- Bitcoin open interest has reached an all-time high, with a notable increase in shorting activity.

- While “cautious optimism” has kept BTC near $100,000, the rally to $130,000 remains elusive.

Two weeks ago, market speculators set their sights on Bitcoin [BTC] reaching $100,000 by the end of the fourth quarter. In just 14 days, BTC has almost reached that goal, closing at almost $99K and setting a new ATH.

More than $4 billion has flowed into US-listed Bitcoin exchange-traded funds since the election. This week, BlackRock’s ETF options were on a strong run debutwhere call options – bets on price increases – outperform puts.

Despite this enormous inflow, BTC has not yet fully achieved its objective. Every new ATH since the election has faced resistance, indicating potential overextension.

With current momentum, $100,000 seems within reach. However, with Bitcoin open to a new ATH, the RSI in overbought territory, and weak hands shaking out, there are still crucial factors to keep an eye on before BTC can make its way to $130,000.

The high open interest for Bitcoin underlines the strong demand

Over the past ten trading days, Bitcoin’s daily appreciation has slowed to around 3%, a noticeable decline from the first week after the election when daily highs exceeded 10%. This decline in momentum may indicate a cooling-off period.

However, there is a silver lining. Unlike previous cycles, where investors typically exited when BTC entered a ‘risky’ zone, fearing an impending correction, current sentiment signals more cautious optimism.

This optimism is driven by bulls who are targeting $100,000 as the next major milestone for Bitcoin. motivating investors to jump in and take advantage of the rally. As a result, the number of new addresses with BTC has increased doubled in the past 30 days.

The derivatives market has followed suit. Facts from Coinglass reveals that Bitcoin open interest has risen to a new all-time high of $57 billion, with more traders betting on the future direction of BTC’s value.

In short, these factors underline strong demand at current price levels. FOMO drives continued interest, keeping BTC resilient despite signs of overextension.

While this momentum may be enough to keep BTC near $100,000, the next upside target depends on the continued strength of this trend, supported by a favorable macroeconomic backdrop.

Conversely, if short sellers in the derivatives market get back to business tractionand FOMO fades, a long squeeze could push BTC to $89,000 before a move to $130,000 is feasible – unless the current range turns into solid support.

$100,000 opportunity turning into solid support

Look at this graphicMany altcoins are approaching key areas of interest, while BTC appears to be on the verge of another potential fakeout above local peak levels.

This signals caution as Bitcoin’s upward move could be short-lived or deceptive. Meanwhile, altcoins are approaching crucial price levels where significant price action is likely.

When BTC reaches a target price, capital typically shifts to altcoins, with investors looking to reduce risk and redistribute profits across the broader market. This often acts as a major resistance to BTC’s rally.

Therefore, converting this resistance into support – by seeing substantial capital flow ‘in’ rather than ‘out’ of Bitcoin – will be crucial in determining whether the $100,000 range can hold in the long term.

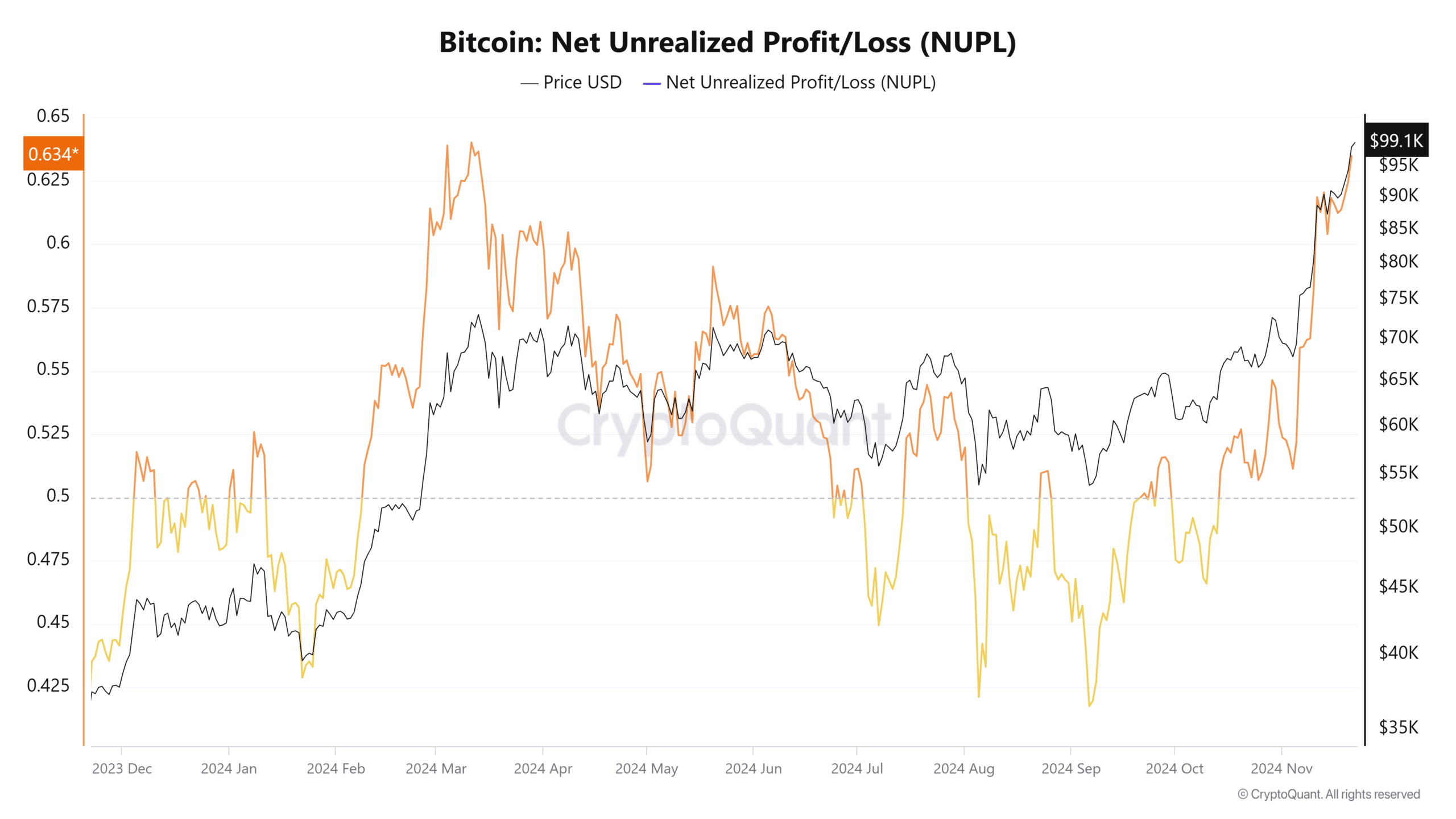

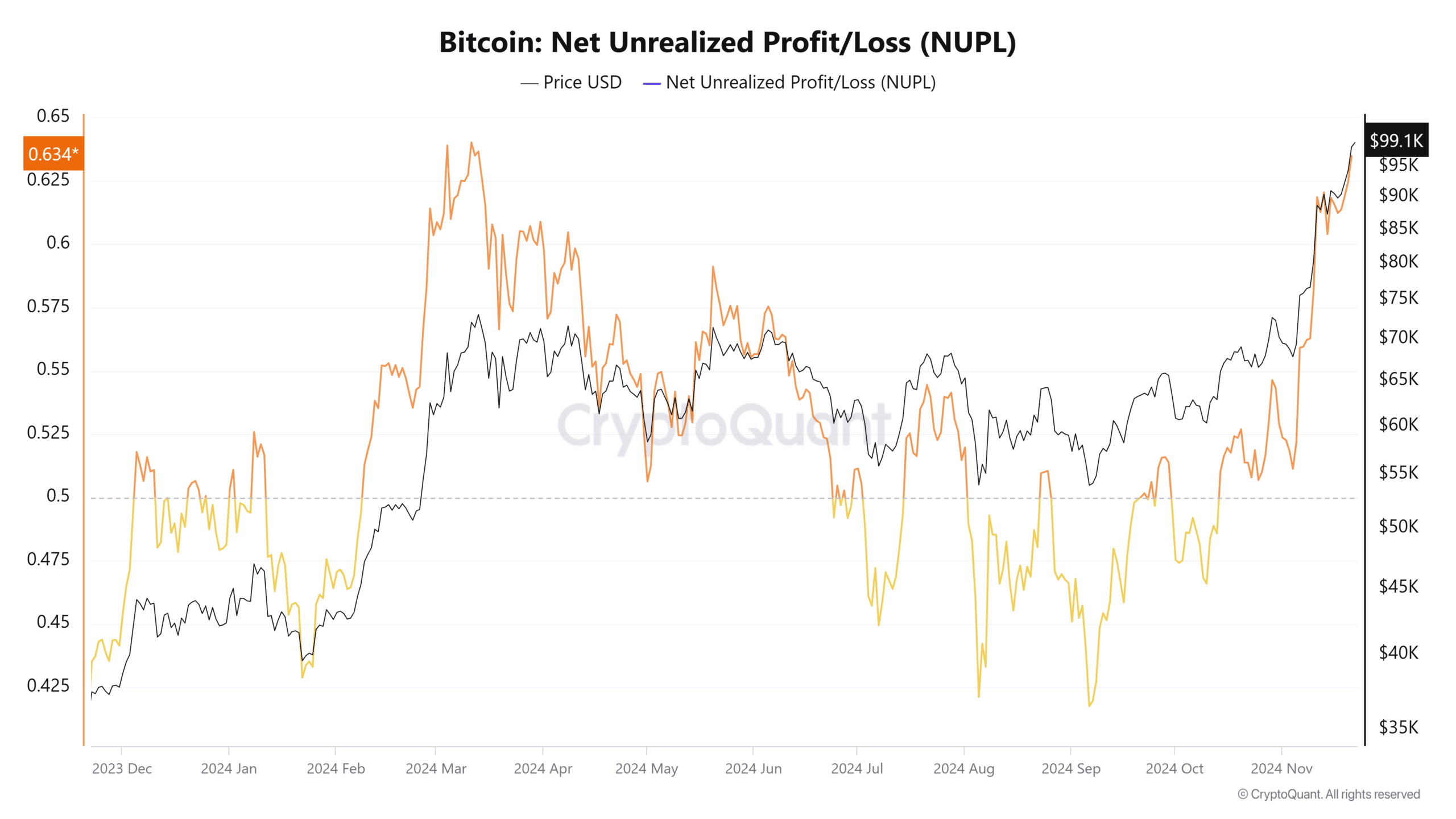

Source: CryptoQuant

Interestingly, the NUPL indicator reflects a pattern similar to the trend seen in March, when many ‘weak hands’ started cashing out profits, fearing that the rally was nearing its peak.

As previously mentioned, demand has remained strong, absorbing selling pressure despite the overheating of the market. However, a potential top could still be close, especially if major altcoins continue to outperform Bitcoin.

Solana in particular is positioning itself for important moves ahead of its long-awaited ETF mentionwhich could change market dynamics in the coming days.

In summary, while BTC is on track to reach $100,000, with Bitcoin open interest hitting new ATHs, high FOMO sustaining new interest, and strong demand countering signs of overextension, other factors could still influence its trajectory.

Read Bitcoin’s [BTC] Price forecast 2024-25

Altcoin performance, market sentiment, and external events could be crucial in determining whether Bitcoin can maintain its momentum or undergo a correction before heading towards $130,000.

This scenario seems likely, especially given the notable shorting activity within Bitcoin’s open interest and the increasing interest from investors looking for more affordable assets, which is understandable given the high stakes surrounding Bitcoin at these high price levels.