- Whale accumulation of more than 43,100 BTC and falling exchange for reserves signal bullish strength.

- Bitcoin’s rising triangle and rising network activity support a potential outbreak to $ 98k.

Bitcoin’s [BTC] MVRV ratio recently has formed A golden cross with its 365-day SMA, a pattern that precedes large bullish rallies.

At the same time, the price floated just below the key resistance, with bulls that intensify the accumulation. At the time of the press, BTC traded at $ 94,650.57, something with a 0.18% decrease in the day.

That is why the convergence of technical and on-chain signals increases expectations for an outbreak. An important question now is whether this set -up BTC can propel on $ 95.3k and to the purpose of $ 98k.

Preparing whales quietly bitcoin for elevator-off?

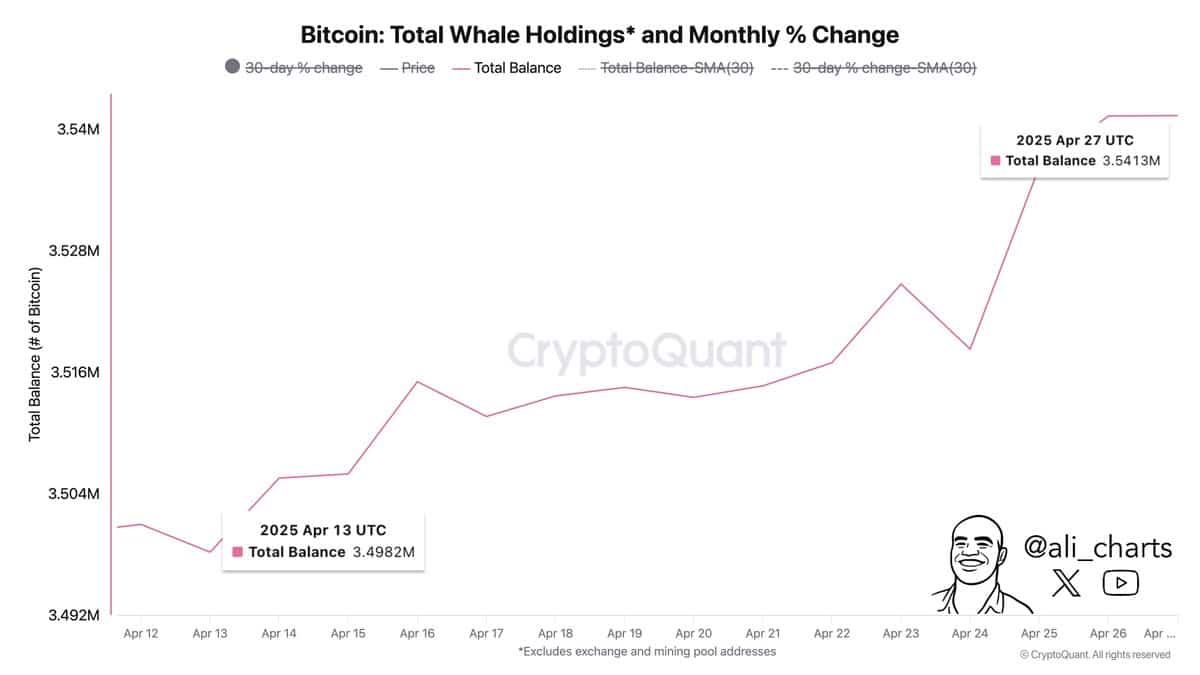

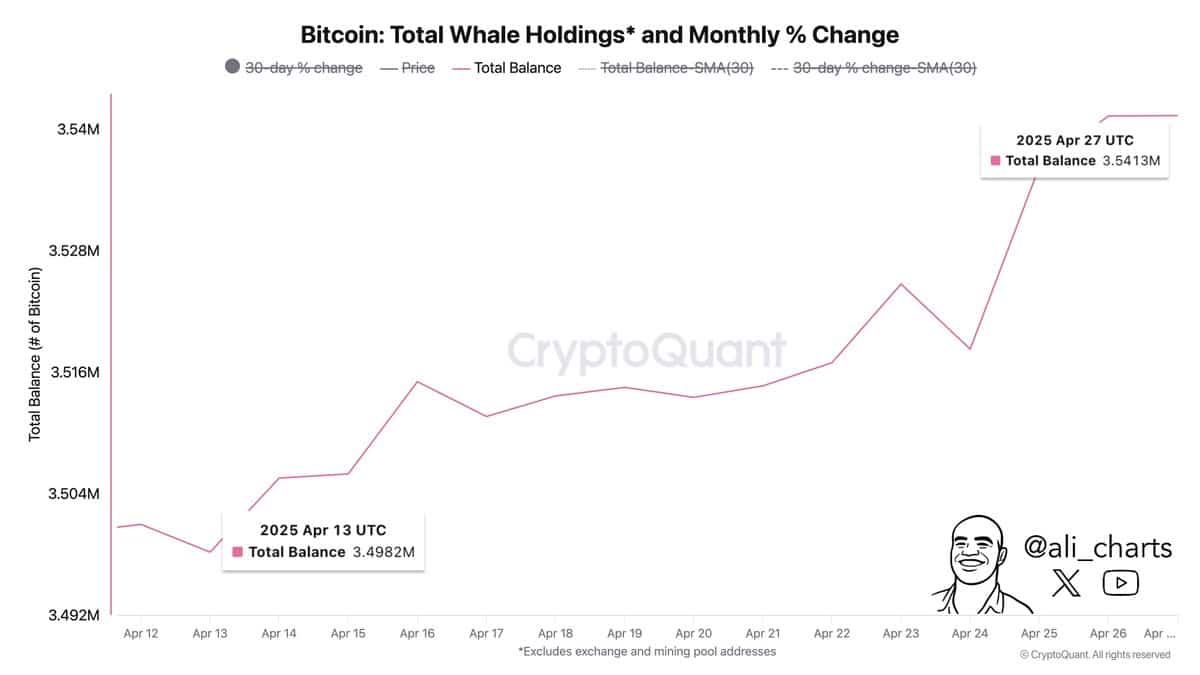

In the past two weeks, whales acquired 43,100 BTC, which increases their participations from 3,498 million to 3,541 million BTC.

This aggressive accumulation, worth almost $ 4 billion, indicates a strong conviction among large investors and usually predicts a bullish momentum.

In addition, such purchases during consolidation reflect long -term trust instead of short -term speculation. That is why this increase in whale activity adds a considerable upward pressure and reinforces the potential for an outbreak.

Earlier rallies have in fact often followed such accumulative phases, especially when prices flirt with resistance zones.

Source: X | Ali -cards

Will shrinking exchange reserves cause a supply spa?

In addition, Exchange Reserves fell by 2.33% in just seven days, now resting at 2.48 million BTC. This persistent decline confirms that fewer coins remain for sale at centralized fairs.

In combination with increased accumulation, this trend often indicates a tightening dynamic that can strengthen price increases.

That is why the chance of a outbreak driven by the stock increases as reserves continue to fall.

Source: Cryptuquant

Is BTC about to break $ 95.3k?

Bitcoin was an ascending triangle on the 4-hour graph at the time of the press, where the price repeatedly tested the resistance of $ 95.3k.

Every failed rejection of resistance showed that sellers lost strength, while bulls continued to put pressure. That is why a breakout seems threatening when bulls maintain pressure.

If Bitcoin closes above this threshold, it could collect to $ 98K, in accordance with historical technical behavior after comparable formations and supply conditions.

Source: TradingView

Does network activity aim the current bullish setup?

The NVT ratio has fallen to 187.33, suggesting that an increased transaction volume compared to the market capitalization of Bitcoin.

This decrease usually indicates healthier network fundamentals and growing utility, to support a sustainable price movement.

In addition, the falling NVT ratio during price consolidation indicates that the rally can be powered by real use instead of hype.

Source: Santiment

Despite bullish signals, sentiment remains somewhat bearish, with 115 bears versus 111 bulls, according to Intotheblock.

However, sentiment often lags behind actual market shifts, especially when large investors stimulate accumulation. IF Bitcoin breaks above $ 95.3k, sentiment can quickly reverse and attract wider market participation.

Will BTC break out to $ 98k?

Bitcoin is now at a turning point. Whale accumulation, falling reserves and technical force all point to a movement of $ 98k.

Despite mixed sentiment, underlying statistics claim that the momentum is building, and if bulls remain active, a breakout looks inevitably.