- More than a million users bought BTC at $94,000, making it strong support for an upward move.

- But a sharp pullback in BTC cannot be overruled as key metrics showed red flags.

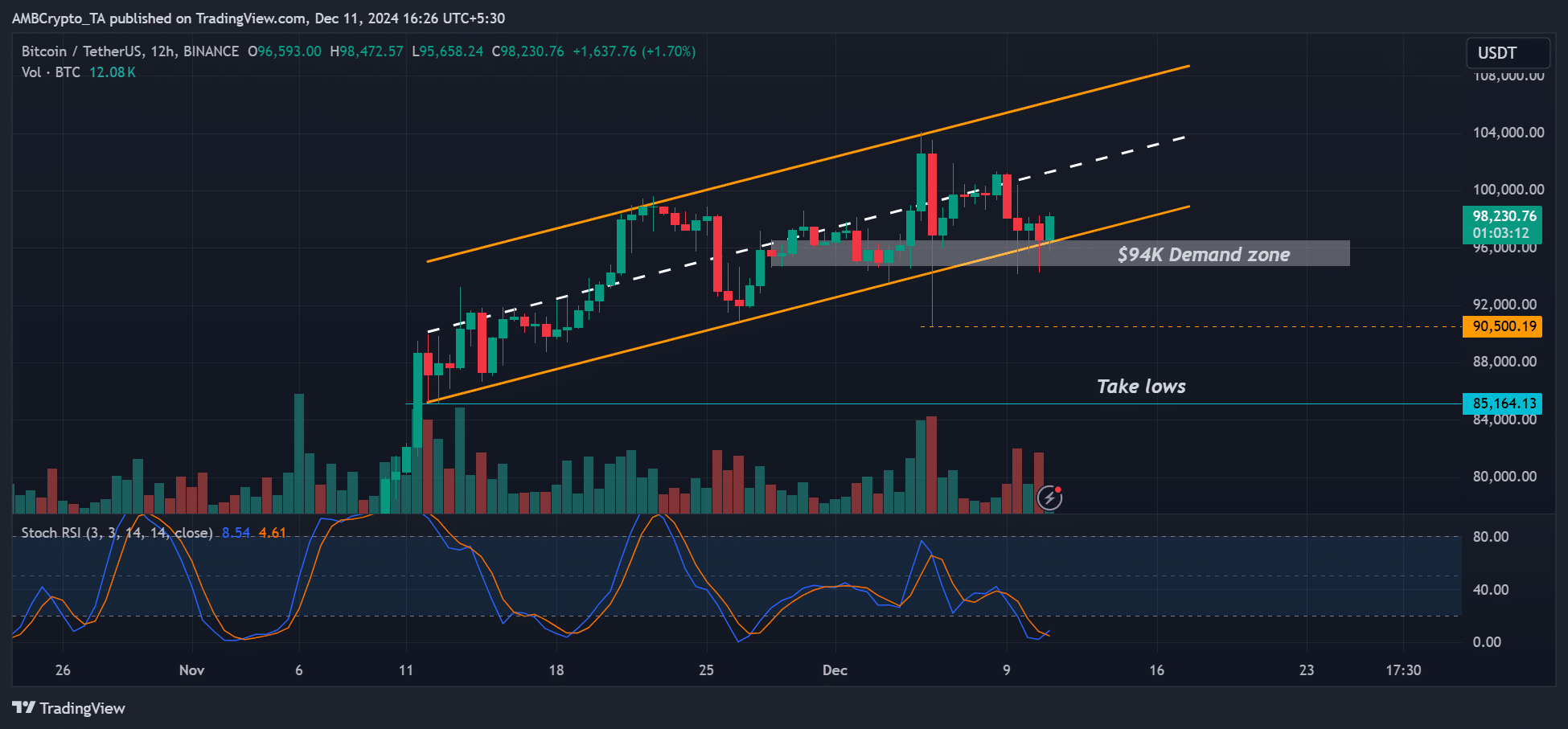

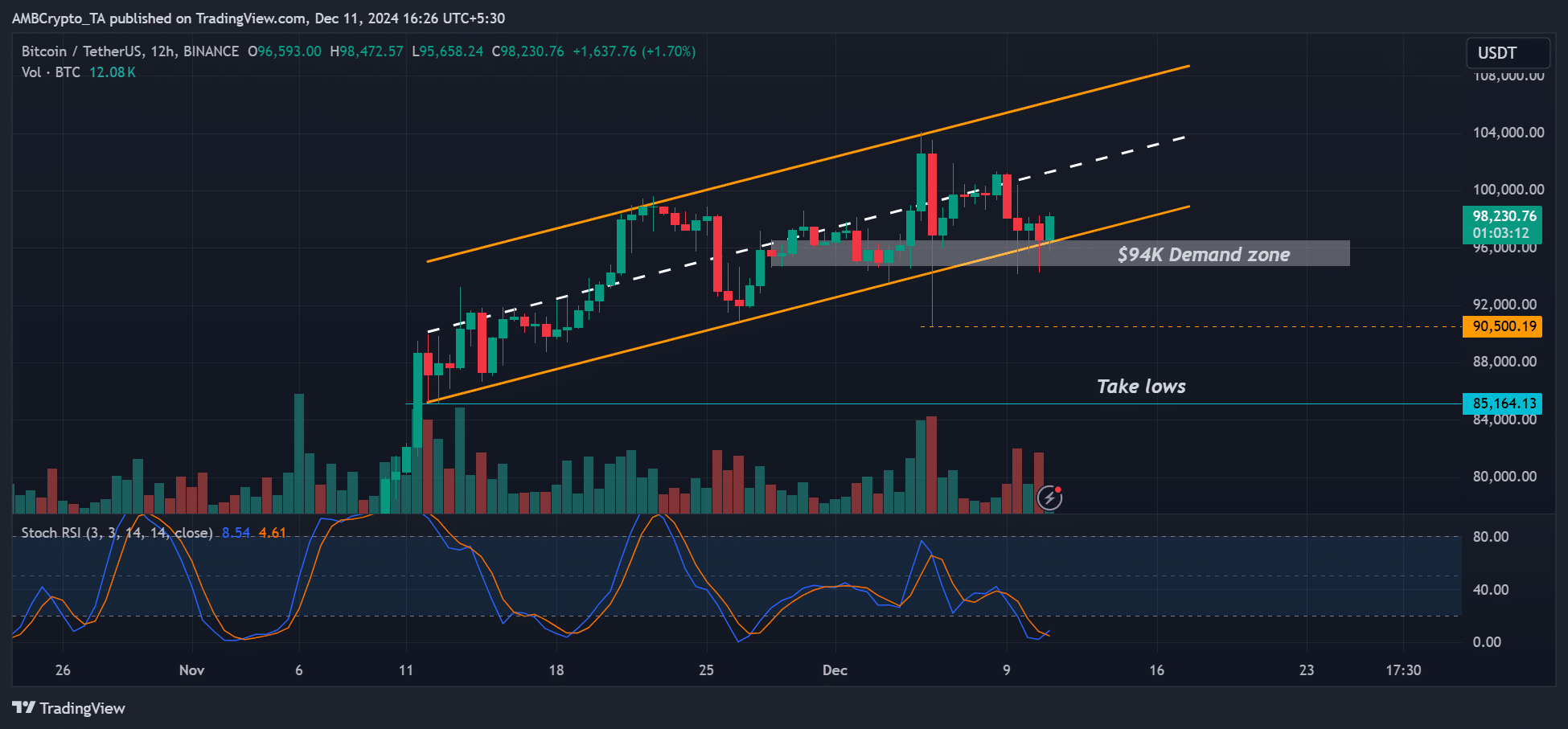

Despite the recent sell-off, Bitcoin [BTC] has marked $94K as key support and was valued at $98K, higher than key US inflation data (CPI).

This week’s key macro updates, from inflation to the labor market, could lead to wild price swings as the data points determine the pace of Fed rate cuts starting Dec. 18. The market was currently prices an interest rate cut of 25 basis points.

Another BTC crash?

Source: BTC/USDT, TradingView

Interestingly, BTC still controlled the short-term channel and the $94K was in line with the lows in the range. Will it save or crack post-CPI data?

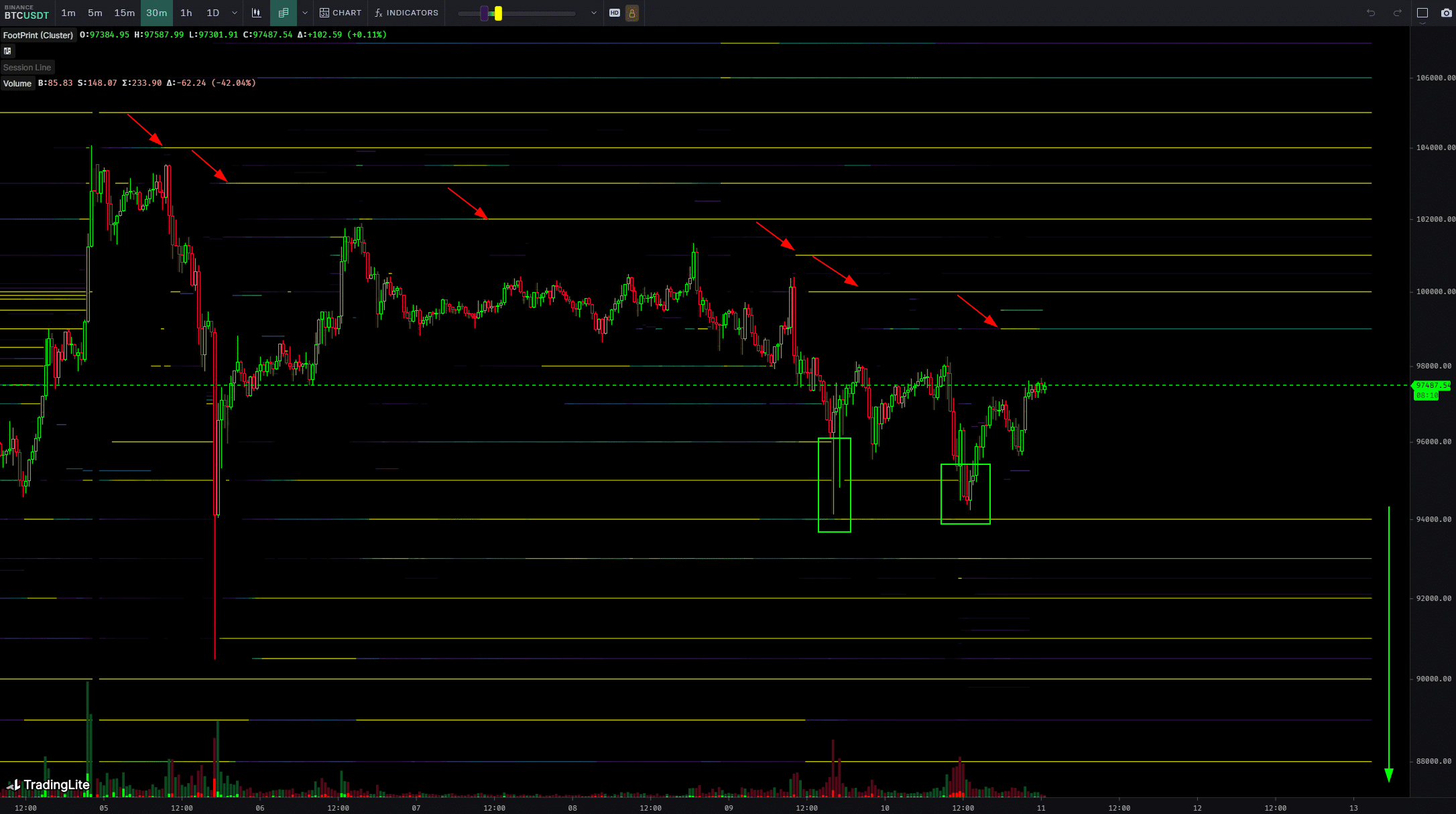

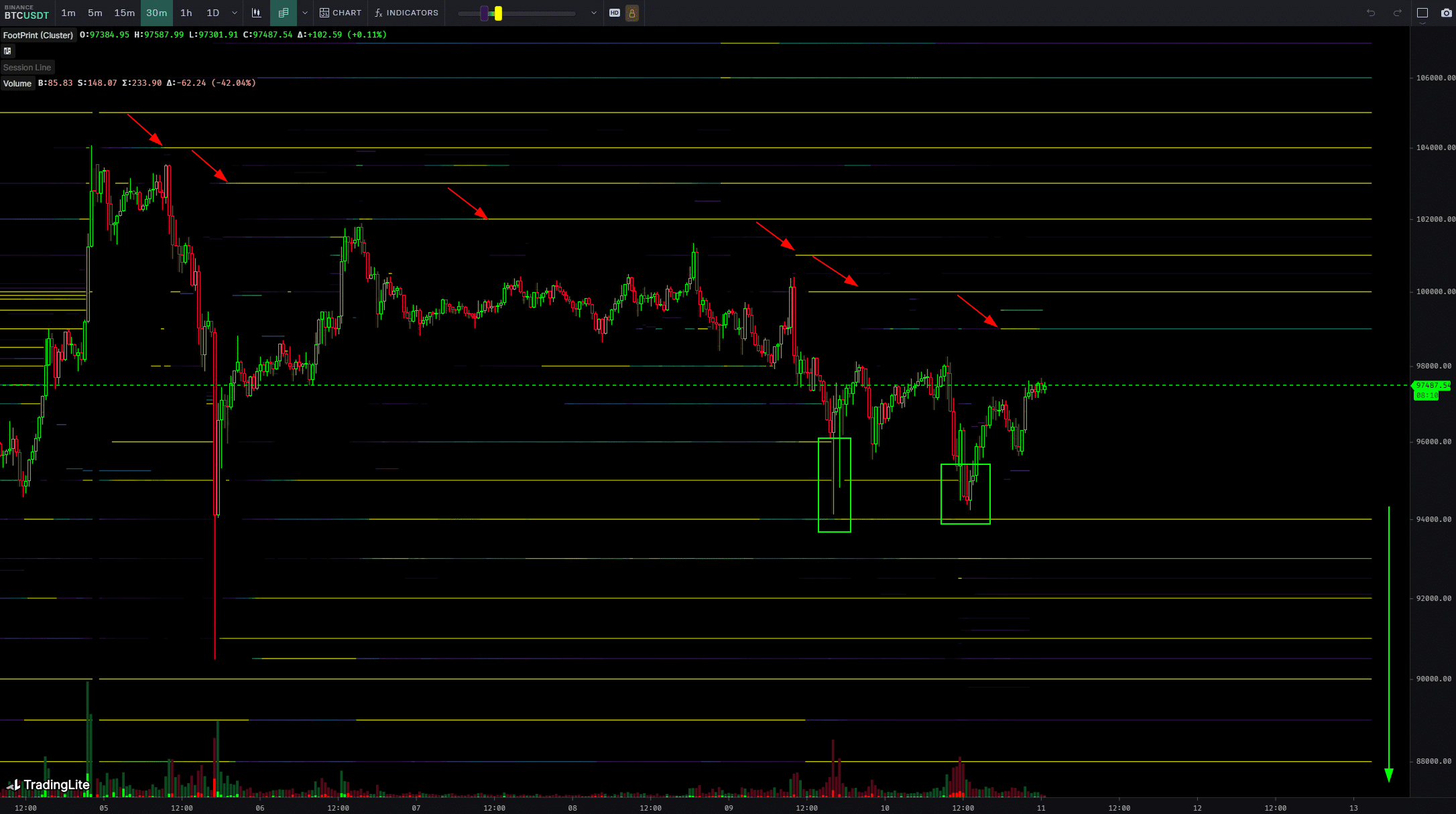

According to BTC trader Skew, there was strong demand between $90,000 and $95,000, suggesting that BTC may have stabilized at this level with $97,000 as the equilibrium point. Part of his analysis read,

“I think the market has found or found its equilibrium here… The market continues to add bidding liquidity around the current lows of $95K – $90K, and passive buying is present in these two sweeps so far.”

Source:

Blockchain analytics firm IntoTheBlock also confirmed strong bidding levels above $90,000. The company noted That,

“The real demand zone is between $94,800 and $97,700, where more than 1.3 million addresses have accumulated Bitcoin. This reach represents a critical area for potential support.”

Put another way, $94,000 was a crucial demand zone and springboard for a possible move to the US Goal of $105,000.

However, this also meant that a drop below $94,000 could flood more than 1 million addresses. They could panic sell and drag down BTC if they are not diamond holders.

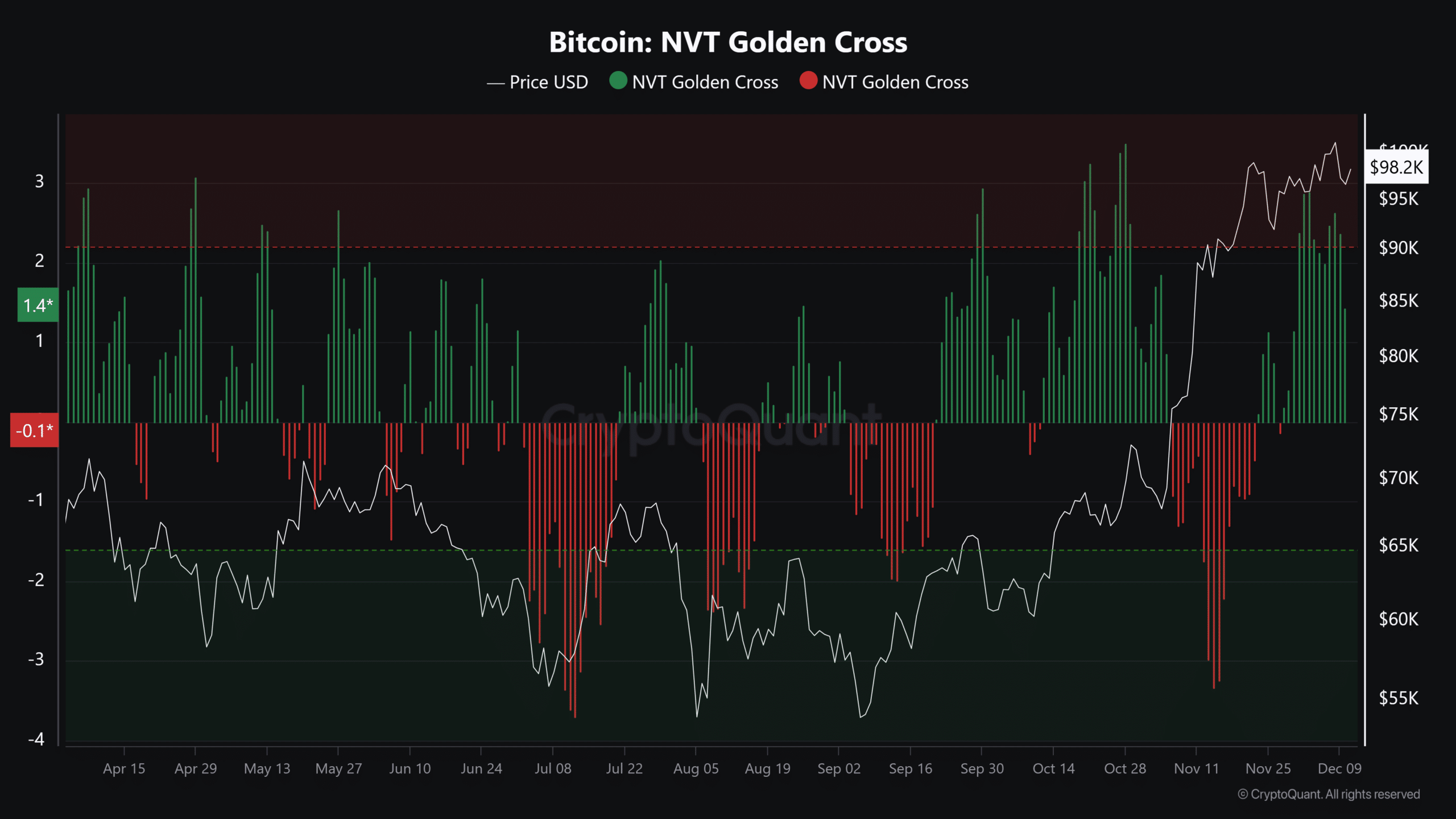

The sticky NVT Golden Cross metric supported this potential bearish scenario.

Source: CryptoQuant

For context, the statistic highlighted previous local tops and bottoms. It first marked an impending local BTC top (green bars) in late November and remained sticky despite this week’s shakeouts.

This suggested that despite recent pullbacks, BTC may not be out of the woods yet, at least according to the NVT Golden Cross.

Read Bitcoin [BTC] Price forecast 2024-2025

Additionally, MVRV recently increased to one overheated areafurther indicating a likely relapse. This implied that BTC could still rise above $100,000, but a sharp pullback could not be ruled out.