- Bitcoin’s appeal is waning as Tether’s attack on Ethereum and Tron fuels capital inflows.

- USDT supply is soaring amid rising market volatility and is playing a crucial role in shaping future crypto trends.

November was the most bullish month, driven by the ‘Trump pump’, post-halving momentum, a favorable inflation report and Bitcoin’s price. [BTC] strong basics thereby strengthening its position as a store of value.

$114 billion is flowing into the crypto market and Tether’s [USDT] Currency wave that boosts liquidity. This underlines the strength of the past 30-day rally, indicating the potential for continued near-term upside.

However, the uncertainty surrounding Bitcoin’s next psychological target raises concerns about potential bearish pressure, especially as first-quarter volatility could signal longer-term market instability.

Could high liquidity in this environment push investors towards a more conservative approach, using it as a refuge instead?

Expect high volatility in the coming days

Currently, the market can be summed up in one word: ‘volatile’. This is reflected in the increasing volatility of cryptocurrencies indexThis indicates that investors expect higher returns within a shorter time frame.

Despite the optimism following the election results, which pushed Bitcoin above $100,000, the breakthrough was short-lived. Enormous speculation in the perpetual market led investors to shift their focus and look for immediate returns by pushing BTC down.

This bubble effect has left both market makers and outside observers unsure of Bitcoin’s next resistance point, with many investors on the verge of a break even before a potential correction occurs.

As a result, using stablecoins as a safety net, providing a buffer against potential market crises, could be the best option.

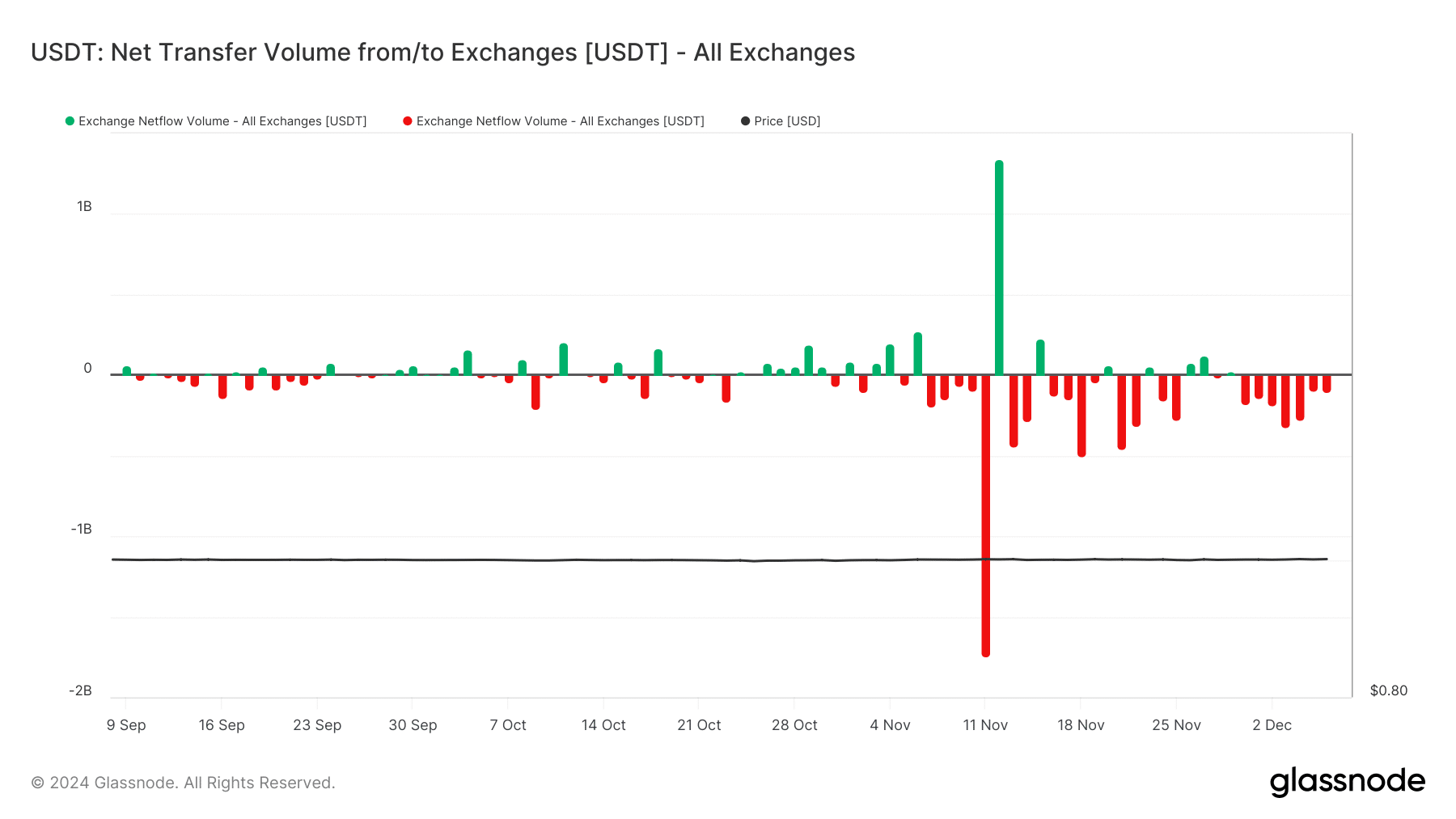

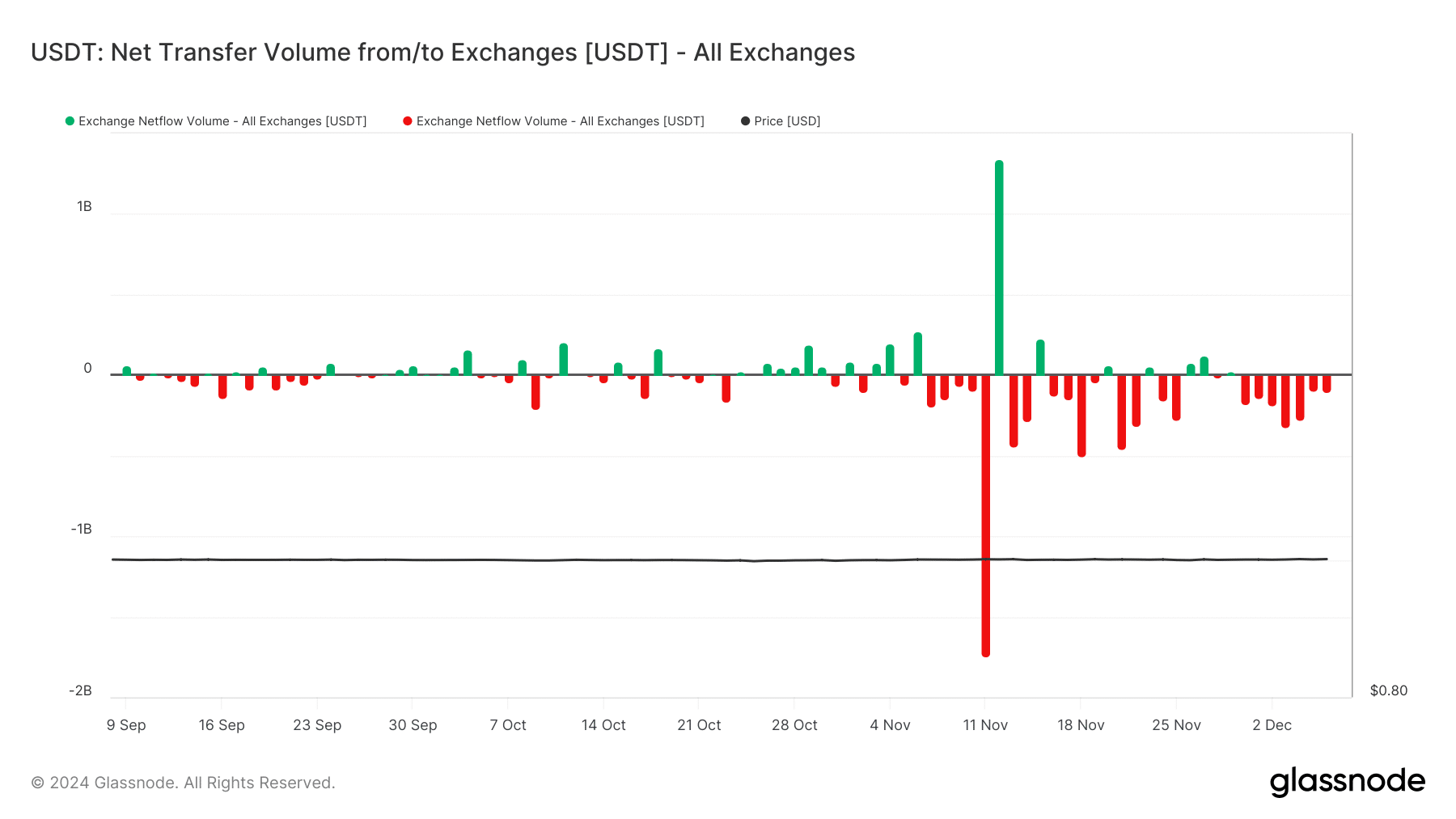

Source: Glassnode

However, this shift could lead to bearish sentiment in the coming days. Bitcoin’s robust fundamentals should spark another rally, turning $100,000 into a steady support level.

Otherwise, a local top at this price level could indicate tight liquidity. Profit-taking could increase and new buyers could hesitate to absorb the pressure, leading instead to greater dependence on USDT.

Is $100,000 a Bitcoin Top or a Bottom?

Currently, the market is gripped by conflicting forecasts: one based on ‘uncertainty’ and the other on ‘anticipation’. Each drives different market movements.

This lack of confirmation causes many investors to see the $100,000 mark as a local top. It causes a significant exodus of those who play it safe to break even.

As a result, Tether has made approximately $19 billion in USDT over the past 30 days. In the last four days alone, $4 billion was minted across the Ethereum and Tron networks. More and more investors are heading towards high-cap altcoins, unsure of Bitcoin’s next move.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, there is still a strong group of stakeholders who expect a major breakthrough. Their long-term investment causes USDT reserves seen a remarkable increase.

However, this alone will not be enough. Tracking USDT exchange flows is essential to understanding how the market is reacting to current price levels.

While the coin boom has created a wave of bullish optimism, analysts view the influx of liquidity as a potential catalyst for a Bitcoin rally as investors rush to swap USDT for BTC.

However, rising volatility could throw a wrench in the plan, reducing Bitcoin’s appeal against its rivals, with the USDT holding being the safe haven of choice.