- Analysts downplayed the positive impact of the Fed’s rate cuts on Bitcoin.

- Andrew Kang stated that BTC could remain range-bound until a major crypto catalyst emerges.

There is general market optimism Bitcoin [BTC] could explode in the fourth quarter of 2024, especially given continued rate cuts by the US Fed and China’s stimulus package.

These factors are considered net positive global liquidity and risky assets, including BTC. The Fed’s aggressive 50 basis point rate cut in September was considered the catalyst for BTC’s rally to $66,000.

Opposing view Fed rate cuts

But Andrew Kang, co-founder of crypto investment firm Mechanism Capital, has taken a cautious and contrarian stance.

According to Kang, the impact of the Fed’s interest rate cuts and Chinese policy could be exaggerated. He said,

“I believe that crypto market participants as a whole have overestimated the impact of the Fed’s rate cuts and China’s stimulus measures.”

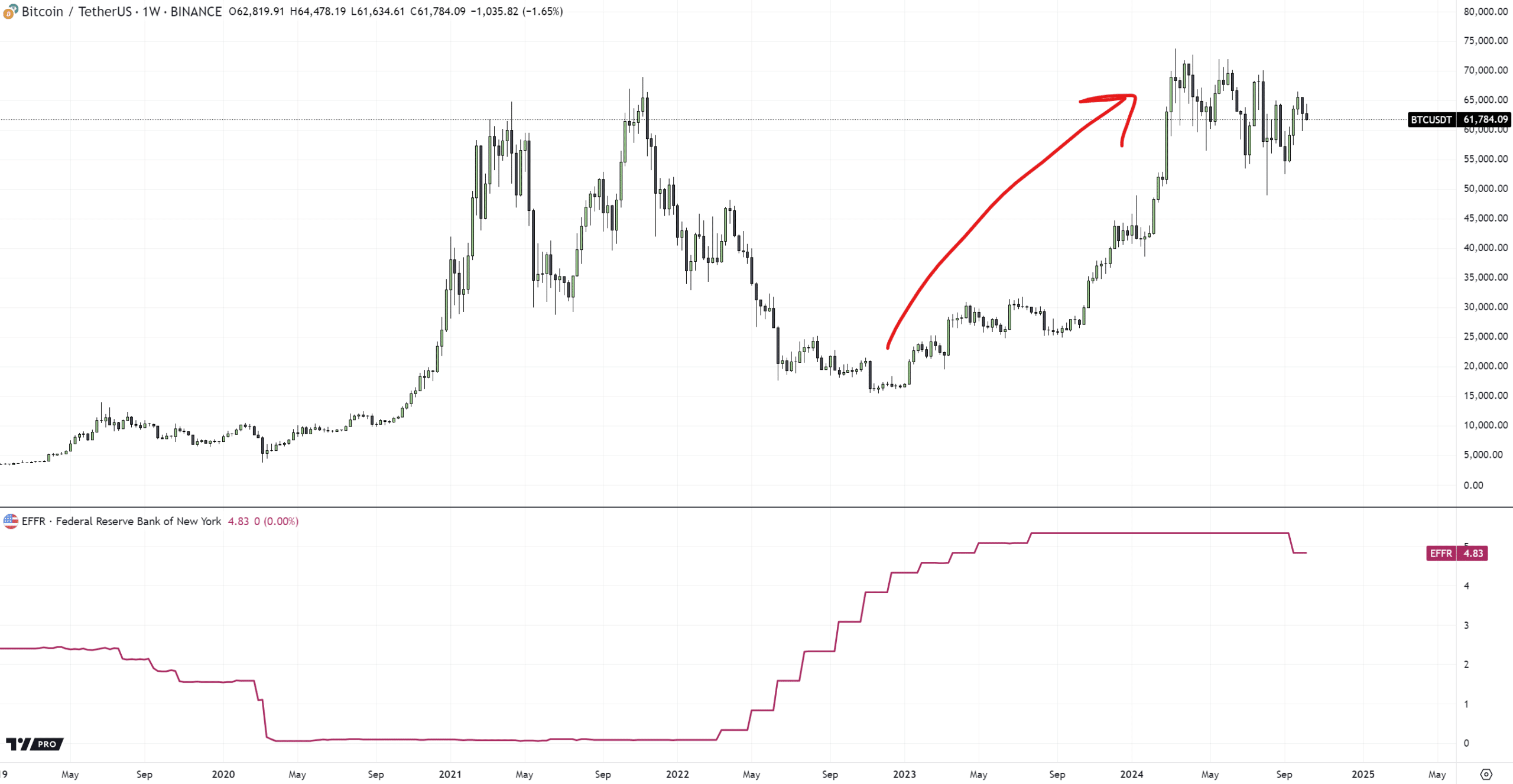

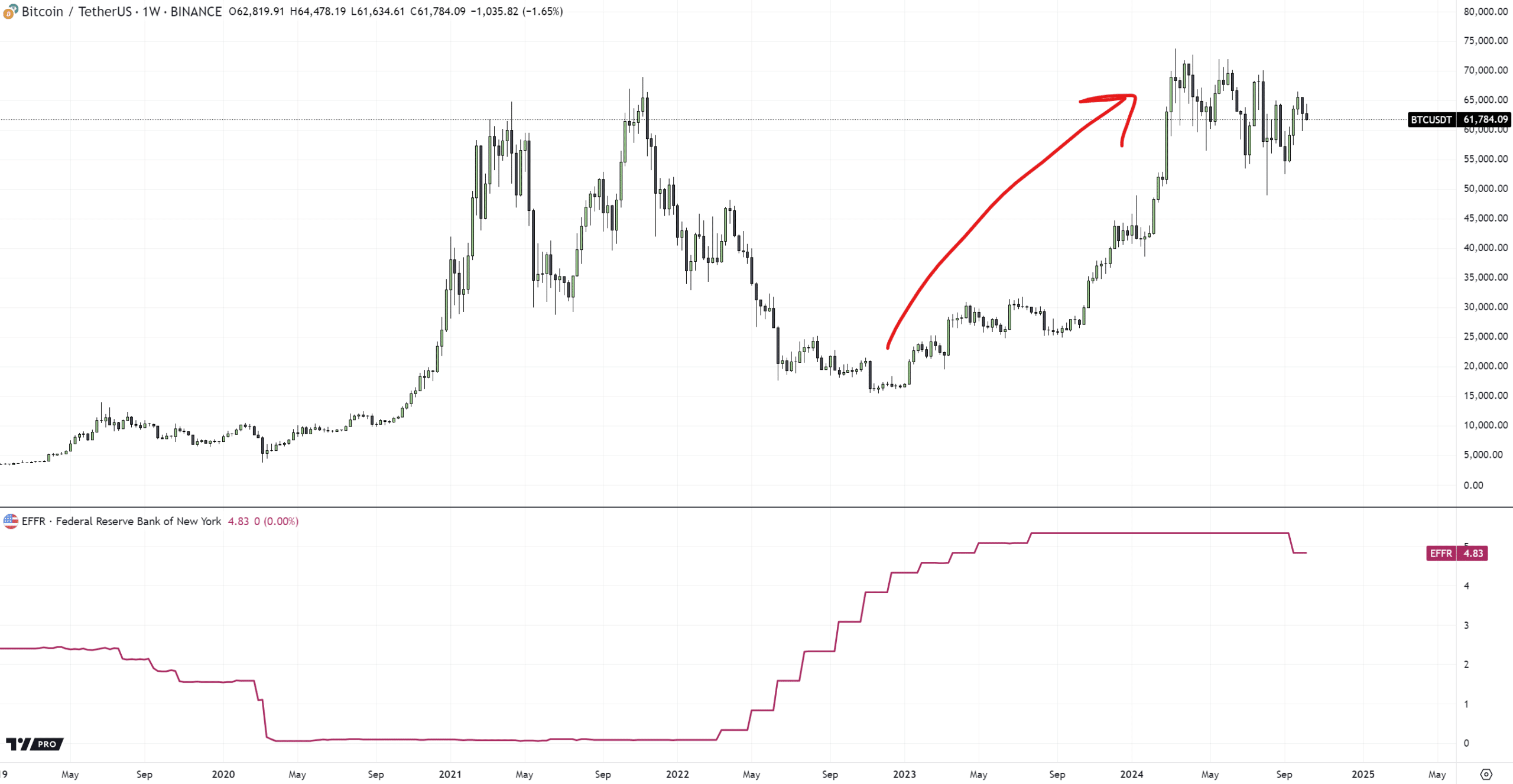

Source: BTC vs Fed Rate Cuts, TradingView

Kang argued that Fed rates are just one of many factors affecting global liquidity. He added that even global liquidity is just one of many factors influencing crypto prices.

To make his argument, Kang cited BTC’s wild rally since 2023, when Fed rates soared to record highs.

“It seems nonsensical to see BTC rise 4.5x during a period when rates were at multi-decade highs – with little correlation between rates and BTC, and then expect a strong inverse correlation to occur once interest rates start to fall. .”

While he recognized the importance of the Fed rate, he felt the market was overemphasizing it.

SwissOne Capital, a crypto-focused asset manager, backed the projection.

The company added that altcoins will benefit more than BTC during the Fed’s rate cut cycle because BTC’s dominance always declines during these periods.

“During the previous rate cut cycle that started in mid-2019, Bitcoin’s dominance subsequently fell to 38%.”

Source: TradingView

Chinese stimulation

Kang also claimed that Chinese stimulus was more bullish for stocks than crypto. He cited recent trade discounts between USDT and the Chinese Yuan (CNY).

“Those in China have noticed a migration from crypto to A-shares. The data backs this up: since the Chinese stimulus announcement, USDT has traded at a discount to the CNY. Still at 3% as of recently.”

Although the Chinese stock rally stuck temporarily, market experts predicted that an additional stimulus package from the Chinese government could reignite the upward trend.

If so, crypto investors could reallocate capital to stocks, as Kang noted.

Ergo, he predicted that BTC could remain between $50,000 and $72,000 until a strong crypto catalyst activates the market.

“This doesn’t mean I’m bearish; I just think some people have gotten over their skis a little bit. I still believe we are in the $50,000 to $72,000 range until there is a meaningful catalyst for crypto.”

In the meantime, BTC was still below the 200-day MA (Moving Average), reinforcing that it had yet to undergo a convincing market structure shift to bullish.

Source: BTC/USDT, TradingView