Bitcoin miners have received a profit boost after the planned difficulty adjustment resulted in a positive balance. This is the first time since February that the difficulty level, which controls the issuance of coins on the network, has decreased. Recent data from Brains showed that Bitcoin’s computing power experienced a drop of more than 45+ EH/s between April 20 and April 28. However, this trend has been reversed by the increase in miner profits over the past week.

Despite restoring the hashrate to 350 EH/s, it wasn’t enough to avoid a retracement of 1.45% difficulty adjustment, as reported by Mempool.space. Currently the mining difficulty is 48T (trillions). This change in difficulty affects the profitability of the miners, as less competition for the reward means a higher estimated income for those still connected to the network.

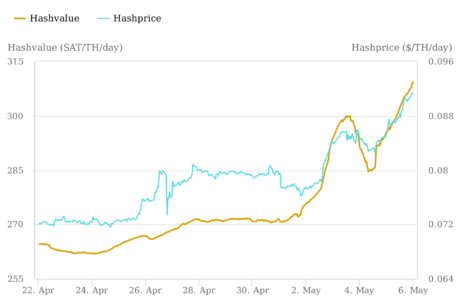

Bitcoin Miners profit as the hash price rises

The current price for Bitcoin hash power rose to 0.088 USD/TH/day (88 USD/PH/day), up from 0.077 USD/TH/day (77 USD/PH/day) on May 2. This 11.49% increase over three days is a positive development for Bitcoin miners, indicating higher profitability for their operations. The hash price is a crucial metric for calculating the profitability of a mining operation, representing the value assigned to a unit of account in dollars per terahash or petahash per day. While the cause of last week’s significant drop in hashrate is uncertain, the current state of the network justifies the rapid reconnection of miners.

Recently there has been more interest in it BRC-20 tokens, which are used to create memecoins, leading to network congestion in Bitcoin within a few days of their release. As reported recently, this could be a possible factor in the hashrate drop. As a result of this high activity on the network, fees now make up 12.4% of miners’ revenues.

Read related: Bitcoin Breaks Out: Experts Predict $36,000 Target While Market Outlook Remains Positive

Bitcoin commissions rise after new record of ordinal numbers

In the wake of the increasing interest in tokens that can be registered with Bitcoin through Ordinals, the value of transaction fees paid by Bitcoin users has skyrocketed. Within one day, average transaction costs more than doubled. According to data from Mempool.space, current transaction fees range from 70 sat/vB to 100 sat/vB. This means that a transaction of 140 vB (median) would require a payment of almost $4 USD to be confirmed within the first few minutes.

Note that the sudden interest in tokens registered through Ordinals is responsible for the backlog of transactions to be confirmed, leading to an increase in average commissions. According to Murch, a Bitcoin developer, the depth of the mempool has reached 104 blocks, despite there being 8 blocks per hour for the past six hours. The rise of Ordinals NFTs has not been without controversy, as some Bitcoin maximalists blame this trend for increased transaction fees that have resurfaced in recent months.

Related Reading: Former DoJ Kennedy Jr, Complains of Global Financial Censorship, Shows Support for Bitcoin

Bitcoin price analysis

At the time of writing, Bitcoin is trading around $29,000, up 2% over the past week.

Featured image from iStock.com, charts from Braain.com, Mempool.space, and Tradingview.com