Bitcoin prices were only 0.95% in the midst of intense market consolidation last week. The Prime Minister Cryptocurrency is struggling to break out the price range of $ 85,000 $ 86,000 after an impressive price rally in the second week of April. However, the popular crypto analyst Ali Martinez has identified the most important price resistance for the current Bitcoin -Uptrend.

Bitcoin STH realized the price for $ 91,000 presents a large make-or-break moment

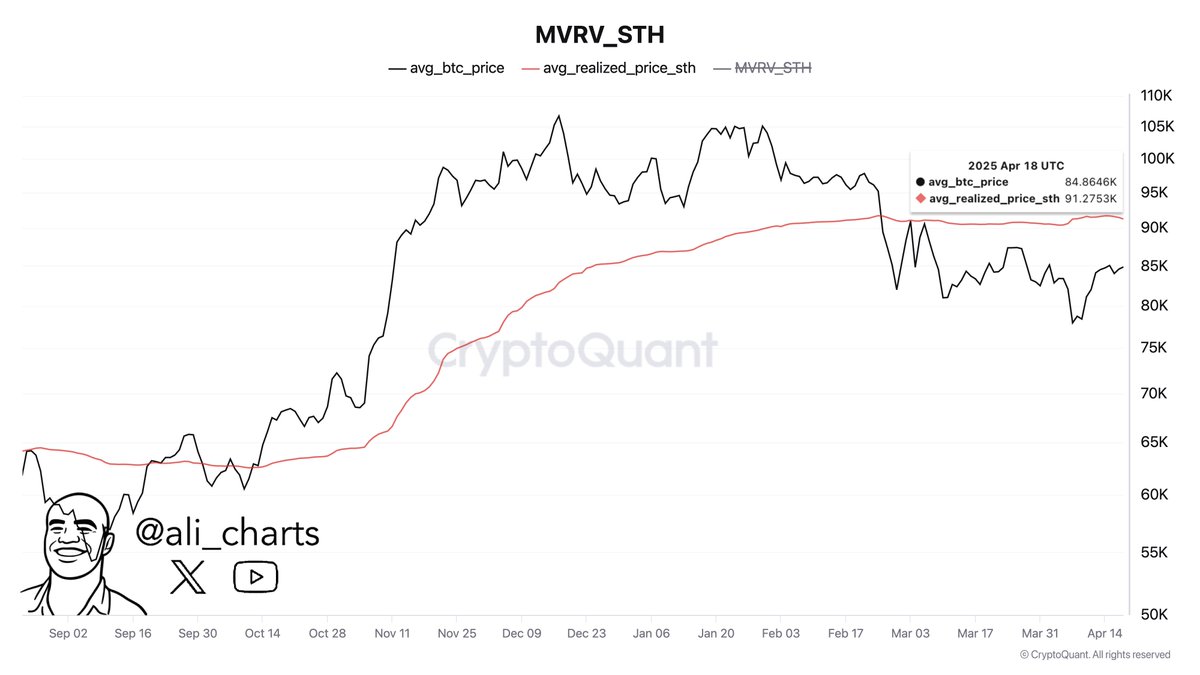

In one Recent Post On X, Martinez states that Bitcoin is confronted with a key resistance level at $ 91,275 after a price rebound at the beginning of April. It is remarkable that it was active by 17.33% after reaching a price of $ 75,000 on April 9. However, BTC has since entered into a consolidation after this performance, so that no significant price movement is produced in both directions.

In the past week, the crypto market leader only moved between $ 84,000 to $ 86,000, which formed a tightly reached market. In the midst of these struggles, however, Martinez states that the short -term Bitcoin realized that the price is at $ 91,275, indicating the crucial resistance to the recent revival of the market.

For the context, the realized price of the short -term holders is the average price with which new buyers (ie new Bitcoin investors in the last 155 days) have acquired their BTC. It is an important technical indicator that is used to evaluate market sentiment in the short term and behavior.

When a market price is above the STH realized price, this indicates a bullish momentum, because recent buyers have a profit and will probably be in force. In this case, the STH realized price serves as a strong level of support, where new market participants often defend their access zone.

However, when the price of Bitcoin is lower than the STH realized price, as is currently being seen on the market, the realized price is a considerable resistance of psychological price. This is because many holders can choose to leave in the short term as soon as the market even breaks, which increases the sales pressure around that zone.

That is why Bitcoin is that $ 91,275 back, essential to validate a sufficient bullish potential to feed a full price reverse.

Bitcoin -Award overview

At the time of writing, Bitcoin acts at $ 84,872, which reflects a price growth of 0.14% on the last day. In the meantime, the most important cryptocurrency drops by 1.34% on its monthly graph while Beerarish continues to decrease.

Although a large market resistance is $ 91,000, Bitcoin stands for an immediate opposition at the price zone of $ 86,000 and breaks beyond that a competitive price increase could stimulate up to $ 91,000. A price drop below support at $ 84,500 can, however, lead to further price blisters of up to $ 84,000, with the potential to act as low as $ 83,300.