- Bitcoin, at the time of the press, tested his upper channel boundary when the inflation cooled and Trump paused tariff increases

- Whale activity and rising large transactions reinforced a potential outbreak over important resistance

Bitcoin [BTC] The attention of investors regains again after the tariff break of Trump and cooling inflation has facilitated the macro-economic pressure, which may create the perfect set-up for a bullish breakout. These two developments have fueled optimism in the worldwide markets, which reduces the need for aggressive monetary tightening and a shift to risk assets is encouraged.

That is why Bitcoin has – often preferred as a hedge and a growth -active – to take advantage of the improving background. As the institutional appetite gradually returns, the price structure and behavior of the chain begin to display this renewed momentum.

Is Bitcoin ready to escape from the falling channel?

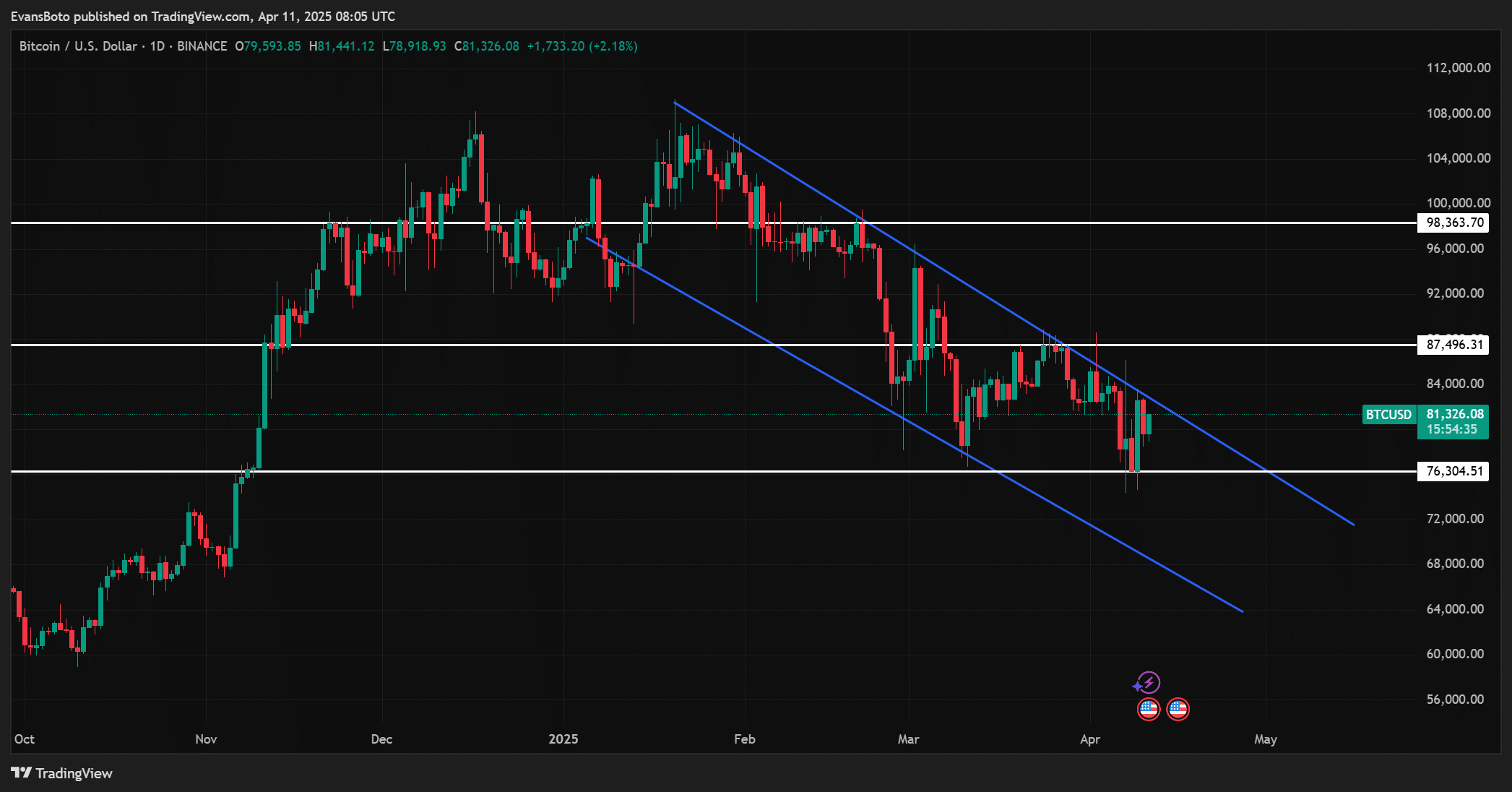

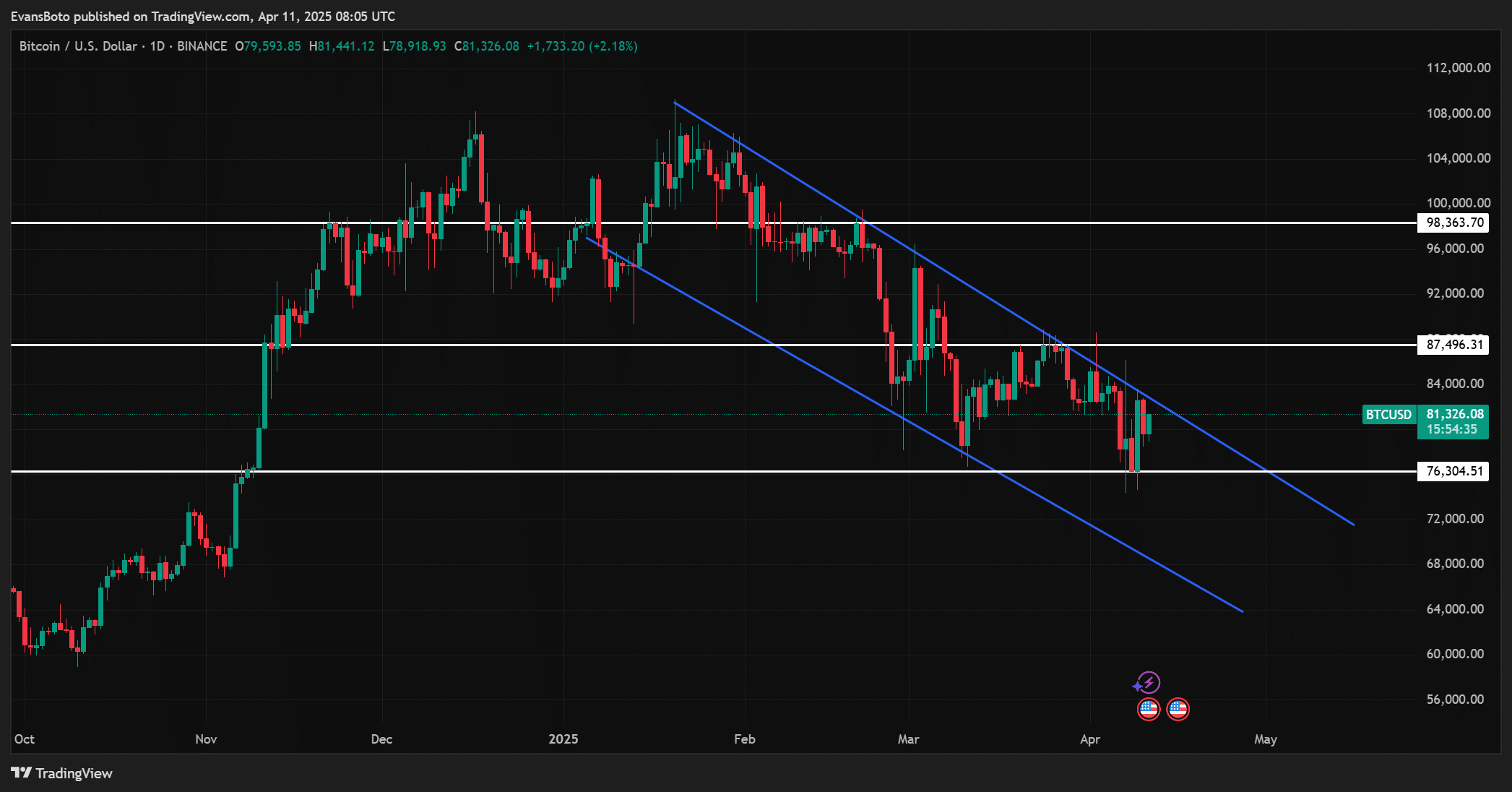

At the time of writing, Bitcoin acted at $ 81,614.11, with 0.15% in the last 24 hours. However, this light dip masks an important development on the graph. BTC seemed to test the upper limit of a falling channel after bouncing the support of $ 76,304.

A daily close to $ 87,496 could confirm an outbreak, which means that the price may push to the resistance of $ 98,363.

That is why the technical set -up Bullish can lean, but only if buyers maintain pressure. If BTC did not know the channel, the risk of a withdrawal to the lower support levels increases. Momentum is built, but the confirmation remains the key.

Source: TradingView

What is the Stablecoin nutrition signaling?

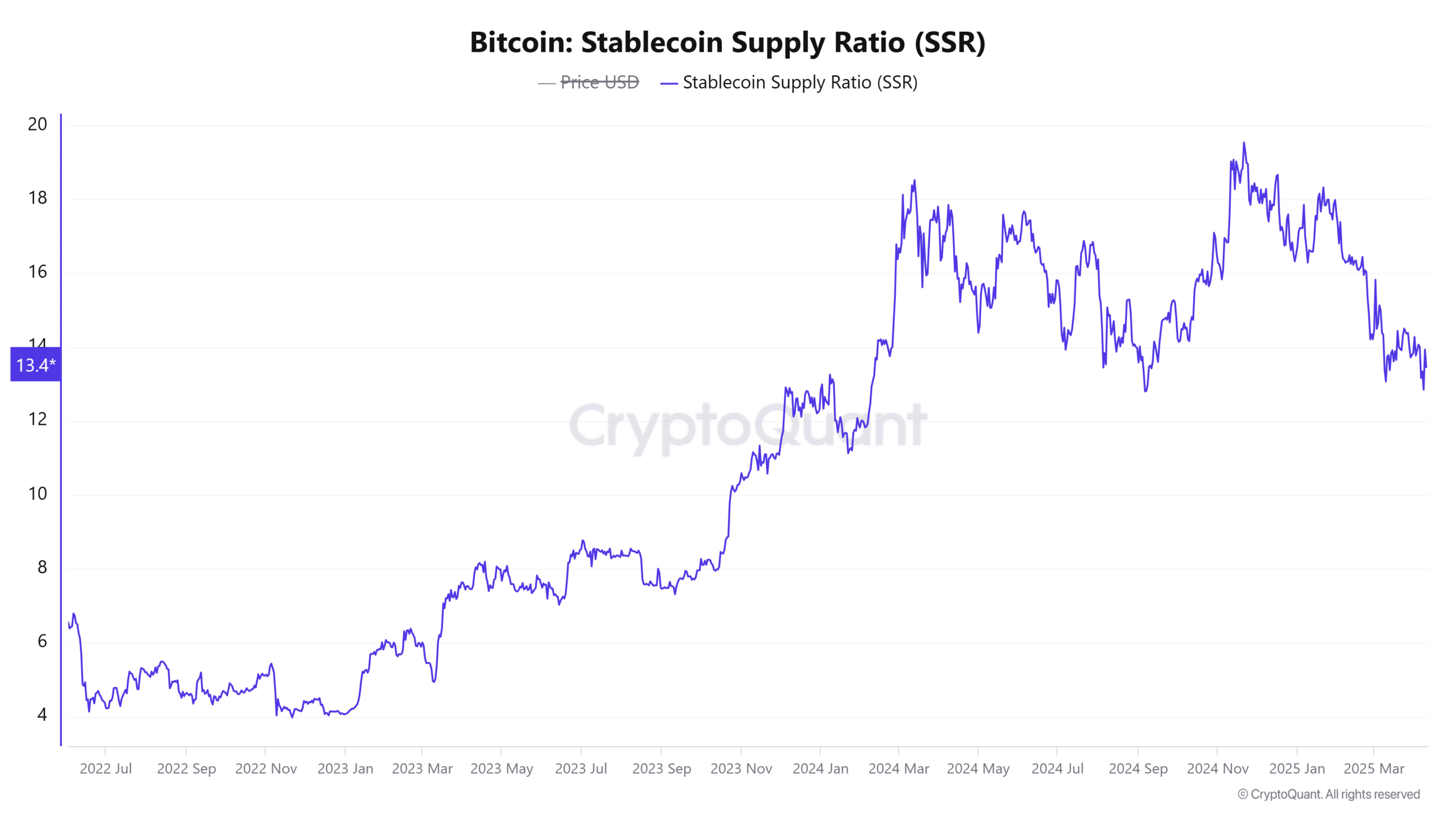

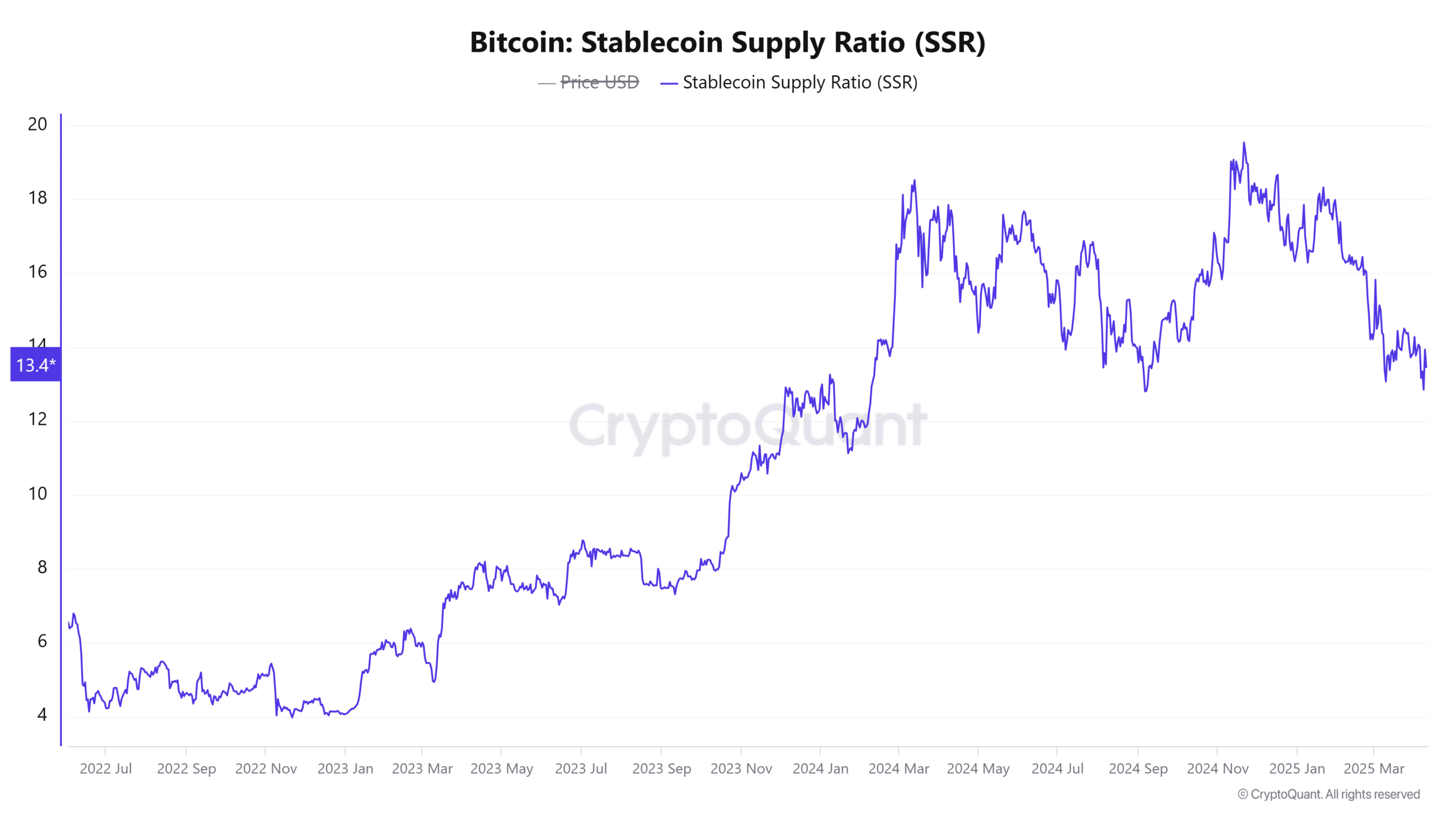

The Stablecoin Supply Ratio (SSR) increased 0.97% to 13.40Suggesting somewhat reduced purchasing power of stablecoins compared to the market capitalization of Bitcoin. However, this walk is moderate and does not indicate significant sales pressure.

Instead, it underlined that capital could wait for a directional signal.

In addition, a stable SSR supports a healthier rally during a potential breakout scenario. That is why this statistics only seemed to strengthen the idea that investors are ready to use funds. Especially once the technical outbreak has been confirmed.

Source: Cryptuquant

What are bitcoinwalfish and settings signaling?

Large BTC transactions rose by 1.28%, suggesting that accumulation by whales or settings. These entities usually work for the most important price shifts and the increase in activity often precedes rallies.

That is why this statistics seemed to be in accordance with the bullish pressure that forms on the charts of Bitcoin.

Moreover, Smart Money tends to enter again during consolidation phases. Such an increase in high -quality transactions also validated the possibility of an outbreak in the short term.

Source: Intotheblock

However, that is not all as a lookonchain reported That a whale recently deposited 1500 BTC ($ 120.29 million) to Binance. However, the whale still contains 1,486 BTC, since retained exposure. This promotion reflects the taking of profit-not a full exit-after earlier the collection of BTC at $ 80,449 and selling a number at $ 87,812.

That is why the behavior of the whale is a sign of trust in the long -term strength of Bitcoin, despite the cropping of companies in the vicinity of his resistance. Strategic outputs are normal for strong setups.

Conclusion

Bitcoin may be well positioned for a rebound. The combination of a tariff break, cooling inflation, walk in whale activity and institutional positioning may have created a supporting environment for the crypto.

Although the outbreak still has to be attached to the graph, all indicators seemed to point out the upper potential. Therefore, if BTC knew his resistance, a sharp rally will become more and more likely.