- Bitcoin’s rally to $60,000 was short-lived as fear and uncertainty continued to dominate the market.

- Profit-taking by short-term holders and miners’ selling behavior indicated a lack of confidence in a bullish reversal.

Bitcoin [BTC] has continued its choppy price movements, having fallen 2.3% to trade at $58,740 at the time of writing. The market also saw the price drop sentiment shift from ‘neutral’ to ‘fear’.

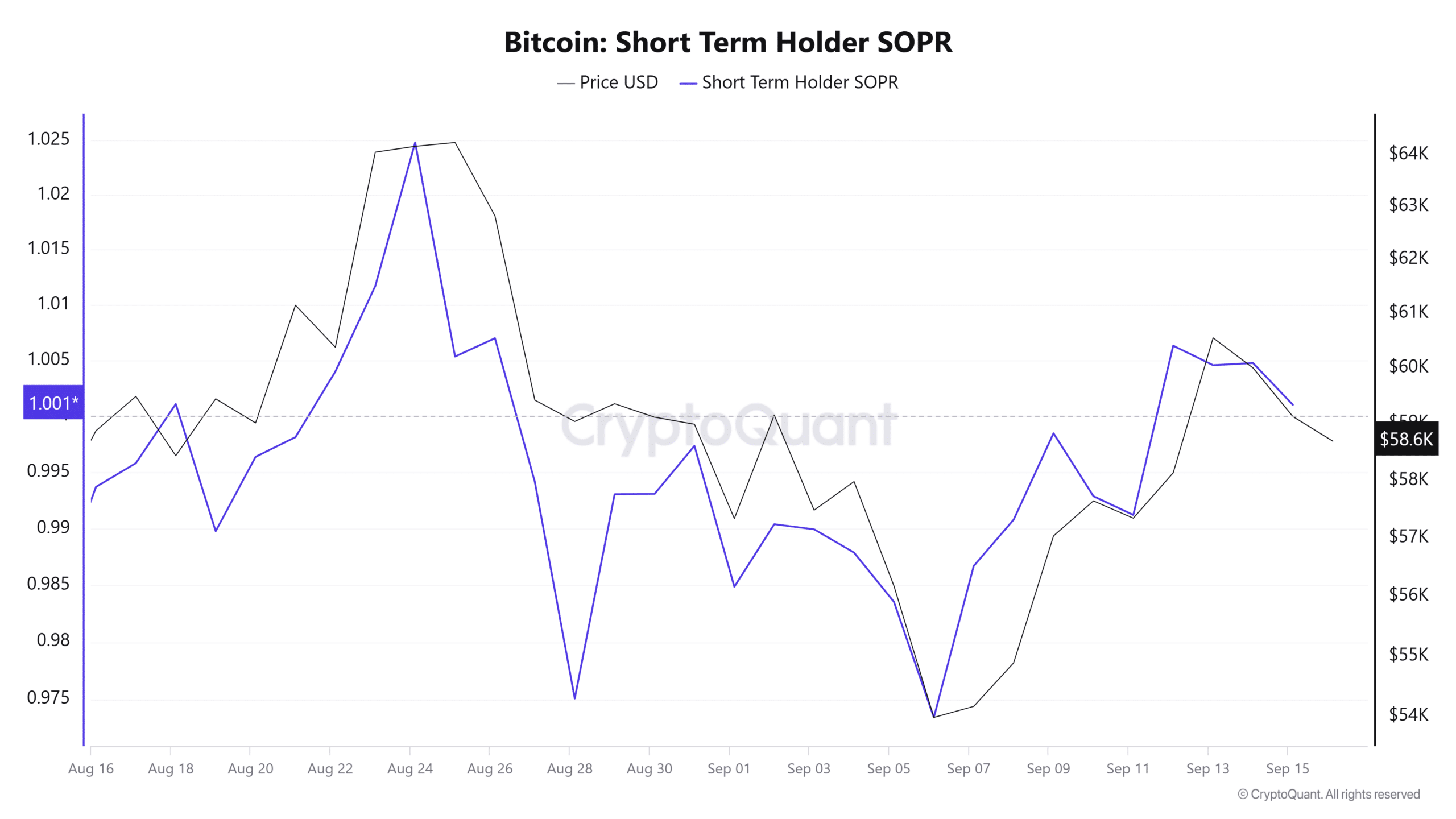

BTC’s recent price surge above $60,000 has revived market confidence as the short-term holder Spent Output Profit Ratio (SPOR) rose above 1, according to CryptoQuant.

However, this confidence was short-lived as the ratio has since fallen to near breakeven. This indicates declining profit margins and the possibility of a sharp increase in selling pressure.

Source: CryptoQuant

Will prices continue to decline or stagnate as profit-taking behavior and fear maintained dominance over Bitcoin?

The downside risk remains high

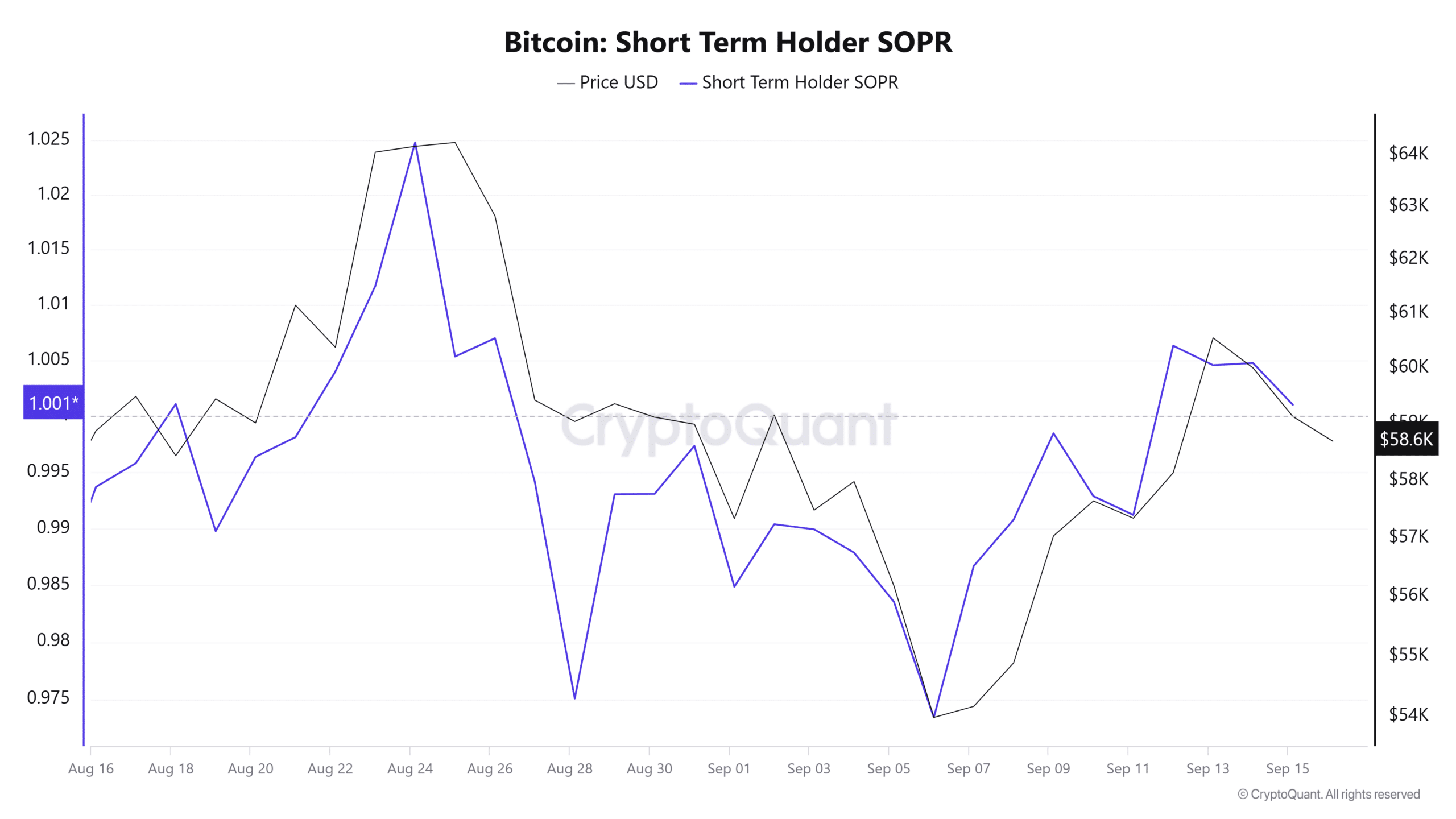

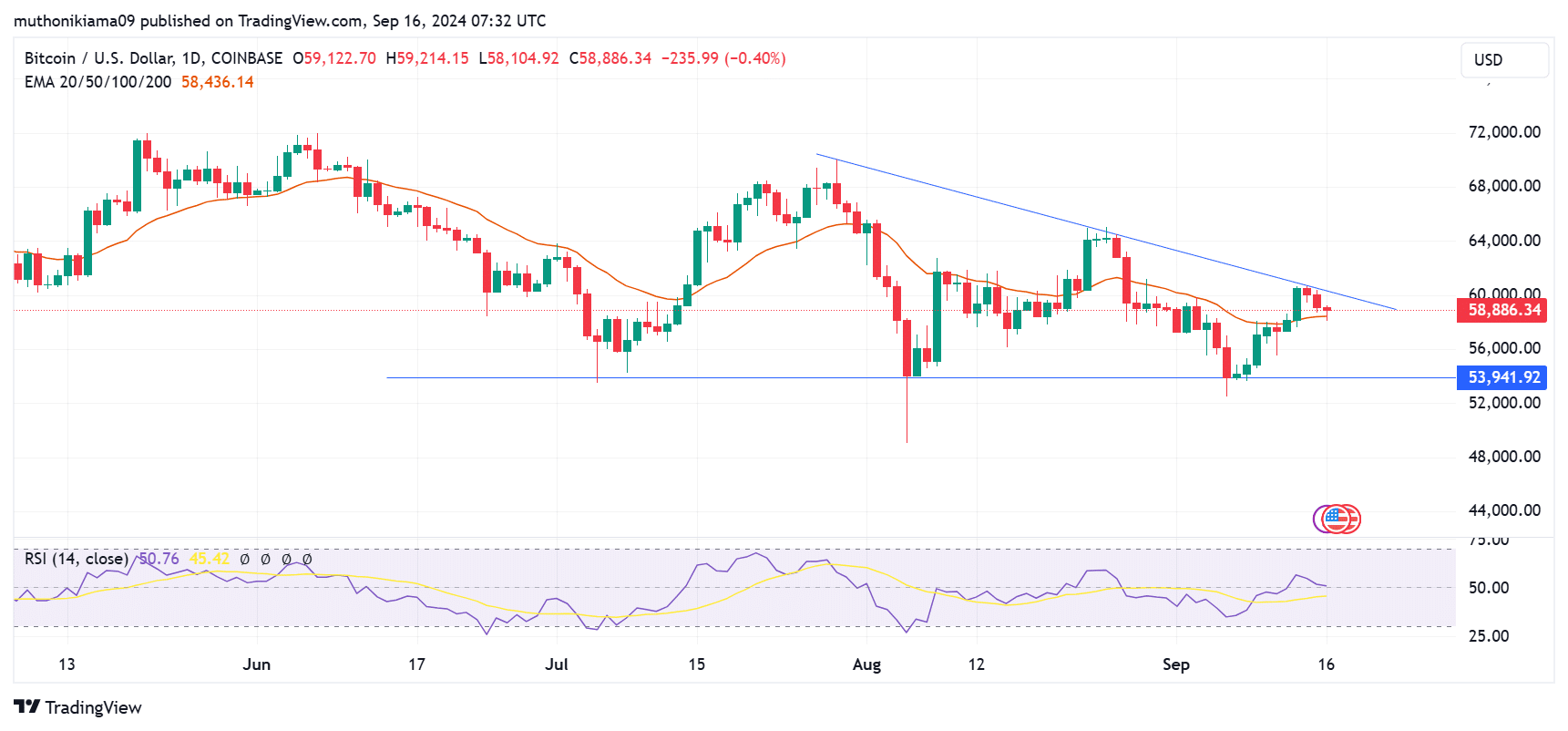

Bitcoin must break above a descending trendline to minimize downside risk, according to a recent report from 10x Research.

This downtrend appeared on the one-day chart, with BTC facing resistance every time it tried to break out.

Source: TradingView

The failed breakout stems from the lack of buying activity in the market, as evidenced by the Relative Strength Index (RSI) at 50. This measure showed neutral sentiment.

A return of buyers to the market could lead to BTC regaining $60,656, which will be a strong bullish trend according to 10x Research.

Nevertheless, traders should beware of the 20-day Exponential Moving Average (EMA). Bitcoin was at risk of falling below this critical point, which could lead to further losses.

Miners capitulate

The market uncertainty is also making Bitcoin miners reluctant, as evidenced by the declining hash rate.

Data from BitInfoCharts showed that after the hash rate of the Bitcoin network increased record highs above 700 exhalations per second earlier this month it dropped to 665 EH/s at the time of writing.

This indicated that as miners became less profitable due to falling BTC prices, they reduced mining activity.

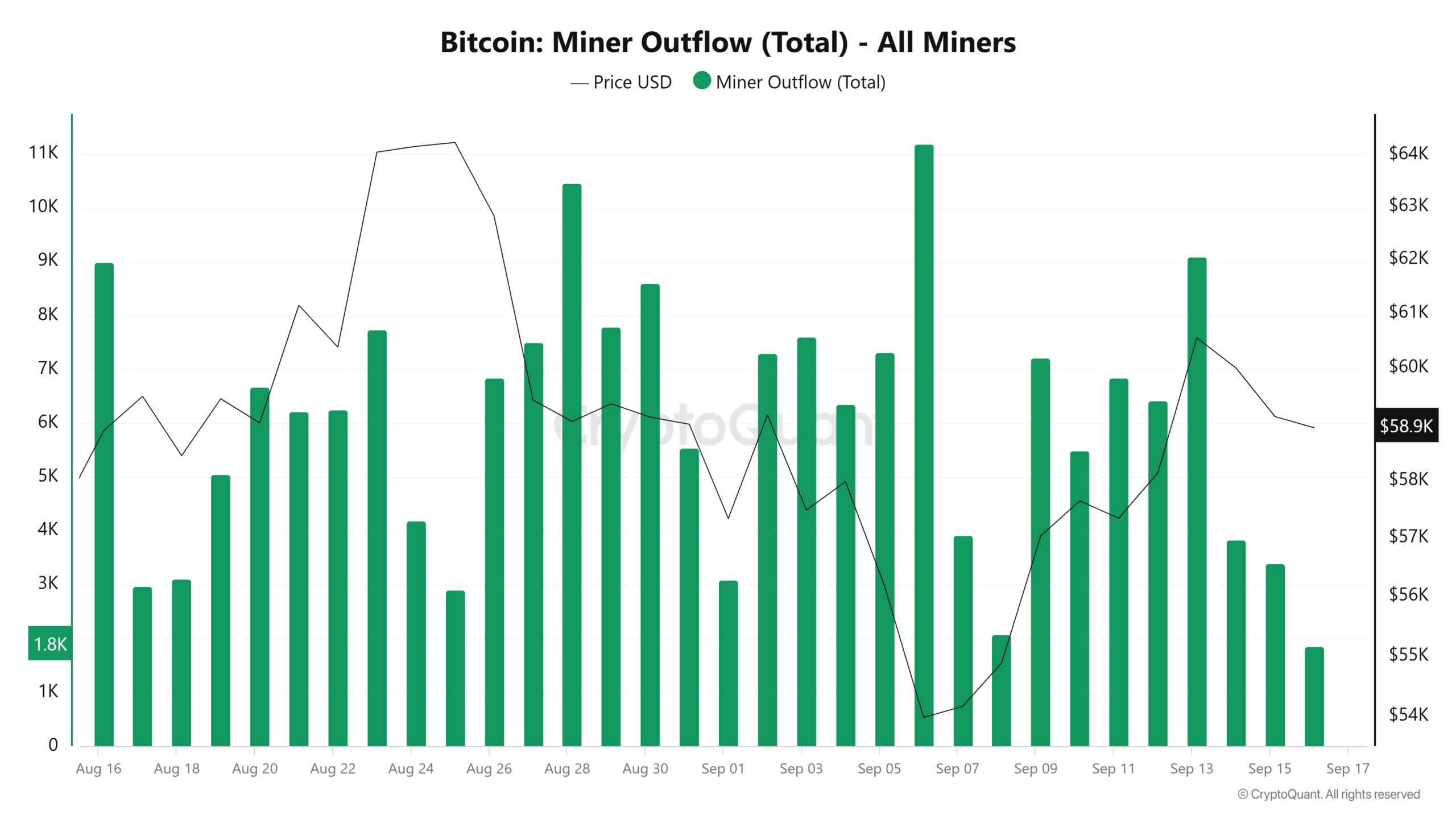

Data from CryptoQuant also showed that this weekend, when BTC was trading at around $60,000, miners sent 7,230 BTC to exchanges, worth more than $400 million.

Source: CryptoQuant

This data indicated capitulation from miners, which also increased downside risk for BTC.

Do positive stories suggest tailwinds?

The Federal Open Market Committee (FOMC) is expected to announce an interest rate adjustment later this week.

A rate cut is expected to fuel gains for risky assets like Bitcoin.

However, since the market is already anticipating a Fed reversal, the event could already be priced in, with the announcement causing minimal price changes.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Moreover, 59% of investors expect a steeper cut of 50 basis points per year CME FedWatch tool.

A major cut could raise concerns about the weakening U.S. economy, prompting investors to abandon risky assets for safer ones like gold.