- Bitcoin finally managed to jump above its possible market bottom.

- Although buying pressure was high, some indicators turned bearish.

After a week of price increases, Bitcoin [BTC] has turned bearish again in the past 24 hours. However, this trend could change in the coming days as BTC followed a historical trend. If history repeats itself, investors could soon witness a major price move.

Bitcoin’s main indicator is flashing

AMBCrypto reported rather that Bitcoin managed to cross $64,000 a few days ago, but this move did not last long. The king coin witnessed a price correction of almost 2% in the last 24 hours, dropping it to $63,117.53.

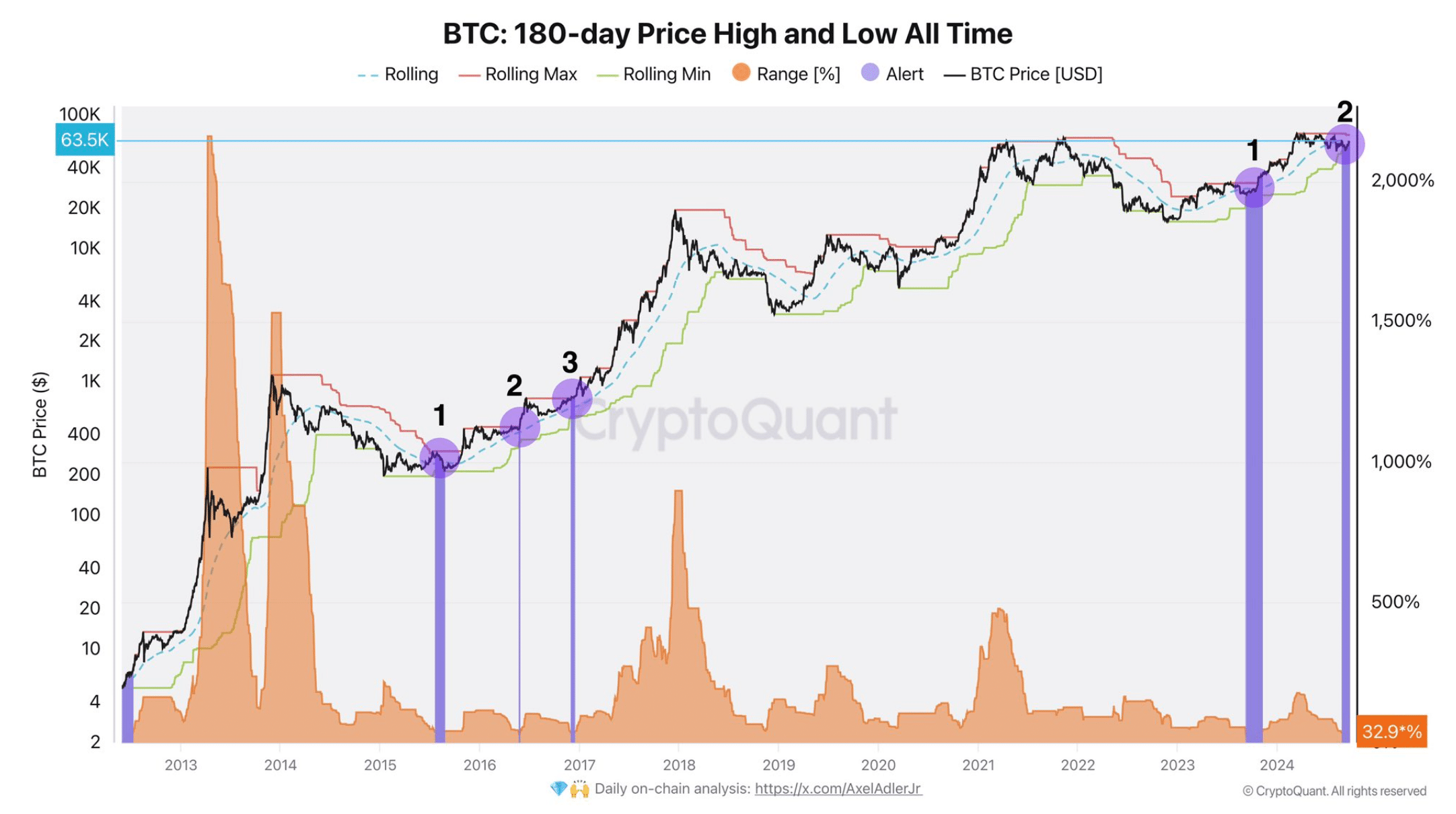

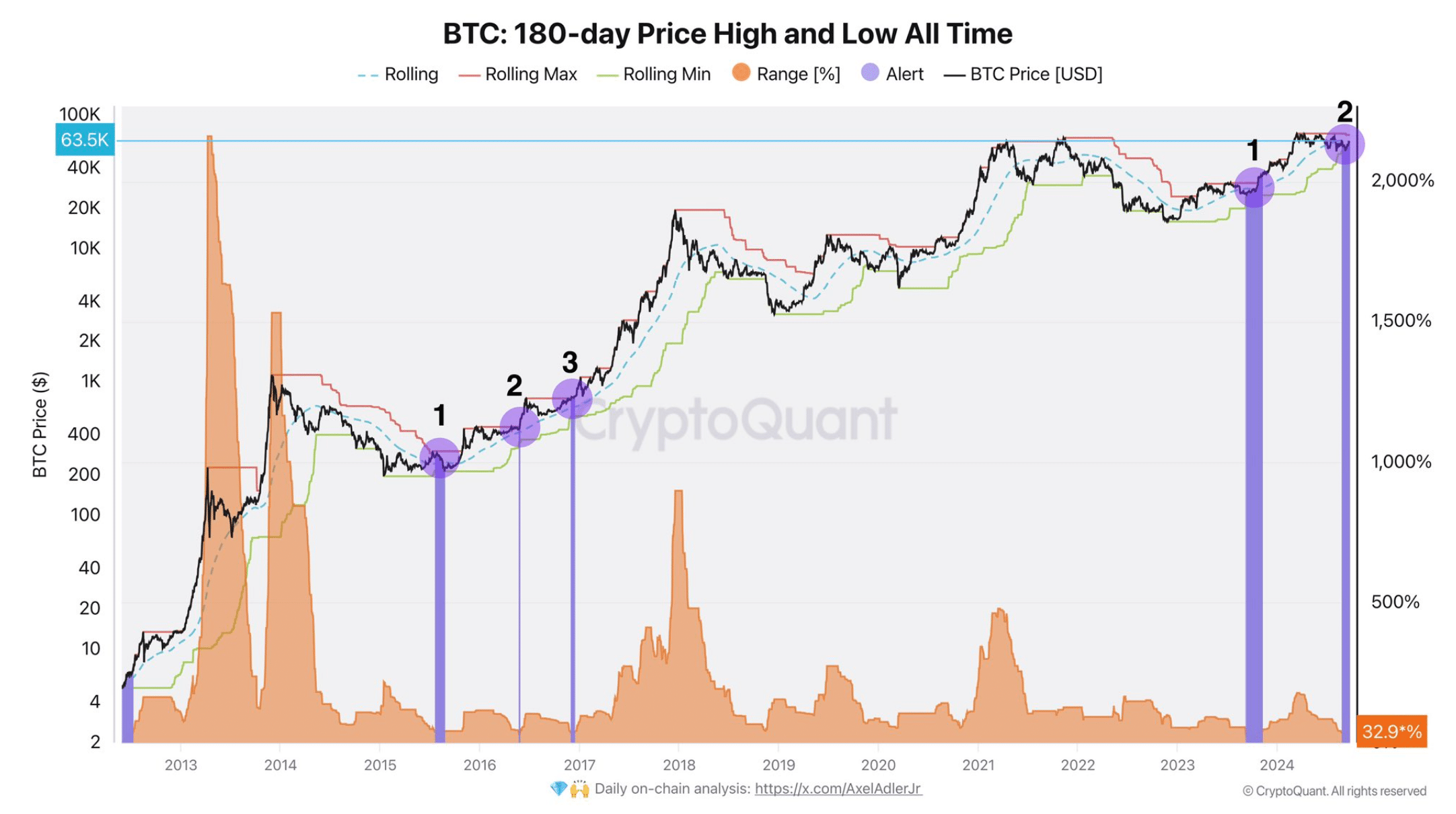

While that was happening, Axel, a popular crypto analyst, posted tweet shows an interesting development. According to the tweet, volatility has been decreasing over the past six months and a warning has appeared on the map.

Notably, the warning appeared for the fifth time in Bitcoin history.

To be precise, such warnings already appeared in 2015, 2016, 2017, and 2023 before appearing again in 2024. Historically, whenever this warning appeared, the price of BTC registered a significant price movement northward.

Therefore, if history repeats itself, investors can expect Bitcoin to embark on another bull rally in the coming days.

Source:

Is BTC Ready for a Price Pump?

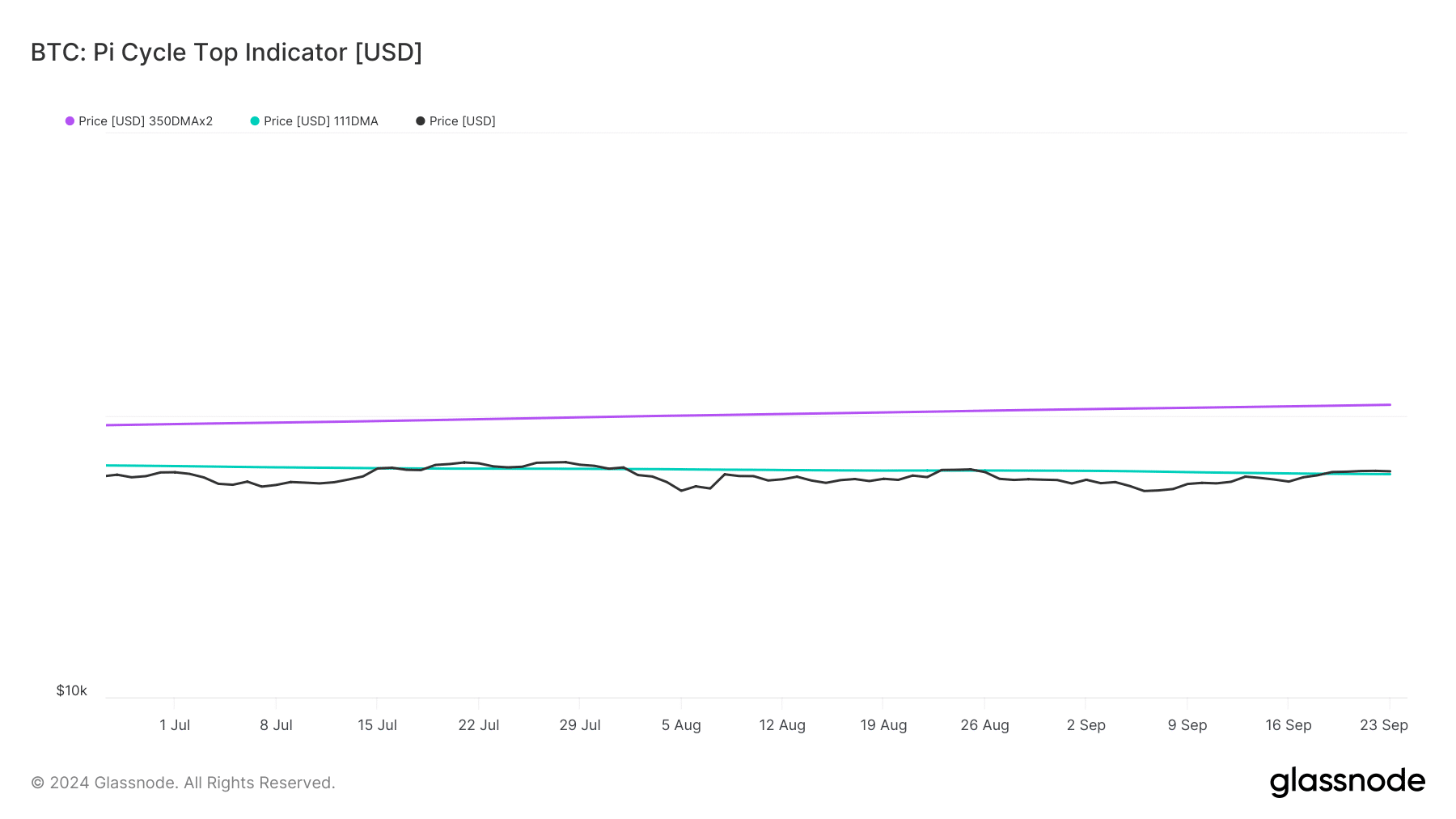

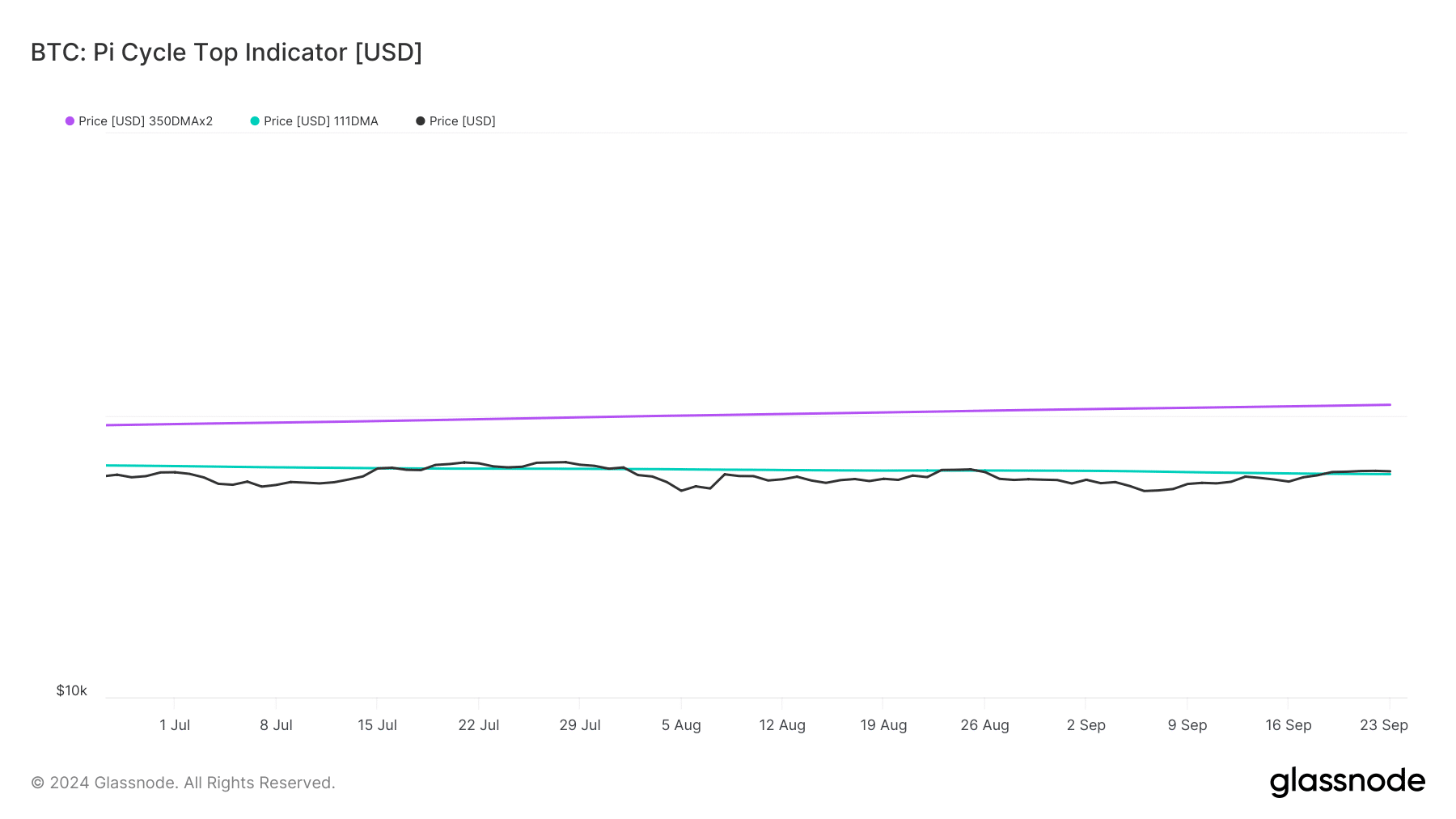

As history indicated another bull rally, AMBCrypto checked Bitcoin’s on-chain metrics to see if they also suggested a price increase. Our look at Glassnode’s data showed that the price of BTC has risen just above the possible market bottom of $61.8k.

If the Pi Cycle Top indicator is to be believed, the upcoming bull rally could as well push the coin towards its possible market top of $109,000 in the coming weeks or months.

Source: Glassnode

In addition, AMBCrypto previously also reported that buying pressure on the coin was high, which also indicated a price increase. However, not everything was in favor of the king’s coin.

Our analysis of CryptoQuant’s facts revealed that Bitcoin’s aSORP turned red. This clearly meant that more investors sold at a profit. In the middle of a bull market, this could indicate a market top.

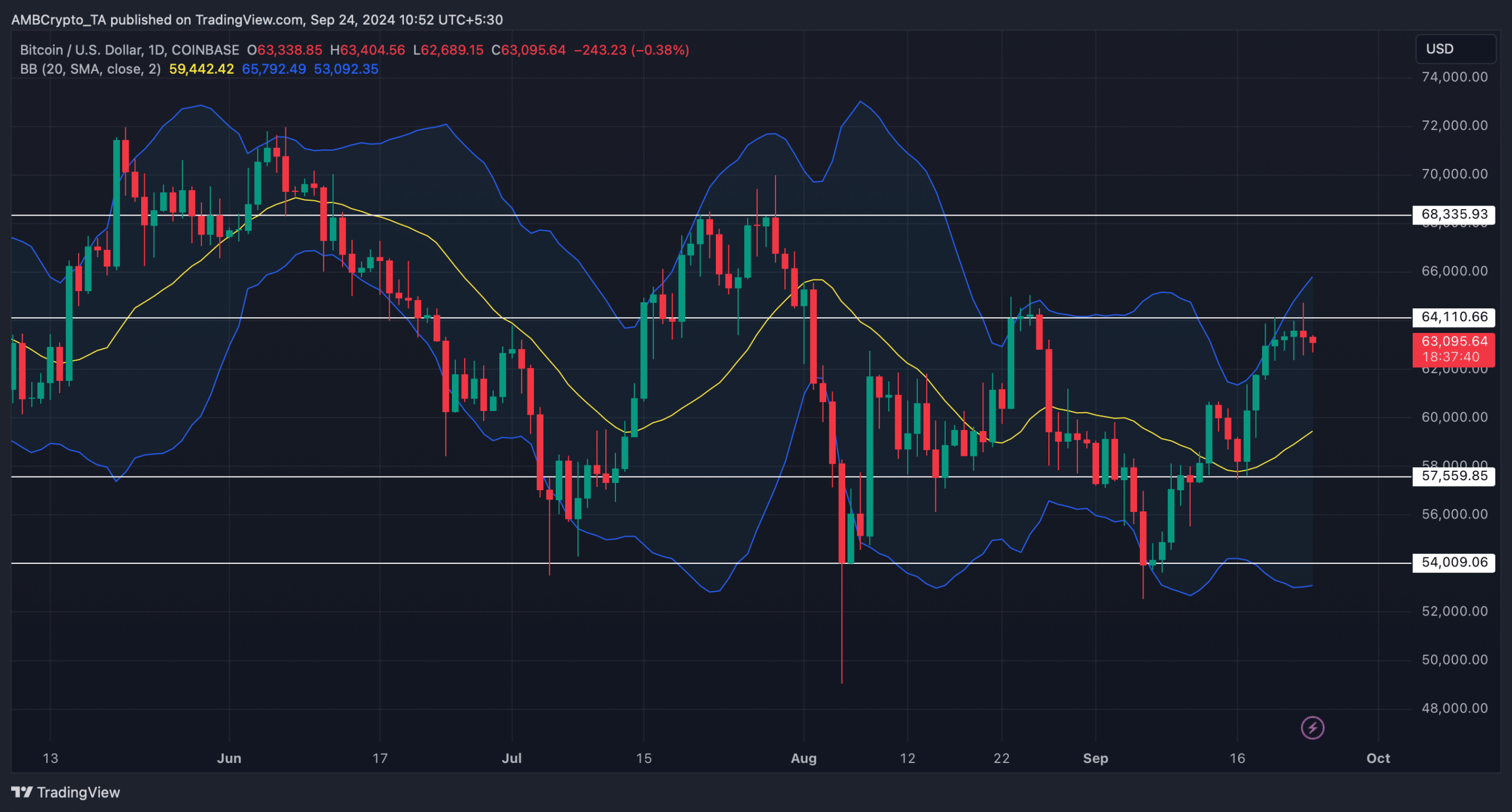

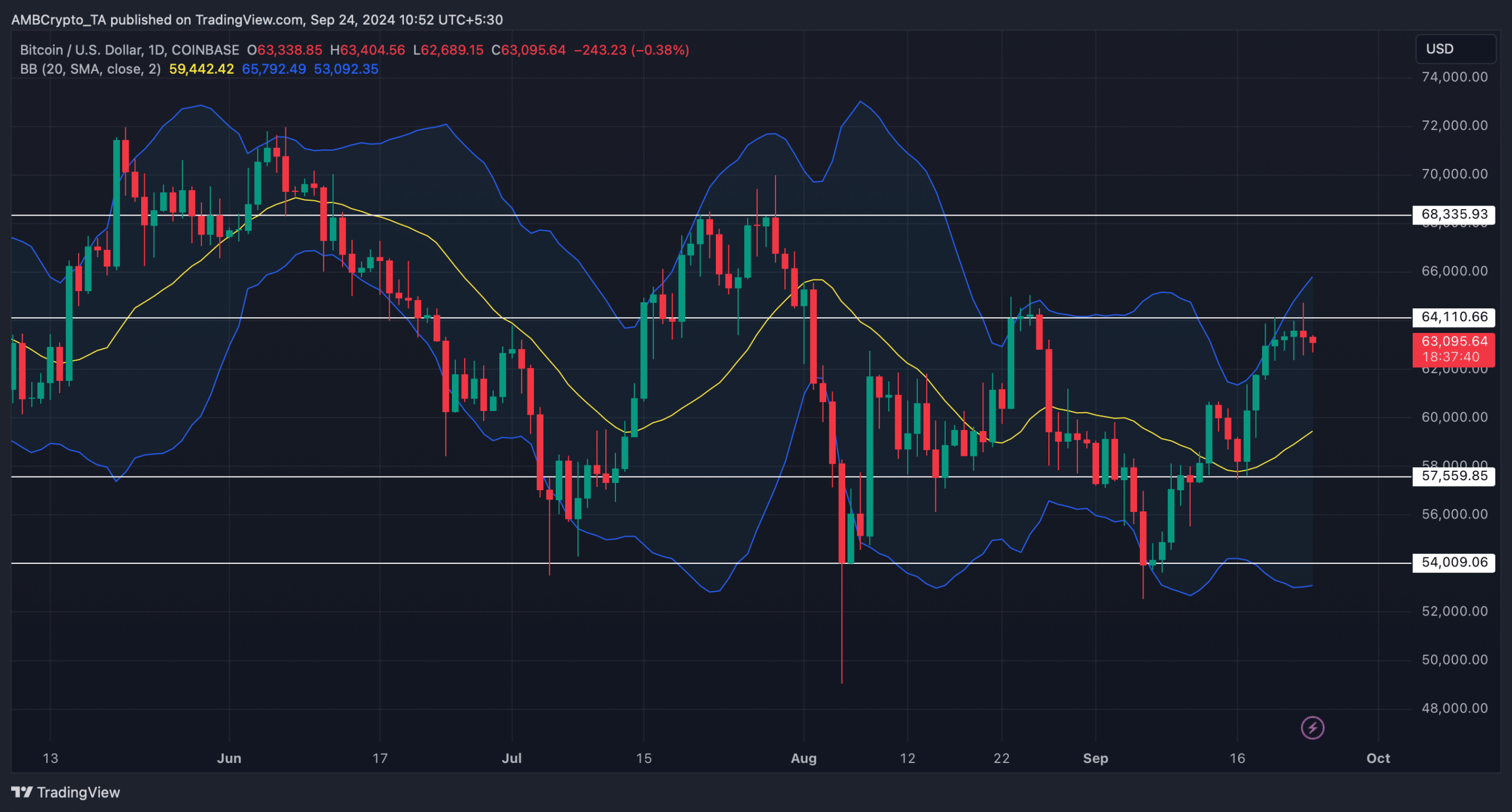

We then looked at Bitcoin’s daily chart to better understand the likelihood of a bull rally. According to our analysis, BTC was rejected due to the resistance at $64.1k.

Moreover, the price of the coin had also reached the upper limit of the Bollinger Bands, indicating a price correction.

Source: TradingView

Read Bitcoin (BTC) price prediction 2024-25

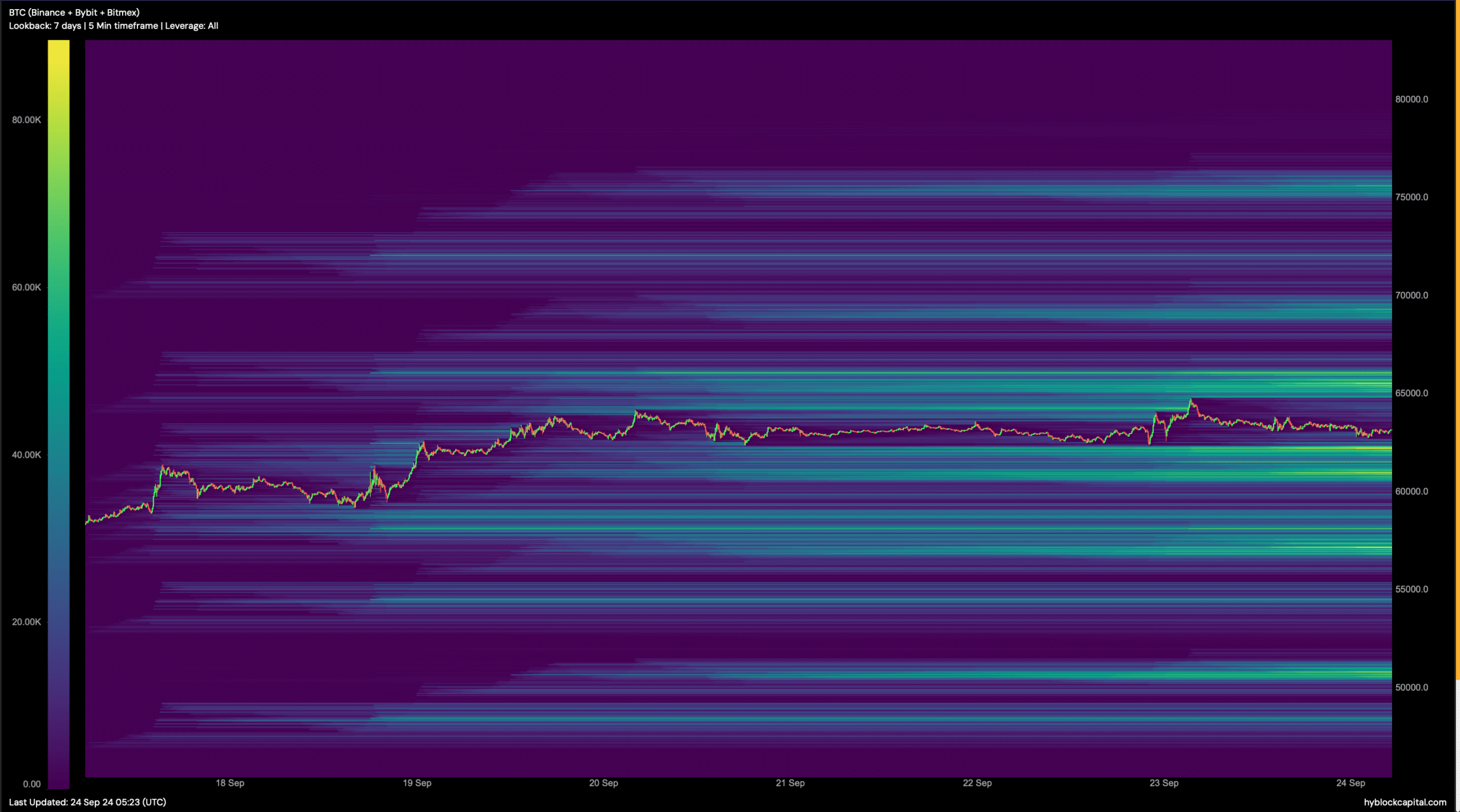

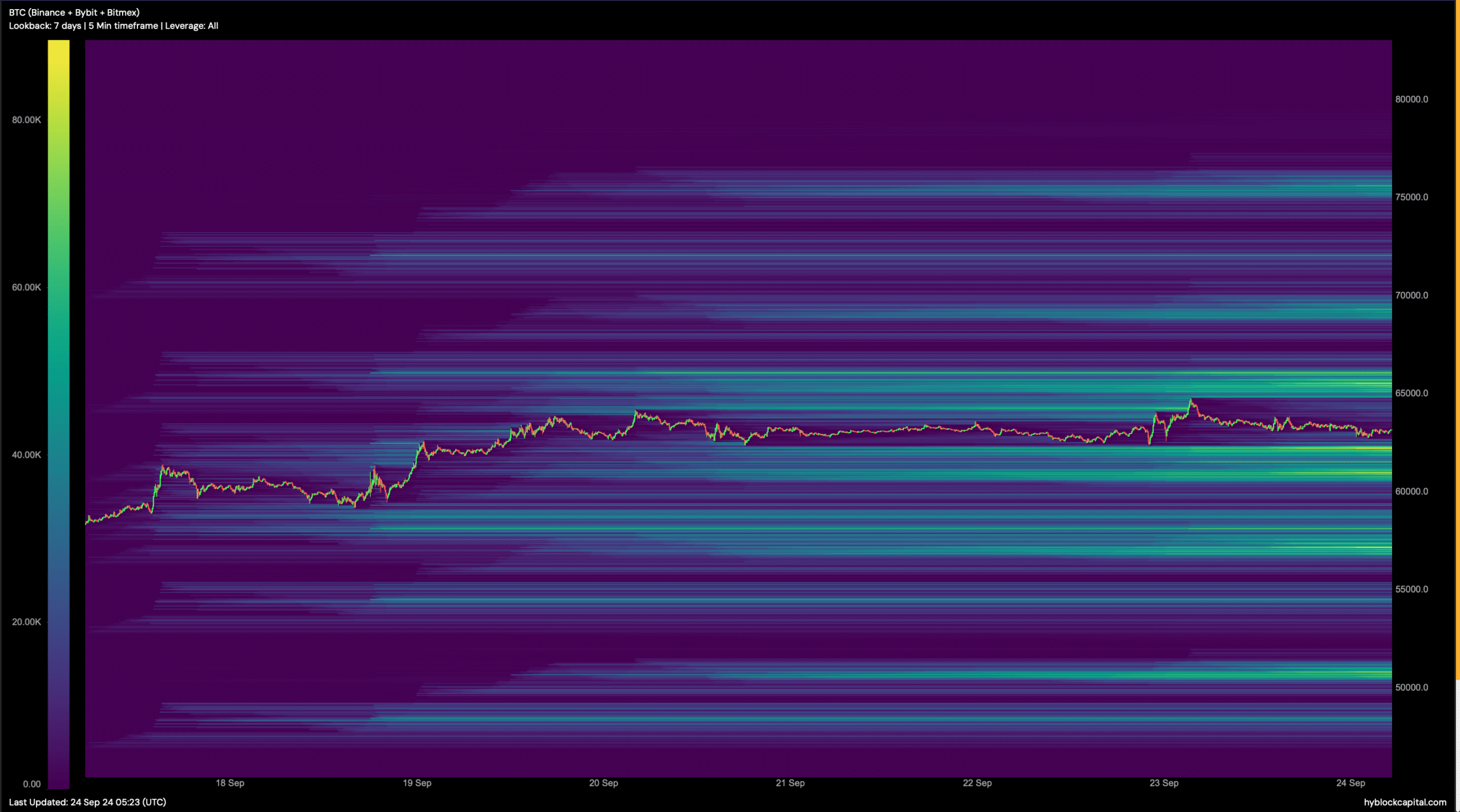

If a price correction occurs, BTC could fall again to $62,000. But in the event of a bull rally, it will be crucial for BTC to move above the $64k-$65k range, and liquidation will rise sharply there.

Typically, an increase in liquidation results in short-term price corrections.

Source: Hyblock Capital