Understanding the valuation of Bitcoin (BTC) against various currencies isn’t just a matter of numbers – it’s about understanding global economic tides, gauging investor sentiment, and pinpointing geopolitical fluctuations. By placing Bitcoin alongside various fiat currency trading pairs, we gain insight into regional economic health, investor behavior, and potential macroeconomic shifts.

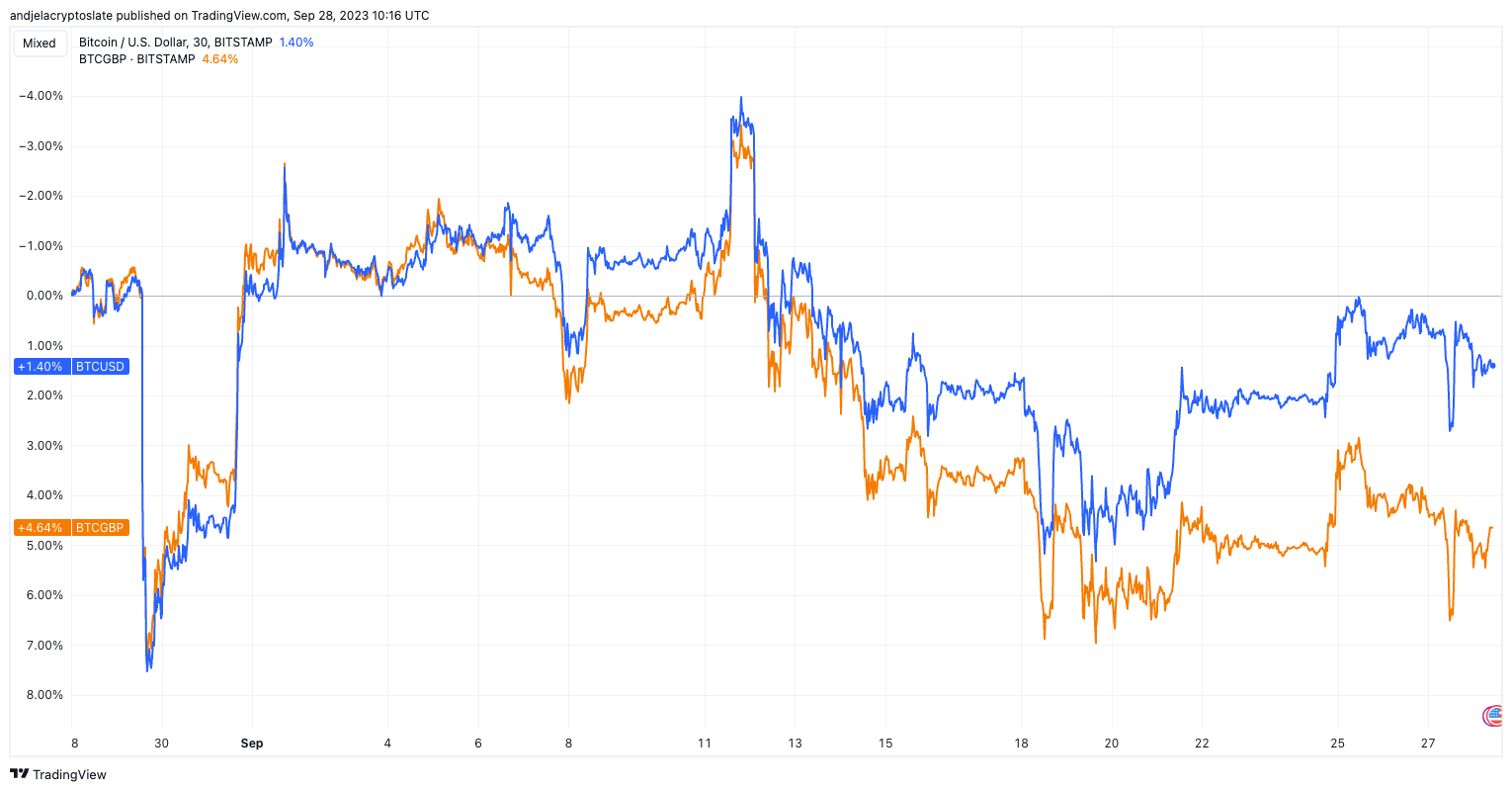

Recent market trends indicate significant variation in the trajectory of the trading pairs BTCUSD and BTCGBP. While both pairs have seen growth over the past 30 days, the BTCGBP pair has consistently outperformed its USD counterpart.

This difference may not only be a result of increased demand for Bitcoin in Britain, but also an indicator of the relative weakness of the pound against both the USD and Bitcoin. Several factors could be driving this increased interest in Bitcoin among GBP users. The falling GBP could drive investors towards Bitcoin as an alternative store of value, hedging against further depreciation. With the current global economic outlook, Bitcoin is also increasingly looking like a refuge from traditional currency fluctuations.

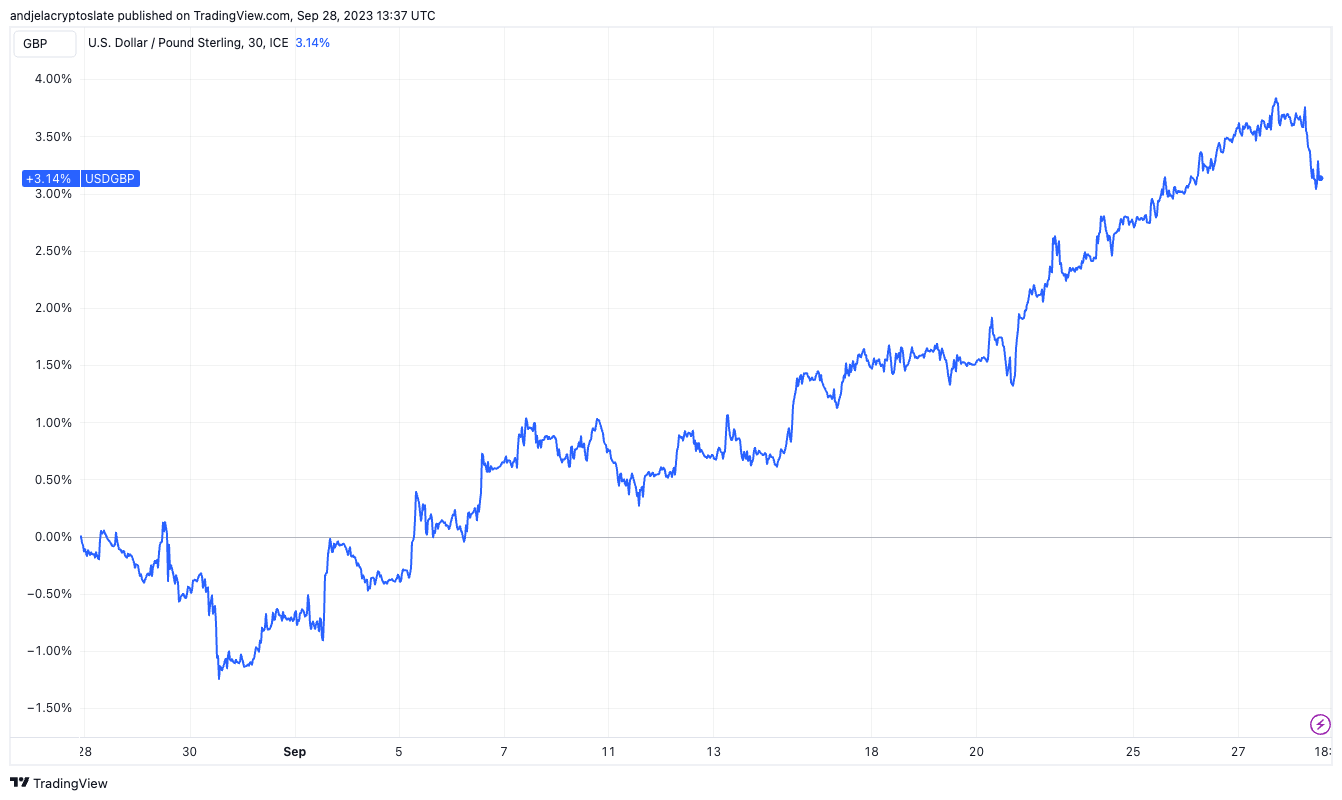

Diving deeper into the currency charts, USDGBP shows a clear increase of 3.08% over the past month, indicating the strengthening of the US dollar against the British pound. Conversely, the GBPUSD trend indicates a depreciation of the pound against the dollar. This is not just a one-month anomaly, but seems symptomatic of deeper economic undercurrents.

The pound is currently experiencing one of its biggest monthly falls against the dollar. The country’s market vulnerability has been evident, especially as the country seeks stability amid widespread financial turbulence. Furthermore, the dollar’s rise to a notable high against major currencies, including the pound, underlines the challenges facing the GBP.

Several underlying factors are contributing to the pound’s current decline. There is a noticeable trend of investors turning away from riskier assets, and the pound has not been spared. Moreover, Britain is struggling with escalating inflation, giving rise to speculation about future measures by the Bank of England. Warnings have emerged about the potential stagnation of the British economy, and there are clear signs of renewed economic tension, pointing to a potentially tumultuous financial future for the country.

A weakening GBP usually signals concerns about Britain’s economic health. Investors, wary of market turbulence, may increasingly turn to cryptocurrencies such as Bitcoin as alternative investment options. The changing dynamics in the GBP’s performance against major currencies and Bitcoin could indicate a broader trend: cryptocurrencies are not just speculative assets, but are steadily becoming an integral part of global financial strategies.

With the GBP facing headwinds, Bitcoin’s appeal in Britain appears to be increasing.

The post Bitcoin Sees Surging Demand in Britain as the British Pound Struggle appeared first on CryptoSlate.