- Miners sold more than $13 billion worth of BTC in the first half of December.

- According to Puell Multiple, BTC was not yet overvalued or in a red zone.

Bitcoin [BTC] Miners have intensified selling since the cryptocurrency crossed the $100,000 mark. In December alone, miners sold 140,000 BTC, worth $13.72 billion.

According to Santiment data, at the time of writing, the dumping wave has shrunk the miner’s balance from over 2 million to 1.95 million coins.

Source: Santiment

BTC stable above $100,000

Despite the aggressive sell-off, the king coin remained resilient above $100,000.

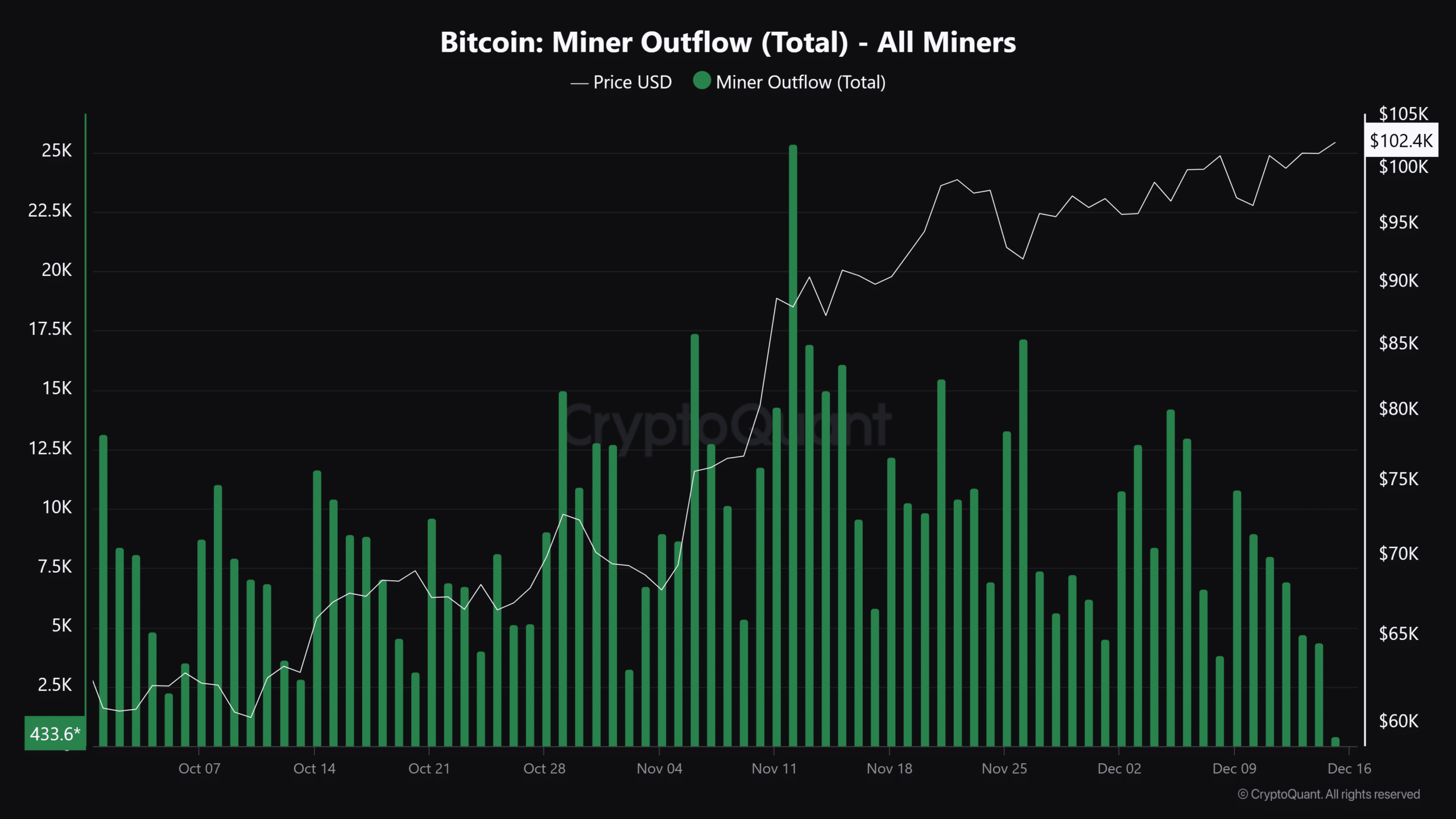

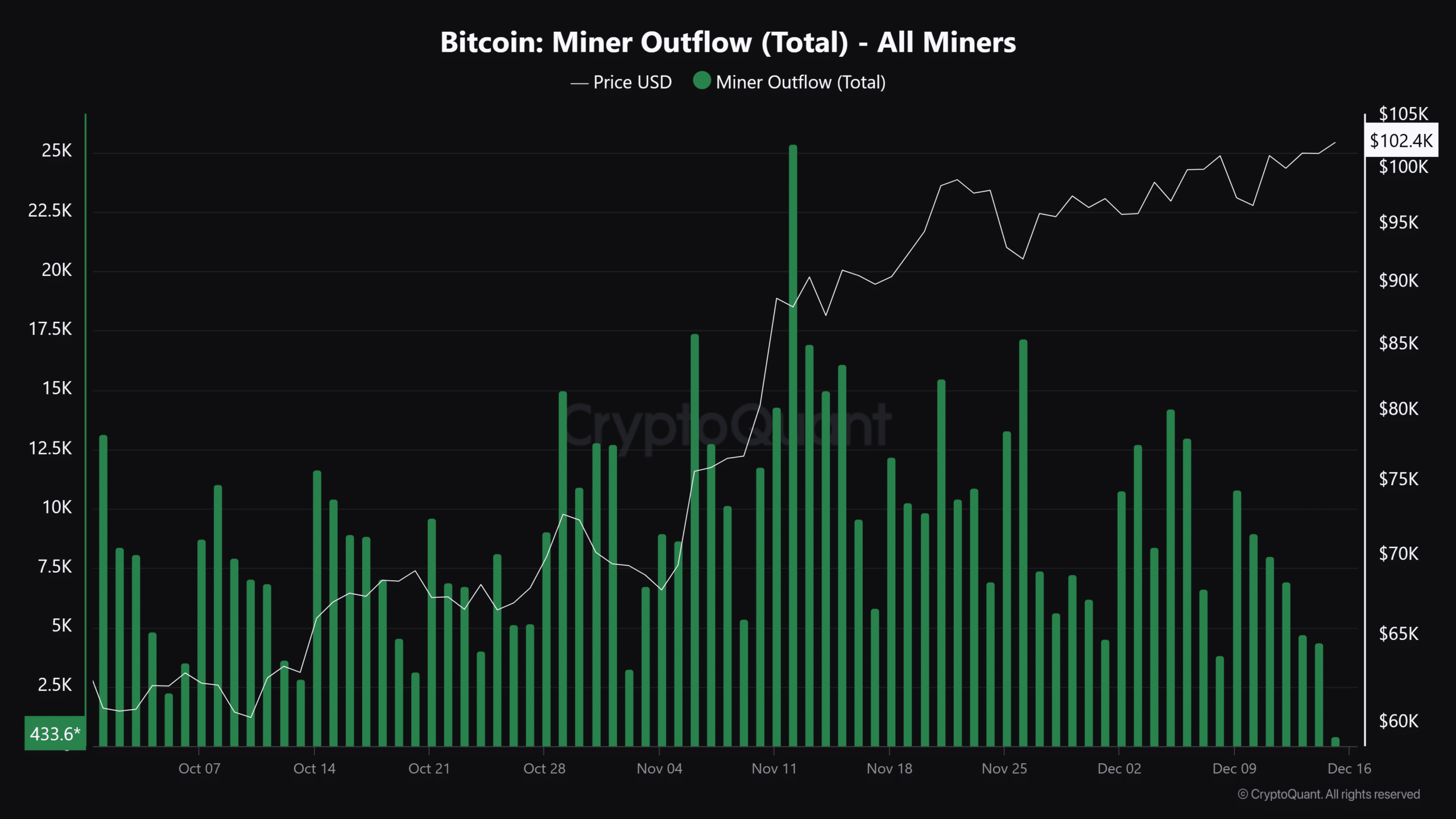

However, the miner sell-off seemed relatively less intense as measured by miner outflows. The metric tracks all miner portfolios and their transfers to exchanges.

On November 12, BTC saw its highest daily selloff of 25,000 BTC for miners. But the pressure has eased, as evidenced by the retreating outflow of miners.

Source: CryptoQuant

Perhaps most of the sell-off would have occurred through the OTC (Over The Counter) markets.

That said, the overall sell-off in December slightly exceeded demand for ETFs. Over the past two weeks, BTC ETFs have emerged logged in Inflow of $4.9 billion. During the same period, MicroStrategy purchased $3.6 billion worth of BTC.

Excluding Mara Digital and other BTC corporate bond companies, demand for ETFs and MicroStrategy reached $8.3 billion over the past two weeks. This was slightly less than the $13.72 billion offer from miners.

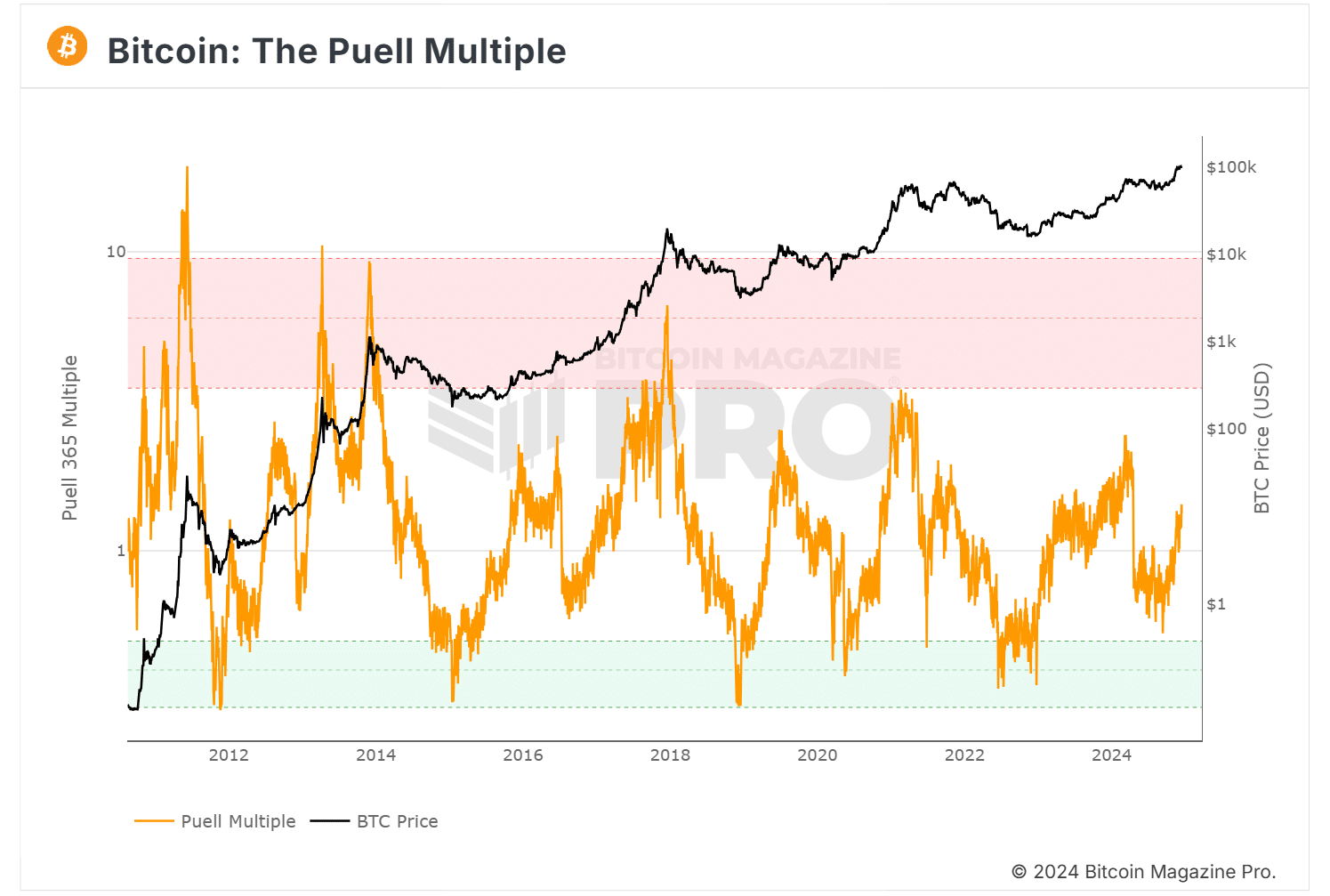

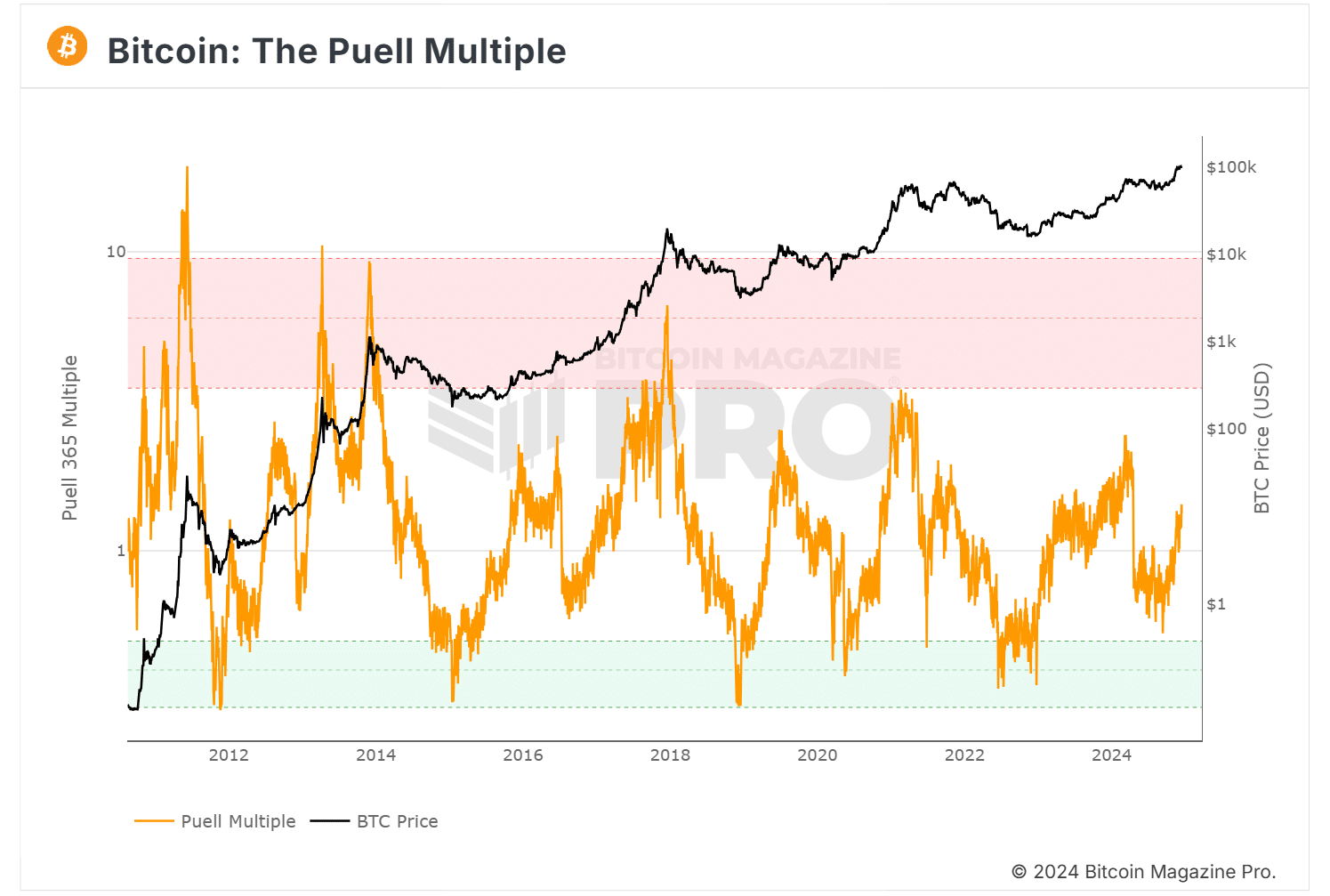

Should intensive mining sales be a concern for your portfolio? We checked the Puell Multiple for insights.

For the unfamiliar, Puell Multiple allows users to measure BTC valuation and cycles from the perspective of miners. If the measure rises to the upper band, BTC’s value is considered unsustainably high.

On the other hand, a low Puell Multiple value indicates relatively undervalued BTC.

Source: BMPro

In early 2024, the metric reached 2.4 and marked a local BTC top of $73.7K. At the time of printing the metric reading was 1.3 and there was little space in front of cross 2 or the top band.

So, based on Puell Multiple and miners’ perspective, BTC was not overvalued or elevated, but that could change if the value rose above 2.

In the meantime, BTC consolidated below $102,000 ahead of the Fed rate decision on December 18.