- Strong long positions and large OI indicate that shorts are at risk.

- Indicators showed a bullish bias that could push Bitcoin towards $77,000.

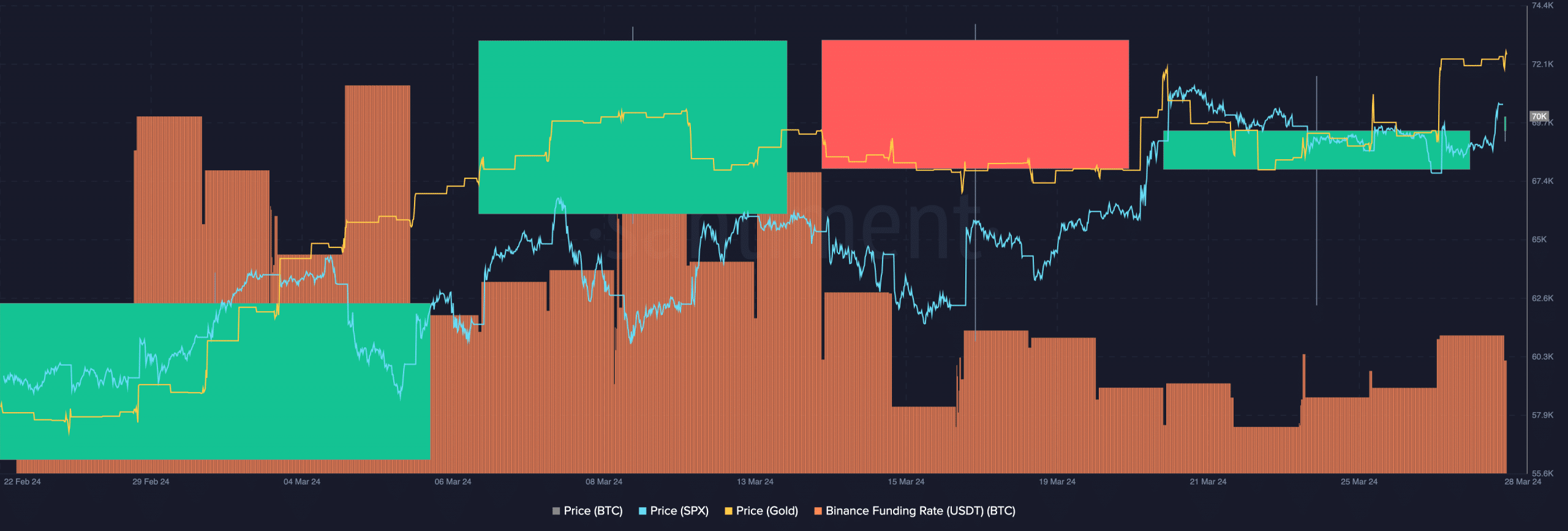

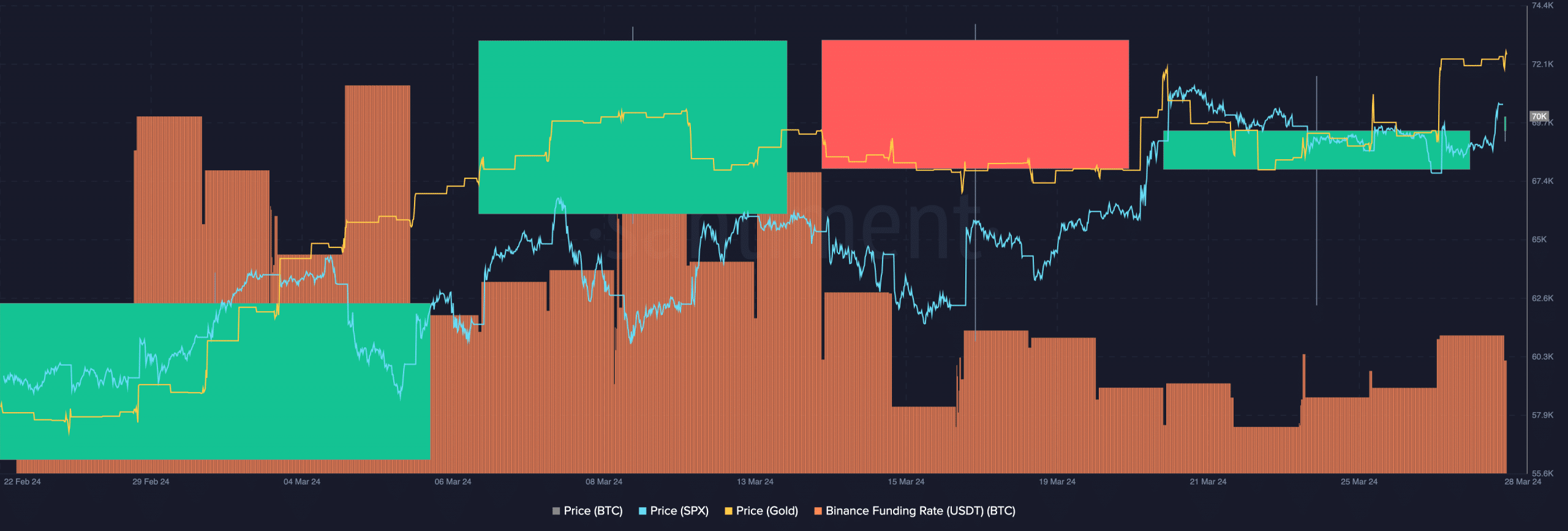

Bitcoin [BTC] Traders are at it again. But this time they are not betting much money and are predicting a nosedive for the currency. Instead, AMBCrypto’s funding rate assessment showed that many traders were long.

Having a long position means that a trader expects to make a profit from the price increase of a cryptocurrency. The financing ratio also indicates whether longs pay shorts differently.

A divergence caused the doubling

At the time of writing, Bitcoin’s funding rate was at its highest level highest point Santiment has been on display since March 18. At the time of writing, BTC had risen to $70,368.

When financing becomes more positive as the price rises, it means perp longs are aggressive and paying off. In the context of the price, this is potentially bullish. If this continues, the price of the coin could rise higher than the predicted $75,000.

Source: Santiment

Meanwhile, traders seemed to have their reasons for betting big on Bitcoin. Interestingly enough, it was something outside of the crypto ecosystem.

AMBCrypto’s investigation into the situation found that traditional assets such as the SPX and gold retested their respective all-time highs. This happened at a time when Bitcoin was struggling to climb back to $73,000.

Historically, such divergence when the halving is close suggests that BTC had not yet finished its rally before the halving. Therefore, distribution could come to a standstill in recent weeks.

All things work together in BTC’s favor

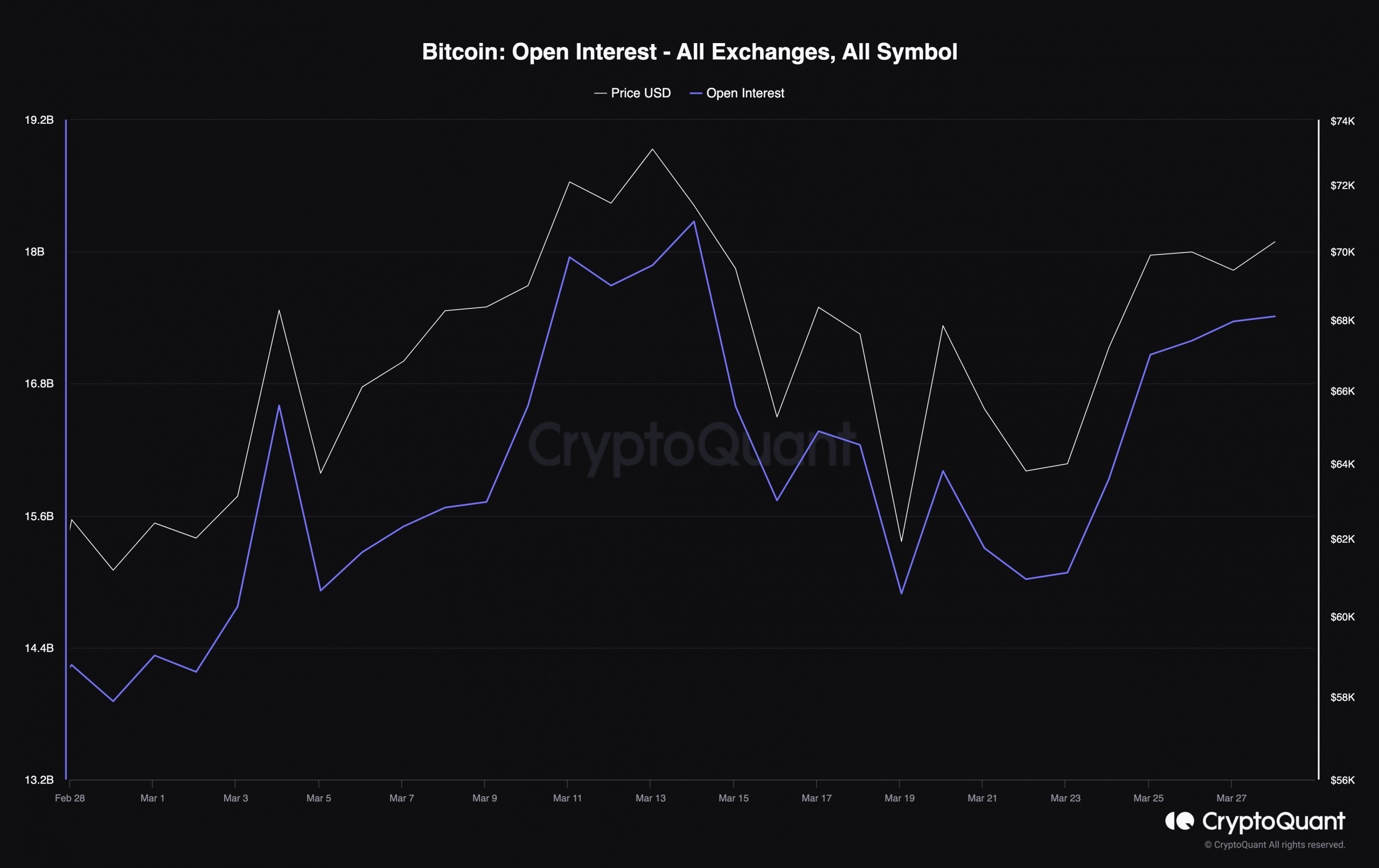

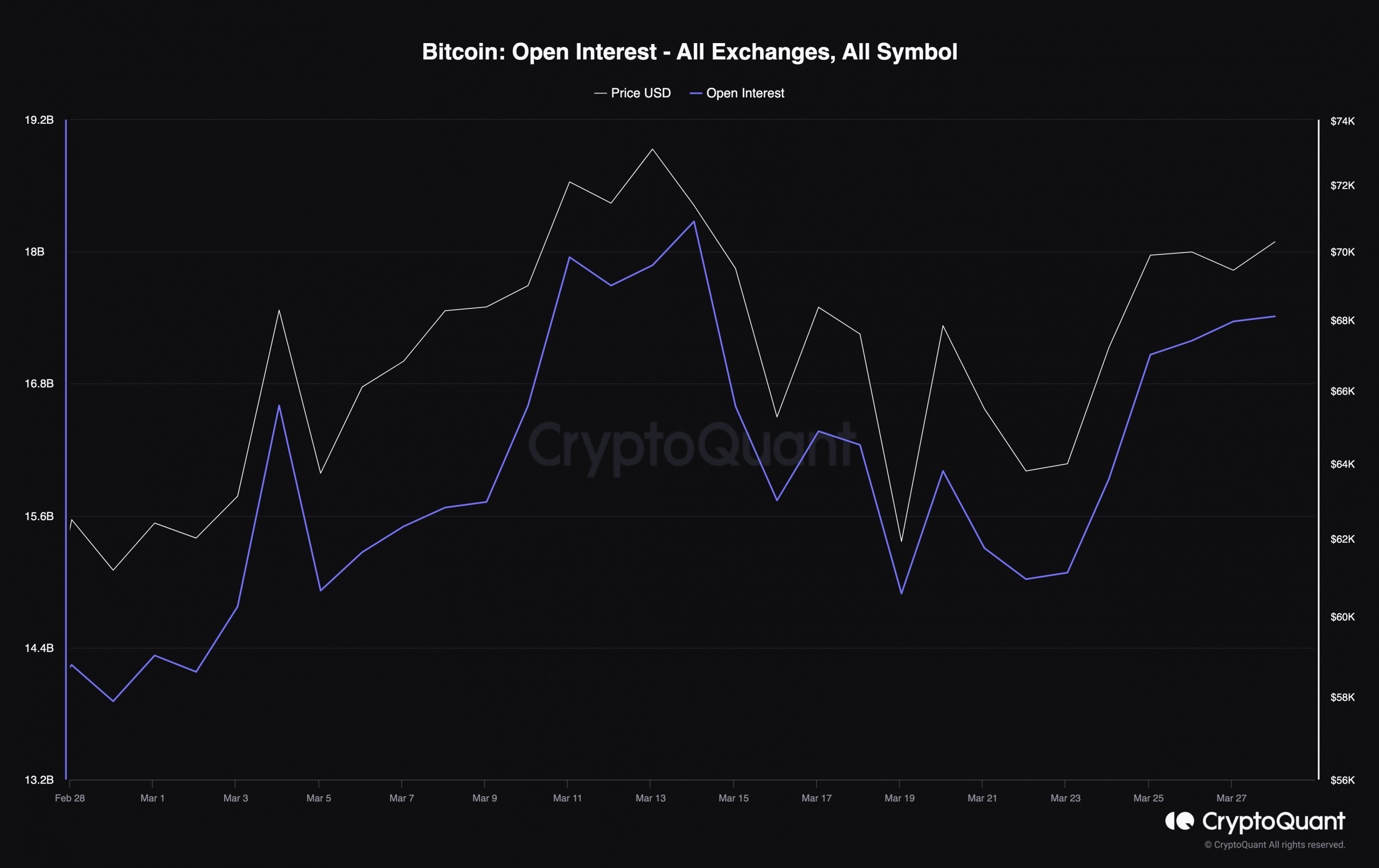

Regardless of the funding rate indications, it is important to assess Bitcoin’s Open Interest (OI). OI is the value of open positions in the derivatives market.

Increasing OI suggests that there is more liquidity, attention and volatility coming into the market. However, if the OI decreases, it means that traders are closing their positions more and more often.

Using data from CryptoQuant, AMBCrypto observed the increase in Open Interest. At the time of writing, Bitcoin’s OI was a mind-bending $17.41 billion.

Source: CryptoQuant

In addition to the price action, increasing OI was a sign of strength for Bitcoin. Should the OI continue to rise while BTC does the same, another all-time high could emerge before the halving occurs.

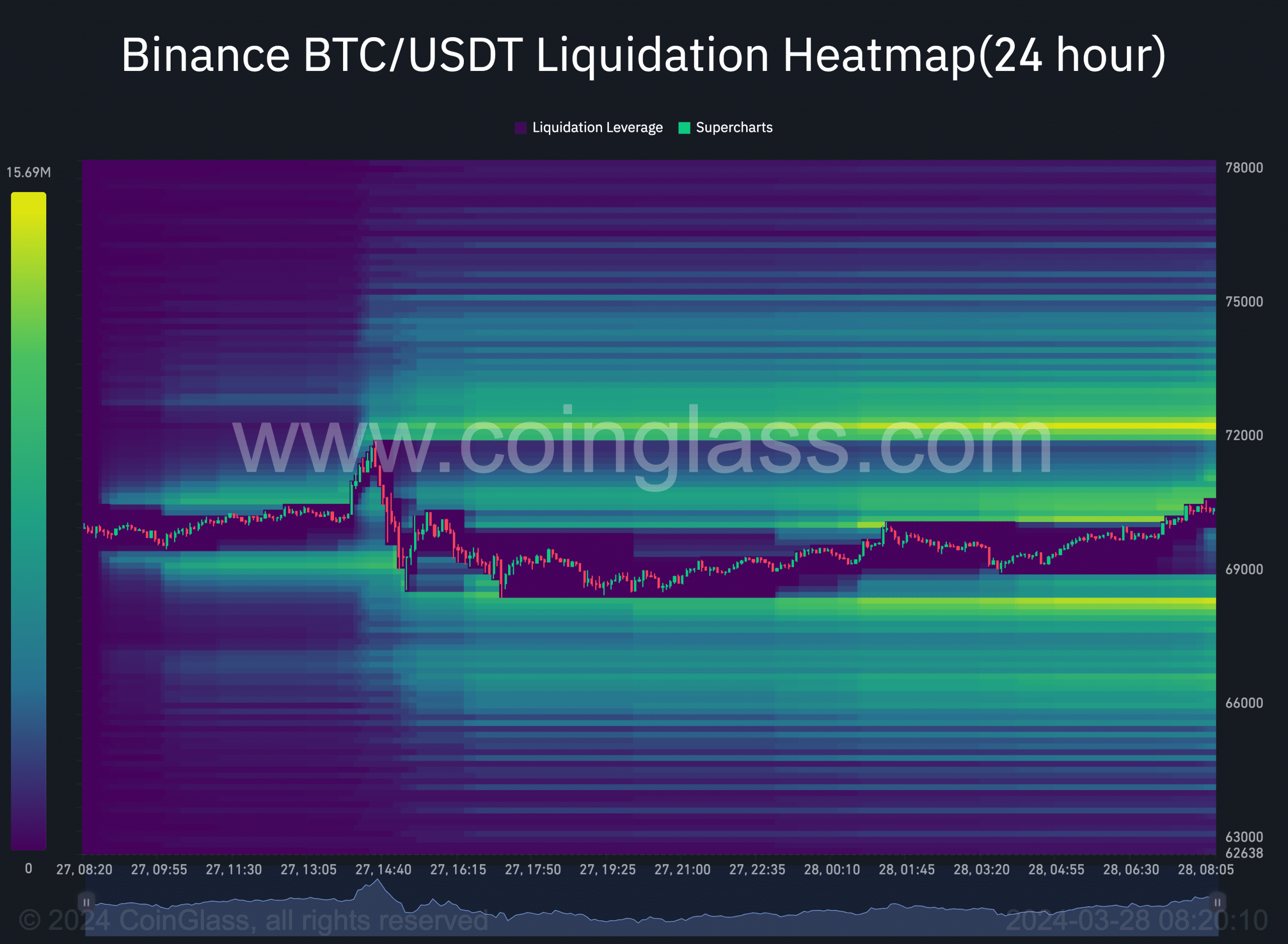

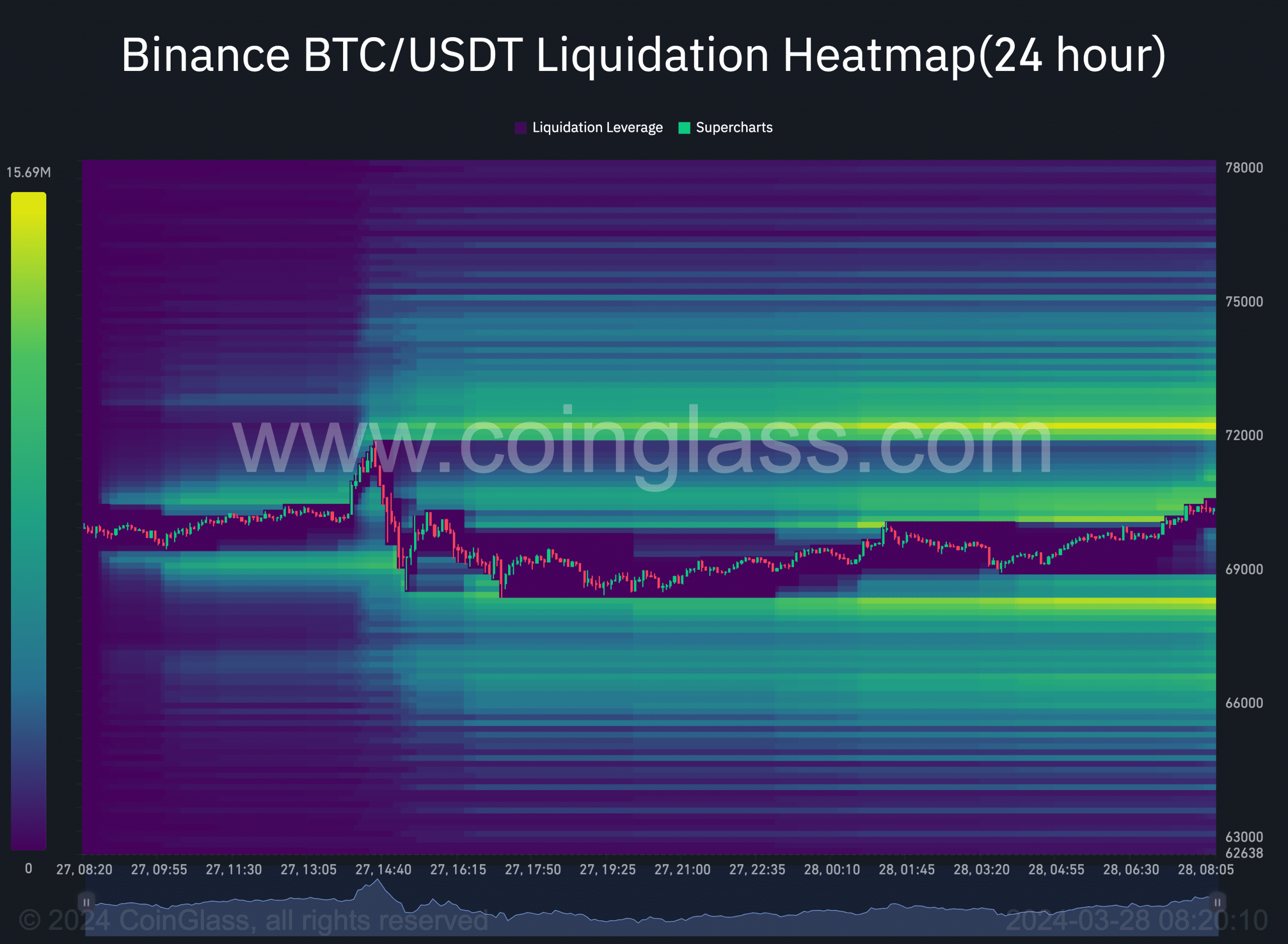

On the other hand, we looked at the liquidation data. As I write this, many shorts have had their positions wiped out in the last hour.

According to Coinglass, the liquidation heatmap showed that BTC could soon approach $73,311. If the coin reaches this price, outstanding contracts worth approximately $6.31 million would be liquidated.

Source: Coinglass

Is your portfolio green? Check the Bitcoin Profit Calculator

Furthermore, a large portion of the victims could be short positions that used medium to high leverage.

From a trading perspective, large Open Interest and short liquidations could lead to a breakout. While Bitcoin may not reach $80,000, a possible surge towards $77,000 is a prediction that could come true.