- BTC miners have shown resilience, increasing the likelihood of an upcoming supply shock.

- However, the bottom of the market remained elusive, reducing the impact of their efforts.

Bitcoin [BTC] Bulls showed strength over the weekend, recovering from a dip at $52,000. With continued volatility in leveraged positions, the support of major investors is becoming increasingly important.

Among these large holders are miners, who tend to capitulate or HODL during extended periods of bearish sentiment.

Therefore, for a supply shock to occur, AMBCrypto found that a number of key factors must align. If these conditions are met, there could be a potential price increase as market supply tightens.

BTC miners support the crisis, while the whales retreat

From an economic perspective, a significant tightness in BTC supply could be a crucial catalyst for a price correction. To achieve a supply crisis, miners must move beyond the distribution phase.

In short, miners unloading less BTC means the supply shock could become bigger.

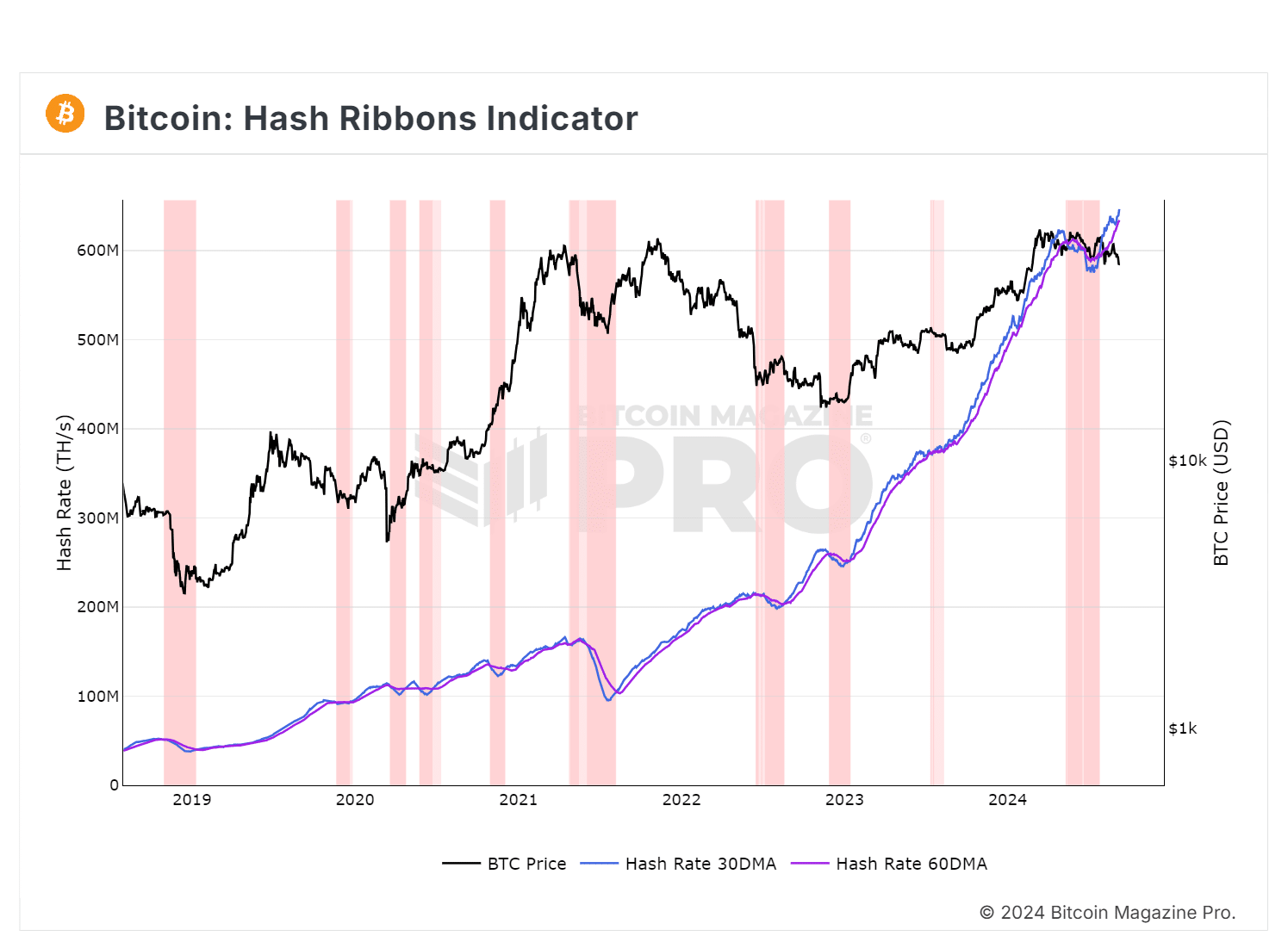

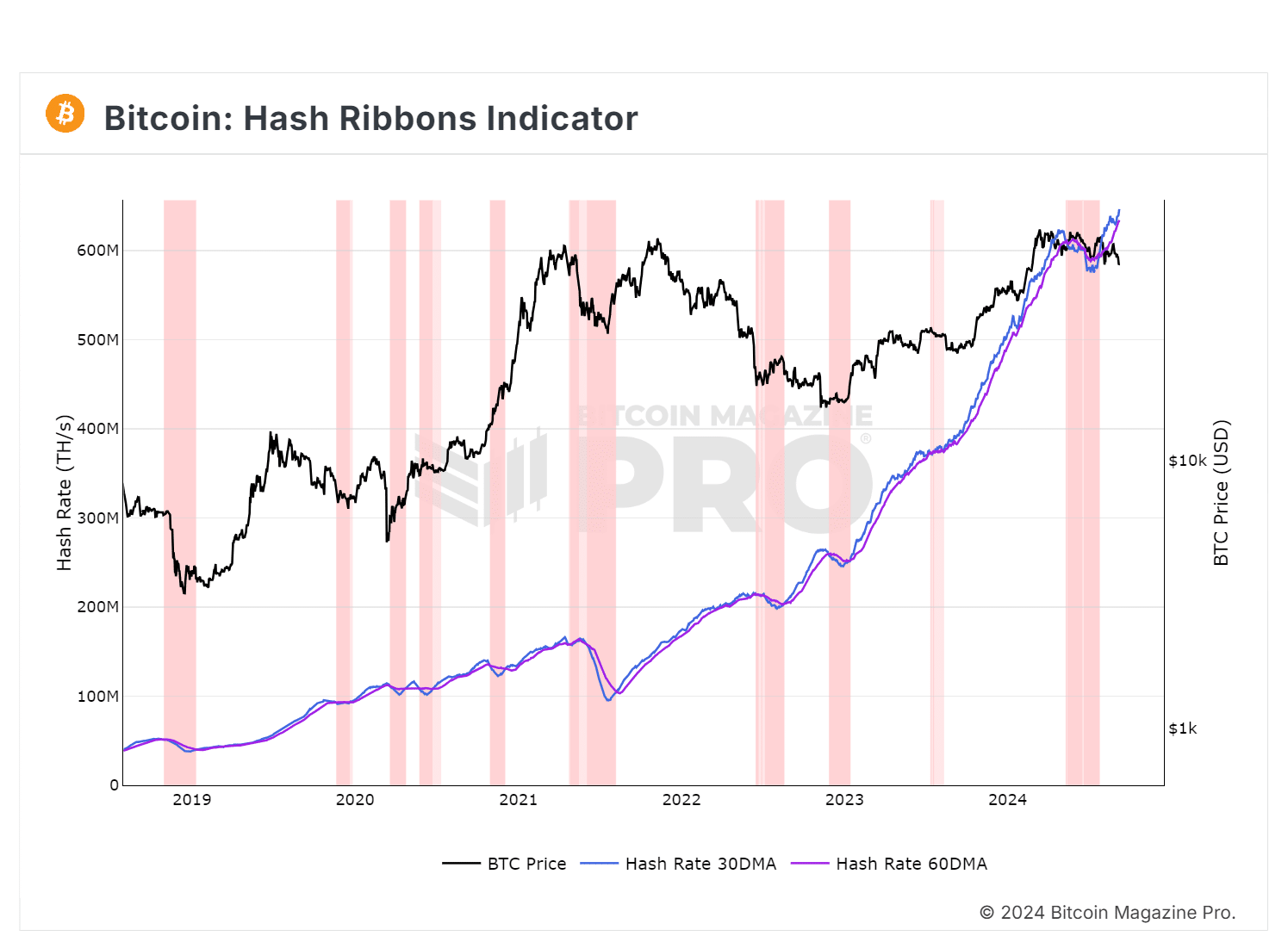

Interestingly, the chart below shows that the 30-DMA recently rose back above the 60-DMA, generating a hashlint buy signal.

Source: Bitcoin magazine Pro

This indicated a potential bullish trend, reinforcing the possibility of a price correction due to the accumulation of mining companies.

Currently, the total circulating supply of BTC is 19.7 million. Miners own 1.8 million BTC, which amounts to approximately 9.1% of the total supply.

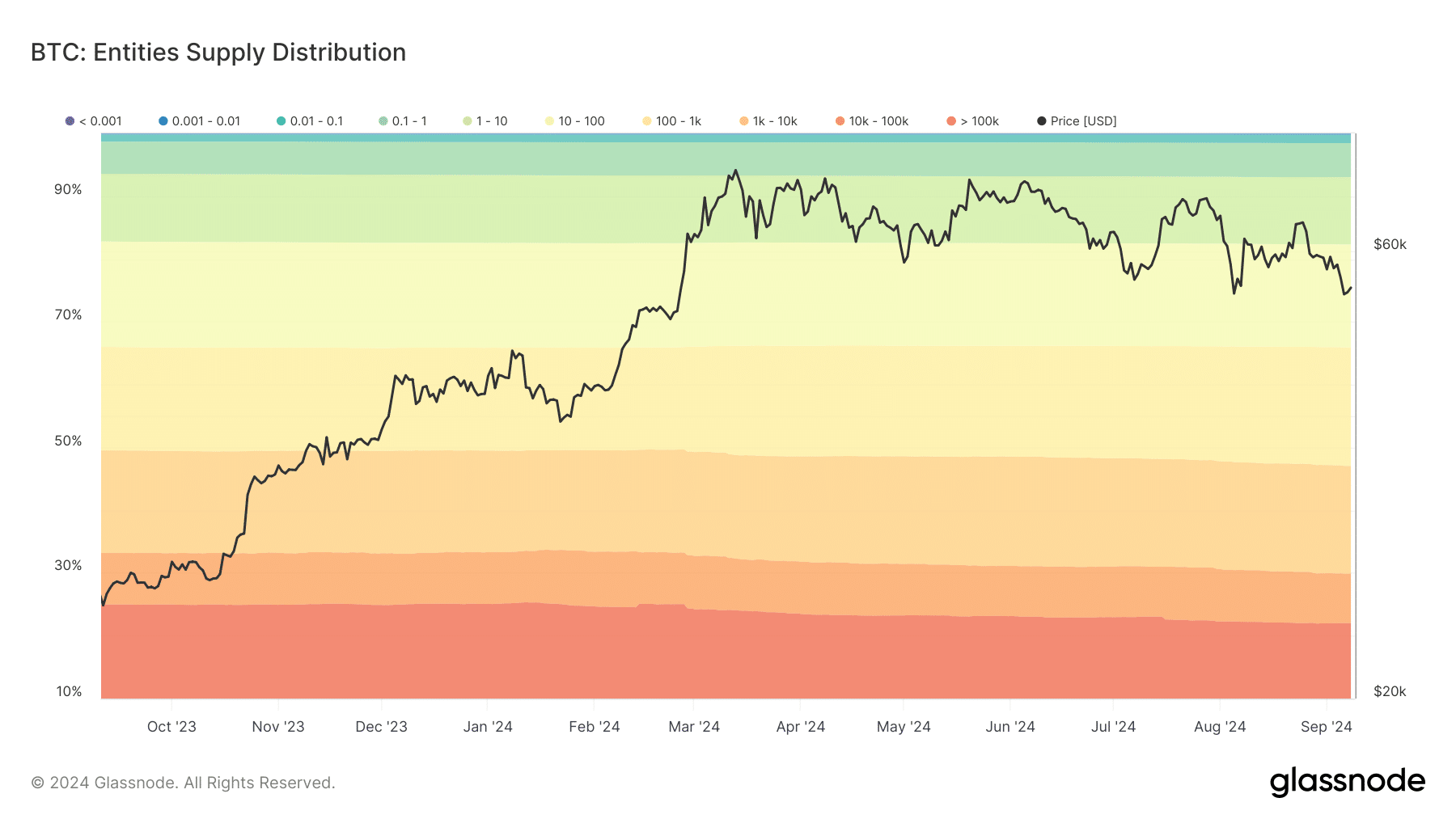

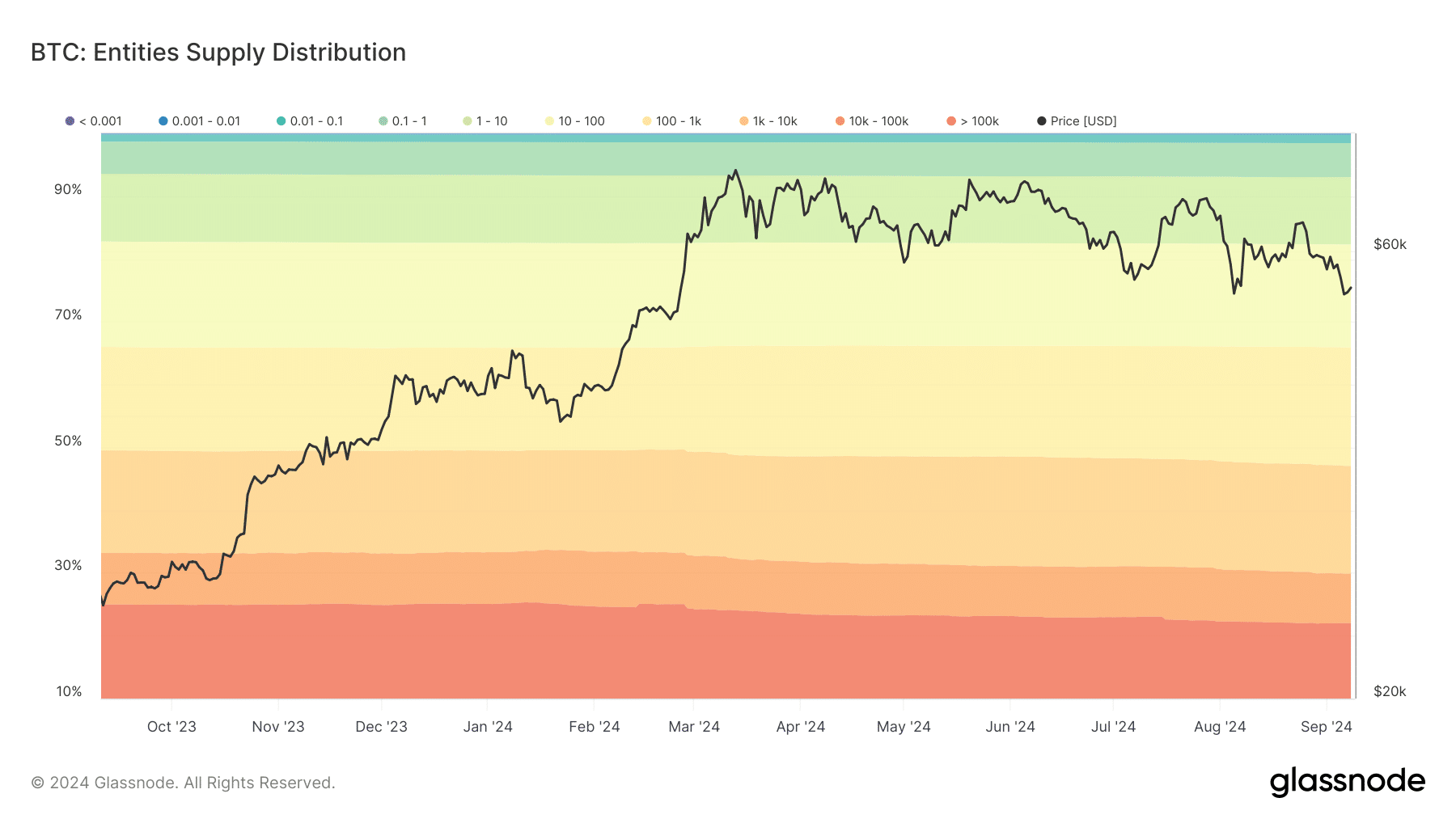

Meanwhile, the share of BTC held by whale cohort portfolios has fallen from 24% when BTC tested the $73,000 ceiling to 21.9% at the time of writing.

Source: Glassnode

According to AMBCrypto, this decline indicated a reduction in the concentration of large BTC holdings.

While miners reserves have remained resilient these routine deposits by whales have reduced the likelihood of a supply shock. That said, a turnaround is still possible if demand outweighs selling pressure.

While the BTC bulls keep the price above the $51,000 support level, potential for an outright reversal remains if buying pressure increases.

If this increased purchasing pressure maintains the supply crisis, a supply shock may indeed occur. The key will be whether demand continues to exceed available supply.

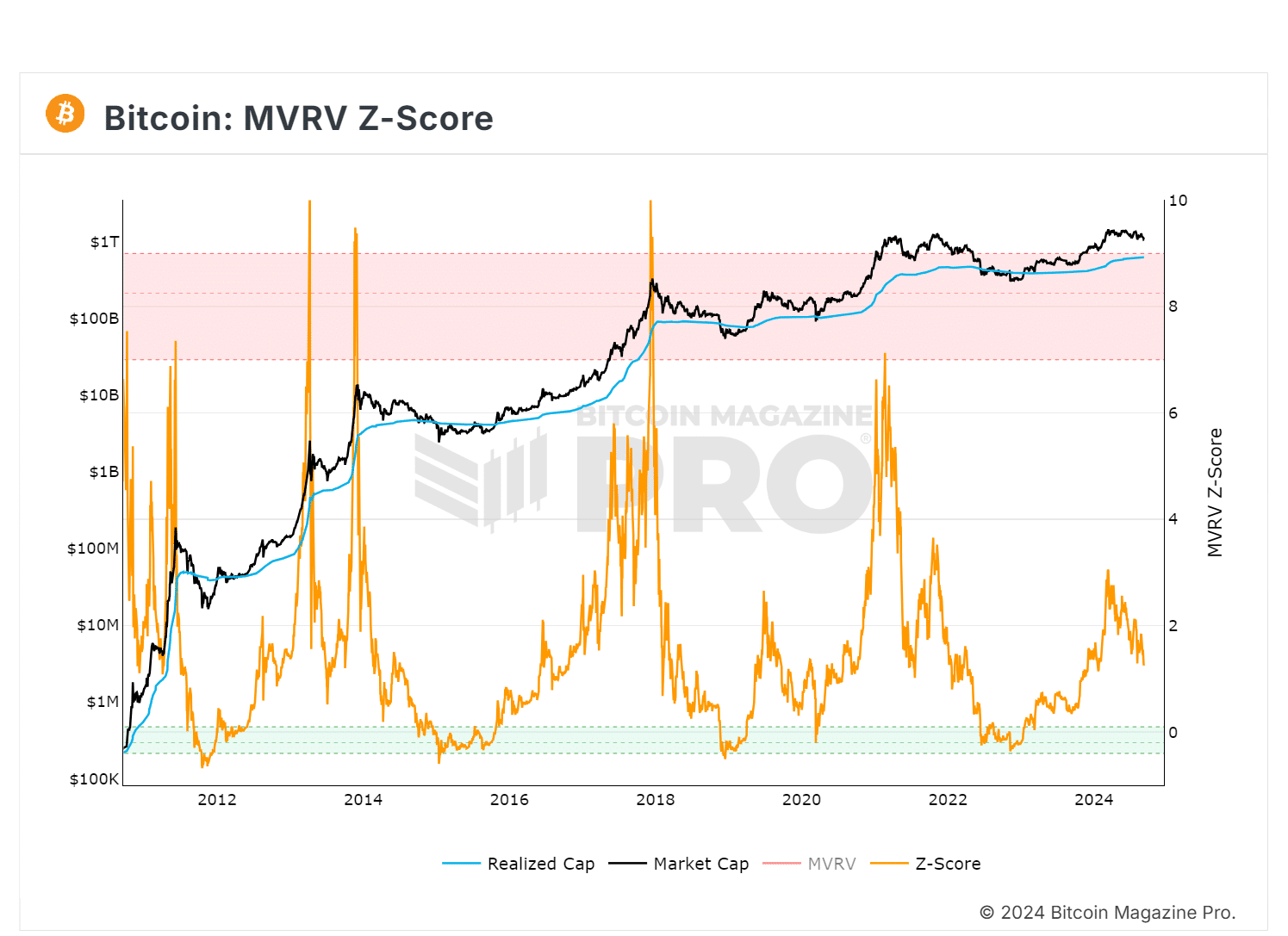

The MVRV card tells you..

The MVRV Z-score has historically been very effective at identifying periods when market value moves unusually high above realized value.

Source: Bitcoin Magazine Pro

Interestingly, when the Z-Score (orange line) enters the pink box, it often indicates the peak of a market cycle. Historically, this indicator has managed to establish market highs within about two weeks.

Conversely, when the Z-Score enters the green box, it indicates that BTC may be undervalued. Buying Bitcoin during these periods has historically produced outsized returns.

Therefore, an experienced trader will watch the bottom of the market to identify the optimal ‘buy the dip’ opportunity.

Read Bitcoin’s [BTC] Price forecast 2024-25

This is evident from the bull rally that typically follows whenever the market reaches a bottom price.

Simply put, demand is unlikely to exceed supply unless the bottom zone is tested. In short, AMBCrypto notes that a reversal remains unlikely. Without sufficient evidence, the chance of recovery decreases.