- Bitcoin’s price struggle after the halving highlighted the market’s volatility and the challenges of crossing $60,000.

- Mining profitability has fallen significantly, despite increased hashrate and improvements in equipment efficiency.

The expected impact of Bitcoin [BTC] The fourth halving, which was expected to drive the price to new highs, initially appeared to materialize when BTC surged above $70,000 in March, marking an all-time high.

However, recent developments show a different story.

From the last CoinMarketCap Update: BTC struggled to maintain its momentum, trading at $58,629, and is down 2.41% over the past 24 hours.

Bitcoin miners are struggling after the halving

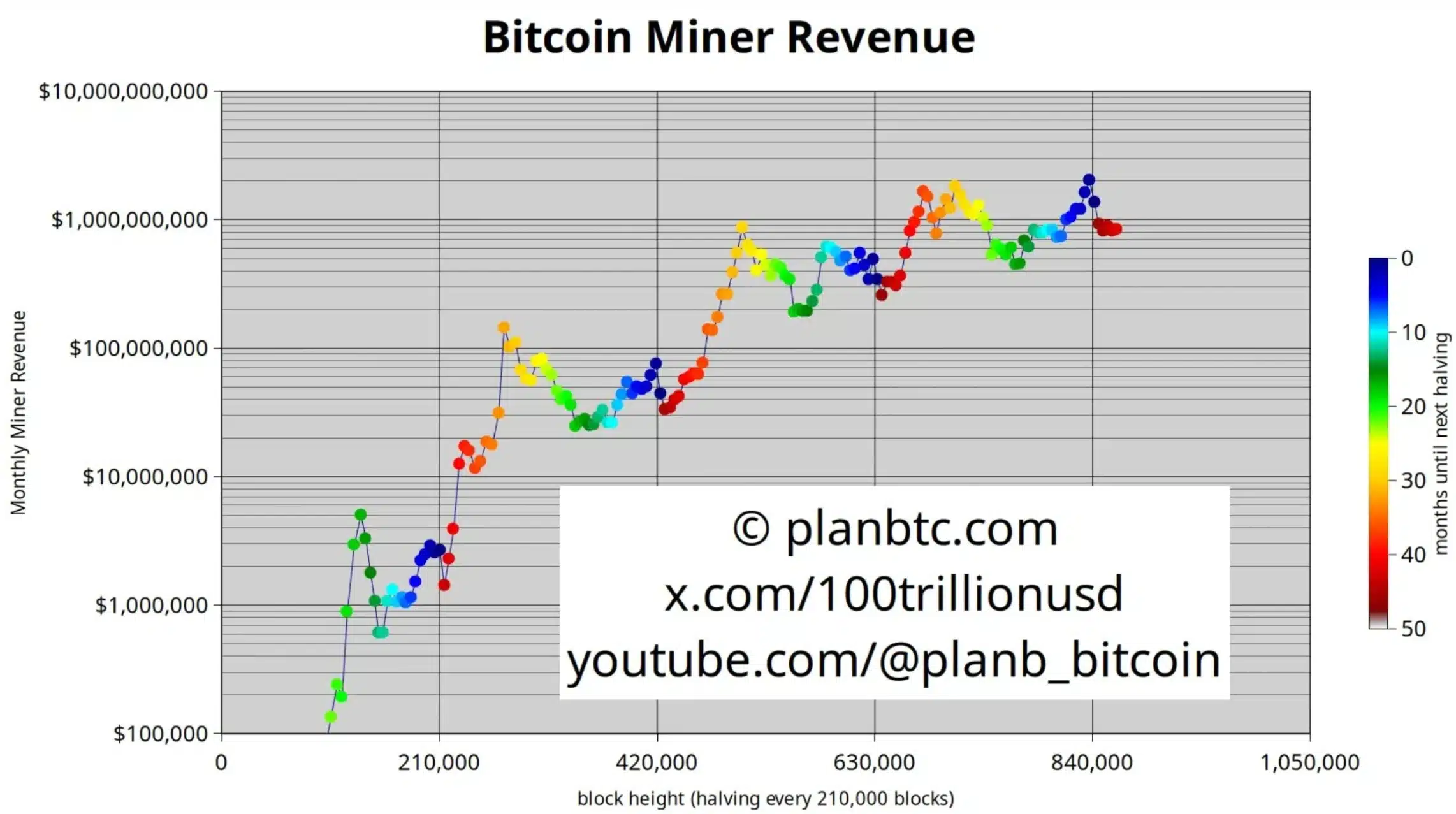

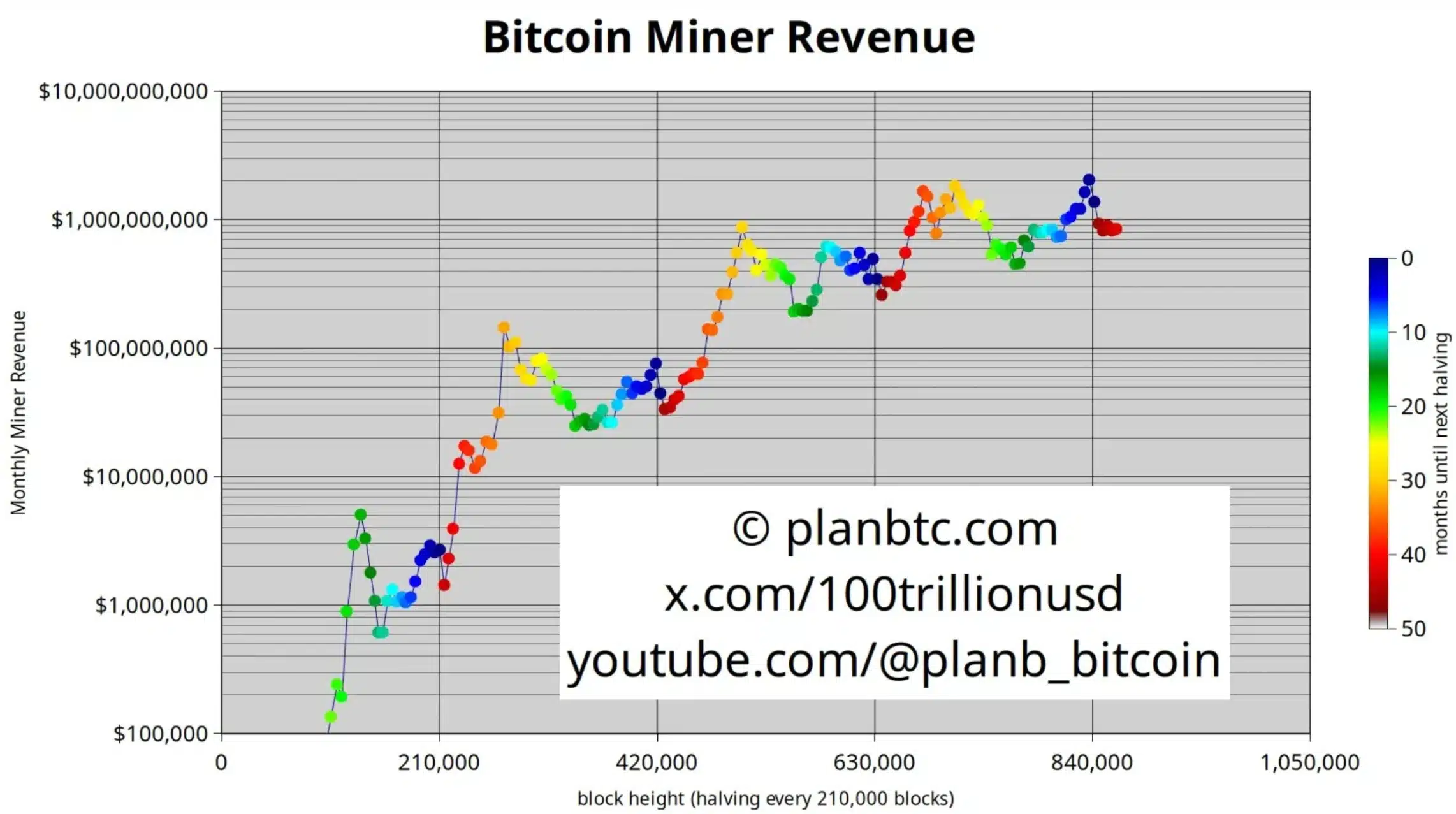

After Bitcoin’s recent halving, miners have done the same encountered their own challenges. PlanBthe creator of BTC’s stock-to-flow (S2F) model, highlighted these issues on X, saying:

“Miners are still struggling with the aftermath of the halving. We need a doubling of the current BTC price to prime the bull pump.”

Source: PlanB/X

Complementing these challenges, investment bank Jefferies in a CNBC report that cryptocurrency mining profitability took a significant hit in August.

According to Jefferies, average daily revenue per exahash (essentially income per miner) is down 11.8% compared to the previous month.

This decline underlines the growing financial pressures miners face amid fluctuating market conditions and rising operating costs.

According to an AMBCrypto analysis of IntoTheBlock data, rewards for BTC miners have decreased dramatically.

In the 2020 halving, miners were awarded 7,010 BTC, worth approximately $75.99 million.

However, at the current halving in 2024, this reward has dropped to just 471.88 BTC, which is equivalent to approximately $28.1 million.

This sharp reduction underlines the financial pressures miners face as a result of changing market conditions.

Source: IntoTheBlock

Hashrate sees an increase

However, BitcoinMiningStockGuy added,

“And the hashrate is still rising. Bullish.”

This trend is further validated by AMBCrypto’s analysis of IntoTheBlock data, which revealed a dramatic increase in BTC’s hashrate.

In 2020, the hashrate was 140.93 million terahashes per second (TH/s), while in 2024 it increased to 695.84 million TH/s.

This significant increase highlights the increased competition and increased computing power required in the mining sector.

Source: IntoTheBlock

What is the solution?

In response to declining profitability, North American publicly traded mining companies are investing heavily in equipment upgrades to improve operational efficiency.

These improvements allow newer machines to achieve double the hashing power of their predecessors while consuming the same amount of energy.

Marathon CEO Fred Thiel explained to CNBC that this upgrade cycle is crucial as it helps offset deteriorating economic conditions in the mining sector.

“There’s no need to add locations or power, just upgrade systems.”

However, not all miners face hardship equally.

For example, Core Scientific, which emerged from bankruptcy earlier this year, has successfully repurposed its extensive infrastructure to support artificial intelligence and high-performance computing (HPC).

Thus, as the industry continues to evolve, it will be critical to observe how these innovative approaches can provide solutions and set new benchmarks for overcoming profitability challenges.