- Based on historical trends, BTC could peak in late 2025.

- Analysts believe that BTC could reach $200,000 – $260,000 by the end of 2025; the Power Law model suggests $400,000.

Based on historical trends, Bitcoin [BTC] could be in the final stages before the final leg of this cycle’s bull run.

Most market observers point to the fourth quarter of 2024 as a potential breakout for the six-month price range.

If so, a bullish breakout would trigger BTC’s next and final price increase for this cycle. However, most market cycle analysts believe that BTC could peak in the third/fourth quarter of 2025.

So, how high can the asset get before reaching its peak?

How high can BTC go, $200K?

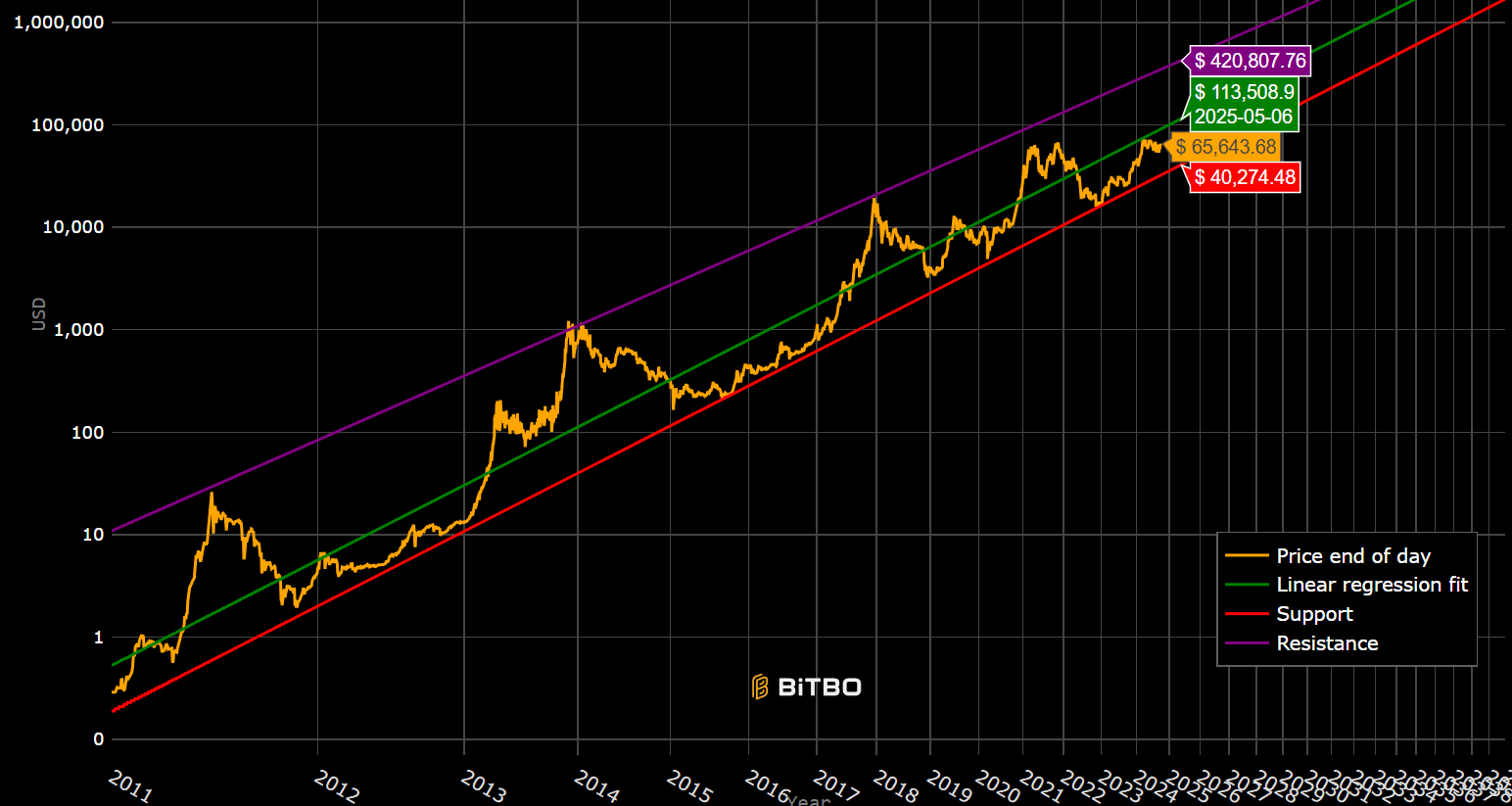

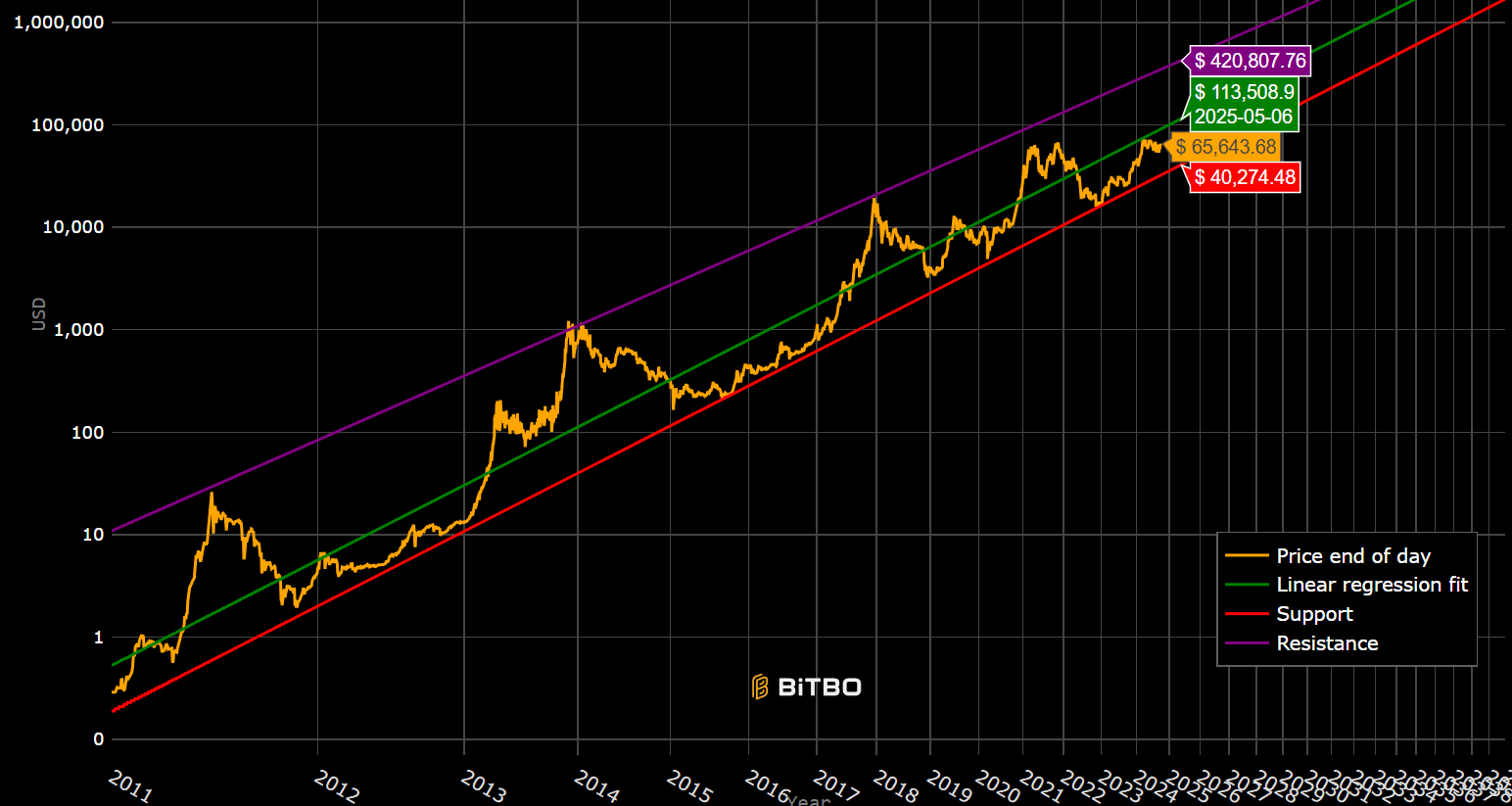

Source: Bitbo

According to the Bitcoin power law model, the rough estimate would be around $400,000 if historical trends continue.

For context, BTC always reached the model resistance level and topped out in previous cycles except 2021.

If the trend repeats, the model predicted $400,000 as the likely target to watch, a prospect strengthened by analyst Ali Martinez. Even the Stock-Over-Flow (S/F) model goal was almost $400,000.

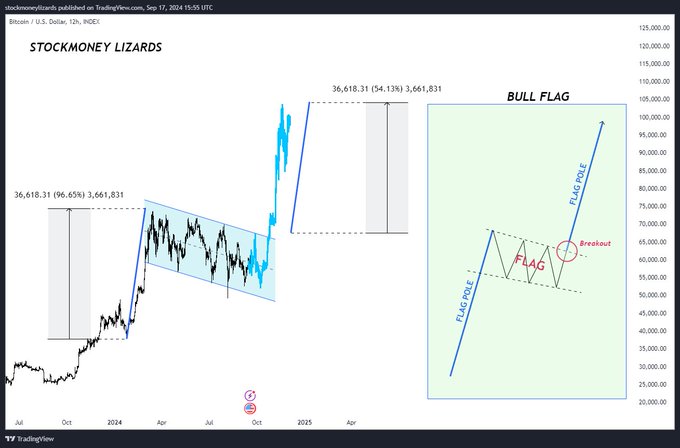

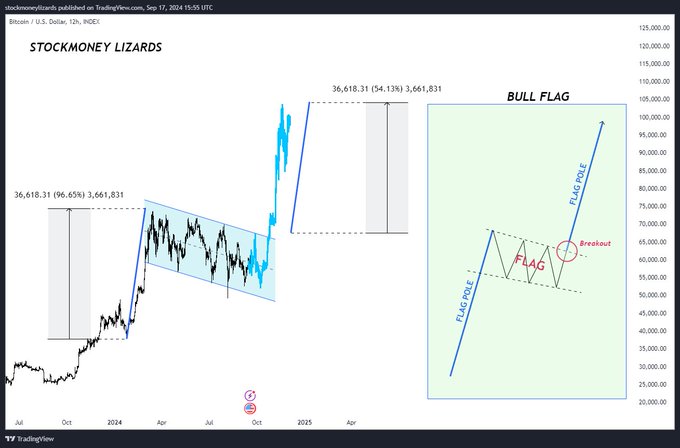

However, Stockmoney Lizards, another BTC analyst, said projected that BTC could reach a high of almost $200,000 – $260,000 by October 2025.

“We are entering what could be the final pump of this Bitcoin cycle. The cycle top is expected around September to October 2025. My personal price target for Bitcoin is between $200,000 and $260,000.”

Source: Stock Money Lizards

The analysts’ timeline and October 2025 target were based on past trends, with BTC topping out 48 months after the previous peak.

Interestingly, its price target was similar to that of Standard Chartered Bank. The bank predicted that BTC could reach $250,000 by the end of 2025.

Before 2024, the bank projected that BTC would rise above $125,000 if Trump won the election. However, if historical patterns played out, Stockmoney Lizards estimated $100,000 per BTC by the end of the year.

Source:

Meanwhile, BTC was valued at $65K at the time of writing. However, the macro front increasingly became a major tailwind for the asset.

After the U.S. Fed’s U-turn on September 18, China launched an aggressive economy stimulus package to revive the economy.

Market experts believe that these macro updates could fuel BTC’s rally.