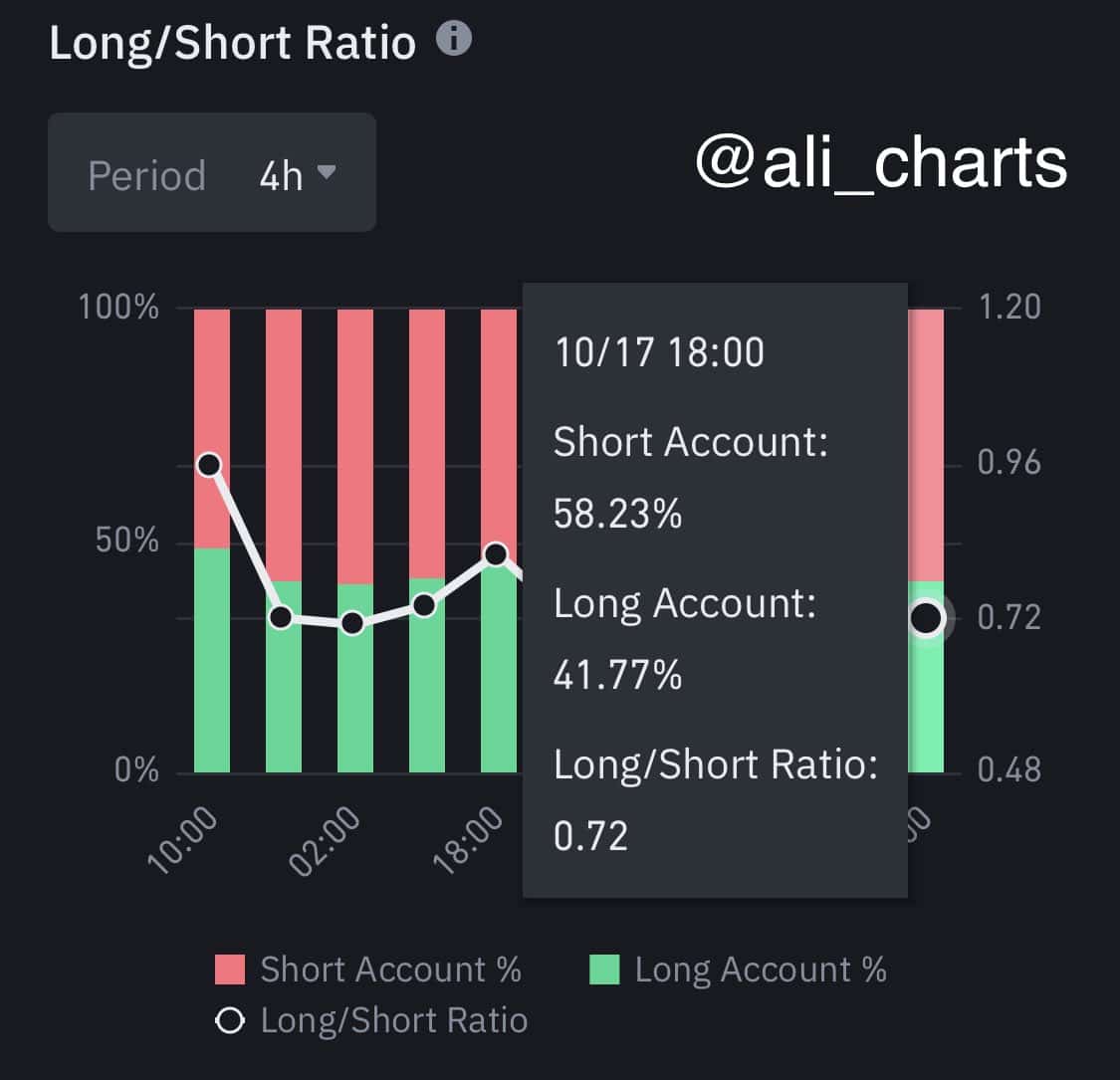

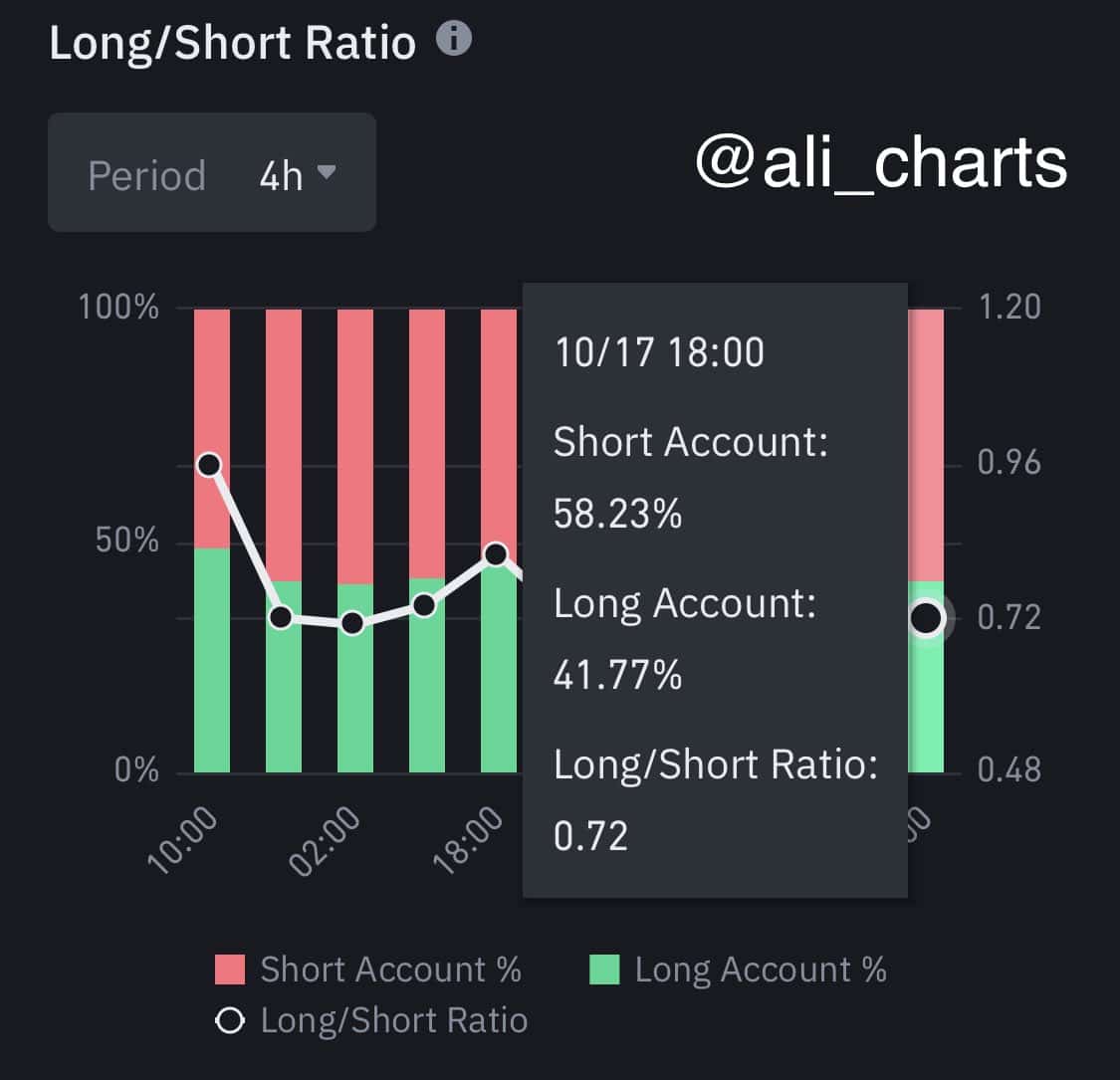

- Bitcoin shorts dominate Binance, with 58.23% of accounts with open Bitcoin positions currently shorted.

- A well-known analyst suggests that a break past $67,400 could push BTC to a potential top around $86,600.

Bitcoin [BTC] price action was the topic of the week, and recent data from Binance and IntoTheBlock have sparked new speculation about the king crypto’s next move.

With a significant portion of market participants going short and the number of active addresses increasing, there is a lot to unpack.

The majority of Bitcoin traders are shorting

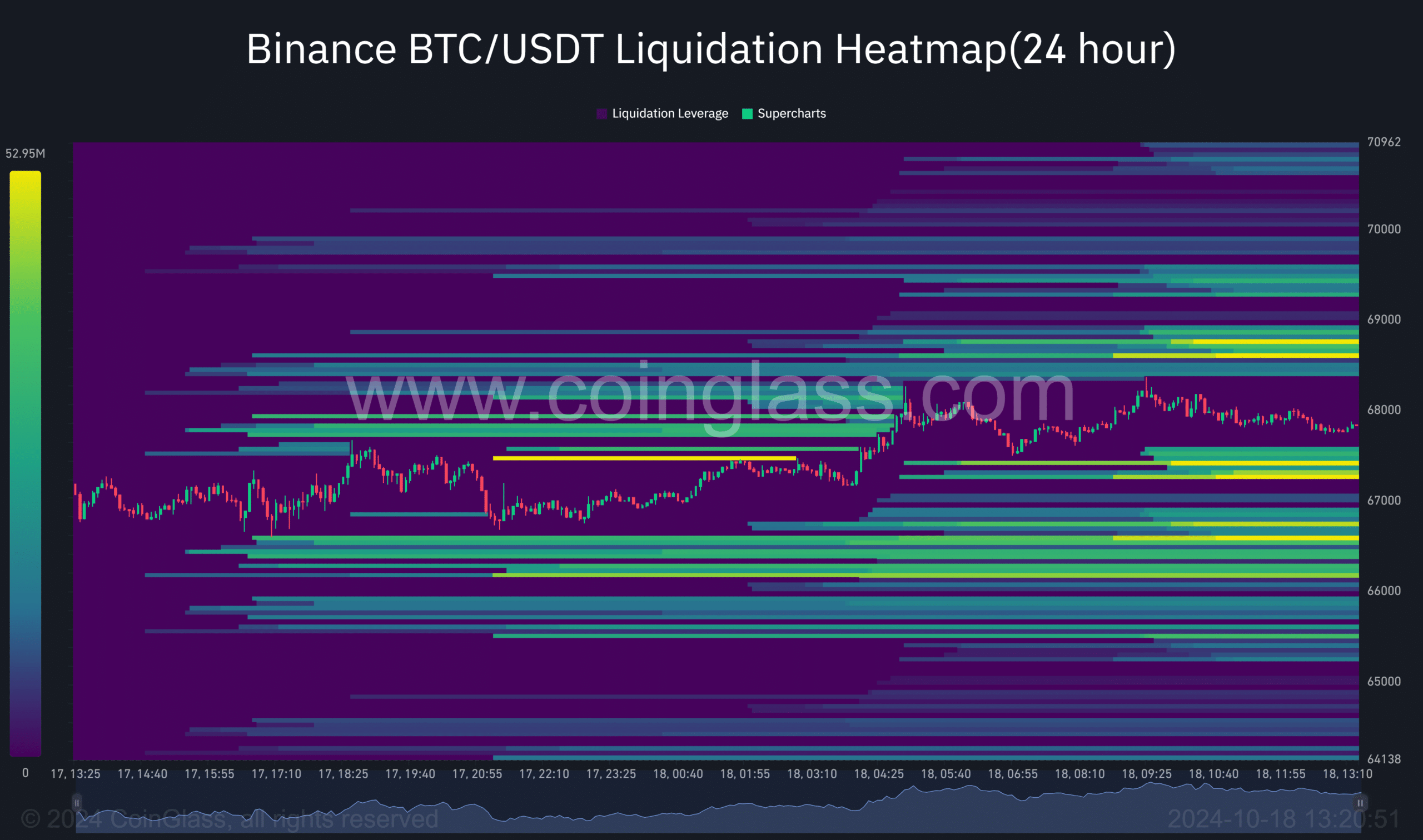

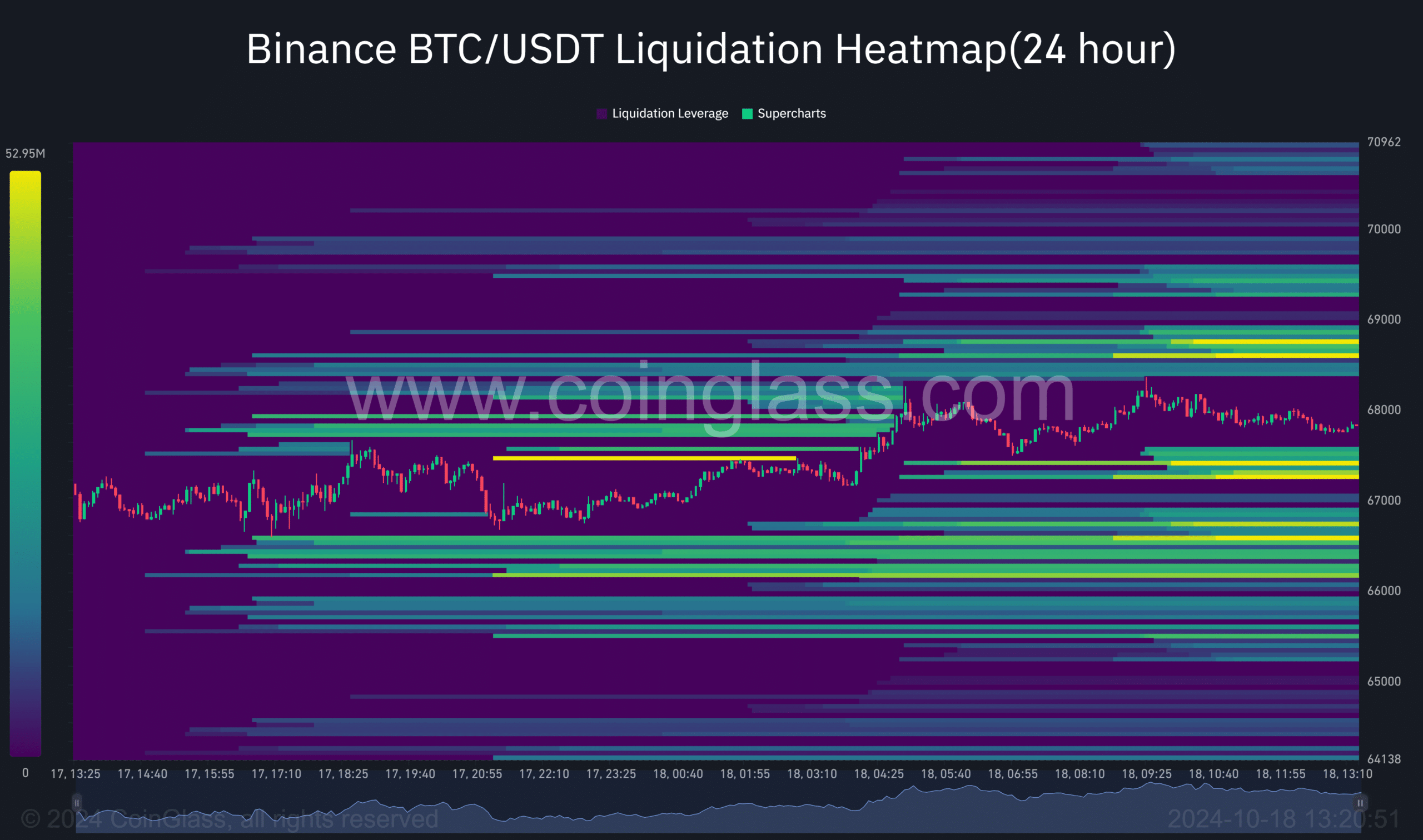

According to the Coinglass data, 58.23% of all accounts in Binance with open Bitcoin positions are shorted. This reflects the very strong sentiment that market participants expect the price of Bitcoin to fall.

On the other hand, however, such short positioning can also lead to sudden price increases as Bitcoin moves against the crowd and forces these traders to cover their positions.

Source:

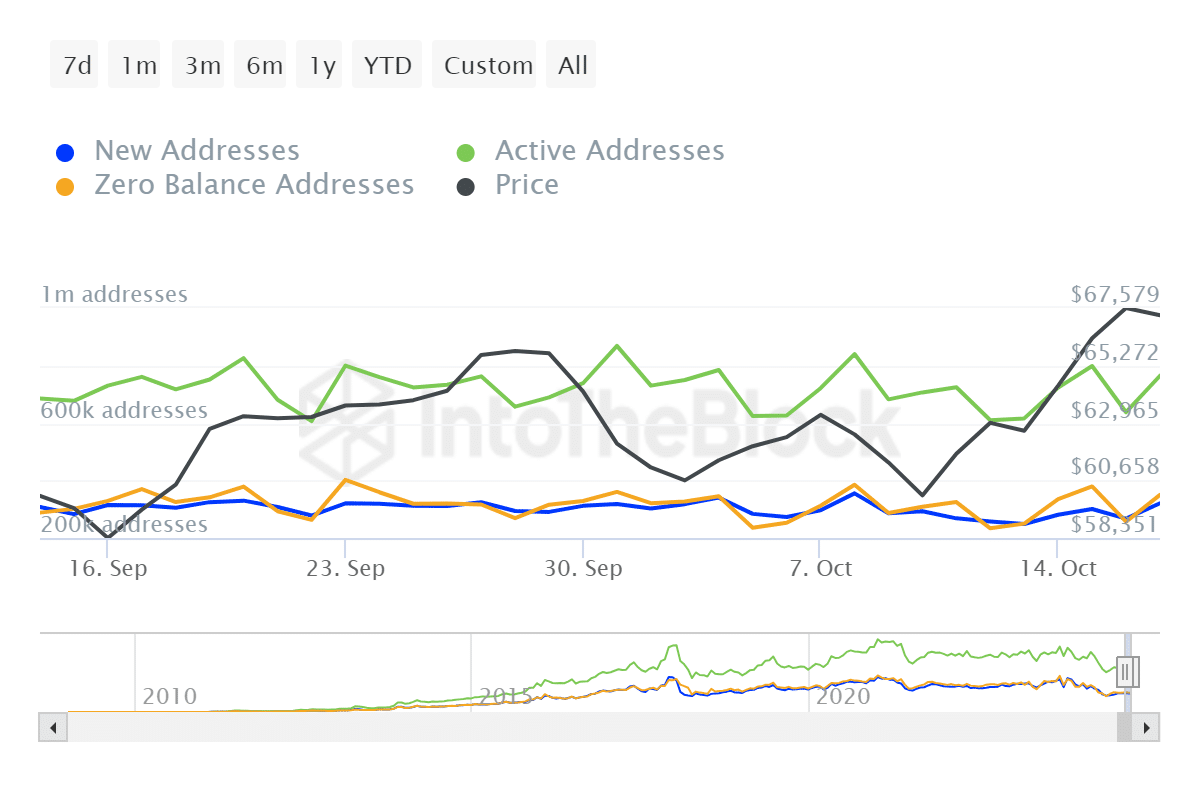

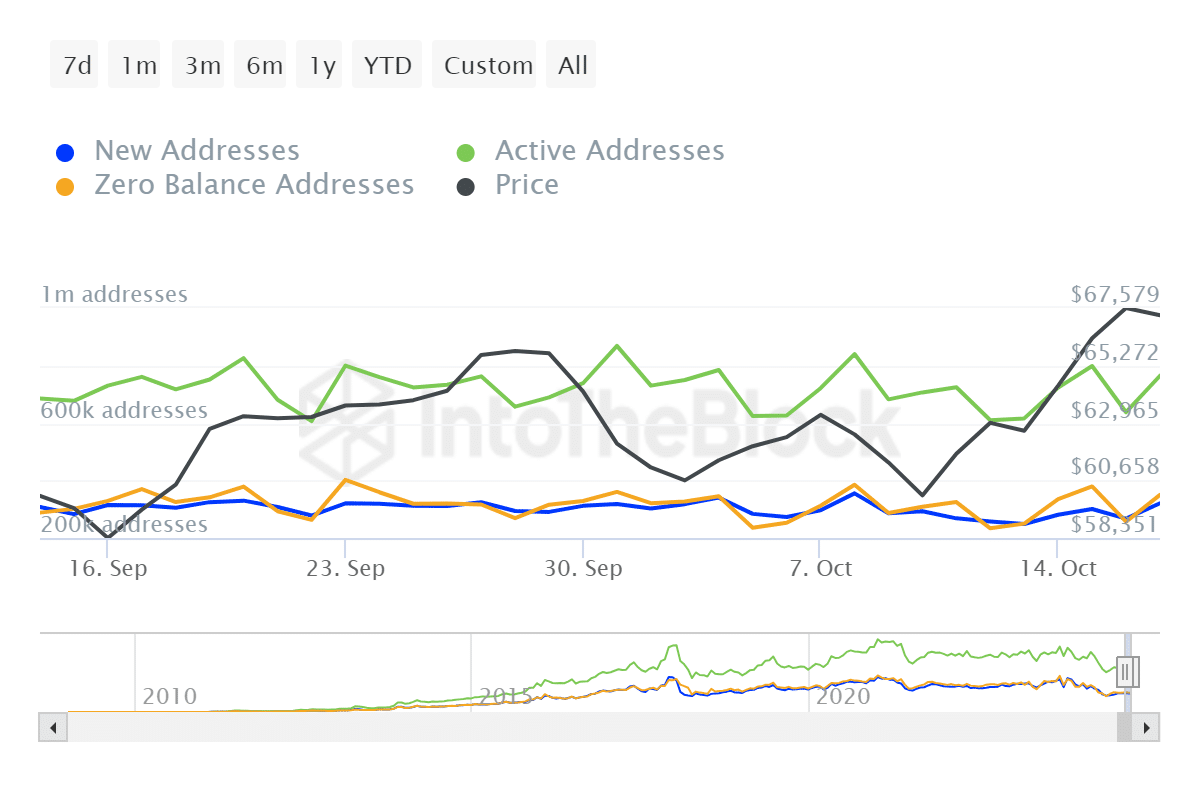

Bitcoin trading activity is increasing

According to IntoTheBlock, Bitcoin active addresses rose 19% to 764.38K in the past 24 hours. This jump in activity often indicates increasing interest and participation in the market, which could indicate a potential price movement.

More active addresses indicate rising demand, adding more weight to the potential upward rally.

Source: IntoTheBlock

Bullish liquidity signals a potential rebound.

Even with the short positions on, the liquidity data still shows a trend towards more bullish sentiment. An important price level to watch is the $68,600 level, where $49.02 million worth of BTC could be liquidated.

This suggests that many market participants still expect an upward Bitcoin rally, similar to recent trading activity.

Source: Coinglass

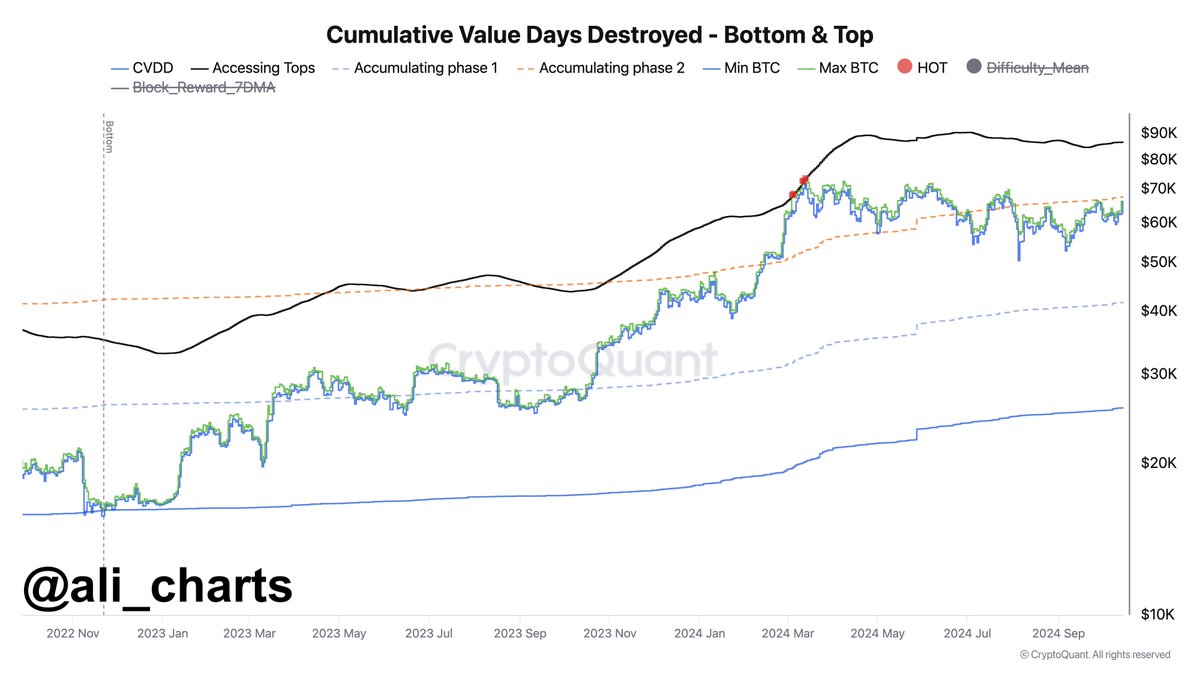

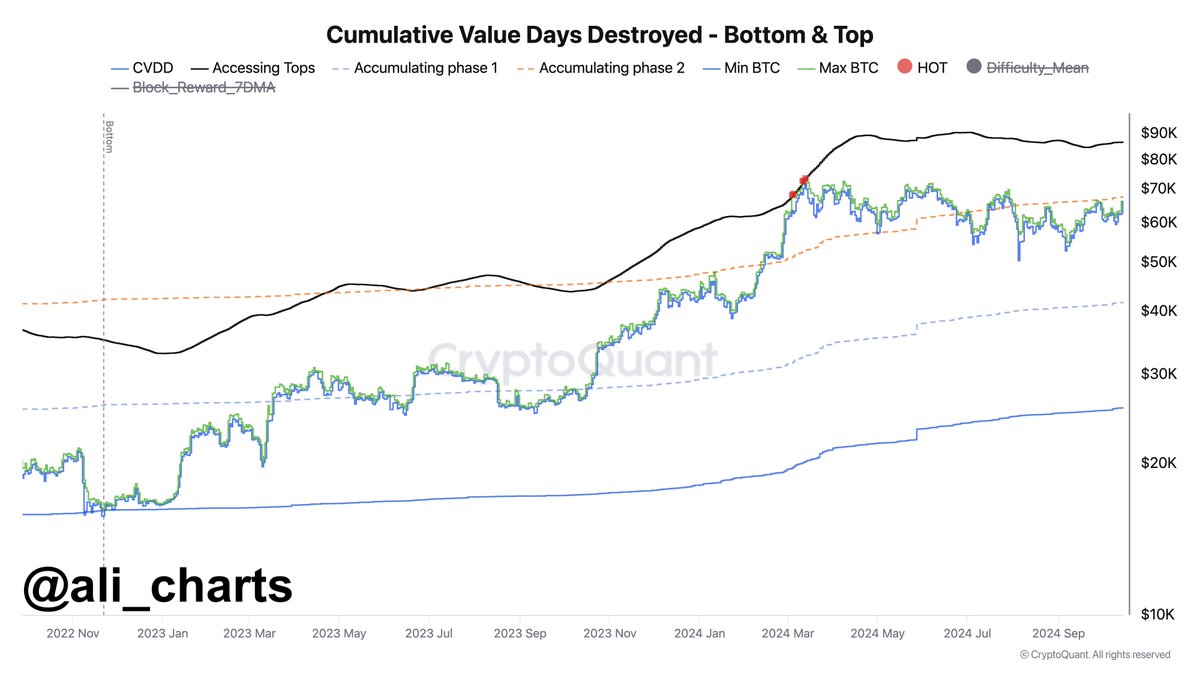

A breakout of $67,400 could spark a rally

Bitcoin’s immediate resistance level is at $67,400. If the price manages to break this significant price level, the next potential target level could be $86,600 according to a well-known Crypto analyst.

Source:

Read Bitcoin’s [BTC] Price forecast 2024–2025

Despite the majority of traders holding short positions, the increase in the number of active addresses and liquidity indicators tells a different story.

Bitcoin is on the verge of breaking above the $67,400 price level, which will see a possible increase in price action towards $86,600.