- Whale activity and technical outbreak signals a potential prize peak from Bitcoin.

- Institutional support and positive sentiment reinforce Bitcoin’s market prospects.

Bitcoin [BTC] continues to attract heavy institutional importance and its price movement reflects this growing attention.

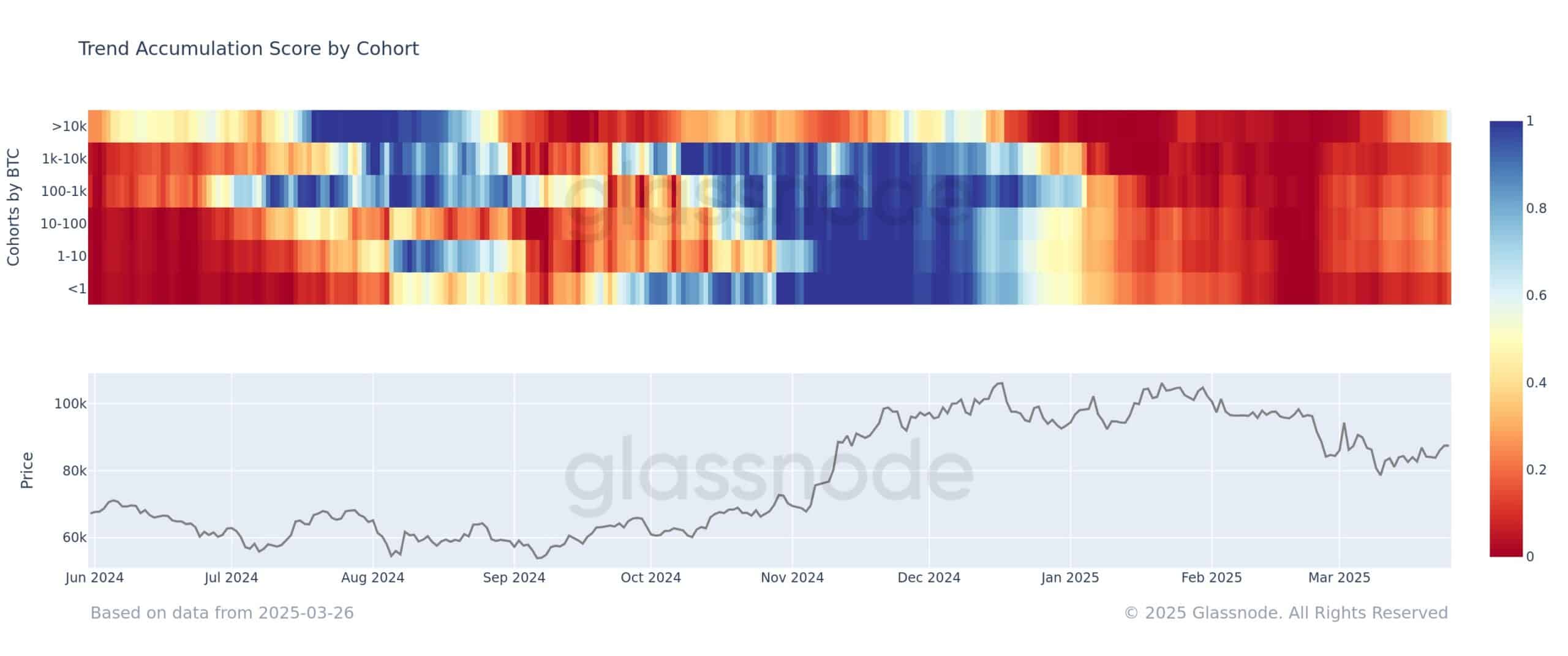

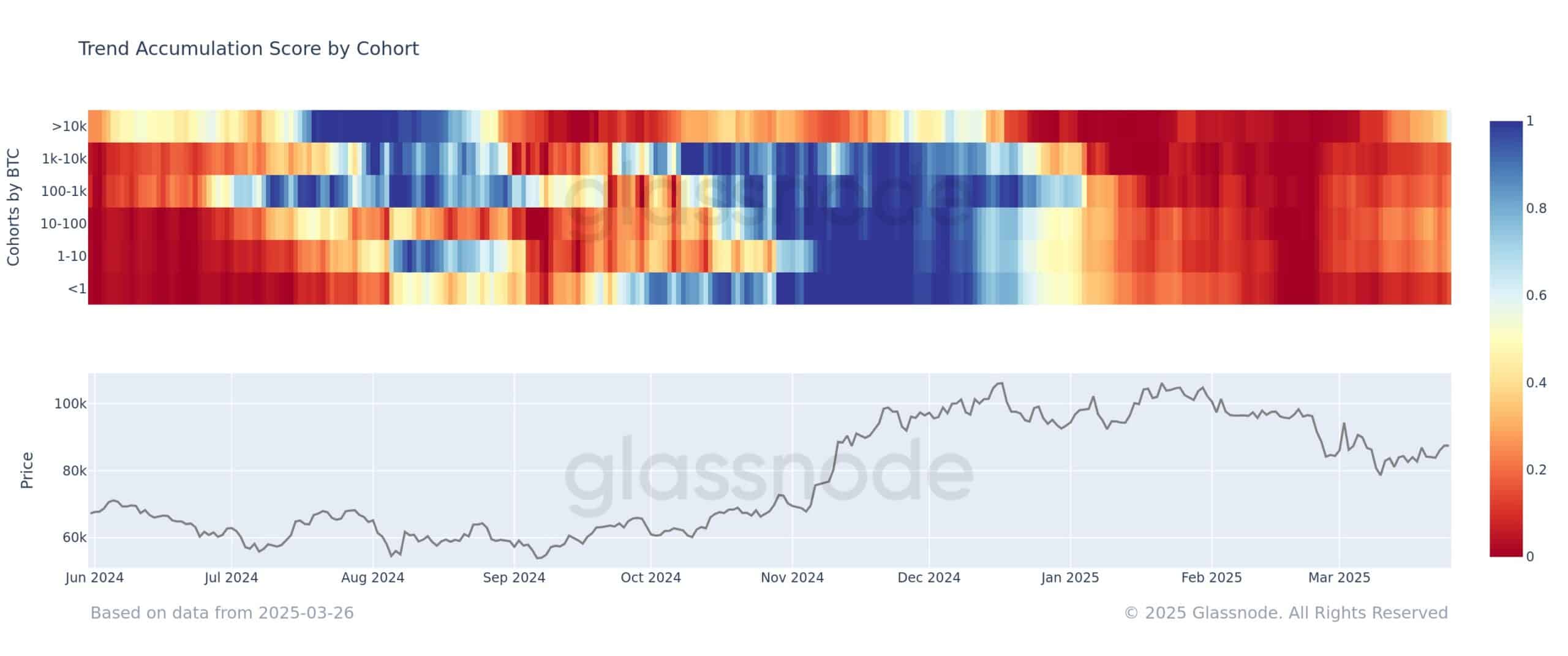

Whales with more than 10,000 BTC have raised their accumulation trend score higher than 0.5, buying a clear indication of steadily.

The trend indicates that large investors continue to collect BTC, while smaller holders are still net sellers, as can be seen in the cohort level graph.

Bitcoin’s recent increase in activities corresponds to these developments and market analysts eagerly look at the next step.

Source: Glassnode

What feeds Bitcoin’s upward momentum?

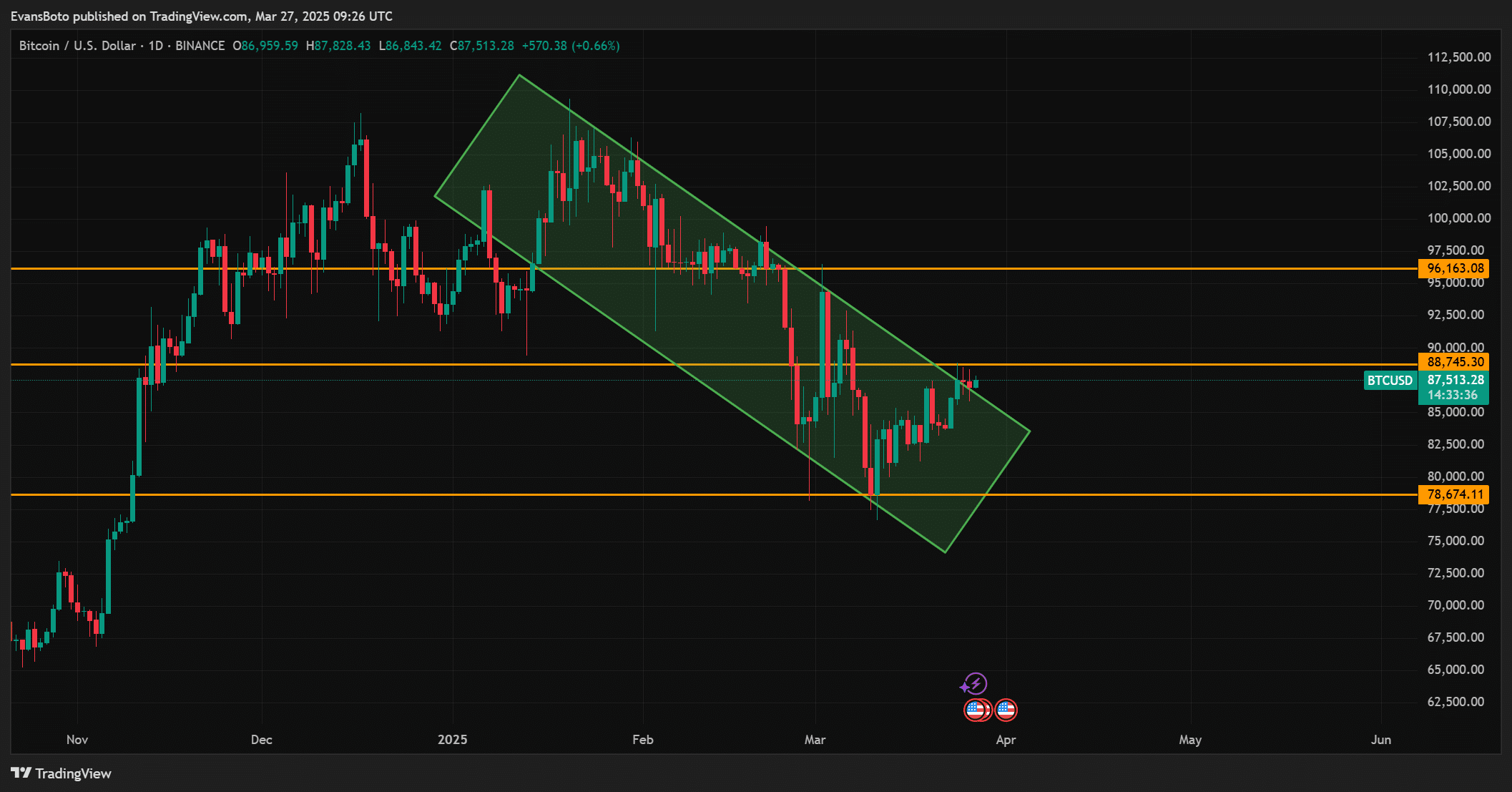

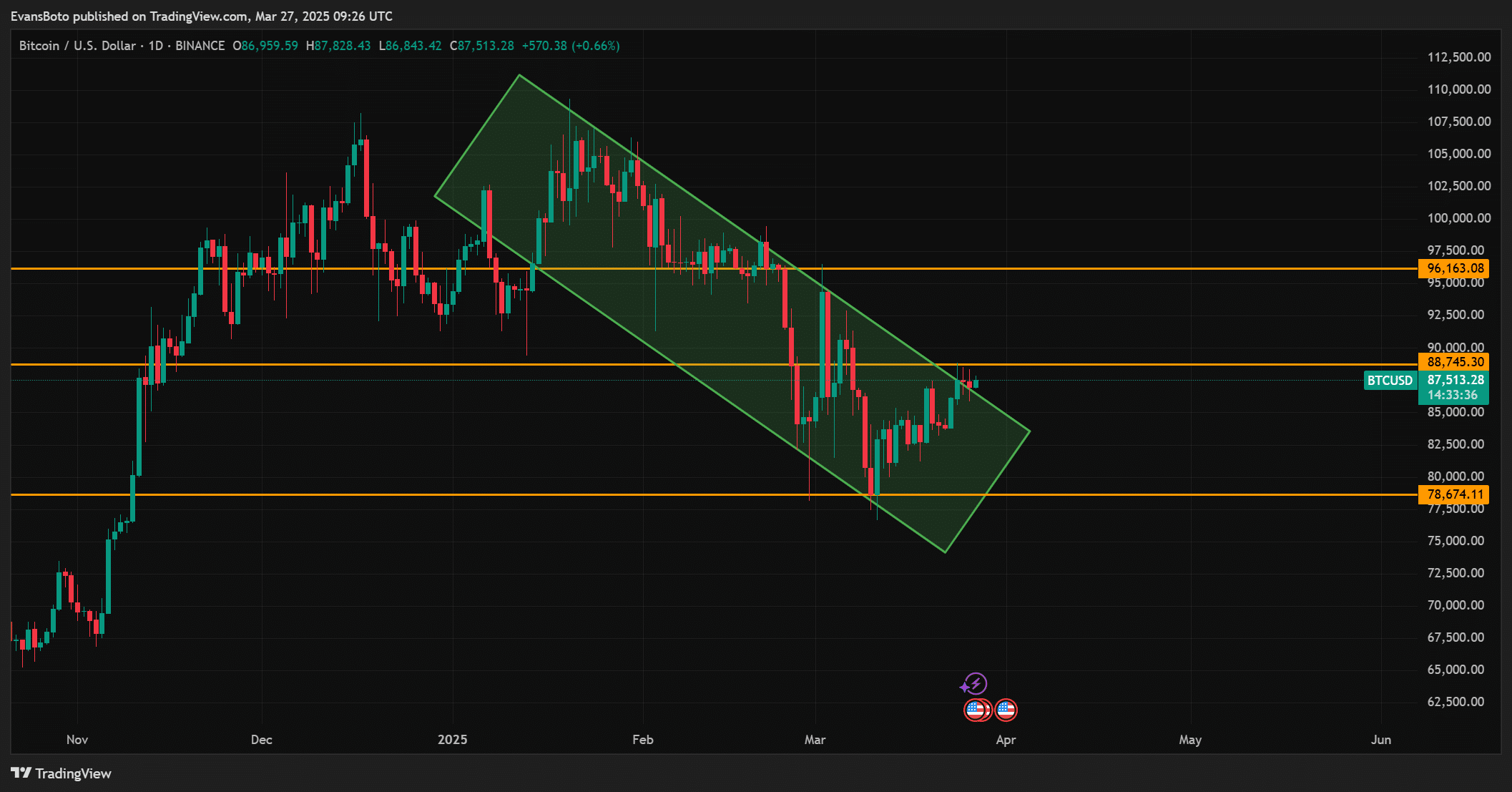

The price of Bitcoin recently broke from a falling wig pattern, which indicates a potential bullish trend.

The graph clearly shows that BTC is pushing up and tries to overcome considerable resistance levels at $ 96,163.08 and $ 95,000.

At the time of the press, Bitcoin trades at $ 87,521.46, which marks a decrease of 0.48% in the last 24 hours.

The outbreak of the Wedge pattern offers BTC the opportunity to reach new highlights, and if it successfully exceeds these resistance levels, a further upward movement can be in store.

Market participants are focused on whether BTC can consolidate the above important support zones.

Source: TradingView

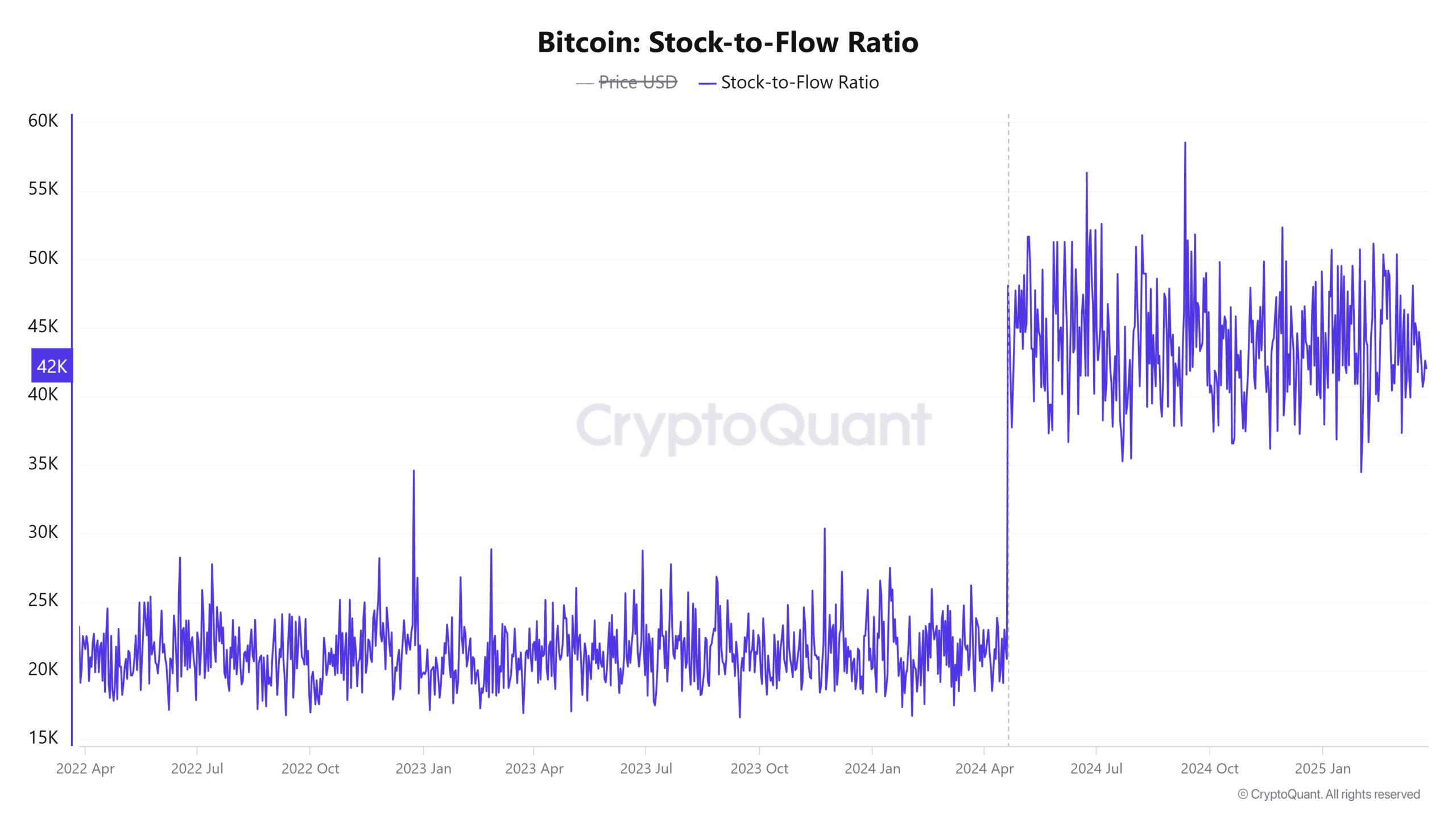

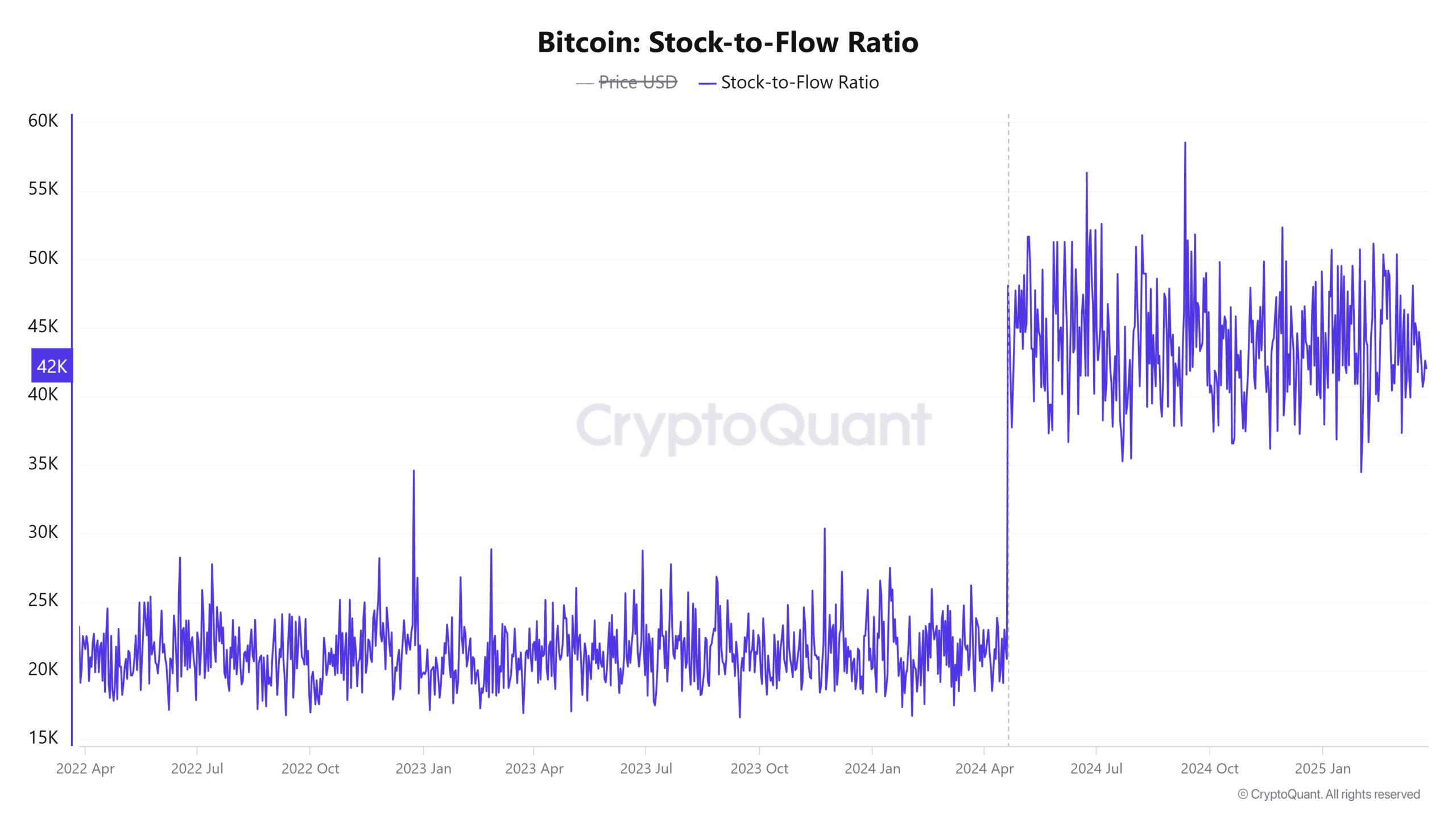

In addition, the Bitcoin stock ratio is currently 907,0911k, which represents a decrease of 42.86%. This metric helps to measure the scarcity of Bitcoin by comparing the circulating delivery with newly mined coins.

The decrease in the to-flow ratio indicates that the scarcity of BTC is increasing, making it possible to become more valuable in the future.

The reduced ratio is a sign that fewer coins are made available on the market, which suggests that the value of BTC can rise as the scarcity grows.

This is particularly relevant because institutional investors and whales continue to keep large quantities of BTC, which stimulates the story of increasing scarcity.

Source: Cryptuquant

How are whales and settings forming BTC ‘S Future?

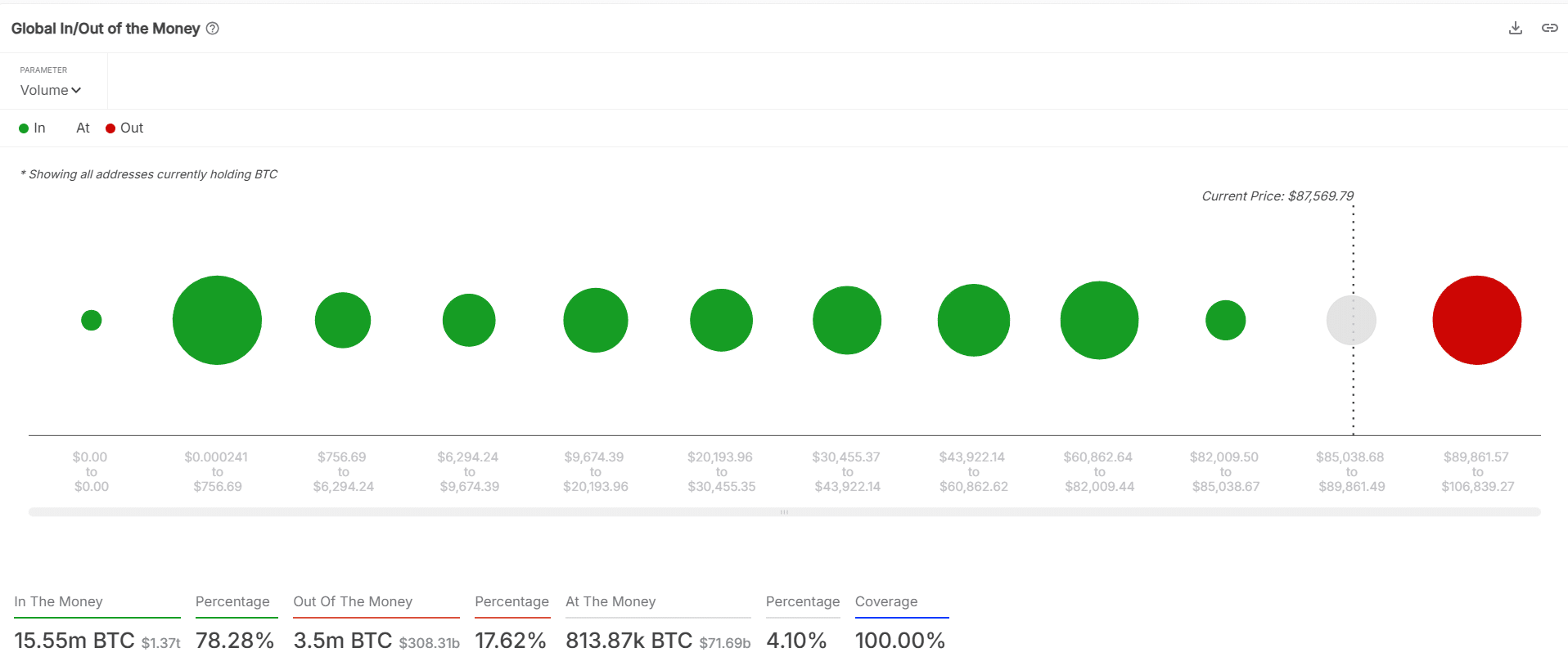

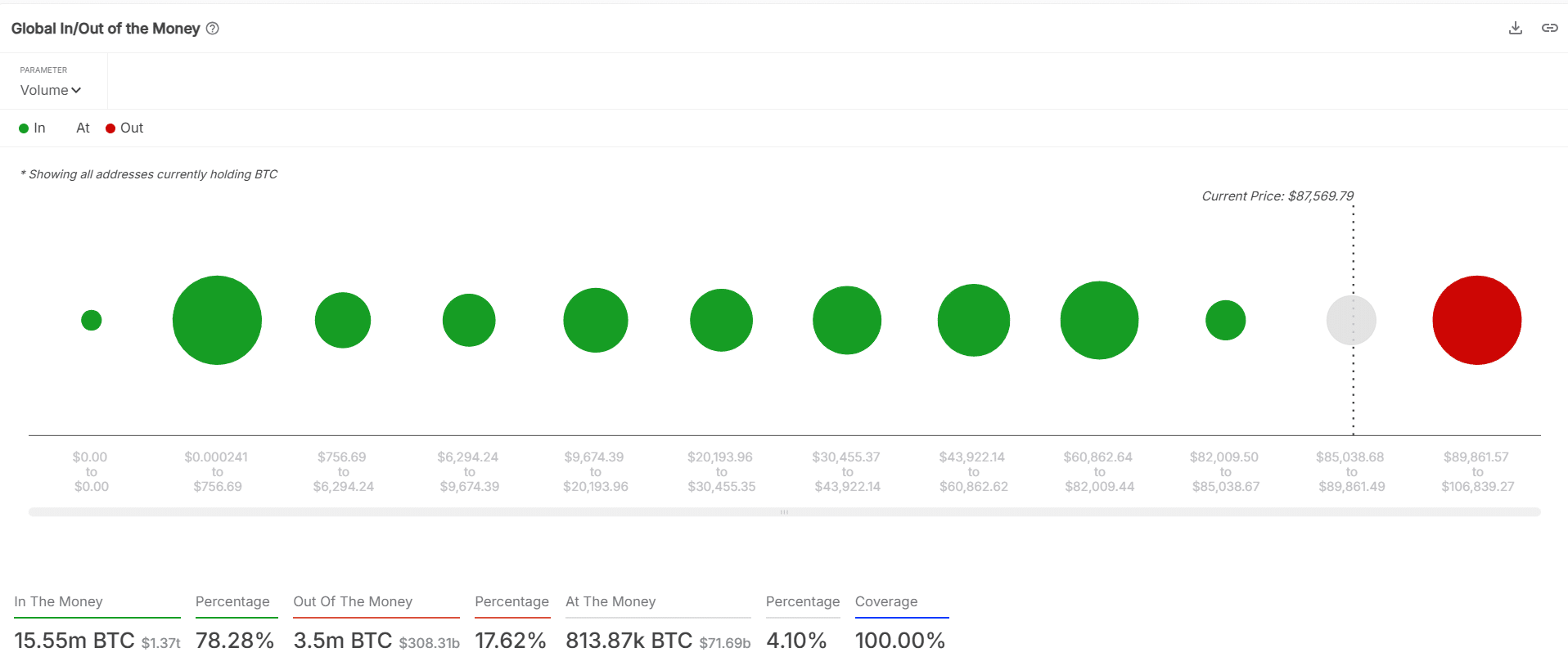

The in/out of the money graph for BTC shows that 77.59% of Bitcoin holders are currently profitable, which supports the idea that most investors keep strong.

This indicates a positive sentiment in the majority of holders, who can help stabilize the market.

Moreover, the social sentiment of BTC is strong bullish. During the DC Blockchain Summit 2025, Senator Cynthia Lummis emphasized the role of Bitcoin in reducing the national debt if they are held for 20 years.

In the meantime, Michael Saylor emphasized the importance of BTC on the world stage and called it the ‘modern digital gold rush’.

Such statements from influential figures contribute to the growing institutional support for Bitcoin.

Source: Intotheblock

Conclusion

The increasing whale activity of Bitcoin, positive technical patterns and strong institutional support suggest that it is indeed ready for a potential price increase.

The accumulation trend under whales, in combination with favorable technical signals and the continuous support of institutional figures, indicates that BTC could see further growth.

That is why the evidence strongly points to BTC that will continue its upward process in the coming months.