- Bitcoin may be at the bottom of the market right now.

- In the event of a bullish breakout, BTC should first target $61.3k before targeting $63.2k.

After a week of high volatility in favor of the bears, Bitcoins [BTC] price started to consolidate somewhat. This gave the idea that the bearish trend might be coming to an end.

But there was more to the story, as a key metric pointed to a continued price decline in the coming days.

Bitcoin still has problems

CoinMarketCaps facts revealed that the bears dominated the market last week when the price of the king coin fell by more than 10%. The last 24 hours have been better, as the price of the coin only fell by more than 1.7%.

At the time of writing, BTC was trading at $57,523.15 with a market cap of over $1.14 trillion.

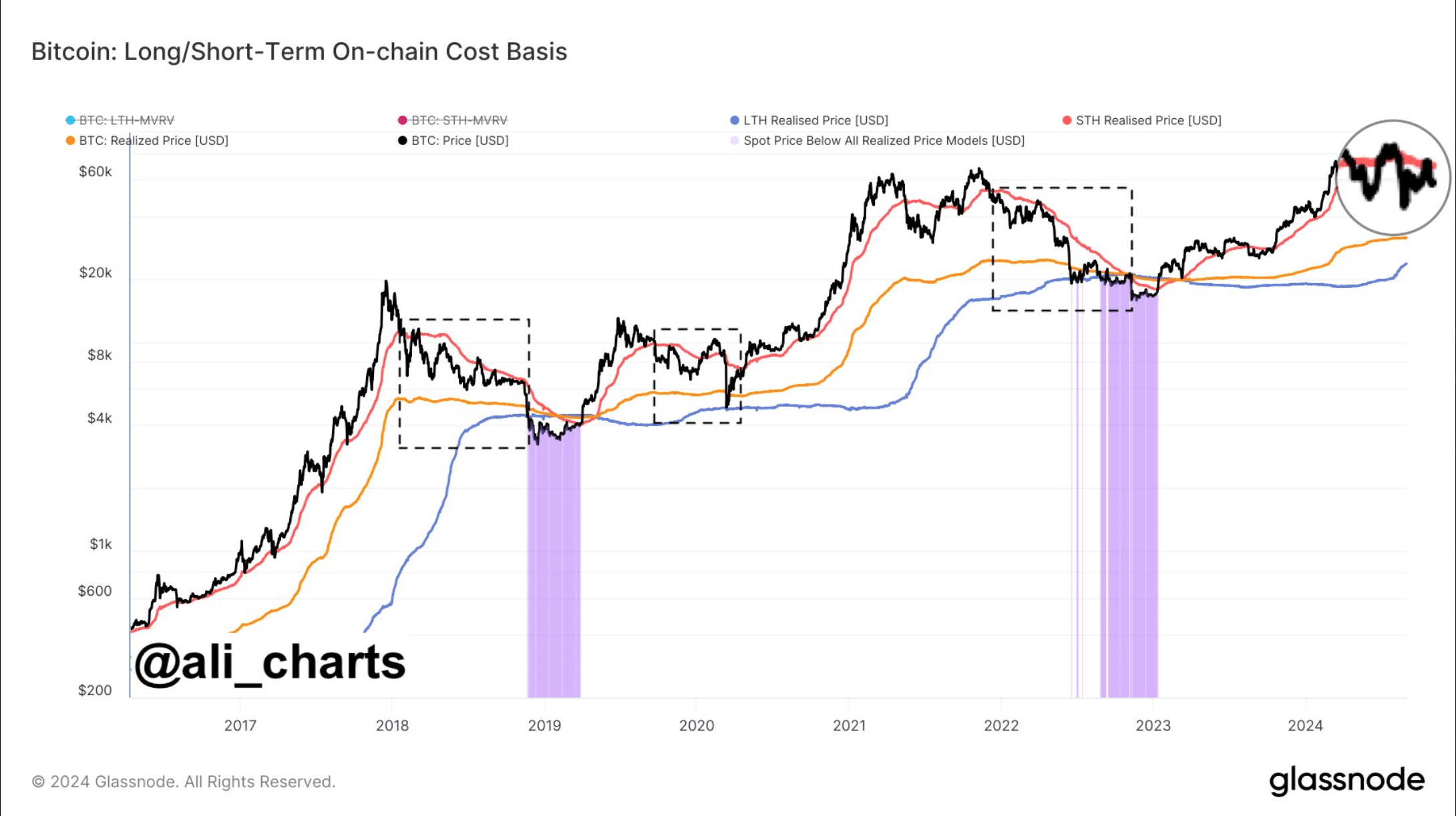

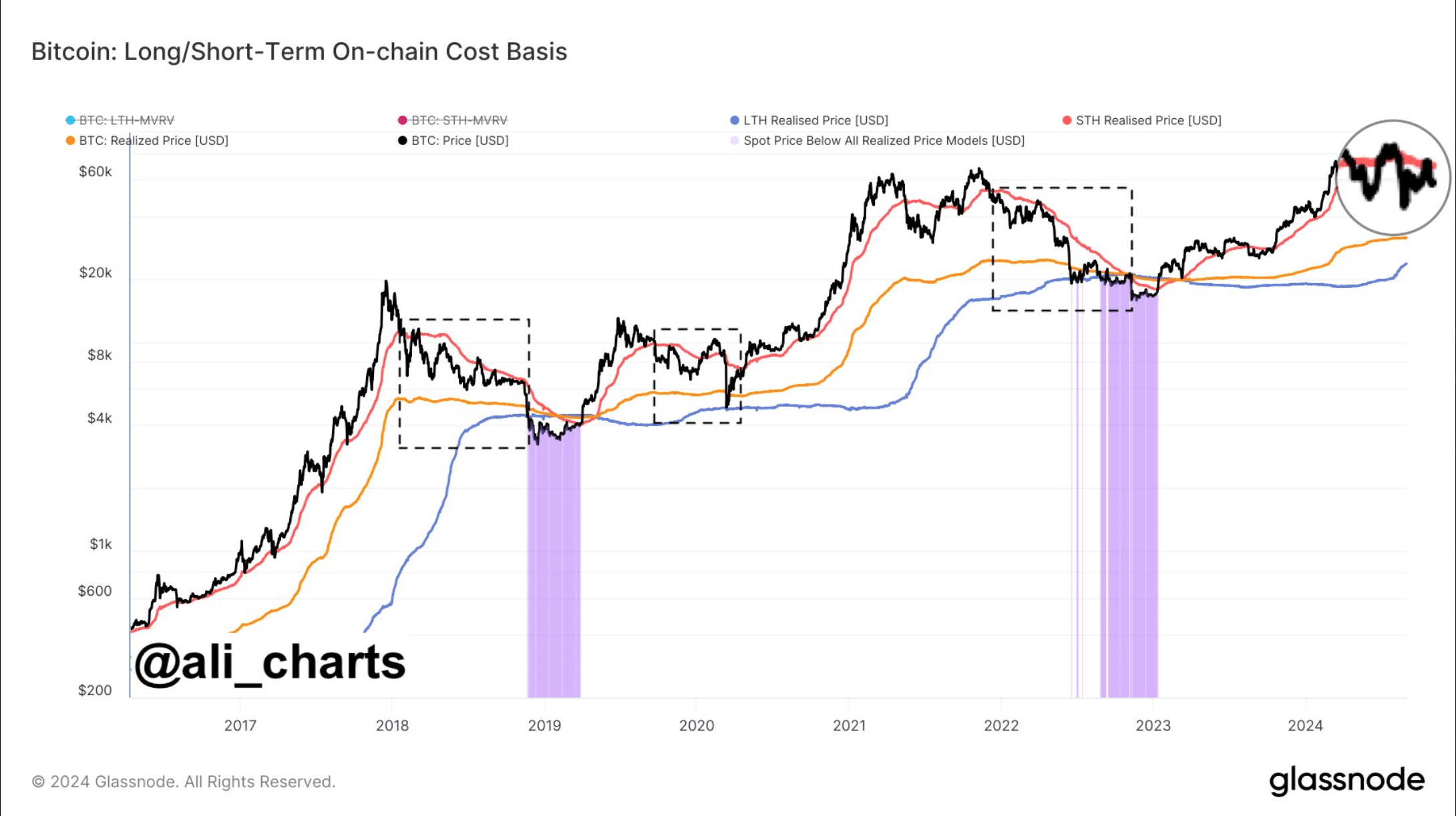

Meanwhile, Ali, a popular crypto analyst, posted one tweet revealing more trouble for the king’s coin. The analysis used BTC’s Short-Term Holder Realized Price, which helps gauge the behavior of recent Bitcoin buyers.

Notably, since June 22, BTC has struggled to break above this level, with the Short-Term Holder Realized Price reaching $63,250. Therefore, it is crucial for BTC to regain this level.

Until then, BTC continues to face the threat of selling pressure, which could further depress the price of the coin.

Source:

Will BTC cross the $63,000 mark soon?

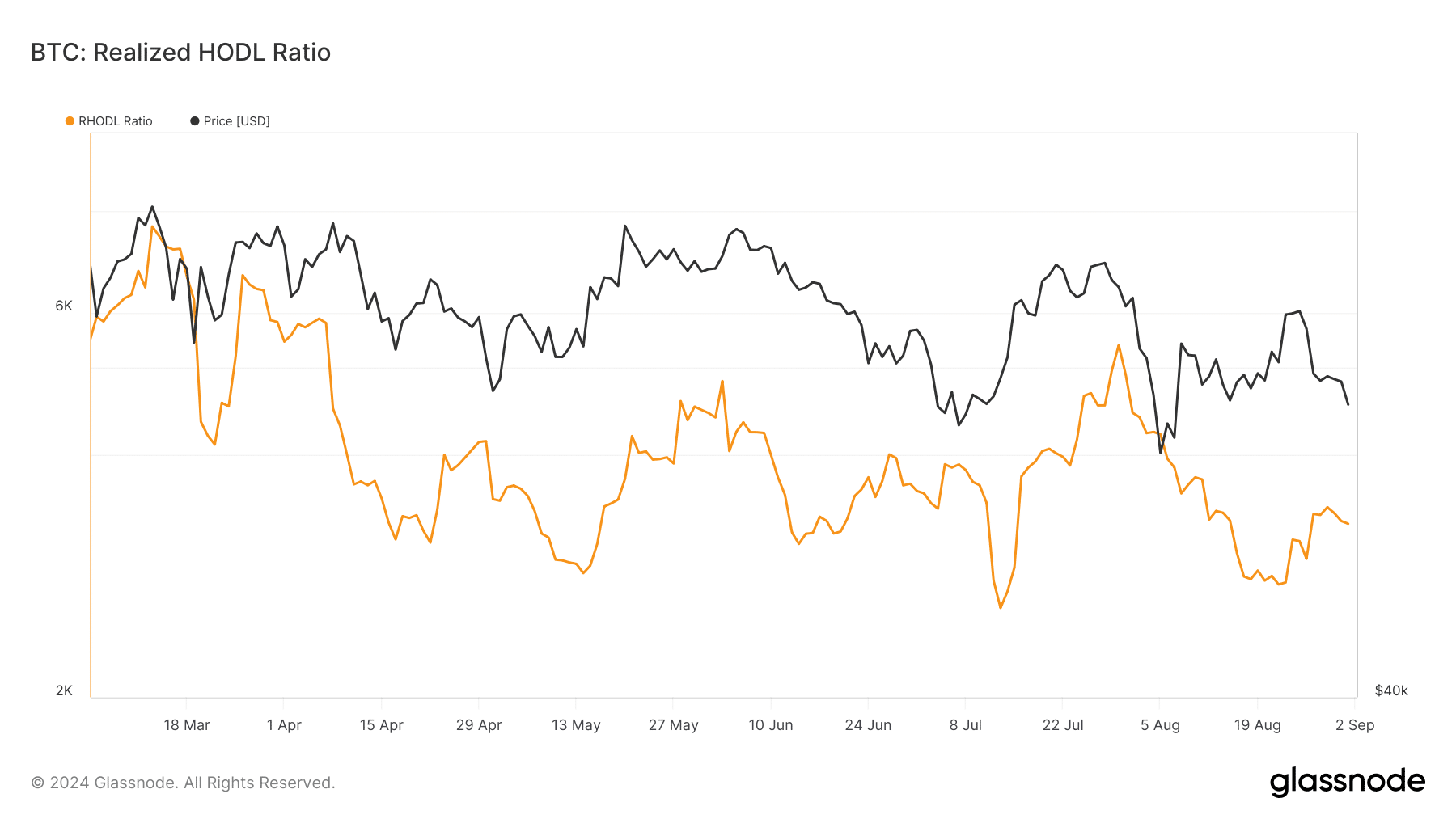

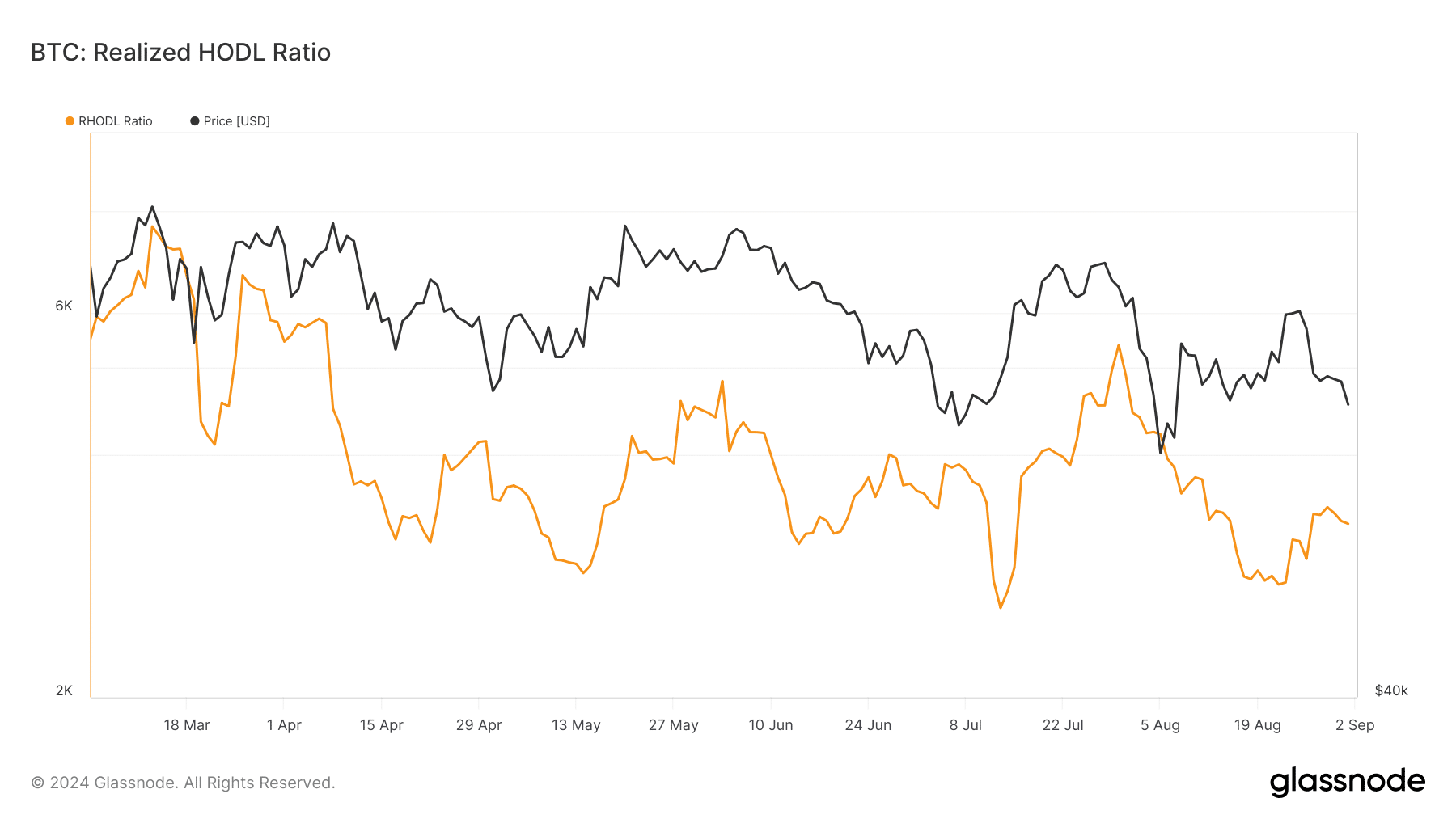

As the danger of a price drop loomed around BTC, AMBCrypto planned to check its metrics to determine the likelihood of BTC recovering $63.2k. Our analysis of Glassnode’s data revealed Bitcoin’s realized HODL ratio.

To start, the RHODL ratio takes the ratio of the 1-week to the 1-2-year RCap HODL bands. At the time of writing, the price registered a decline, which could potentially indicate a market bottom.

Source: Glassnode

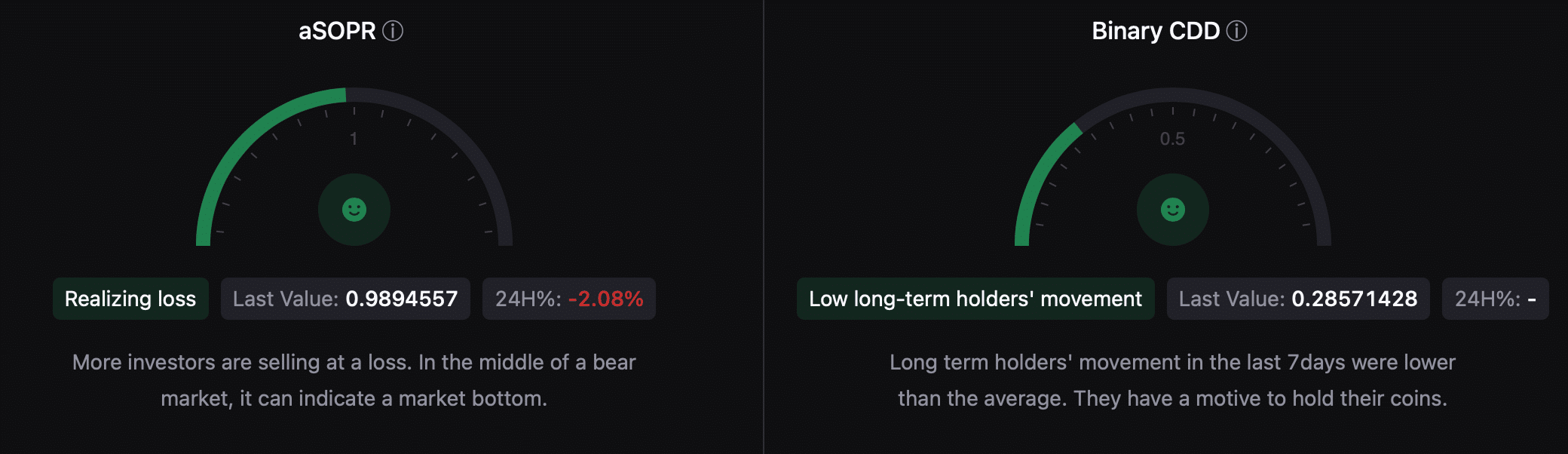

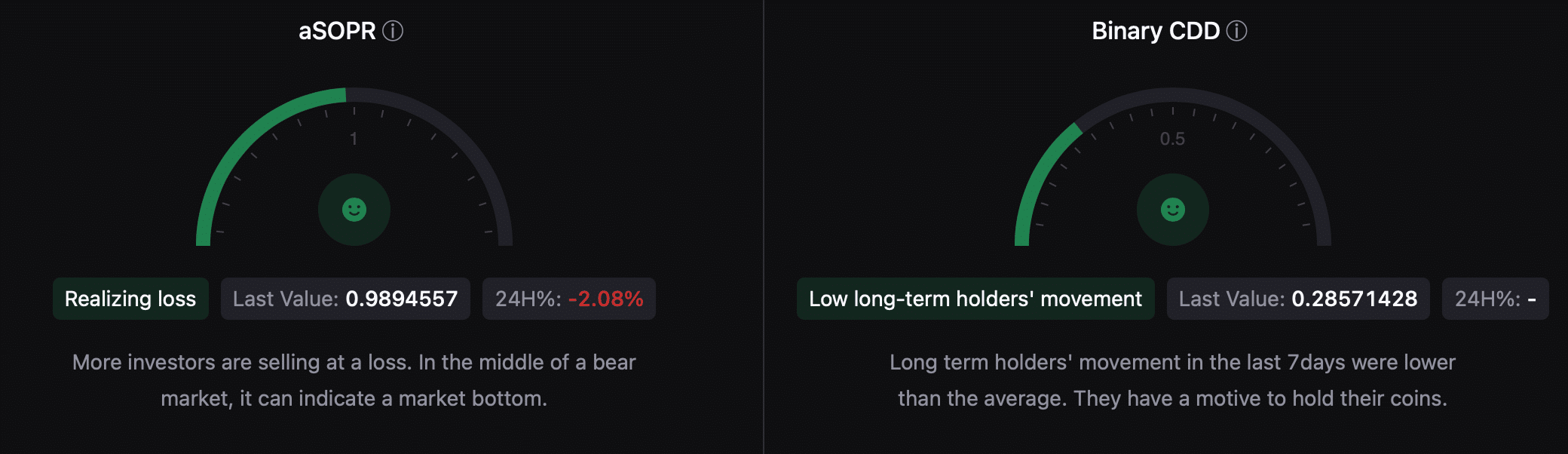

Apart from this, some other statistics also seemed optimistic. Our analysis of CryptoQuant’s facts pointed out that BTC’s aSORP was green, meaning more investors were selling at a loss.

In the middle of a bear market, this could indicate a market bottom.

The binary CDD was also green, indicating that the movement of long-term holders over the past seven days was lower than average. So they have an incentive to hold on to their coins.

Source: CryptoQuant

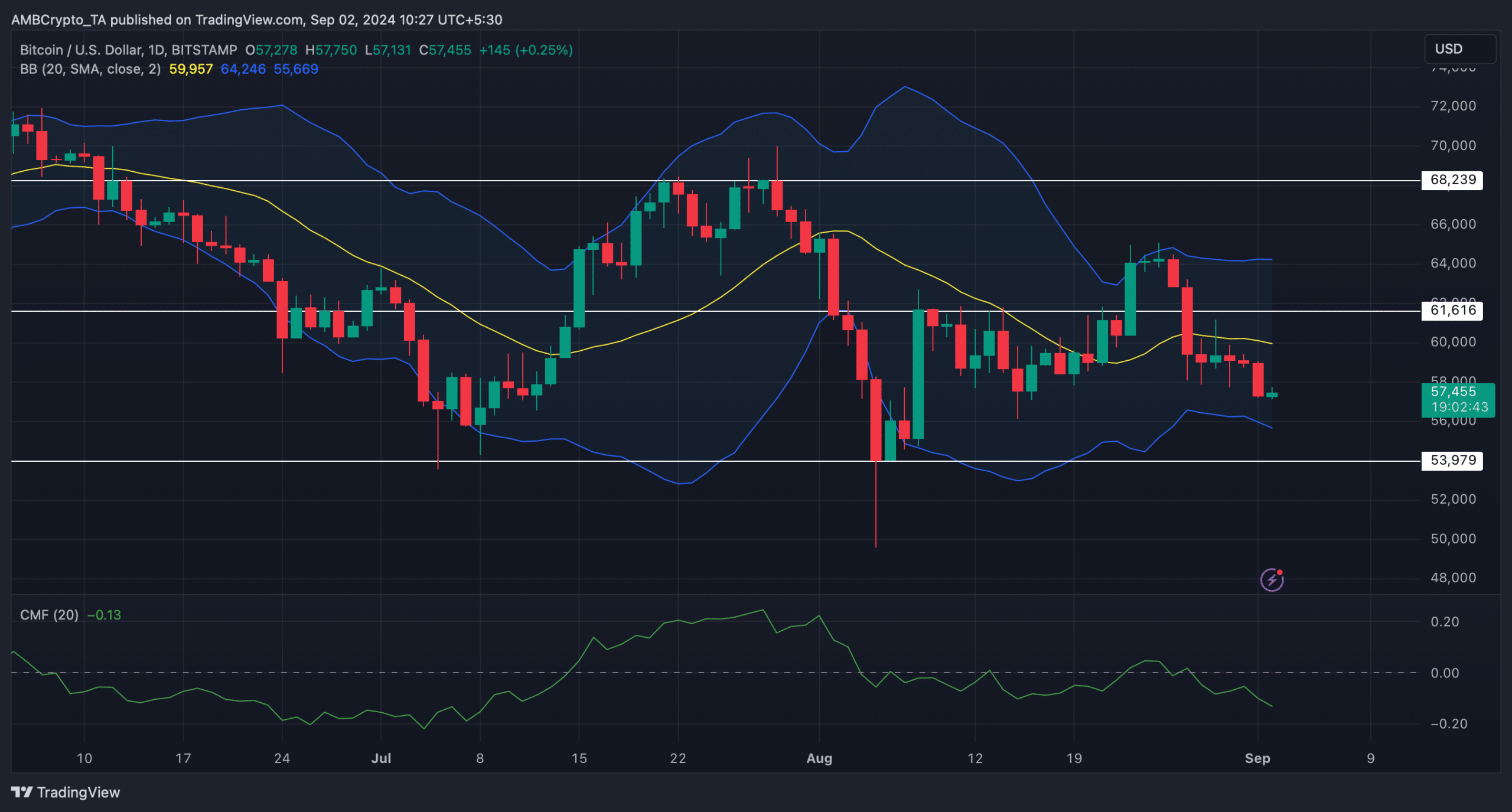

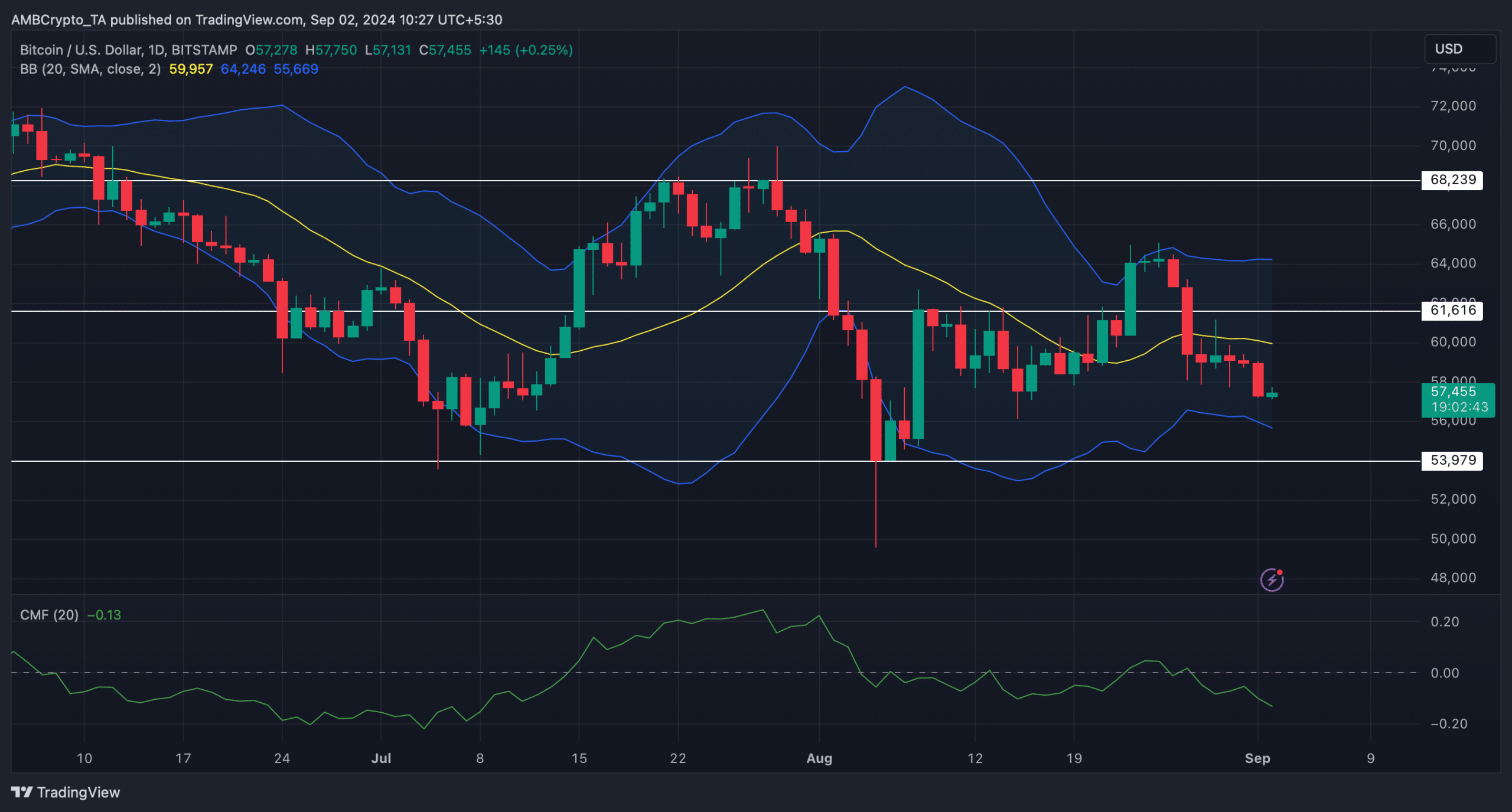

We then checked Bitcoin’s daily chart to see if technical indicators pointed to a price increase towards $63.2k.

Read Bitcoins [BTC] Price prediction 2024-25

Bitcoin’s price was about to hit the lower bound of the Bollinger Bands, which often results in price upswings. If that happens, it would be crucial for BTC to get above $61.6 before seeing $63.2k.

Nevertheless, the Chaikin Money Flow (CMF) moved south, indicating that there were chances for the price of BTC to fall further.

Source: TradingView