- Bitcoin miners exiting the cycle could signal a market bottom, paving the way for new interest

- And yet, specific conditions must apply for a confirmed bull rally

A week of bearish decline followed Bitcoin [BTC] falling below $61k from the previous resistance of $65k. However, at the time of writing, optimism seemed to be brewing in the market, with the crypto valued at almost $62,000.

However, a price correction could occur in the second week of the fourth quarter, especially as profit takers cash in their gains and exit the cycle. Among them are miners who have capitulated as BTC approaches $62,000.

However, unless the bottom is completely exhausted, it may be difficult for bulls to spark a sustained rally.

The miners’ departure could signal a market bottom

On the daily price graphic BTC’s weekly movement mirrored the price action of mid-August, when a rejection near $65,000 halted a potential bull run.

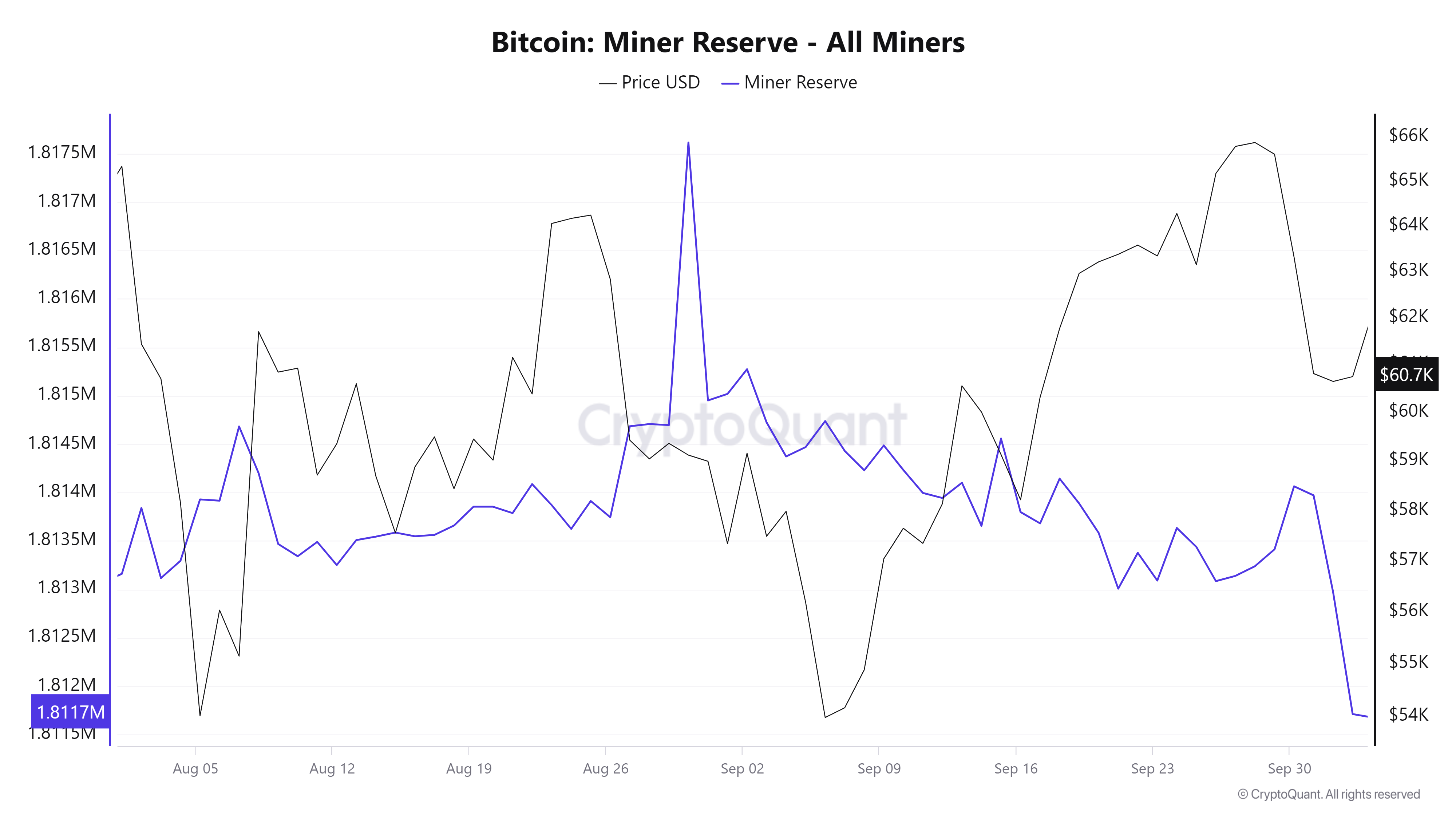

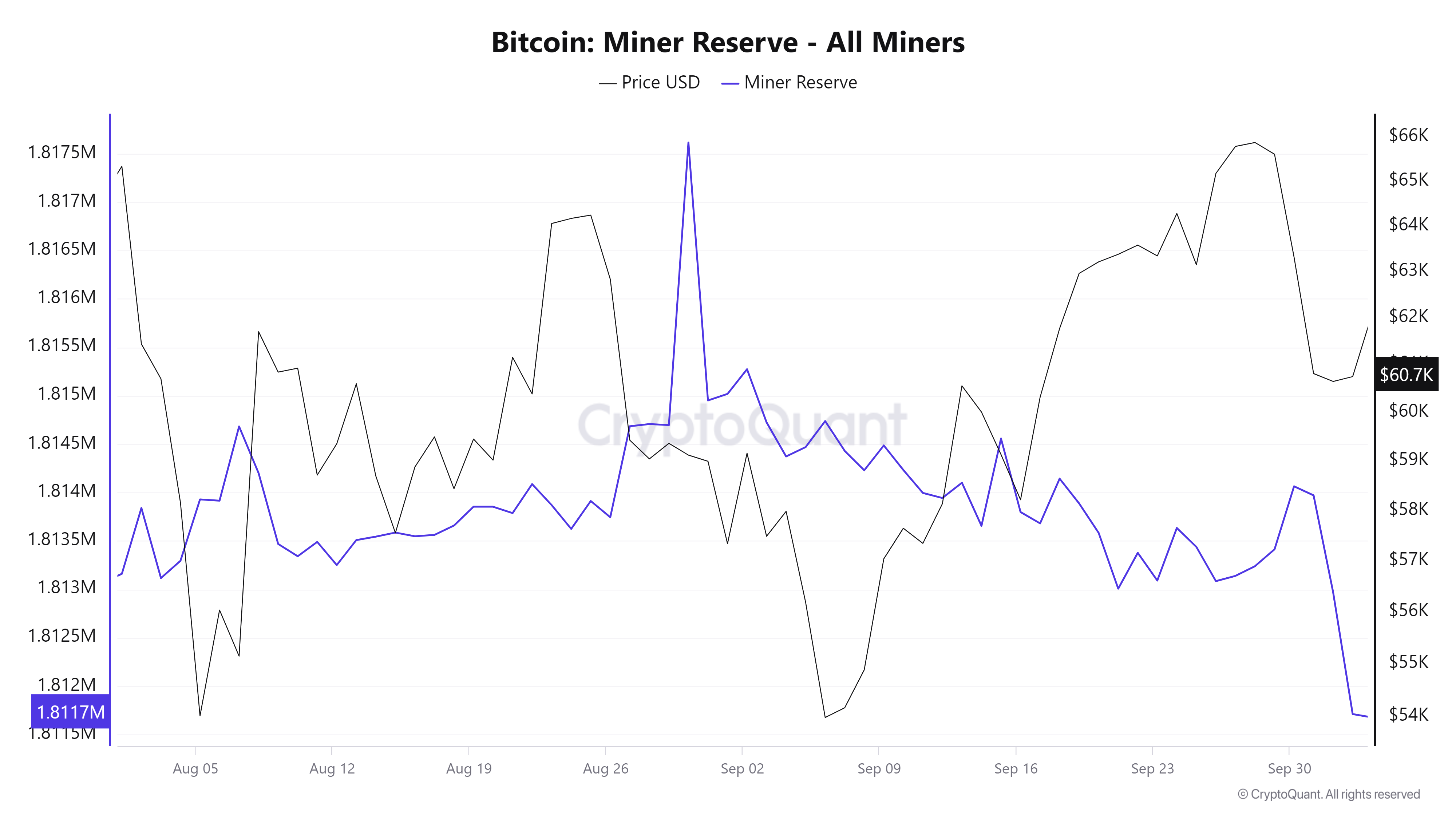

During that time, miners exited the cycle after five consecutive days of downward pressure, with their holdings falling from 1.817 million to 1.814 million.

Source: CryptoQuant

A similar trend was also observed recently. This past week, as Bitcoin retreated from $65,000 to $60,000, miner reserves saw a significant drop, from 1,814 million to 1,811 million at the time of writing.

Typically, the departure of weaker investors often leads to a more stable market, allowing stronger hands to build positions at favorable prices.

If this trend continues, miners breaking even could be a sign of a market bottom. If weak hands leave to capture profits, this could present itself new buyers with ideal dip buying opportunities.

However, as noted earlier, it is crucial to turn $61,000 into support before a bullish cycle can begin. While miner exits can help cement this support, other conditions must also align.

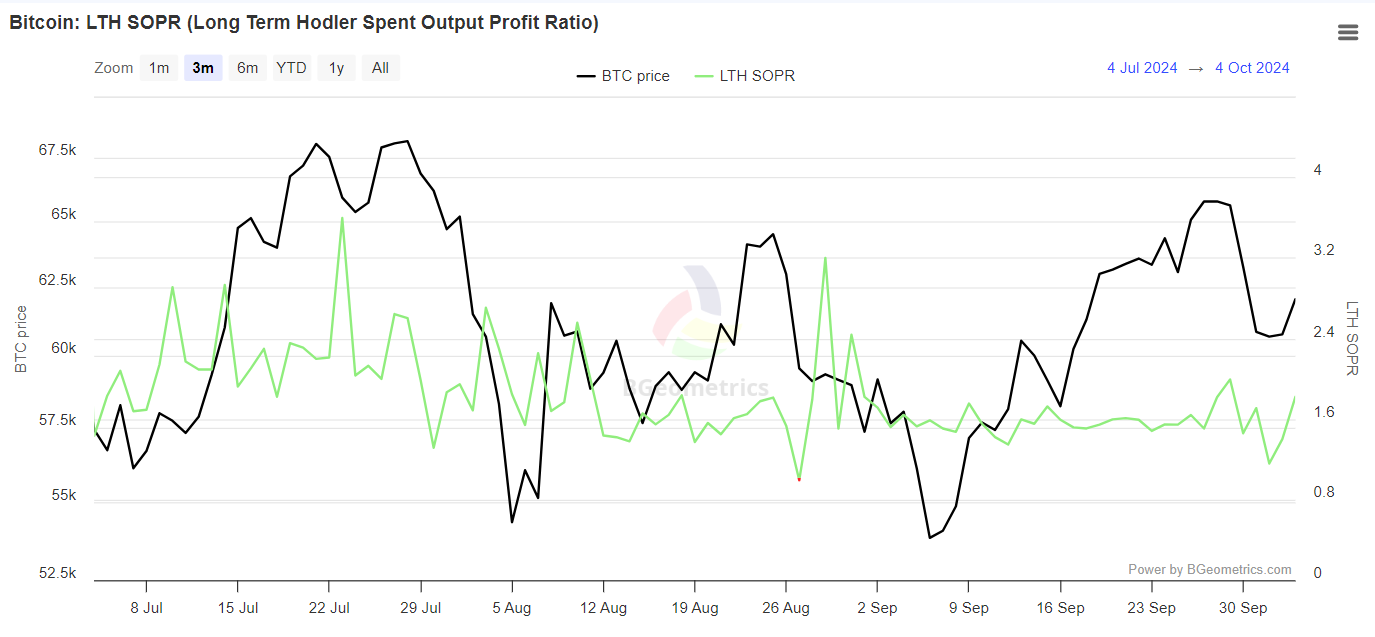

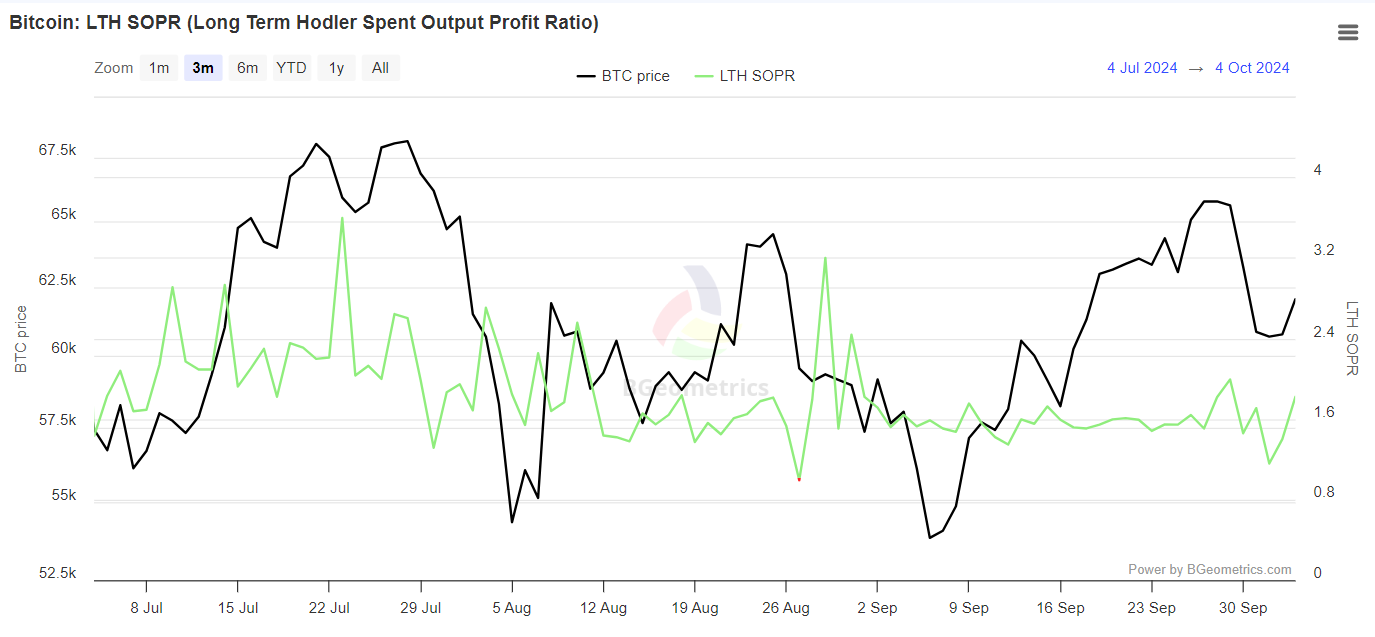

LTHs have confidence in Bitcoin bulls

Unlike miners who capitulate to cut their losses before the market falls further, holders of Bitcoin who have held them for more than 155 days appear to be selling at a profit.

The LTH SOPR recently made a higher high. Historically, such moves have driven positions into FOMO and fueled expectations for future gains in the next cycle.

Source: BGeometrics

If LTHs avoid panic selling – which seems likely – there could be a near-term price correction. This could see resistance at $61,000 turn into support, with bulls then targeting the next resistance at $64,000.

In short, Bitcoin’s decline from $65,000 to $60,000 was key to shaking off weak hands, establishing $61,000 as the next support level.

This drop filtered out less committed investors, allowing stronger holders to do so accumulate positions.

While the numbers showed solid fundamentals, AMBCrypto investigated further to determine if the recent rally was real or just a short squeeze.

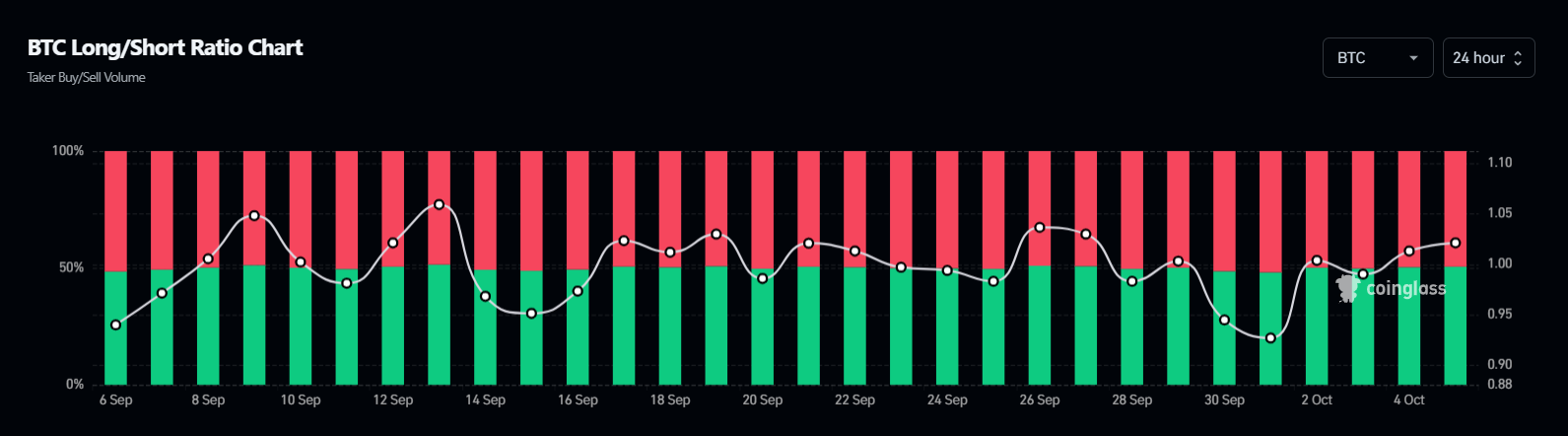

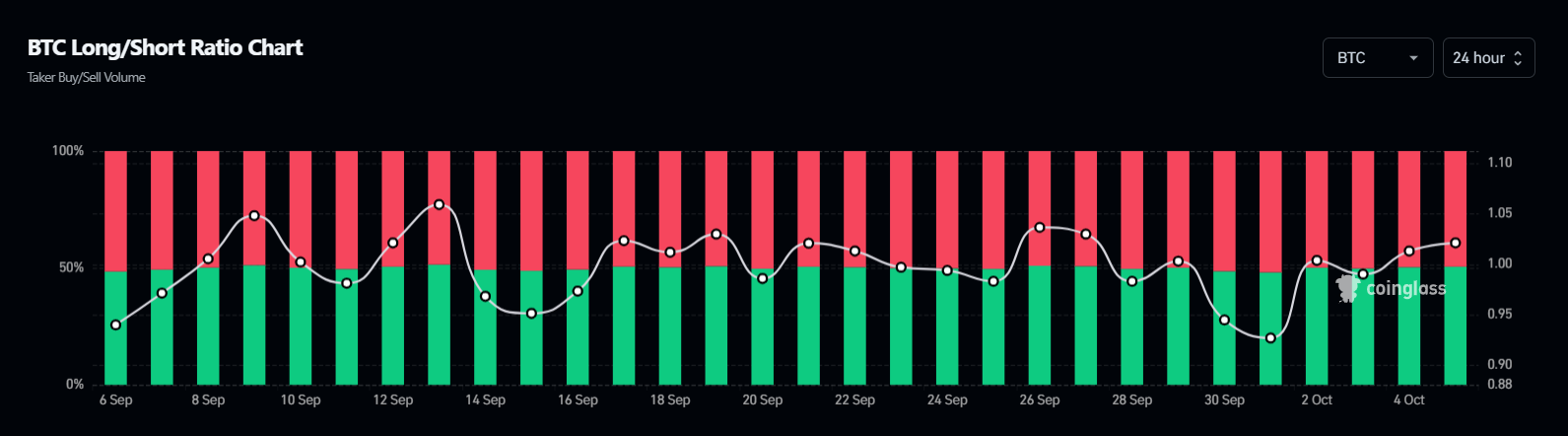

BTC longs regain control

Over the past four days, long positions have regained dominance in the derivatives market, preventing short sellers from effectively shorting Bitcoin.

Source: Coinglass

While this is a bullish sign, it also implies that the influx of long positions has put pressure on short positions, leading to significant liquidations.

So this doesn’t completely rule out a short-squeeze scenario, but it could serve as a starting point for a bullish reversal, which could create excitement among buyers.

Read Bitcoin’s [BTC] Price forecast 2024-25

Overall, with confirmed support at $61,000 and renewed optimism from long positions, bulls are likely to hold at $62,000 next, which could lead to a rally towards $64,000.

To achieve this, however, it is essential that short sellers are closely monitored.