- BTC holders in the short term stood for losses and BTC fell under the 200-day advancing average.

- Long -term investors have to wait for their time, a bullish trend removal was not yet in sight.

The ‘Liberation Day’ that the US President Donald Trump discussed is approaching. On the way to the week, American Tech shares losing losing in the Overnight tradeWith Tesla [TSLA] and Nvidia [NVDA] 5% and 3% respectively lose posts.

The Kobeissi Letter noted that the uncertainty of economic policy achieved the highest it has Since 2020With April 2 as the date to look at.

Moreover, the American job report will arrive on April 4, which can also influence the market sentiment outside the tariff news.

Gold ETFs saw enormous inflow capital, probably a direct consequence of the growing economic uncertainty. Bitcoin has also placed this [BTC] And the rest of the crypto globe on the rear, because they are risk-on assets.

Ambcrypto disappeared into chain statistics to understand whether BTC can stabilize low points around the Mars at $ 78k or that investors would expect more losses.

Bitcoin is approaching overbought territory, but …

Source: Checkonchain

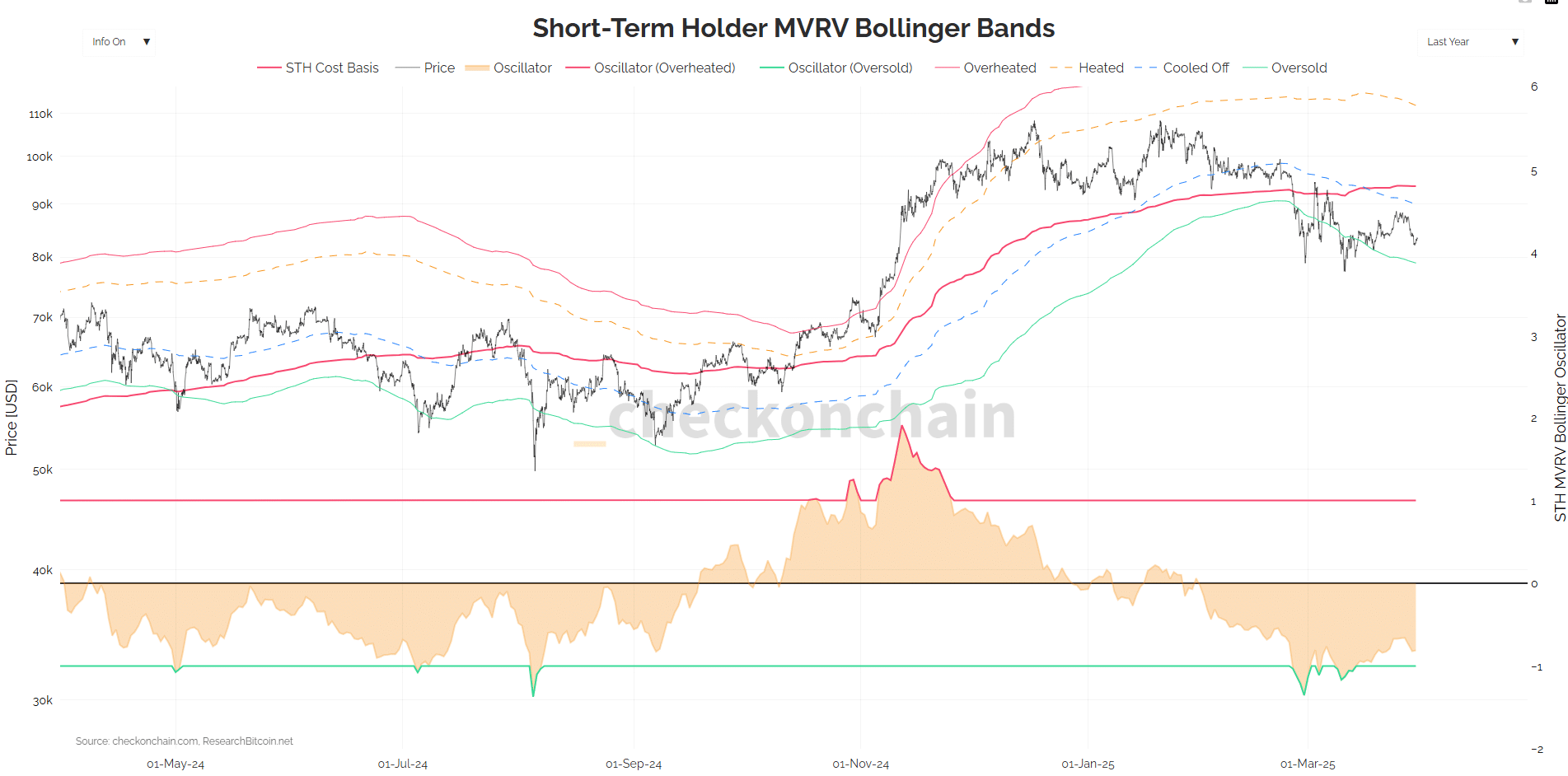

The short-term holder MVRV Bollinger Bands-Grafiek showed that the Oscillator was in Oversolde circumstances at the end of February and the beginning of March.

The price of Bitcoin was also under the cost basis of short -term holders. This is calculated using the realized price of coins that have been moved within the last 155 days.

The prize of BTC was “warmed up” in November and December, but has since cooled considerably. Bitcoin would probably move below the sold -over level, which was on the $ 78.95k press.

Source: Checkonchain

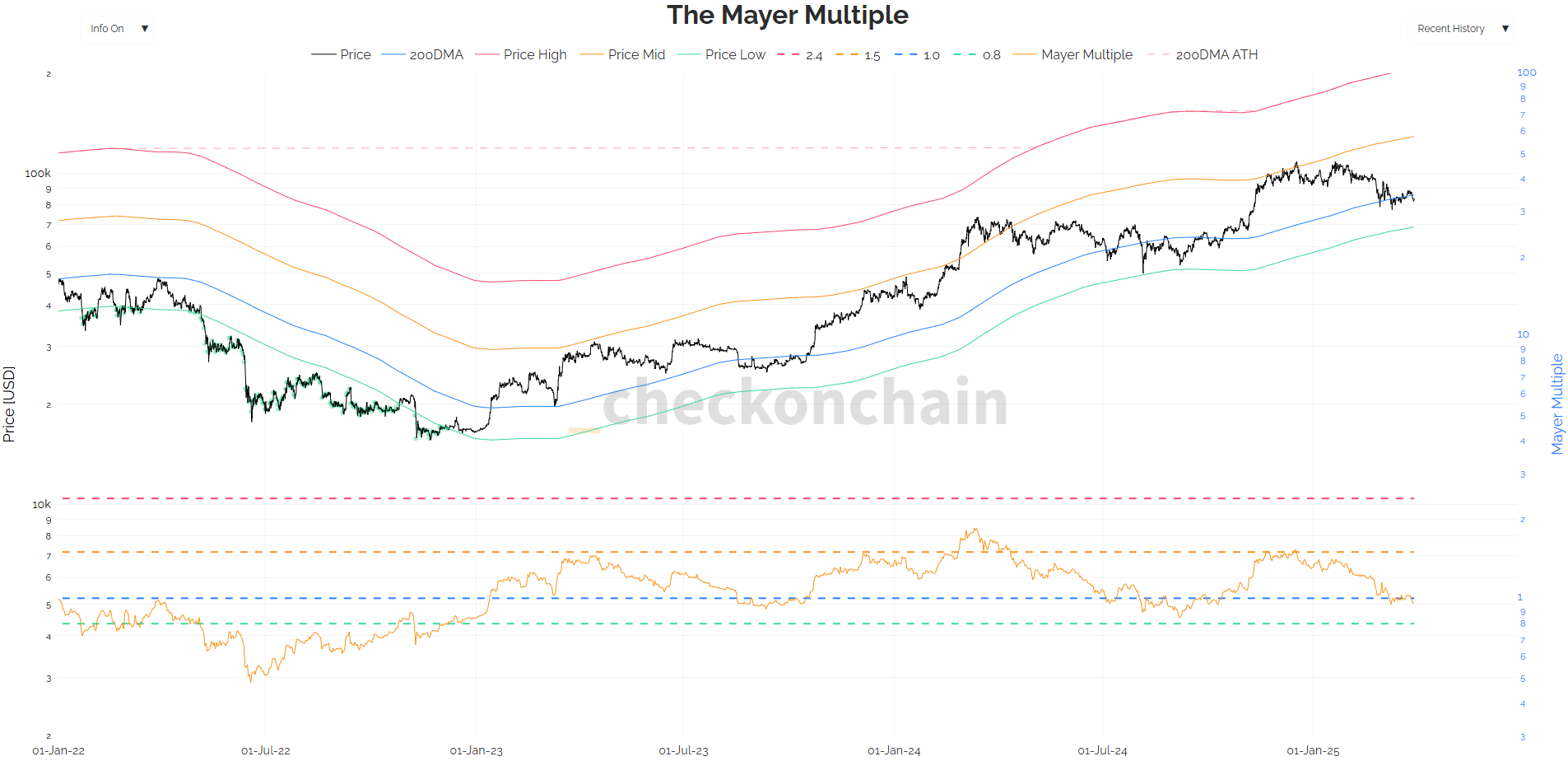

The Mayer Multiple serves as an important statistics to determine whether Bitcoin is reasonably priced, overvalued or undervalued on the basis of historical trends.

Analysts calculate the Bitcoin market price through its 200-day advancing average (MA). At the time of the press, the Mayer was several at 0.96.

Two weeks ago, BTC fell under the 200dma and exchanged just below this level for most of this time. It was at $ 85.92k at the time of the press.

The last time the prize falls below 200 DMA was August 2024. The prize remained under this MA for almost two months.

A similar scenario can now unfold. Investors who want to buy BTC cheaply must keep an eye on the plural of 0.8 Mayer, which represented the level of $ 68.74k. Bitcoin would be considered ‘cheap’ around this price level.

In conclusion, long -term investors must endure and endure the economic storm of the coming weeks and months. As soon as sentiment starts to shift over the market, the trend can shift boisterously.

Until that time they can dollar cost average (DCA) in BTC or wait for unpleasant price decreases of gigantic liquidation events to get more BTC.