- Bitcoin miners are facing a dilemma as they hit their lowest mining rewards in the month of August, putting pressure on their profits.

- However, a strategic approach could help them overcome these challenges.

Bitcoin [BTC] had a volatile end to August, with the price fluctuating within a specific range between $64,000 and $57,000. At the time of writing, Bitcoin was valued at $58,385.

As bulls aim to break the $64,000 barrier, Bitcoin miners are facing their lowest earnings of the year, marking the worst performance in 11 months.

That’s why AMBCrypto investigated whether this sharp decline in BTC rewards could push miners to abandon the trade.

August brings the lowest earnings for Bitcoin miners

In August Bitcoin miners included their lowest revenue-generating month since September 2023, with the number of coins mined dropping significantly.

Moreover, mining comes with high operational costs for Bitcoin miners. If rewards do not cover these costs, miners may face capitulation.

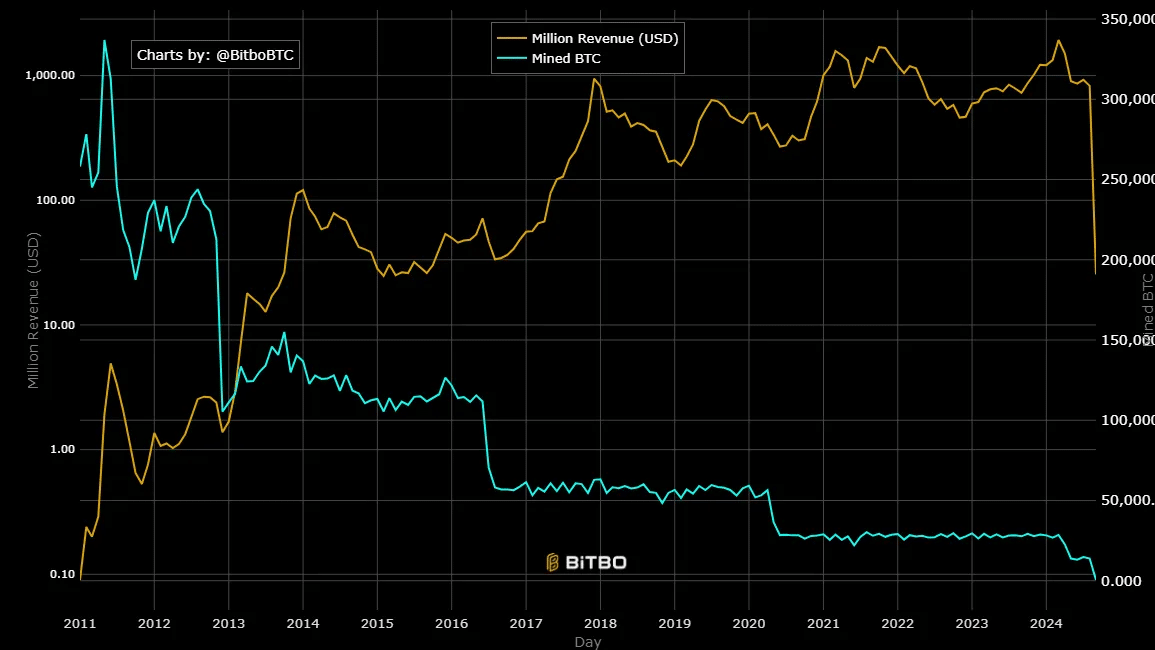

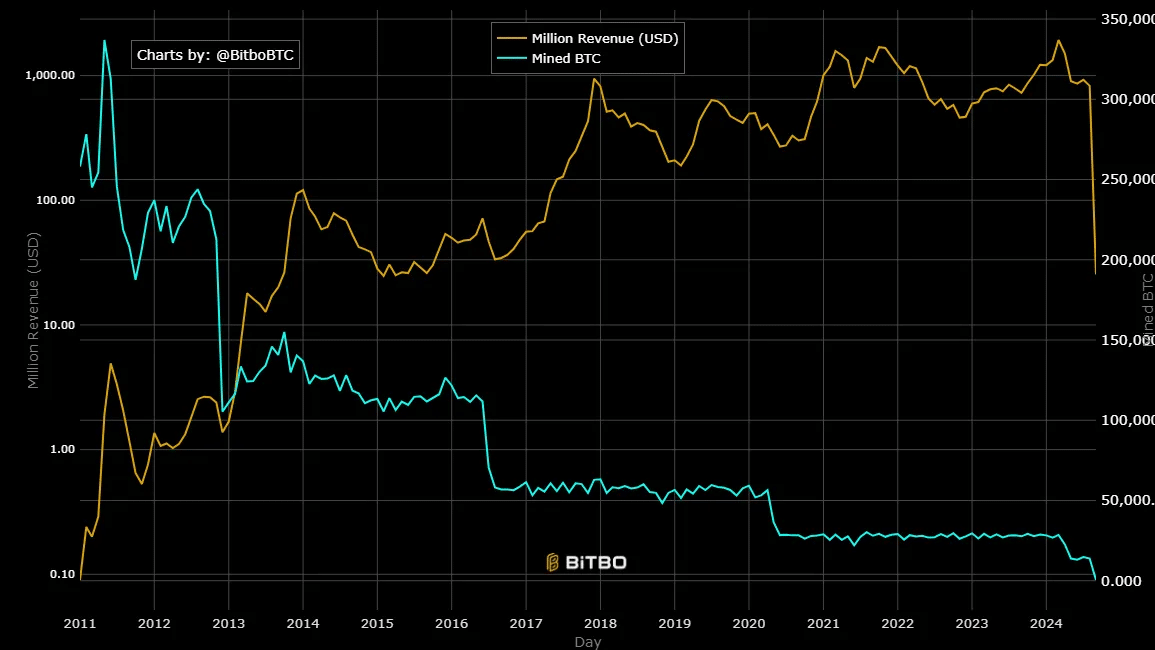

According to AMBCrypto’s analysis of the chart below, miner revenues fell to $820 million in August, down more than 10% from $927 million in July.

Source: BitBo

Interestingly, this August figure represents a 57% decline from the peak of nearly $1.93 billion in March, the same month Bitcoin reached its ATH of over $73,000.

This showed a big drop in mining revenue, despite Bitcoin’s high price earlier this year. But why? AMBCrypto examined.

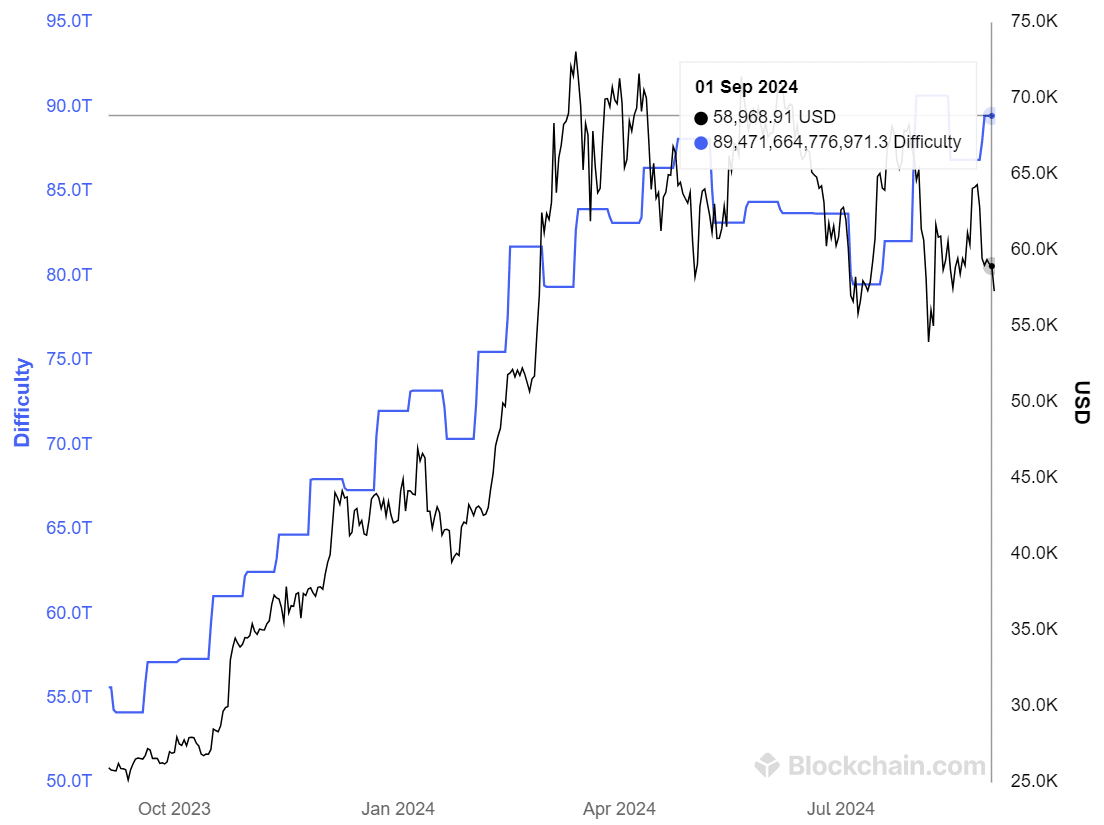

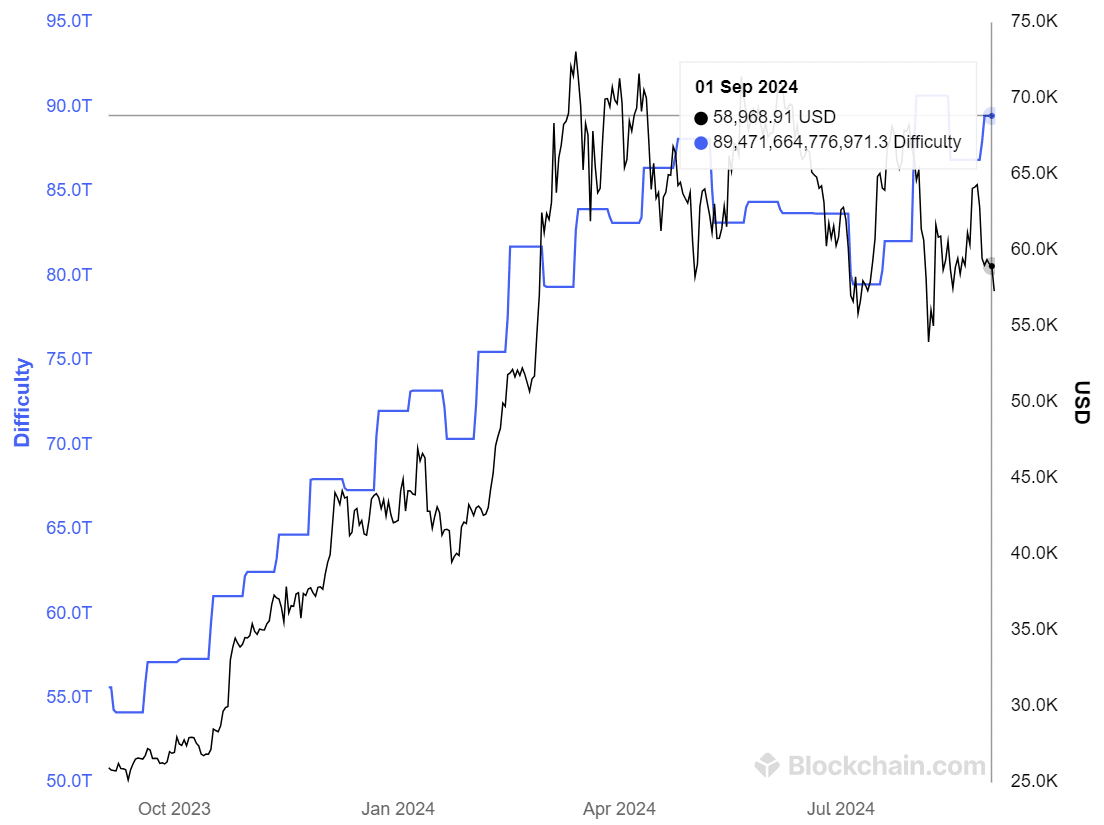

After the last BTC halving in April, which reduced block rewards to 3,125 BTC per block, mining difficulty increased sharply.

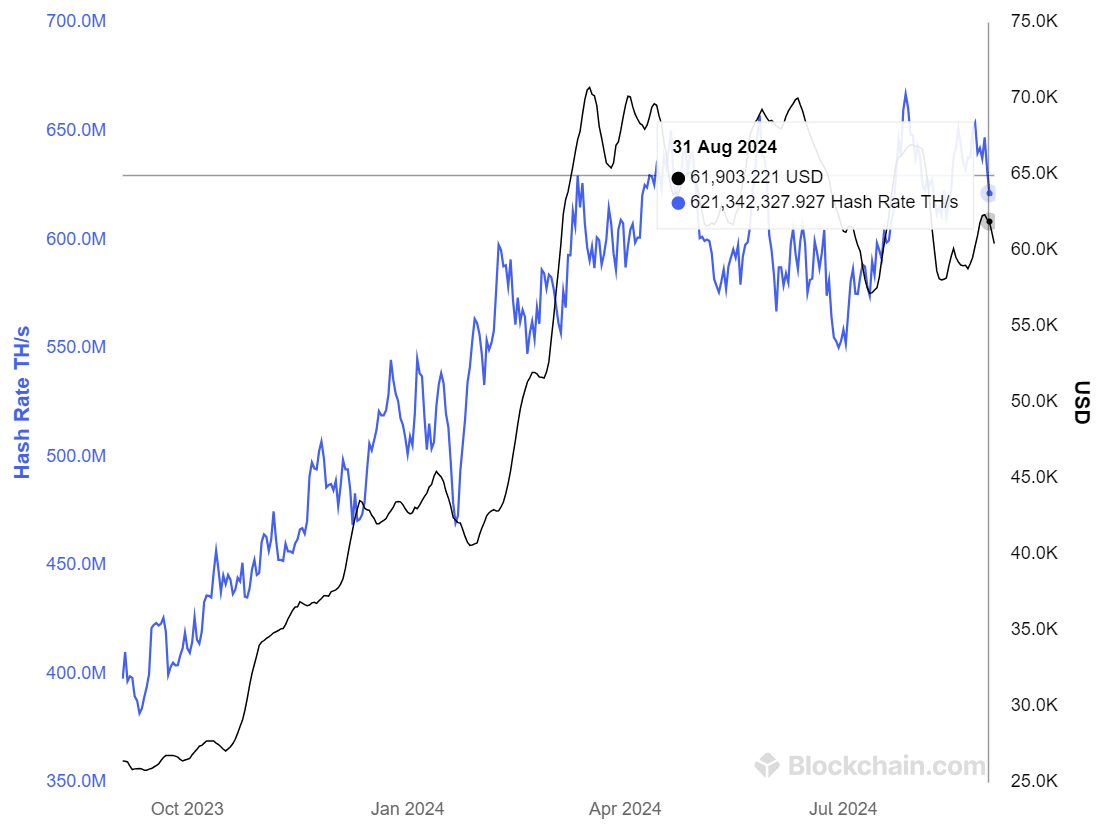

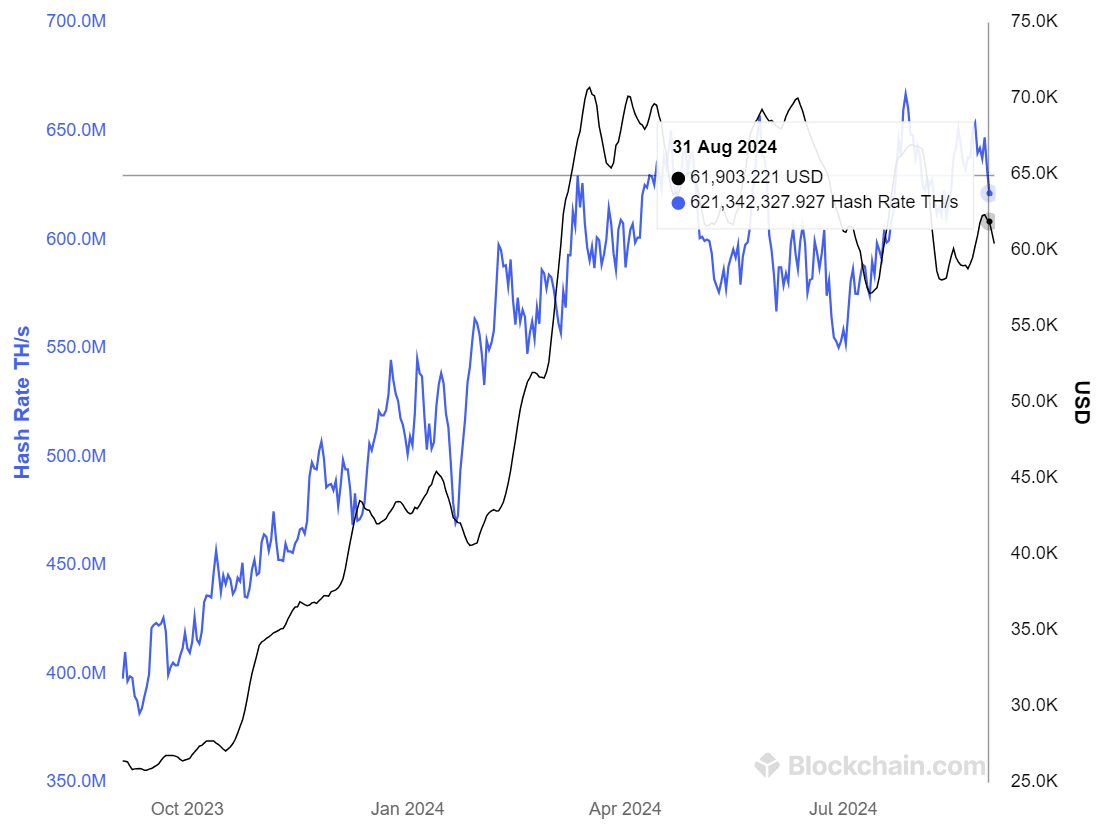

Source: Blockchain.com

As a result, mining difficulty rose to a record high of 89.47 trillion in August, up 3% from 86.87 trillion in July.

As more Bitcoin miners join the network, validating transactions becomes more difficult, reducing the number of coins mined and revenue earned.

In short, this indicated that the increasing mining problems caused by Bitcoin’s halving have significantly depressed miners’ profitability. So Are Bitcoin Miners Leaving the Trade?

Miners’ strategic positioning counteracts short-term volatility

Simply put, the hash rate measures the total computing power used to mine and process transactions on the Bitcoin network.

If this figure drops significantly, it could be an indicator that miners are leaving the network.

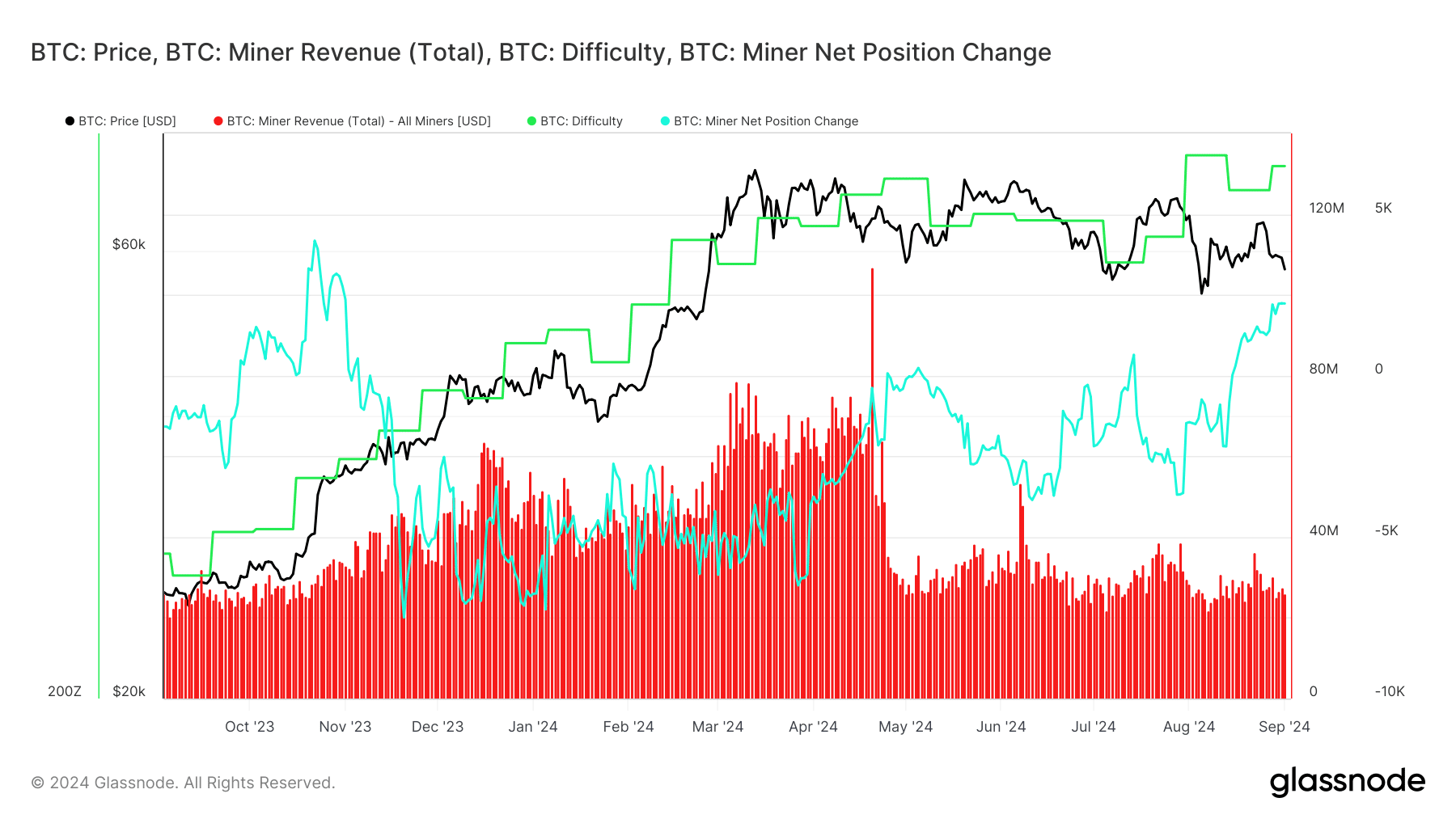

Source: Blockchain.com

The graph above shows a striking trend. Interestingly, whenever BTC tested a crucial resistance level, the hash rate also increased.

According to AMBCrypto, this suggested miners were more concerned or optimistic about potential price movements.

However, the hash rate has suffered a notable drop since the last week of July, from 667 million to 620 million, a drop of 7%.

While not extreme, it suggested that miners are responding to changing conditions, possibly due to lower rewards.

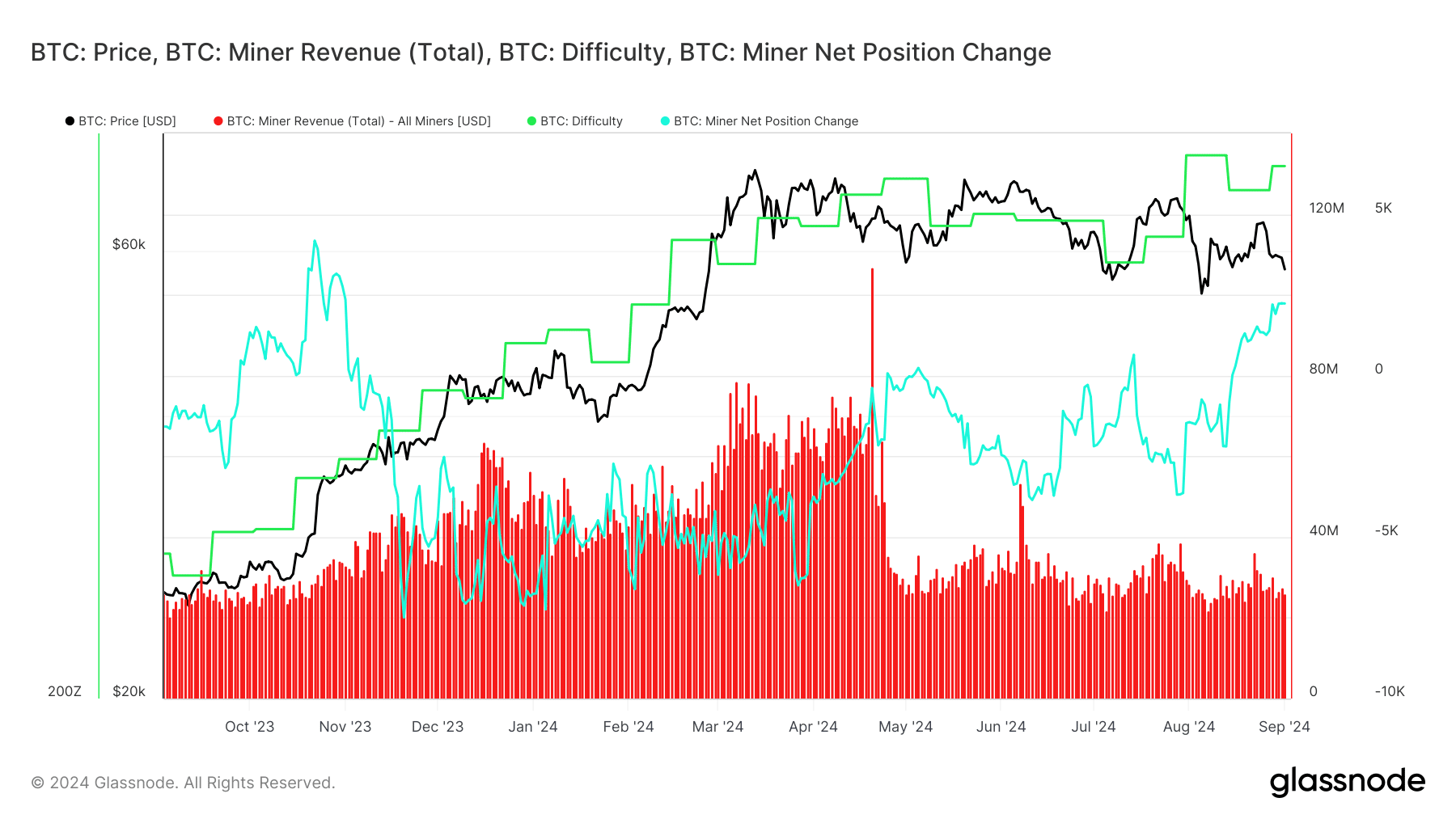

However, BTC’s net position change for miners has turned positive since mid-August, despite lower miner rewards.

Source: Glassnode

This indicated that even though miner rewards have decreased, miners have started accumulating more Bitcoin instead of selling it.

Additionally, AMBCrypto noted that miners could strategically position themselves by accumulating BTC when prices are relatively low.

Read Bitcoin’s [BTC] Price forecast 2024-25

Overall, despite depressed profitability, miners remain confident in Bitcoin’s long-term gains, as evidenced by the positive net change.

However, this reliance could lead to greater mining problems in the long run, potentially further reducing rewards for miners.