- Bitcoin has a Bearish 1-day structure, but showed opportunities for a price stop to $ 88k.

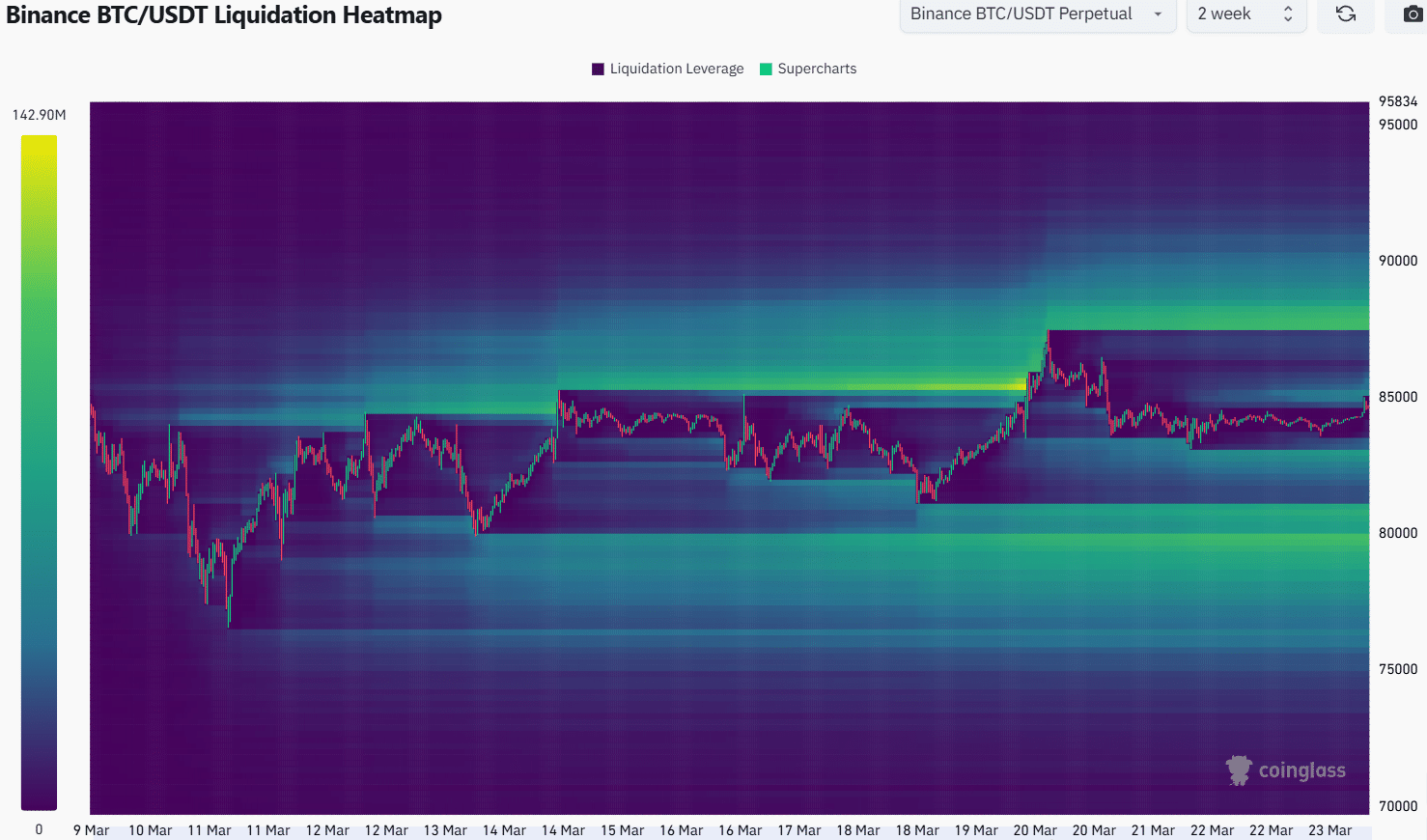

- The liquidation heat showed that bulls should be careful to take long positions on BTC.

Bitcoin [BTC] Handed $ 82k in the past week above the level of support, but it did not have a bullish look at the time frame of 1 days.

Lower time frames showed that there was some hope for a jump, provided that the resistance of $ 86.8k was broken.

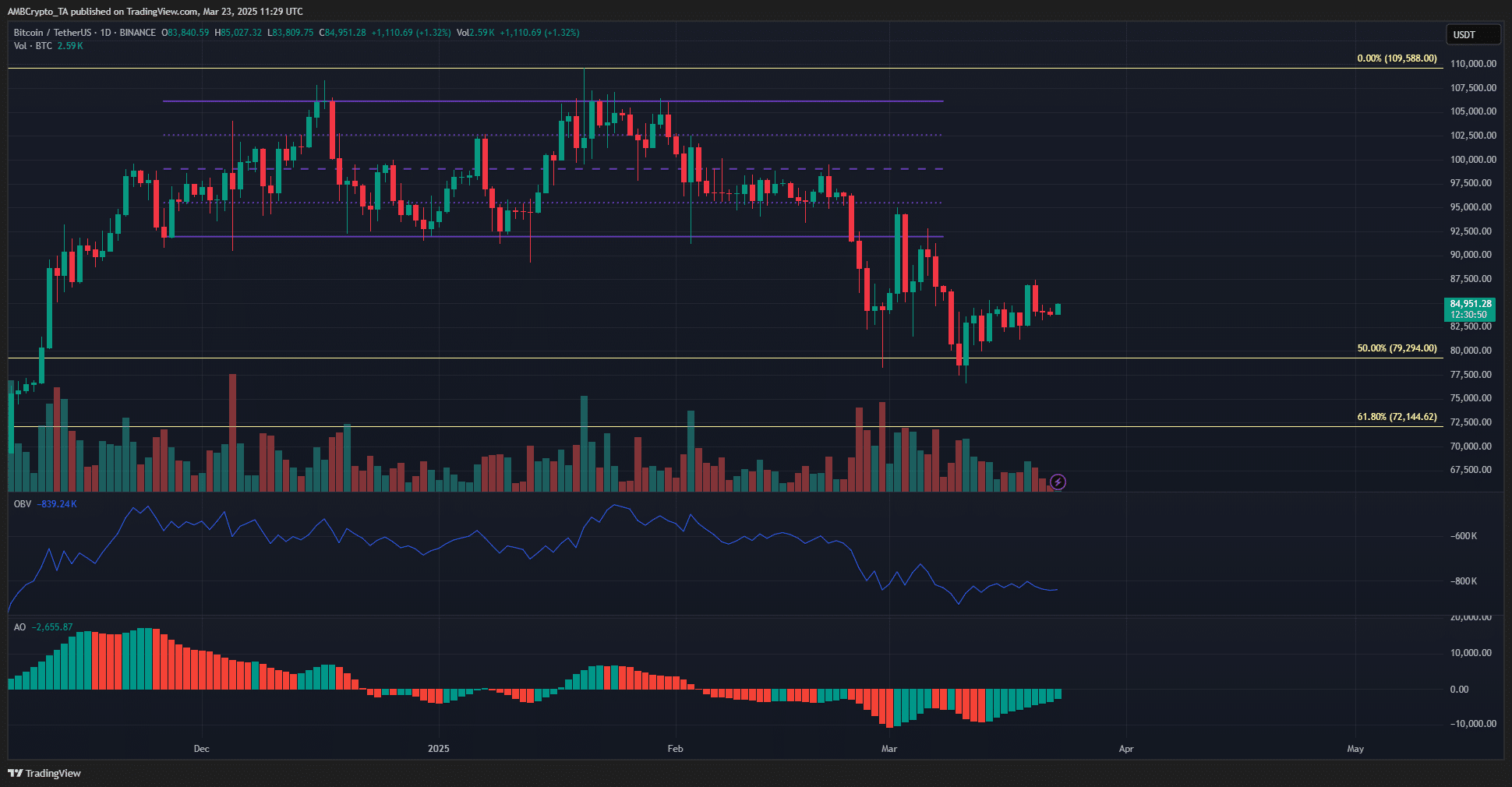

The Fibonacci racement levels of the August-December Rally showed that the $ 72k support level could be the next target. However, on-chain statistics did not support this doom and flea-outlook.

Long -term holders preferred to sell HODL, which means that there was some hope for recovery.

Is Bitcoin ready for a new downward move?

Source: BTC/USDT on TradingView

The BTC Daily Chart retained its bearish structure. The OBV has also been in a downward trend since February, which shows that the sales pressure remained dominant. Together they emphasized the opportunities for further losses.

The bearish Momentum has fallen according to the great oscillator but has not turned bullishs.

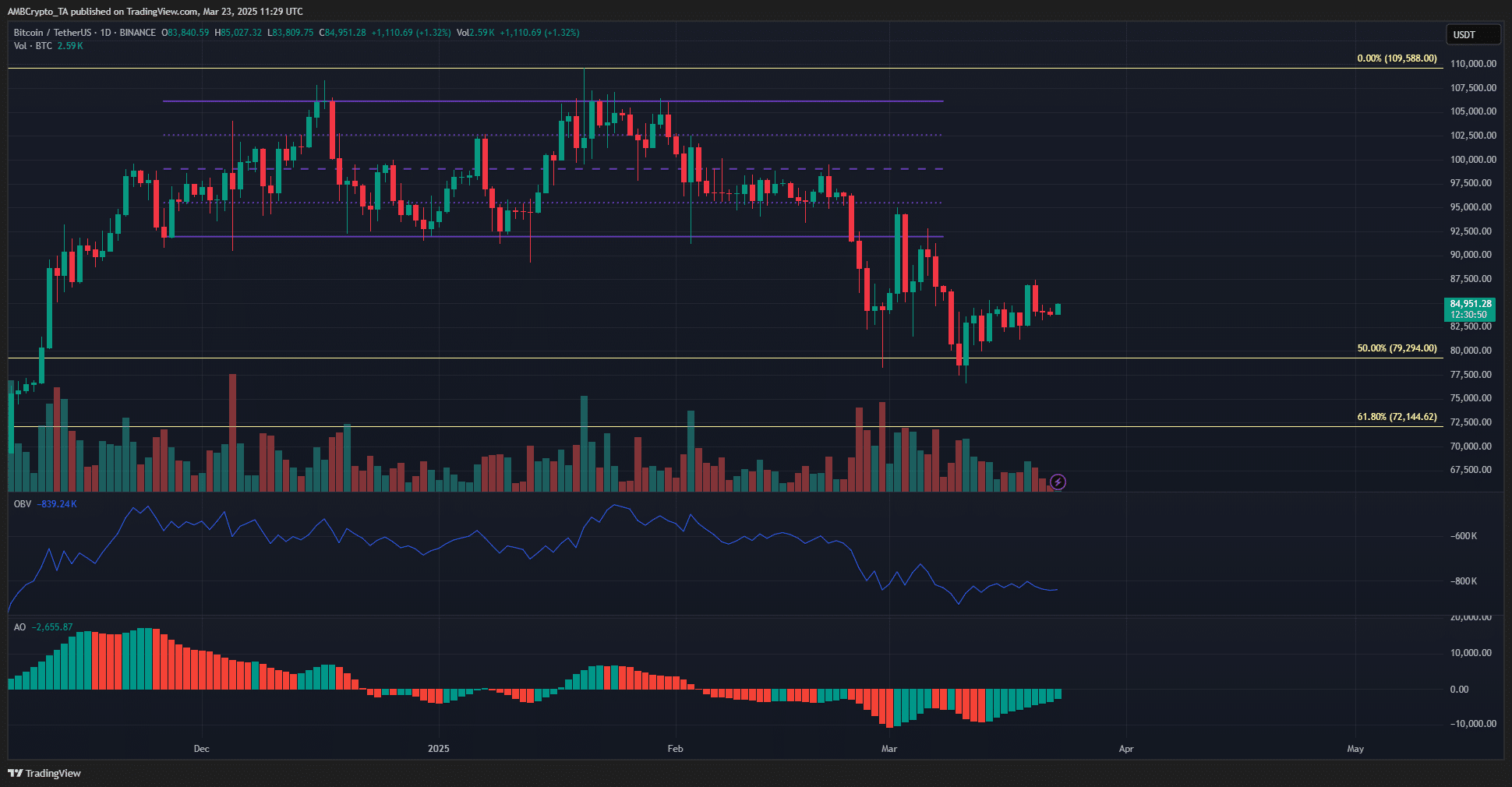

Source: BTC/USDT on TradingView

After having fallen under a range of 3 months old at the beginning of March, Bitcoin seemed to have formed a new range (white). The middle reach level at $ 86.9k has been tested and both support and resistance in the past three weeks.

As it looks now, a movement under $ 83k could initiate a bearish trend, while an outbreak could start an uptrend beyond $ 86.8k.

The OBV has made higher lows in the last ten days, but it was not proof of strong buying. It was also not enough demand to undo the sales pressure of February.

The 2 -week liquidation heat showed that the nearest liquidity cluster was $ 88k. The magnetic zone for $ 83k did not seem as strong as that at $ 88k.

Further on, the $ 80k was considerable, but further away from the price.

That is why traders must be prepared for the Bitcoin price to be attracted to $ 88k before they have confronted a Bearish rejection.

Technical analysis showed that if $ 86.8k was reversed to support, it might be safe to go for a long time. The liquidation heat showed that this may not be true. Caution was justified, especially for the bulls.

Traders must carefully follow the response to both resistors. A rejection can offer a chance to actively sell it.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer