Amid the excitement surrounding the approval of Bitcoin Spot Exchange-Traded Funds (ETFs), BTC miners They have been spotted conducting an aggressive sell-off, leaving the community to consider the impact of the sell-off.

Bitcoin miners are on a sell-off spree

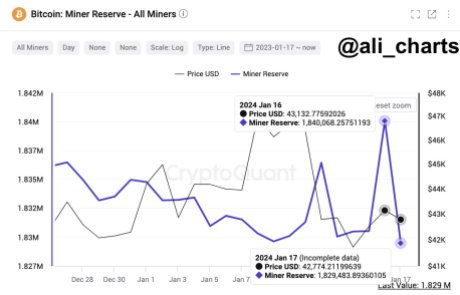

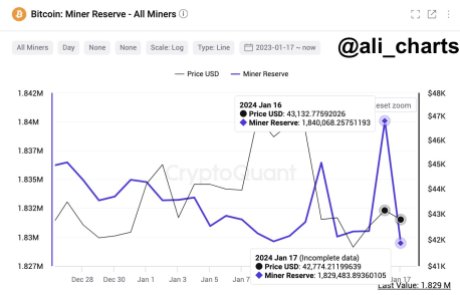

Well-known cryptocurrency analyst Ali Martinez shared this information with the community on the social media network

According to data shared by Ali, miners have sold about 10,600 Bitcoin in less than 24 hours. This was estimated at $455.8 million at the time of the report.

The recent increase in sales by Bitcoin miners indicates a responsive market. Furthermore, the significant amount of money involved represents an impactful development in the cryptocurrency landscape.

There are several reasons that can be traced back to the massive sell-off of these miners. One possible reason could be attributed to the decline in Bitcoin hash rate, which generally affects the profitability of miners.

BTC miners must make several guesses on a challenging mathematical problem in order to process transactions. A higher hash rate indicates that the miners are making more guesses, which indicates that more effort is being put into securing the network.

The crypto asset hash rate experienced a remarkable drop of 25% last weekend. This raises speculation about the security of the BTC network ahead of the long-awaited ‘halving’.

It was reported that the total real-time speed of all mining pools dropped from 570 exahashes per second (EH/s) to just 425 EH/s. However, the hash rate is currently 550 exahashes per second (EH/s).

The reduction occurred as a result of the restrictions placed on electricity consumption by companies by ERCOT (Electric Reliability Council of Texas) due to unfavorable cold weather.

Interest in BTC mining from institutions

Top financial companies have been showing interest in Bitcoin mining companies for some time now. Several financial institutions have made significant investments, which have also helped the mining industry.

Even those who have historically opposed or are hostile to Bitcoin have invested millions of dollars in the industry in 2023.

Since August 2023 Black rock has been a key stakeholder in four of the five largest mining companies. Only in the second half of last year did the asset manager increase its involvement in these companies.

At the time of writing, Bitcoin was trading at $42,710, indicating a decline of over 7% in the past seven days. The market capitalization has risen slightly by 0.02% over the past 24 hours, while trading volume has fallen by 17.17%.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.