- Bitcoin short-term holders were confronted with steep losses, which surpass FTX levels, but without activating full panic.

- BTC investors experienced long-term losses in the short term, whereby market uncertainty caused caution instead of capitulation.

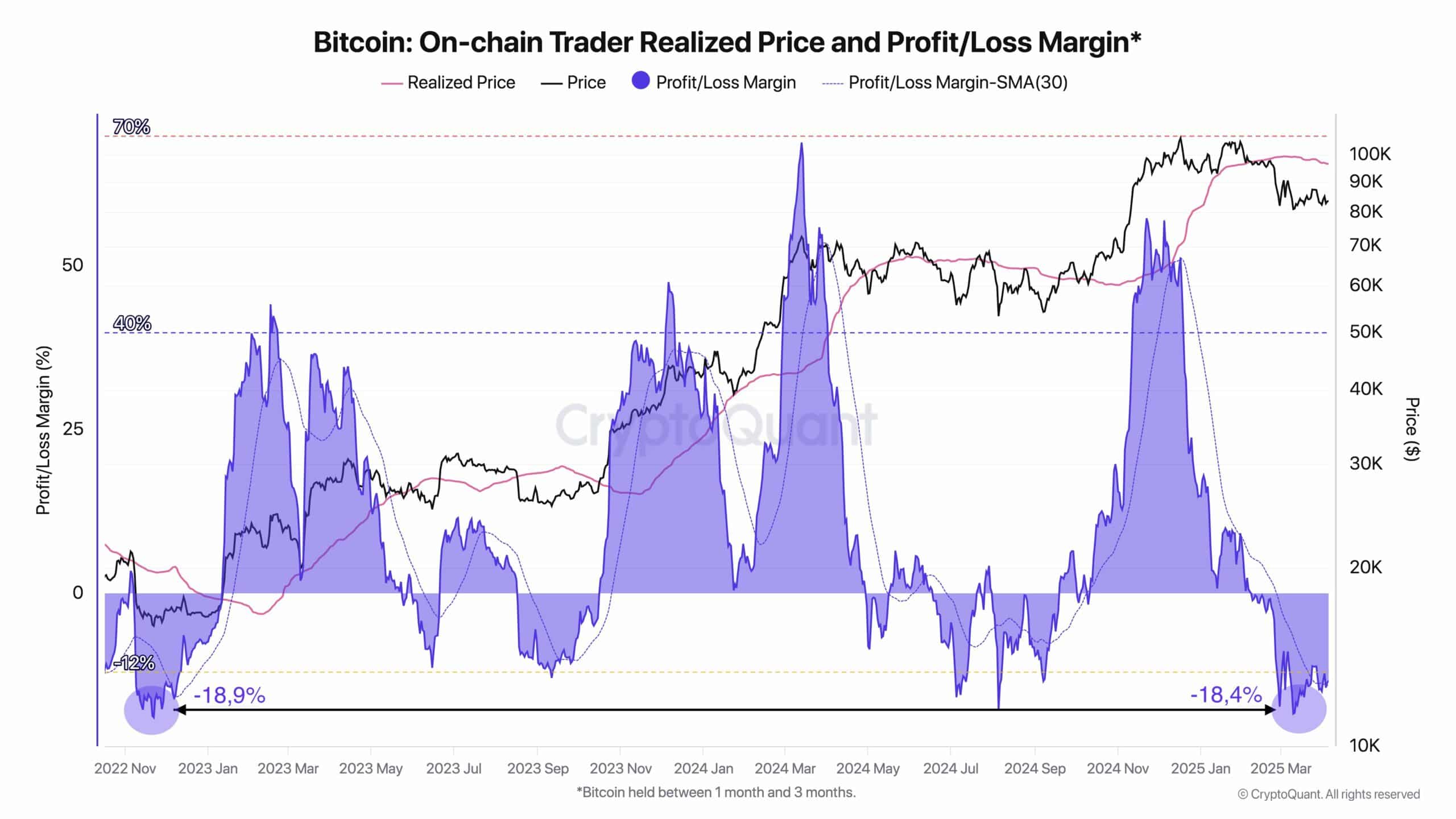

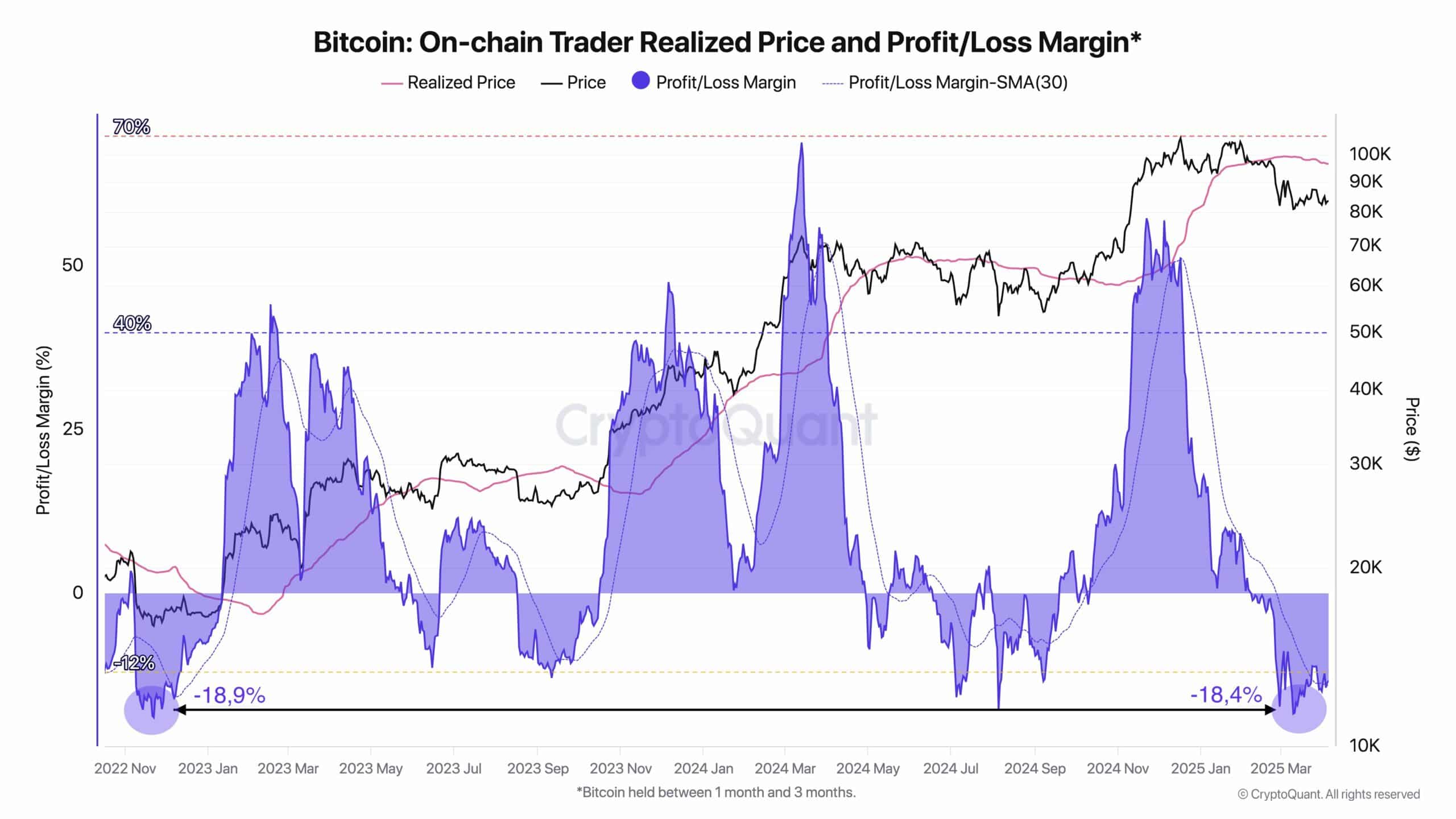

Since the beginning of February, Bitcoin [BTC] Traders have been a loss of nursing, with the current figures that now even exceed the chaos during the FTX -Crash and the market correction of 2024.

The pain is the most difficult in the short term investors, in particular that of BTC for only 1 to 3 months.

While the uncertainty of the market lingers, this trend of growing loss of investors can indicate a deeper shift in sentiment in the short term, so that many wonder whether the worst should get or whether we are just stuck on an outbreak.

Pain, but no capitulation

Source: Cryptuquant

The short-term holders of Bitcoin are deep in the red, with them now on realized losses that are worse than everything that has been seen since the FTX implosion.

The graph shows The profit/loss margin Dank to -18.4%, creepy close to the levels of -18.9% of the end of 2022.

But interesting is that this does not cause a complete panic. While the market is bleeding, there is little sign of a massive exodus – only traders bite their lips and wait for it out.

The mood? Less “go out now”, more “this is better worth it.”

Bitcoin: Why this time feels worse for holders in the short term

In contrast to long-term hodlers who have previously weathered Berencycli, STHs tend to get close to local tops when the hype peaks.

While BTC flirted at the beginning of March with highlights of around $ 84k, many of these traders accumulated, but were trapped in a slow bleeding instead of a dramatic crash.

It is the worst kind of loss: towed away, self -confidence and cloudy in direction. The data shows that this group is now the victim of realized losses – a clear memory that FOMO buyers are still learning in the hard way.

Echos from FTX

The current drawdown reflects the FTX -Crash in size, but not in the mood. At the time, the losses were driven by panic, contamination and disappearing liquidity.

Nowadays markets are hesitant, liquidity is considerable and BTC is still above $ 80k.

Source: TradingView

However, the pain is real. Market guards observe the patterns from the past closely and with loss levels that are now violating the 2024 correction, comparisons with November 2022 are becoming more difficult to ignore.

If history rhymes, the capitulation can still be lurking around the corner in the short term.