- The non -realized losses of Bitcoin continue to dominate while BTC continues to consolidate.

- Despite increasing losses, investors still have to capitulate and remain optimistic.

In the past week, Bitcoin [BTC] has exchanged within a parallel channel and has consolidated between $ 82,000 and $ 86,000 without a clear direction.

With the lack of upward impulse, investors who have bought Bitcoin at these levels remain considerable losses.

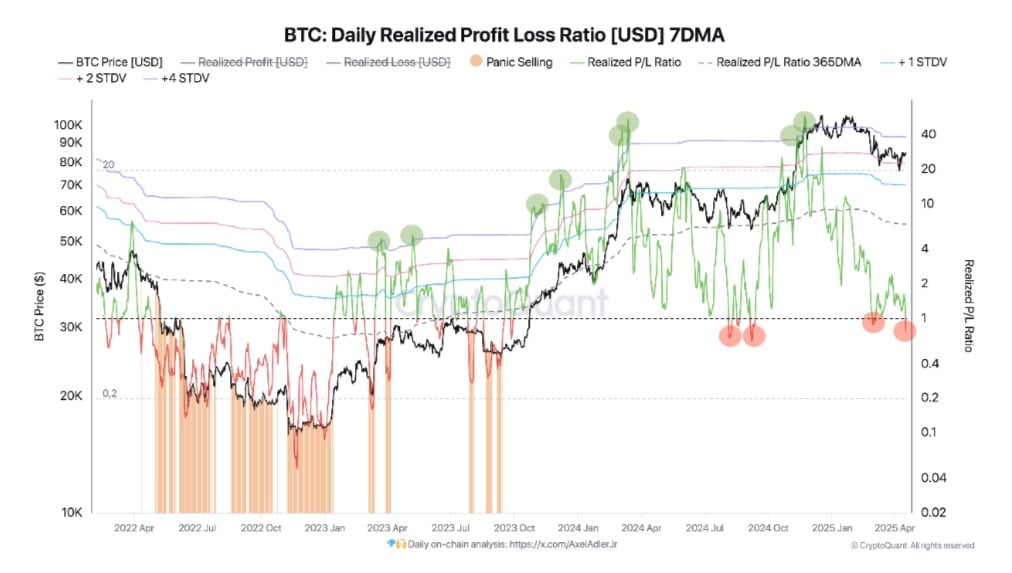

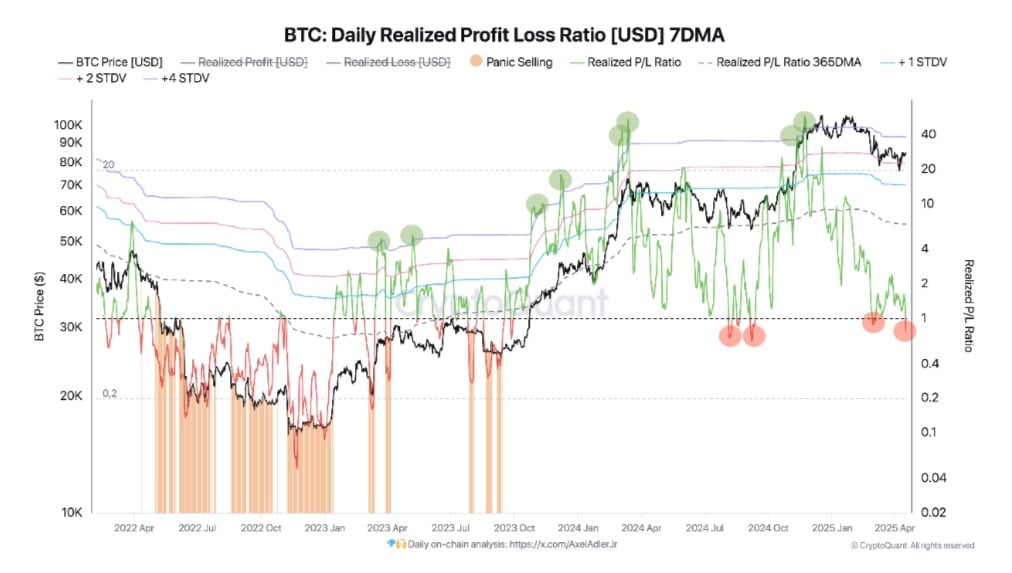

As far as, according to CryptoquantThe realized losses of Bitcoin are currently dominating the market.

As such, the profit/loss ratio of Bitcoin (7DMA) has fallen under the critical level of 1. The recent decrease indicates that the majority of investors are currently realizing losses.

Source: Cryptuquant

These losses are increasing, especially with holders in the short term. Bitcoin’s short -term holder Soprr has even fallen under 1 to settle at 0.9 at the time of the press.

The decrease here suggests that holders sell with a loss in the short term.

Source: Cryptuquant

In addition, Bitbo data confirmed that STHs had not had to deal with losses. Their realized price was $ 92,174 – above the current spot prices near $ 84,000.

Source: Bitbo

However, it is worth noting that the drop does not necessarily indicate a full capitulation, but rather a phase of doubt or potential accumulation.

Looking at earlier cycles, we can note that when the ratio reached the +4 STDV abnormality of the 365DMA, a local market consistant formed, followed by a short-term correction during the bull phase.

With a high degree of uncertainty in the markets, there is a better chance that a capitulation phase can unfold, so that realized losses may be even higher.

Is the capitulation ahead for BTC?

Although non -realized losses dominate, investors are not used to selling. On the contrary, investors are optimistic and expect that Bitcoin prices will go higher in the nearby team.

Source: Cryptuquant

For example, the fund current ratio of Bitcoin fell from 0.13 to 0.06 for four days – somewhat less exchange deposits of retail investors revealed.

Moreover, whale behavior repeated this restraint. The exchange rate ratio fell from 0.51 to 0.37, which implied that whales remained – or even accumulated.

Source: Cryptuquant

What will come afterwards?

In conclusion, although non -realized losses continue to rise, investors still have to capitulate. As such, Bitcoin holders are hopeful and expect the prices to regain higher levels.

If these sentiments can apply, we could see Bitcoin reclaim from $ 86078. If STH starts to sell to prevent more losses, BTC will return to the lower limit of the consolidation channel around $ 82800.