- The negative trend of market capitalization versus the realized PET is historically a bearish signal

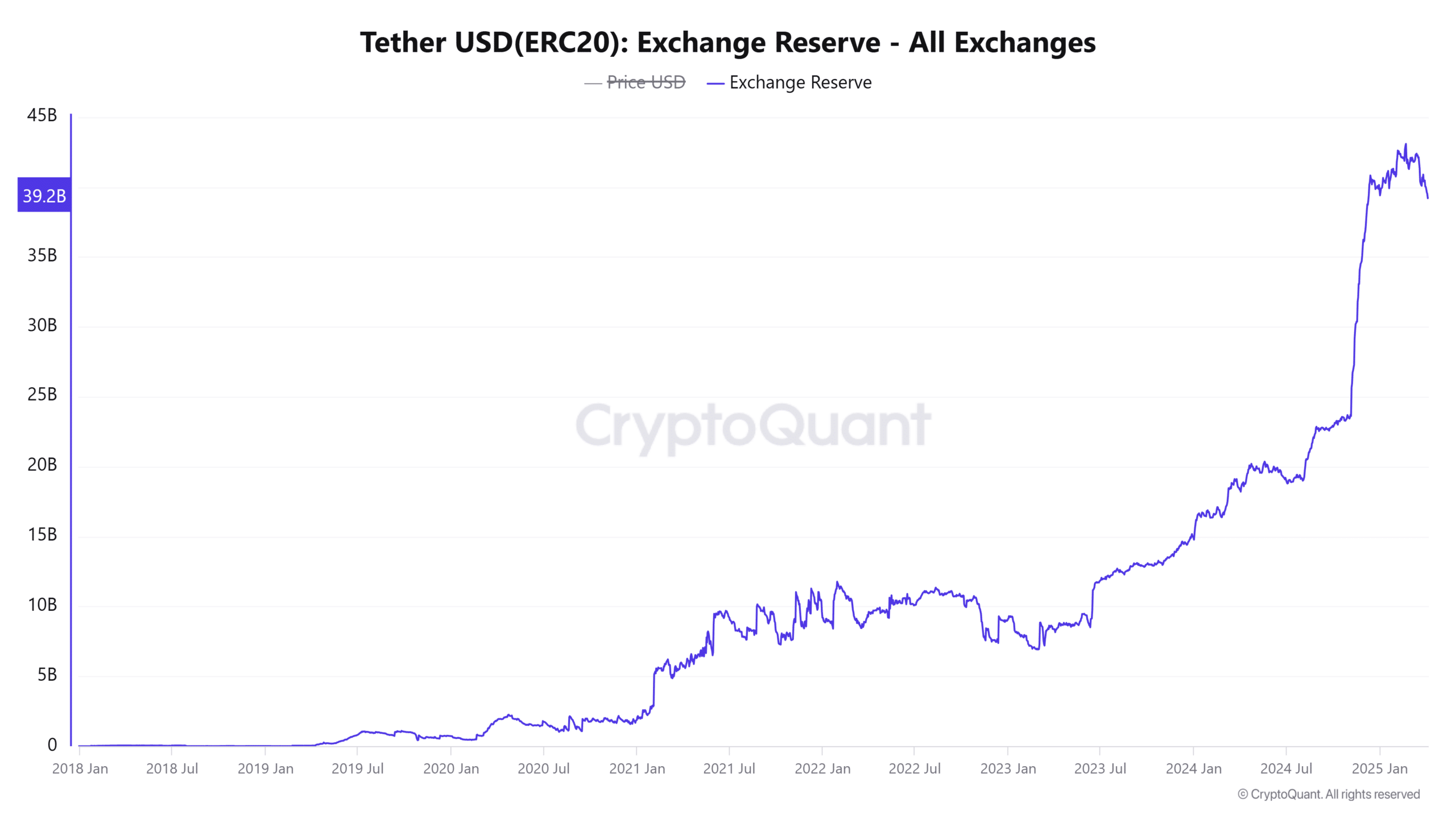

- The Halt in the growth of the Tether Reserve pointed to stable, rather than increasing purchasing power

The global M2, a classification of money supply that includes money market funds, refers to the money supply of large economies such as the US, China and the eurozone.

In a recent report it was noted that the global M2 money amount in 2025 became parabolic while Bitcoin [BTC] Was consolidating.

Historically, such differences do not last long. That is why there is a chance for Bitcoin to appreciate.

On the other hand, the Trade War initiated by the US has affected the confidence of investors. China’s retribution of 34% rate On April 2, the tensions, which also influence the cryptomarkt.

Assessment of the Bearish Arguments for Bitcoin

The Bitcoin spot ETFs have been weak in recent days. The pessimistic macro -economic outlook as a result of the current trade wars was a factor here.

Blackrock’s spot ETF IBIT (Ishares Bitcoin Trust ETF) saw a few inflow over the past two weeks, but most other products have recently witnessed sales pressure. This sketched a bearish short -term sentiment.

In the midst of this Bearish background, the CEO and co-founder of the popular crypto-analysis company Cryptoquant stated that the “bull’s cycle is over”.

Is the BTC Bull cycle about it?

In one Post on X (formerly Twitter)he explained the concept of the realized limit to support this argument.

The market capitalization of an active is calculated by multiplying its circulating offer with its current market price.

The realized cap, on the other hand, measures the market capitalization of Bitcoin based on the value with which each coin was last moved. This offers a more accurate picture of the capital that flows into the Bitcoin market.

The analyst used 365-day advanced averages (MA) for both market capitalization and the realized cap to calculate the 365-day MA of the Delta growth.

A decrease in these metric signals a rising cap combined with a falling market capitalization and trend observed since November-December 2024.

Ki Young Ju emphasized that capital inflows that do not stimulate the price profit indicate a Bear Market. At the time of analysis, the MA of the Delta Growth was negative, which is in line with the Bears Market conditions.

A similar situation took place in December 2021, after Bitcoin’s previous all times of $ 69k and its subsequent decline. Ju also predicted that a short -term rally is unlikely, and this bearish phase could continue to exist for another six months.

According to the realized CAP data, the start of another Bear Market seemed possible. Meanwhile, on the other hand, the Exchange Reserve or Tether [USDT] Has stopped his growth in recent months.

Opposite these views, the aforementioned global M2 pointed out that was previously named after the rising purchasing power in the market.

A delay in the growth of Tether Reserve was accompanied by the previous market top.

The data here suggested that another bear market could be underway, but it must be noted that none of the usual cycle top statistics have reached overheated levels that reflect the previous cycle.