- Bitcoin mining has experienced a shift, with two countries now controlling 95% of the mining hash rate.

- This concentration of power could displease the miners and lead to mass capitulation.

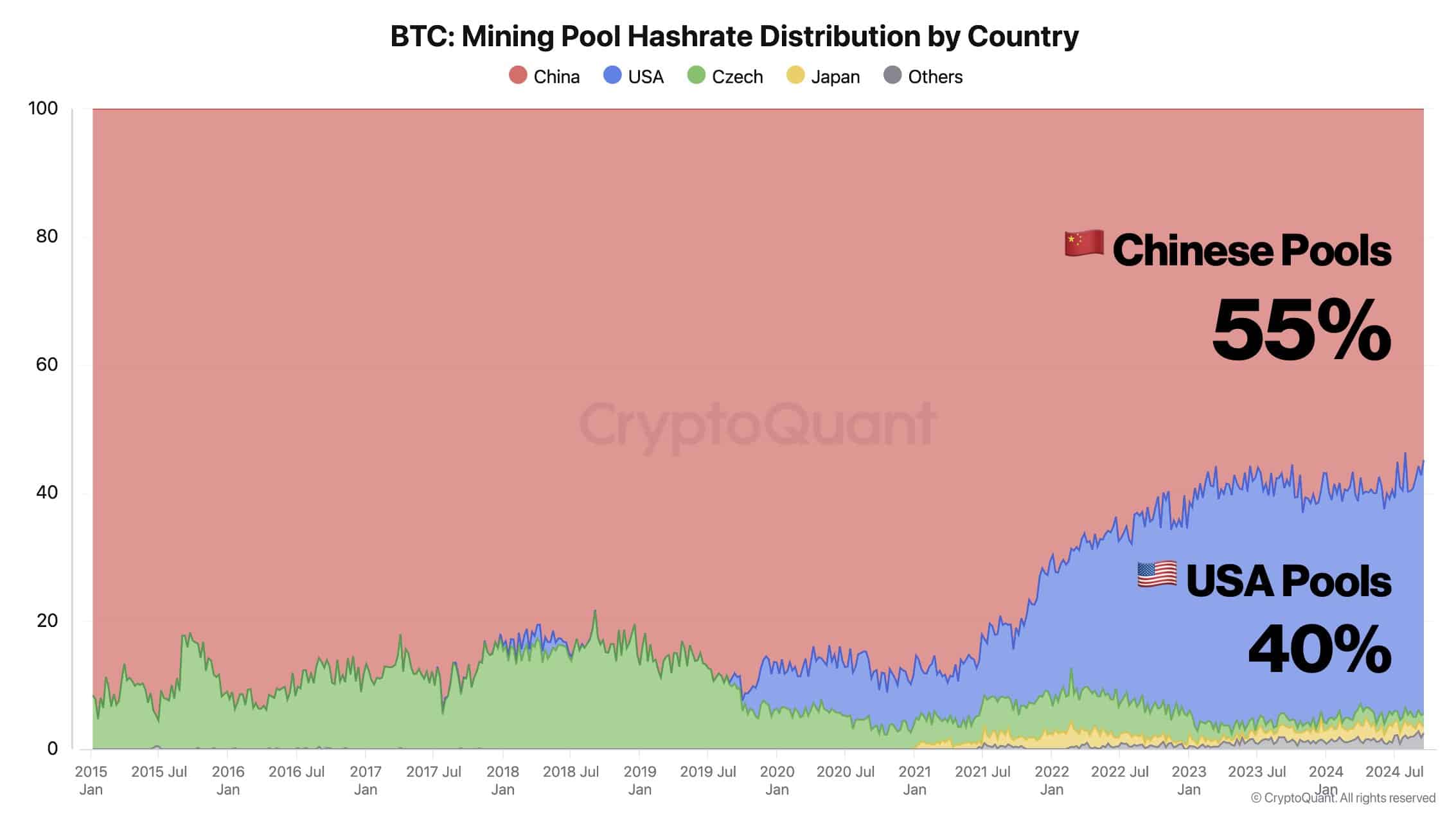

The Bitcoin [BTC] The mining landscape is changing, with US pools now controlling 40% of the hashrate, while Chinese pools control 55%.

Once dominant because of cheap hardware, Chinese miners are losing their edge as the focus shifts to cheap energy sources. This shift, driven by China’s regulatory crackdown, is forcing mining operations to move to areas with more favorable energy sources. Its impact? AMBCrypto investigates.

Hashrate distribution is too centralized

Previously, China had significant influence over the mining industry and controlled approximately 55% of the total BTC hashrate. This meant that most of the Bitcoin mining power was concentrated in China.

This dominance allowed Chinese miners to gain an edge in wagering rewards, leading to greater accumulation of BTC in the country.

Source: CryptoQuant

Now the US is closing the gap and controls 40% of the hash pool. The focus is shifting, with US-based Bitcoin mining companies reaping the most benefits, especially those targeting institutional investors.

However, this mass exodus could challenge American miners as increased competition could undermine profits. It is crucial to keep a close eye on individual miners. If operating costs exceed profitability, they may close their positions.

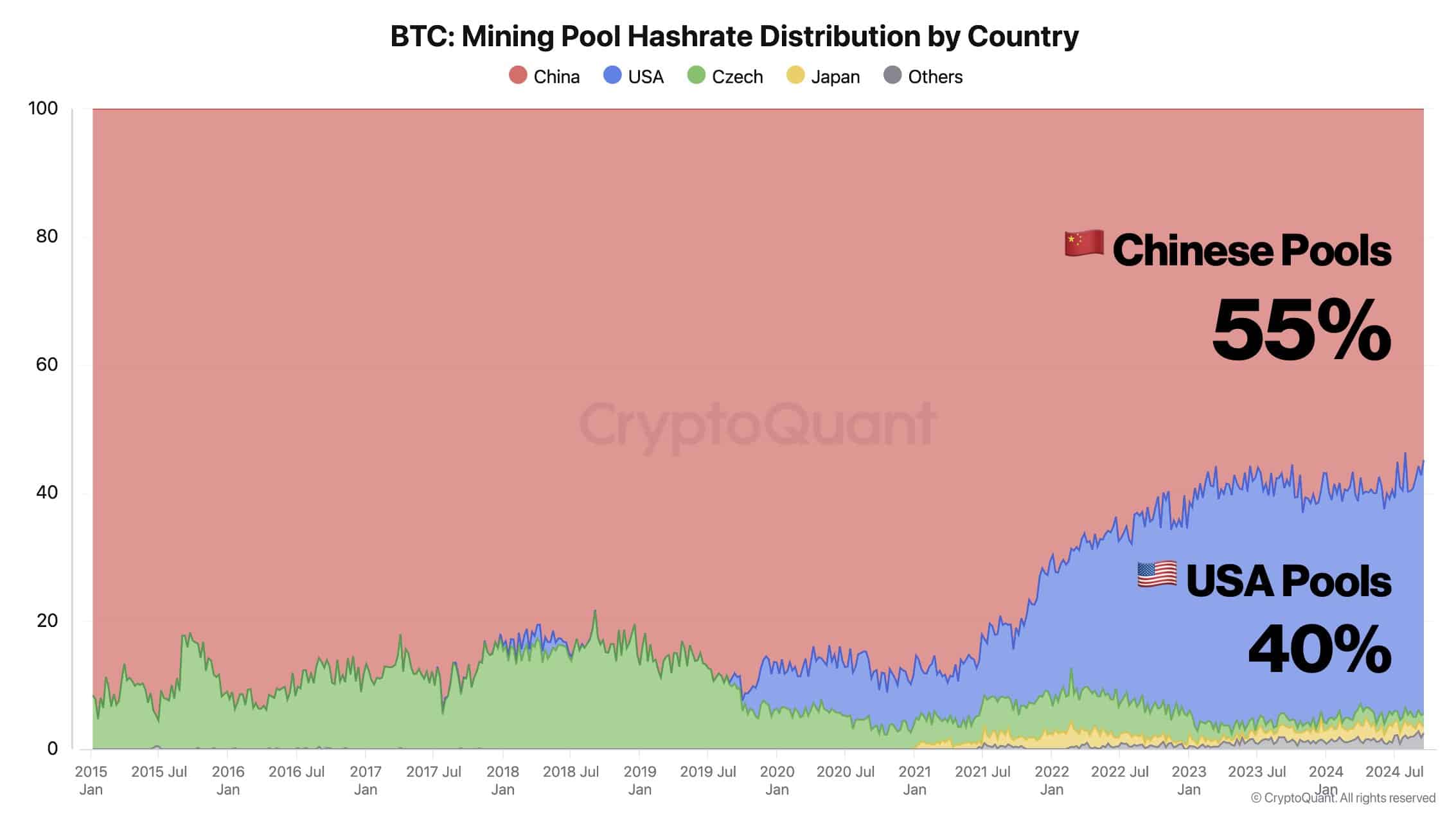

Fear is clearly visible

Taking advantage of the recent surge, Bitcoin miners likely took advantage of the gains, while BTC consolidated above $63,000 and peaked near $64,000, as evidenced by miners’ reserves hitting record lows.

Source: CryptoQuant

With Bitcoin mining difficulty level new monthly highs, it has become essential for miners to seize every opportunity for profit when it arises.

Furthermore, the influx of miners in the US is raising concerns as increased competition is expected to drive the difficulty level to new records, ultimately reducing rewards.

Consequently, the capitulation of miners could significantly threaten BTC’s ability to reach the $68K resistance.

On the other hand, this scenario could emphasize the dominance of large mining companies, giving them an advantage as smaller miners exit the market, which would further centralize the network.

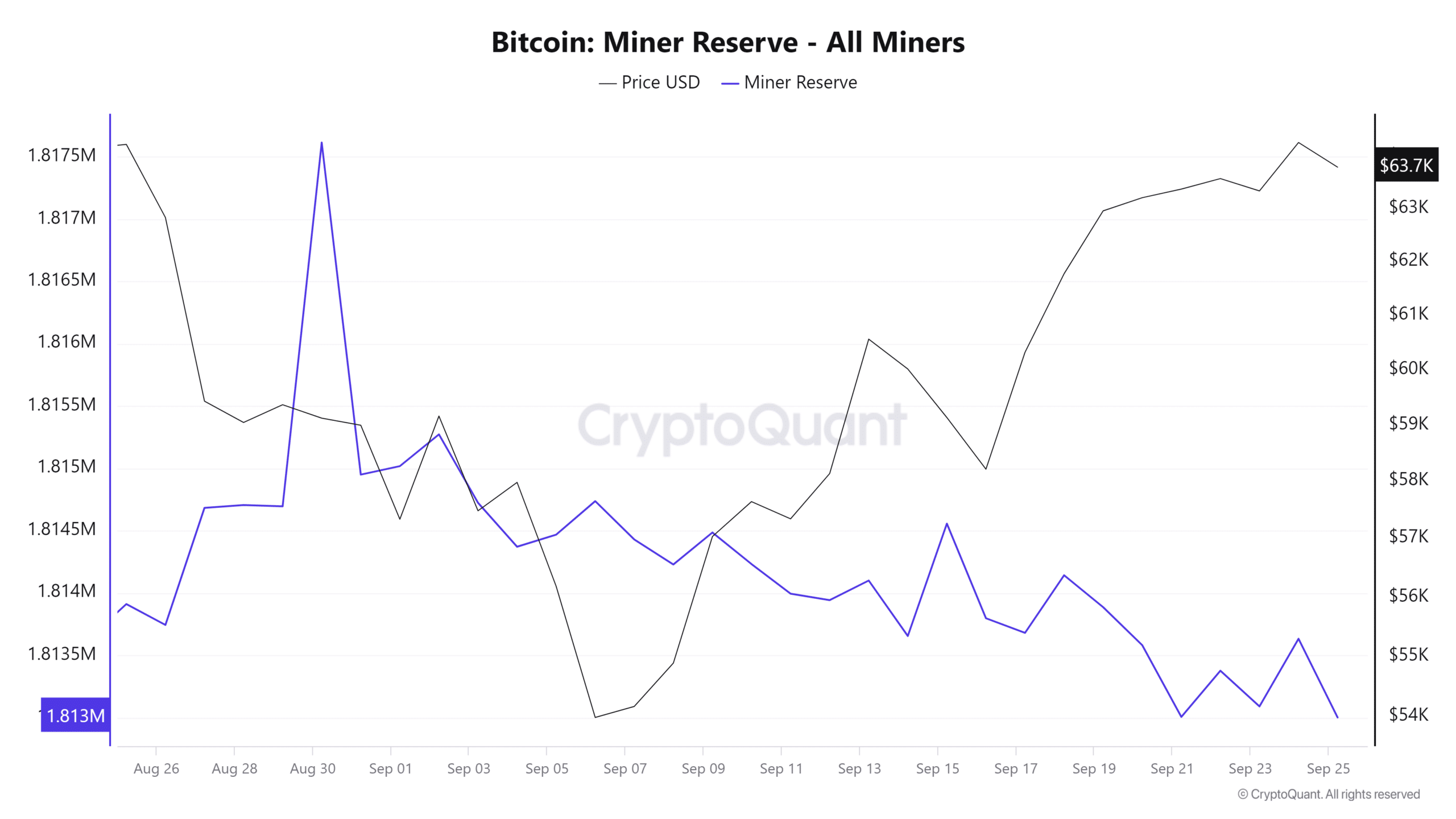

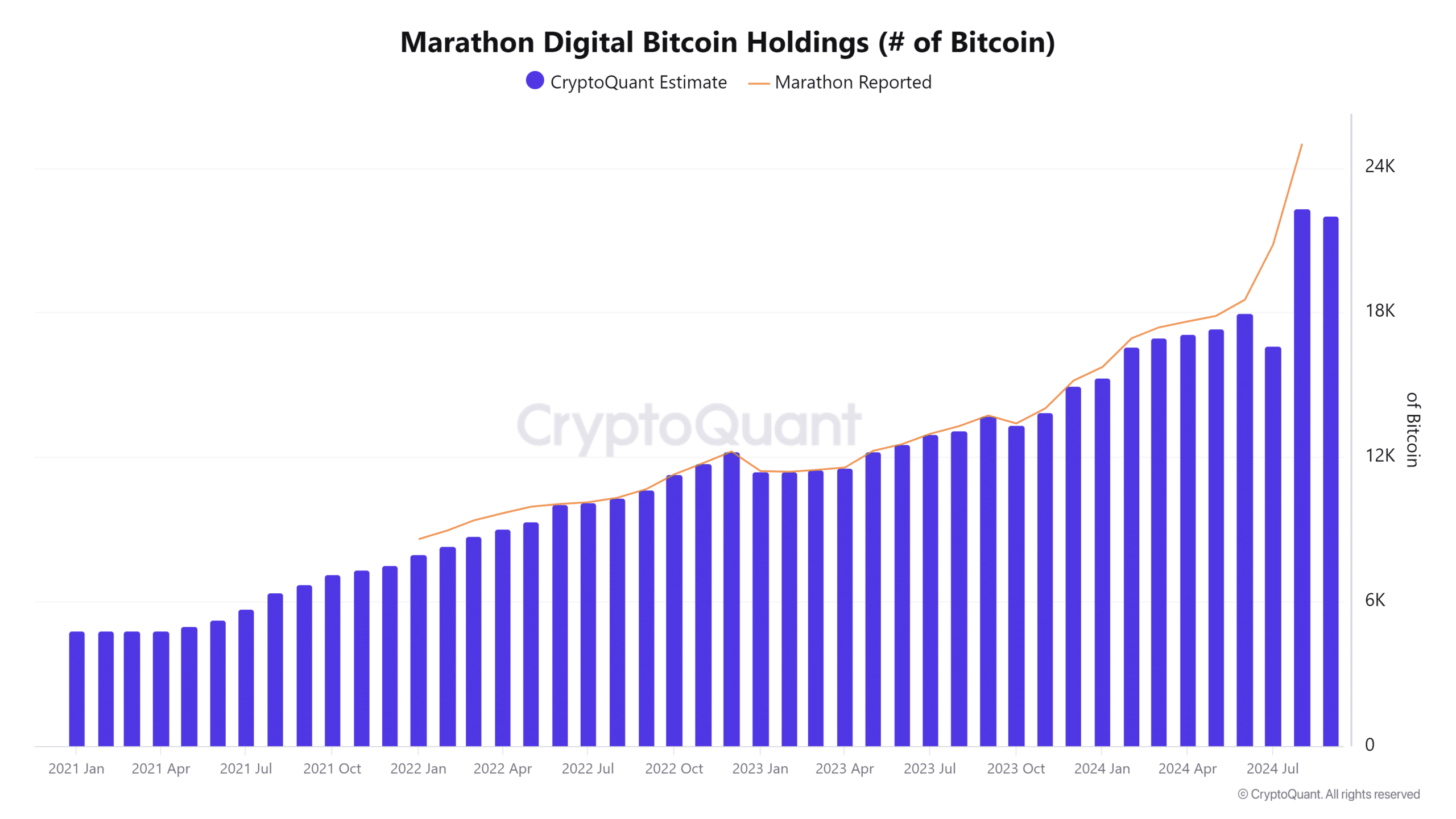

Bitcoin mining houses could take the lead

Bitcoin mining houses with significant assets may look to leverage their resources and take the lead as many miners are leaving due to the mounting difficulties.

For example, the largest Bitcoin mining company in the US has strategically amassed assets, peaking at an estimated $22,022.4, although reported figures may be even higher.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

Furthermore, their substantial holdings could also provide an advantage during miners’ capitulation, allowing them to absorb the pressure when BTC reaches the top of the market.

However, increased centralization could spell trouble for the Bitcoin mining industry, preventing BTC from breaking the crucial resistance at $64,000.