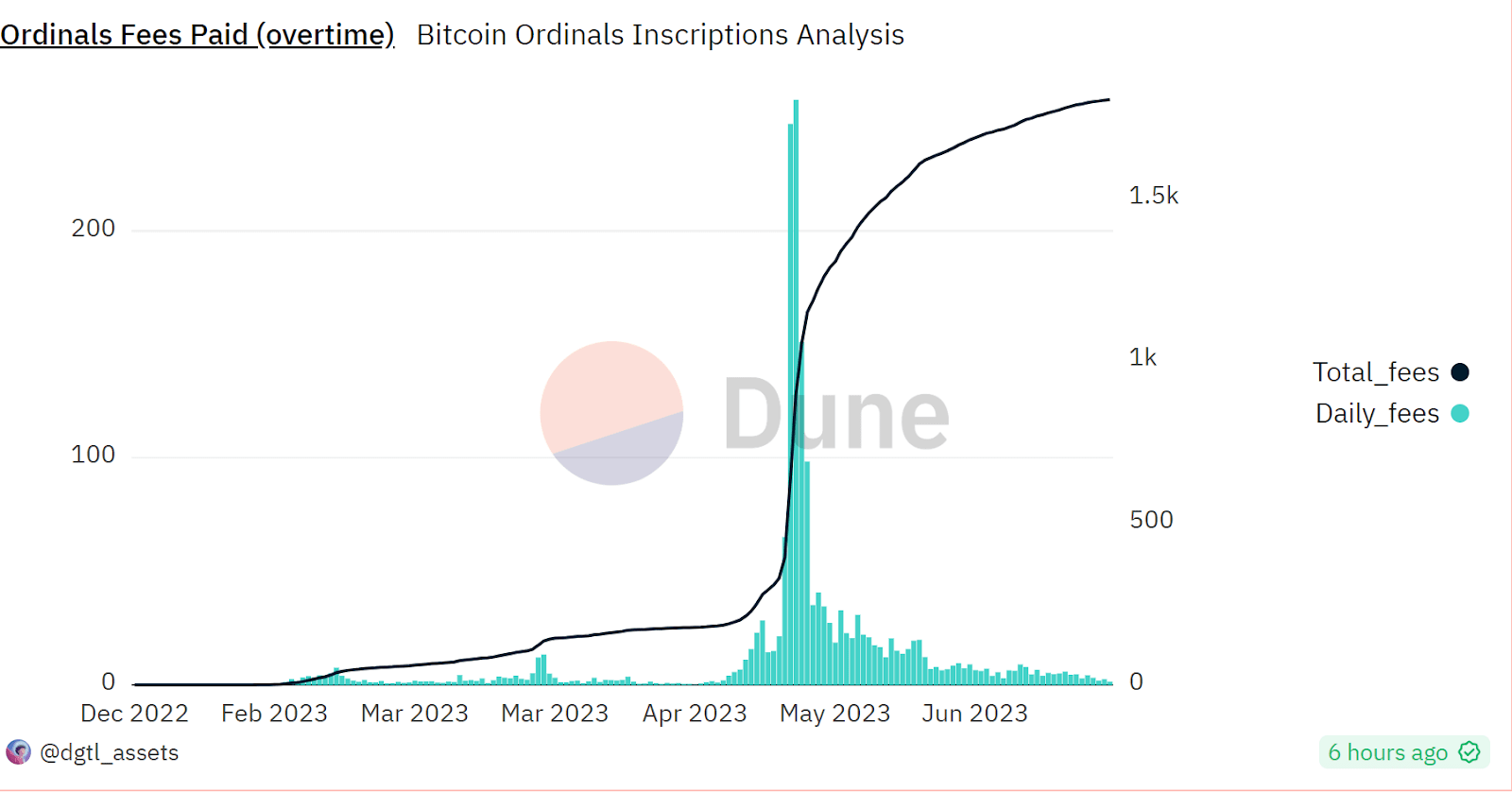

*Source: Dune Analytics, @dgtl_assets*

The total number of Ordinals inscriptions has exploded since the 3rd week of April. There tend to be around 100,000-200,000 new Ordinal inscriptions being made every day and there are now over 14 million inscriptions in the wild. This number has more than doubled since May 15th.

Particularly in terms of fees being generated, the momentum of Ordinals has dropped off considerably since the mid-May peaks. Ordinals are by no means dead, however, and are still being activlely created everyday.

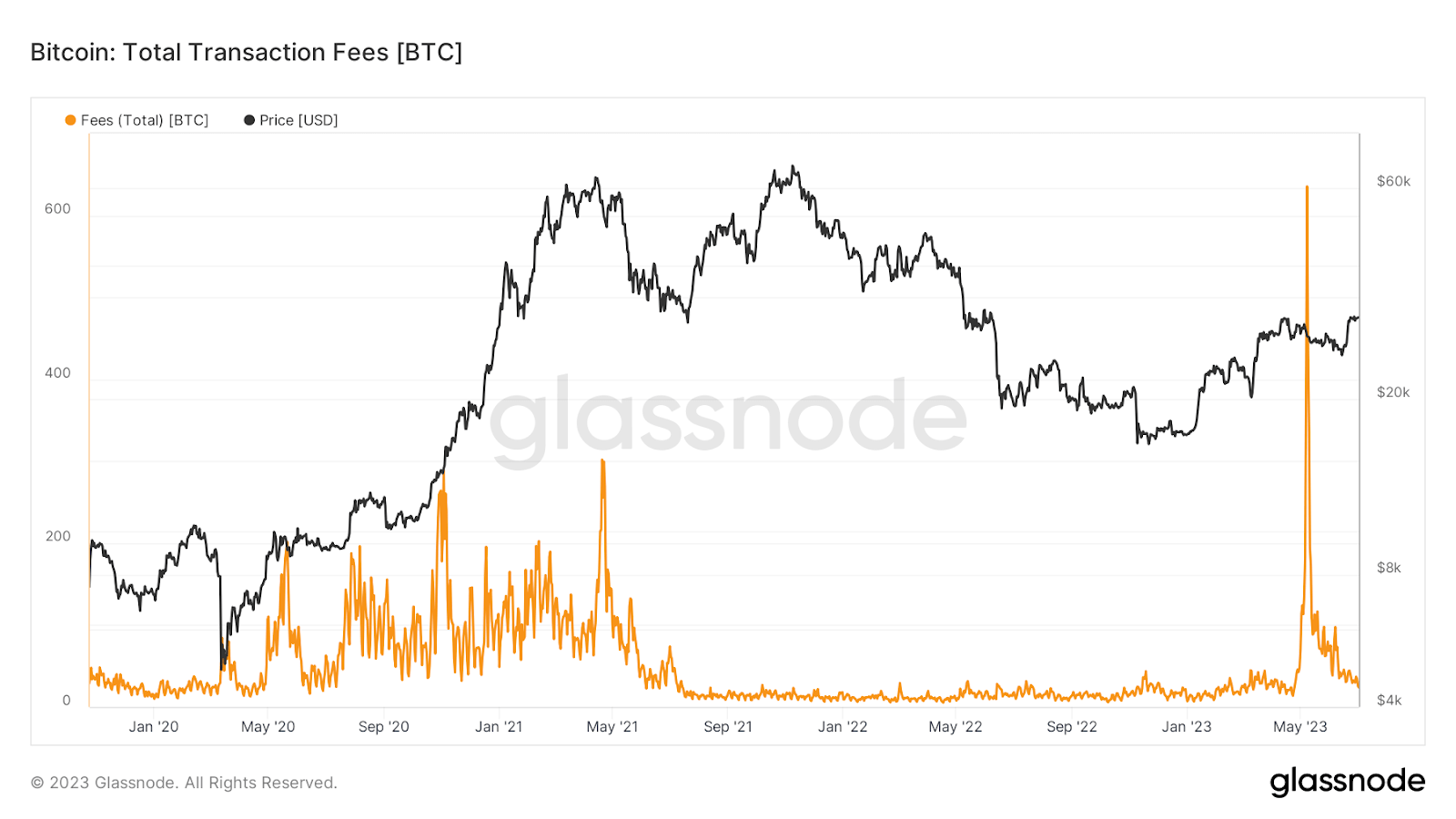

*Source: Glassnode, fees on the Bitcoin network surge*

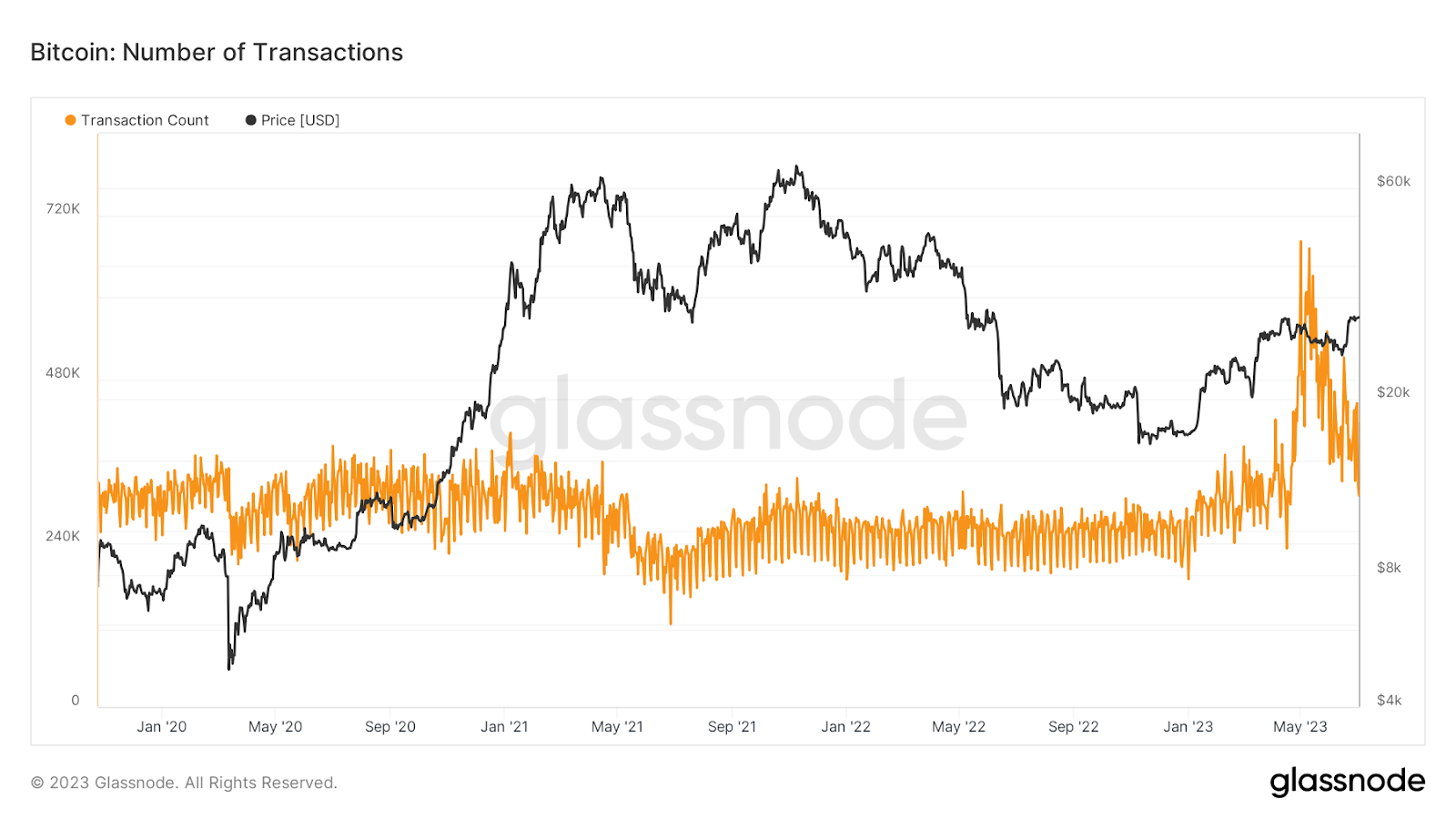

*Source: Glassnode, Transaction count on the Bitcoin network explodes*

A similar pattern can be observed with overall network activity on the Bitcoin chain. Bitcoin ordinals triggered a sudden sharp uptick in activity on the network in mid-May. This activity eventually fell away and the sharp peaks could not be maintained. Activity on the Bitcoin network, however, remains higher than pre-Ordinals levels.

Bitcoin Ordinals Clogging The Network

The emergence of Ordinals has had a clear impact on the wider Bitcoin protocol. While it has boosted transaction activity and increased demand to interact with Bitcoin, it has also bloated the network to the point of incapacity. The scalability of Bitcoin is yet again being questioned, with Ordinals now affecting the ability of Bitcoin to fulfill its primary function of peer-to-peer payment transactions.

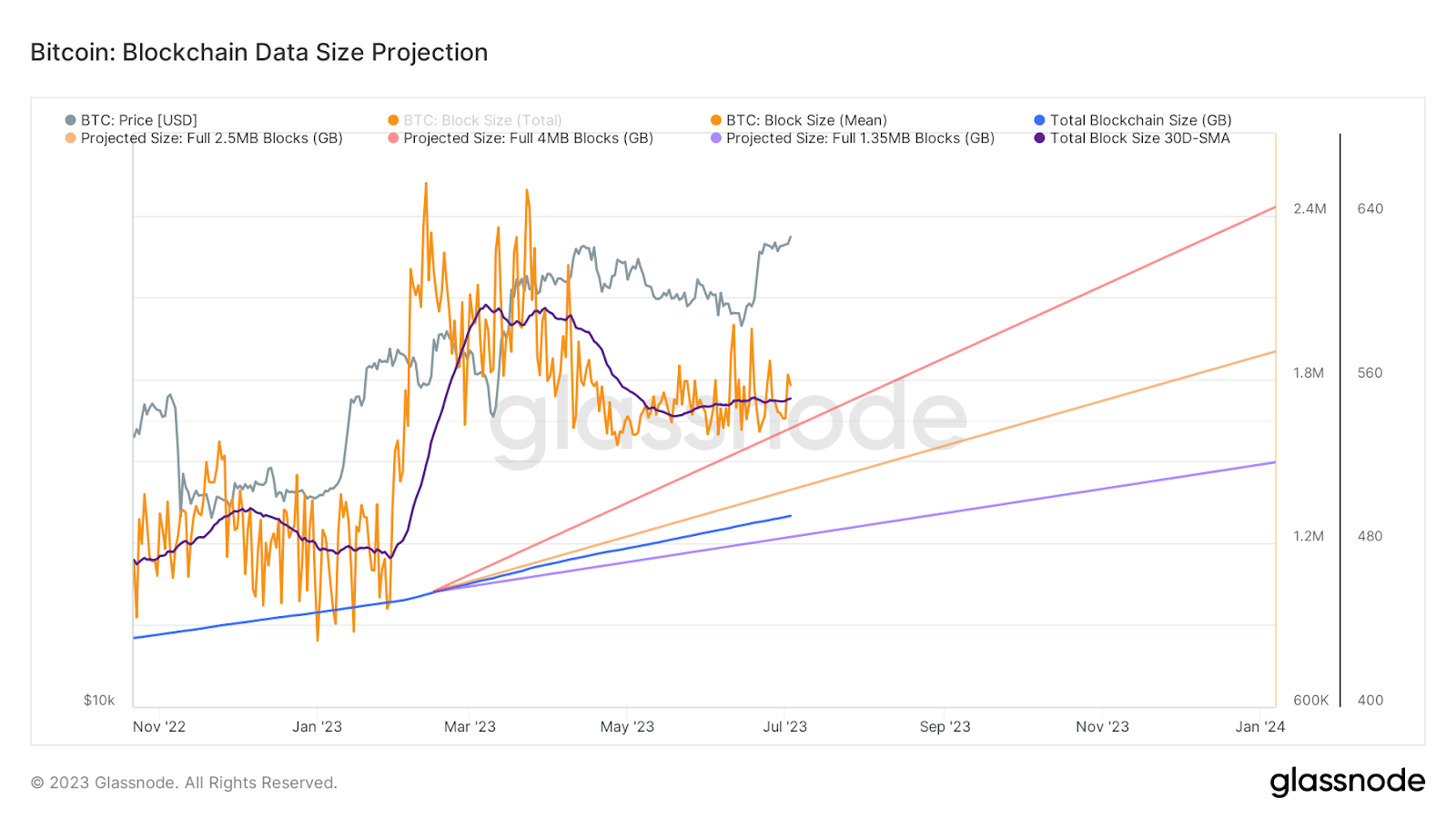

One of the factors leading to Ordinals bloating the network is the NFT size. Ordinal interactions are layered and can require close to Bitcoin’s max capacity of 4mb, standard Bitcoin transactions only take up a few kilobytes. The reason the Ordinals NFT size is so large is that they store data directly on-chain instead of pointing to a separate physical asset.

On June 17th, onchain data provider GLASSNODE’s Twitter account reported that concerns that the popularity of the Ordinals protocols would bloat the Bitcoin chain size to unfeasible levels, were exaggerated. The Onchain data provider has said that the Bitcoin block size is still growing at a manageable rate of 1.89MB per block. This means that future node runners will still be able to download the Bitcoin without excessive hardware requirements.

It is noticeable that the moving average of the total Bitcoin block size has leveled off considerably since the launch of Ordinals in January 2023. This suggests Ordinals creators have developed ways to efficiently create Ordinals and release them to the network.

Ordinals pushes Bitcoin further with the inception of BRC-20s

<span>Glassnode has recently reported that,</span> for only the 5th time in history, the average fee per block exceeded the block subsidy. The last instance of this occurring was the 2017 market peak. In all five of the historical cases, high fees eased and the network normalized. Glassnode say that the fee boom was driven by the popularity of the BRC20 standard, enabled by the Ordinals protocol.

Transaction fees reached 6.66BTC, well above the 6.25BTC block reward. This made the total miner reward a staggering 12.9BTC per block or ~US$348,000.

BRC-20 was created by anonymous developer Domo. They are similar to Ethereum’s ERC-20 custom token model but are not powered by smart contracts. This means that they are not able to be plugged into decentralized applications or have multiple functions like Ethereum tokens. Users can presently only mint, deploy and transfer tokens.

Not all Ordinals are BRC20s but all BRC20s are Ordinals. While there are millions of Ordinals there are around 35,000 BRC20s. The market cap of BRC20s has quickly risen to ~US$163 million but has dropped from peak levels hit late May and early June.

BRC20s function using JSON to initiate simple token contracts, create new tokens and move tokens around. The limited functionality has meant that they have become a popular way to issue meme coins which are designed to have no utility and act more as community badges. Some of the largest BRC20s include PEPE, MEME, and BRUH. Ordi–the largest BRC20–has a market cap of ~US$149 million and is listed on exchanges such as Crypto.com and Gate.io.

BRC20s and Ordinals have created controversy because of how they are stressing the network. There are also naysayers who believe that Ordinals are tainting the network because they are not aligned with Satoshi’s version of a peer-to-peer decentralized money transfer network. They consider Ordinal transactions as spam.

The most well-documented of the limitations of Bitcoin’s Proof-of-Work network consensus is a lack of scalability. Blockchains like Bitcoin face scaling challenges because every node in the network has to verify and execute every transaction. This is computationally intensive and expensive.

Developments in the Ordinal Space

* Multichain NFT marketplace Magic Eden announced on June 27th that it would begin supporting trading of BRC20 tokens. It will allow users to trade BRC-20 tokens on a secondary market and will also includes a launchpad for users to create their own tokens that will then be tradeable on Magic Eden. The Magic Eden BRC-20 launchpad will be a premium service with marketing and strategy support for creators. \

* An NFT from the popular Ethereum collection, cryptopunks, has been burnt and then symbolically tied to an Ordinal NFT. The move was something of a publicity stunt by a group of Bitcoiners but nevertheless clearly identifies the grassroots popularity of Ordinals. On June 17th, Cryptopunk #8611 sold for 55 Ether or ~US$110,000 in today’s prices.

This NFT was then put to rest in a well-known inaccessible Ethereum address which also contains US$24.7 million worth of Ether (~12,598 ETH). Cryptopunk #8611 was then ‘recreated’ as Ordinal inscription 12,456,749 which appears identical to Cryptopunk #8611. The decision to burn and recreate was a community-led effort by a group called the Bitcoin Bandits, which has issued a set of Western-themed collections of Ordinals inscriptions. 150 people contributed to the Cryptopunk conversion cause. The Bitcoin Bandits say that after CryptoPunk #8611 is ceremonially sent to a digital wallet that belongs to Satoshi Nakamoto, in a one way trip similar to a burn, they will launch a special Ordinal NFT collection.

* Litecoin, alongside Bitcoin, has been enjoying an Ordinal driven boost in transaction activity. In February a developer brought Ordinals to Litecoin around a month after they arrived on Bitcoin. Litecoin Ordinals are accessible on marketplaces like liteverse.io. On May 23rd, 2023 the Litecoin Foundation said that the 3 million inscription mark was officially reached on the network. Litecoin is a fork of Bitcoin created in 2011. The price of LTC is up ~40% in the last two weeks. The Litecoin block reward halving, a major bullish fundamental halving which occurs every four years, is expected to occur in 28 days.

Different approaches to scaling – The major Bitcoin layer-2’s

At least in the short term, Ordinals are here to stay. Outside of blocking the protocol, there is potentially another way around the congestion and scaling issues – layer-2 technology. Original base layer technologies like Bitcoin and Ethereum have had historic challenges with scaling and breaking down when facing stress. This led to the building of Layer-1 and Layer-2 infrastructures.

Layer-1 protocols like Bitcoin and Ethereum can be a base layer that interacts with a third-party layer-2 protocol. The layer-2 takes computational load away from the base chain and leaves it to handle tasks like verification and finality.

# The Lightning Network

The Lightning Network is a Bitcoin layer-2 that can buffer the network during periods of congestion. The conception of the Lightning Network began in 2015 when Joseph Poon and Tadge Dryja began work to solve the high fees of the Bitcoin network, a key pain point for users of the blockchain. In January 2016, a whitepaper for the Lightning Network was published and developers began working on solutions for layer 2 which had a Satoshi-driven focus on payment channels.

Within a couple of years, a beta version of the Lightning Network was released. The core of the protocol is enabling the creation of a peer-to-peer payment channel between two peers on the Bitcoin network. Once the channel is established, the two transacting parties can transfer an unlimited number of transactions cheaply and quickly. This makes it useful for smaller payment transactions that may be beleaguered by high fees and wait times of base layer Bitcoin.

Only interactions like the opening and closing of a channel are recorded on the main Bitcoin chain. The Lightning Network has nodes that verify transactions across peers within a channel, this frees up the capacity of primary Bitcoin network nodes. The Lightning network has the added benefit of reducing the environmental output of Bitcoin.

The lightning network is also capable of routing transactions by combining individual channels of concerned payments. It can also consolidate transactions. This is when two channels chose to finish transacting. All the transactions are recorded and then sent to the Bitcoin mainnet.

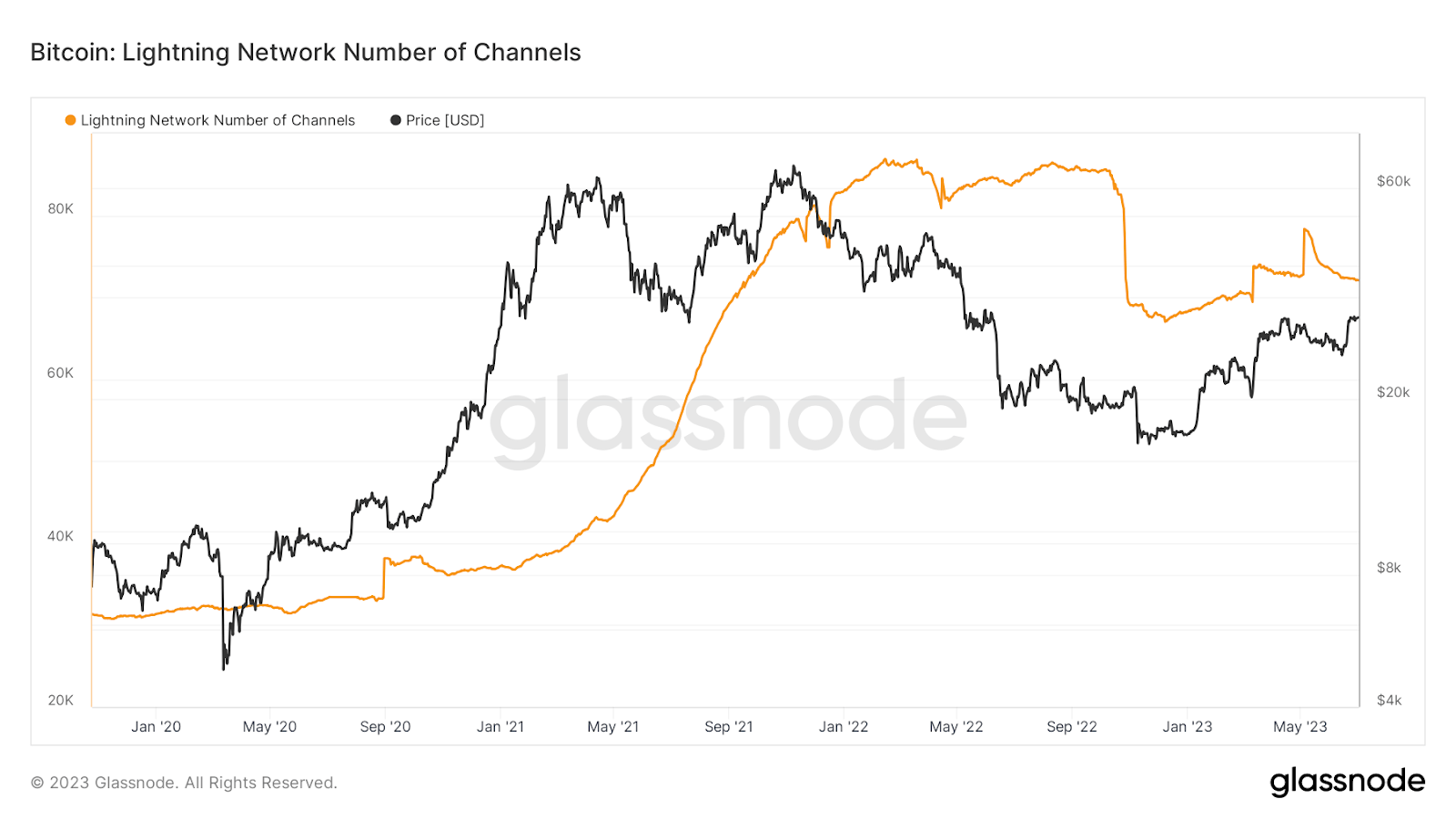

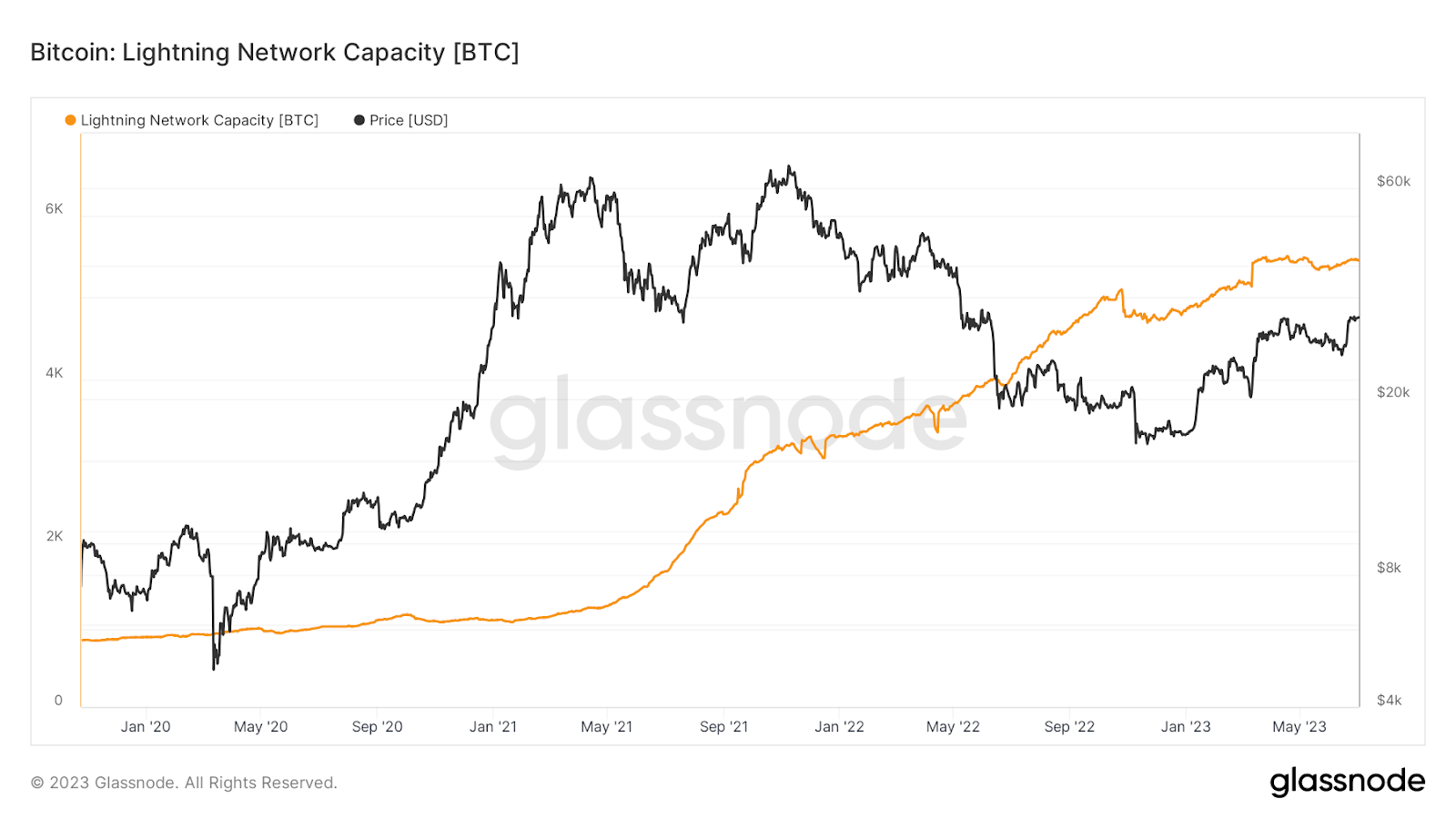

*Source: Glassnode*

*Source: Glassnode*

The number of channels and the amount of Bitcoin tied to the Lightning Network rose sharply in 2022 but has somewhat stalled so far in 2023.

The Lightning ecosystem has a variety of tools for node management, wallets, payments, and gaming designed to add functionality. They include —

* Pool: They help to manage liquidity needs for Liquid users

* Taro: A tool to issue or mint assets on the Lightning Network

* Faraday: a data analytics tool that helps node operators optimize channels and the flow of funds

* Lightning Network Daemon: A Lightning Network node implementation tool

* Neutrino – A light client specification to allow non-custodial Lightning wallets to verify transactions privately, trustlessly, and a full sync to the Bitcoin blockchain.

# The Stacks Solution

Stacks is another layer-2 blockchain solution that connects with Bitcoin through a unique ‘Proof-of-Transfer’ (PoX) model. Stacks aims to boost the utility of Bitcoin by allowing more computationally intensive activities like Smart Contract and Decentralized Applications (Dapps). Stacks has a native token, STX, designed to align incentives within the network.

Stacks was founded as Blockstacks in 2013 before a rebrand in 2020. The project was founded by Muneeb Ali and Ryan Shea who met at Princeton University’s Computer Science Department. Blockstacks first version focuses on replacing the reliance on centralized cloud service providers seen within the smartphone and browser app markets. It was a decentralized identity data storage solution that leveraged the Bitcoin blockchain.

In January 2021, the Stacks 2.0 mainnet was launched. This allowed users to deploy smart contracts and decentralized applications (Dapps) on the Bitcoin blockchain.

A key selling point for Stacks is its unique “Proof-of-transfer” (PoX) consensus mechanism that directly ties to the Bitcoin blockchain. PoX requires miners to spend Bitcoin to participate in miner elections and create a new block on the Stacks blockchain. PoX is tied 1-for-1 with Bitcoin.

Miners send BTC to set addresses for a chance to validate transactions and mine the next Stacks block. Essentially bidding with BTC to have a chance to mine the next Stacks block. The PoX model resembles the Proof-of-Burn (PoB) mechanism used by projects like Slimcoin. Unlike PoB where Bitcoin is sent to a burn address, with PoX BTC is sent to be distributed to STX stakers.

This model means that Stacks validators compete based on Bitcoin that is bid, as opposed to computational resources, as is the case with the Bitcoin base chain’s Proof-of-work model. Expanding PoW without creating higher energy consumption, higher costs and waiting is extremely challenging. PoX is designed to be an expansionary system for the Bitcoin network. It is dependent on Bitcoin’s output for every block

Stacks is different from the Lightning Network because it is not designed to be a peer-to-payment payment solution. It is focused on creating an expansion of Bitcoin that allows Bitcoiners to interact with a smart contract and dapps. In this sense it is less aligned with the original Bitcoin vision than other scaling solutions.

Nevertheless, there appears to be an inevitably about solutions like Stacks. As Bitcoiners have observed money flowing into Smart Contract driven sectors like NFTS and Gamefi, they likely want a piece of that action.

STX is up an impressive ~204% year-to-date, showing significant and outpacing many other digital assets. Over the same period, BTC is up ~63%.

# Ck-BTC

Brave New Coin recently interviewed Dominic Williams from the DFINITY Foundation (a major contributor to the Internet Computer) about Ck-BTC, a unique new implementation of layer-2 Bitcoin.

ckBTC, a version of Bitcoin built on the Internet Computer, is a multi-chain Bitcoin ‘twin’ that is cryptographically secured 1:1 with real Bitcoin. It is created by a pair of open-source, verifiable smart contracts, which allows for cross-chain transactions to stay completely decentralized.

The Internet computer is a blockchain network that is a set of protocols that allow independent data centers around the world to band together and offer a decentralized alternative to the current centralized Internet cloud providers.

Williams says that thanks to chain-key ECDSA and threshold cryptography, “Internet Computer smart contracts can create their own Bitcoin addresses and sign bitcoin transactions on the Bitcoin network. This is a key difference: there are no bridges or centralized custodians involved. ICP is among the first blockchains to perform direct integrations with other blockchains.”

In 2022, the DFINITY R&D team developed a framework for ICP to directly communicate with other blockchains like Bitcoin and Ethereum by designing a new protocol for threshold ECDSA (Elliptic Curve Digital Signature Algorithm). The protocol is detailed in this research paper. The protocol’s design works with a trustless way of computing ECDSA signatures using a cryptographic multi-party protocol, with canister smart contracts controlling ECDSA signing keys on a public blockchain.

ckBTC allows Bitcoin transactions to be integrated into a variety of smart contract-based decentralized applications. This includes messaging app OpenChat. “Every OpenChat account doubles as a crypto wallet. This means that OpenChat users can send ckBTC as instant chat messages. If you forget your friend’s birthday or need to pay back someone for dinner you can just send them a message with ckBTC attached and they will receive it instantly. ckBTC can always be redeemed for BTC, there will never be a liquidity issue or a bridge exploit.” Williams explained.

Williams also stated that the boom of the Ordinals protocol has emerged as an opportunity for products like ckBTC. “Multi-chain solutions like ckBTC can allow the Bitcoin network to function while Ordinal NFTs grow in popularity, I think it is a positive. We want more people to use blockchain technology and we now have the solutions to cater for more than just one use case.” Williams also explained that his team is working towards building a Bitcoin Ordinals marketplace that will utilize ckBTC as a payment method.

Conclusion

The emergence of the Bitcoin Ordinals protocol in recent weeks has ushered in a new paradigm for the Bitcoin network. This one, like the ones before it which led to events like the bigger block debate and Segwit, is filled with promising opportunities but also formidable challenges. While the popularity of the Ordinals has died down, it has nonetheless changed the network forever, generating important questions surrounding the scalability and utility of Bitcoin.

One of the significant opportunities presented is to the Bitcoin layer-2 ecosystem – solutions that are designed to aid it with its scaling challenges. Now more than ever, Bitcoin needs help scaling, given the influx of new transactions affecting the user experience of the network.

As with any innovation,however, it’s important to remain aware of the potential trade-offs and challenges ahead. Layer 2 solutions are often seen as distractions that fragment the network. Potentially, investment and development that would otherwise go into Bitcoin may be going into layer 2 solutions, and some argue that this is a detriment of the main chain. Numerous layer-2 creates competition for value, whereas ideally, all value should be flowing into Bitcoin.

Bitcoin currently stands as the gold standard of cryptocurrency and will likely have to continue dealing with patches of high transaction demands. This may be because of hype periods like the one created by the Ordinals protocol, or simply because Bitcoin organically becomes more popular as a payment medium.

Bitcoin will likely have to adapt and innovate further. Leveraging layer-2 solutions like the Lightning Network, Stacks, ck-BTC, and Liquid may be key in addressing the network’s current scaling issues, optimizing transaction costs, and ensuring growth and expansion. As Bitcoin forges ahead on its journey, the lessons learned from the Ordinals episode will undoubtedly be invaluable in shaping its future.