Bitcoin (BTC) shook off recent bearish whispers and roared back to life on Wednesday. It’s clawing its way past the $44,000 mark and marks a four-week high as the leading cryptocurrency approaches the vaunted $45,000 level. This bullish attack was fueled by a powerful cocktail of factors, from resurgent accumulation by big investors to record highs in US stock markets and a surprising regulatory shift from Thailand.

Bitcoin Surges Amid Whale Activity

The day started with Bitcoin hovering around $42,700, but it quickly gained momentum and reached a peak of $44,300 – its highest since January 12. This 2.5% gain in 24 hours exceeded the 1.6% gain in the broader cryptocurrency market, demonstrating Bitcoin’s renewed strength. While Ether (ETH) and Cardano (ADA) saw modest gains, Bitcoin clearly stole the show.

Source: CryptoQuant

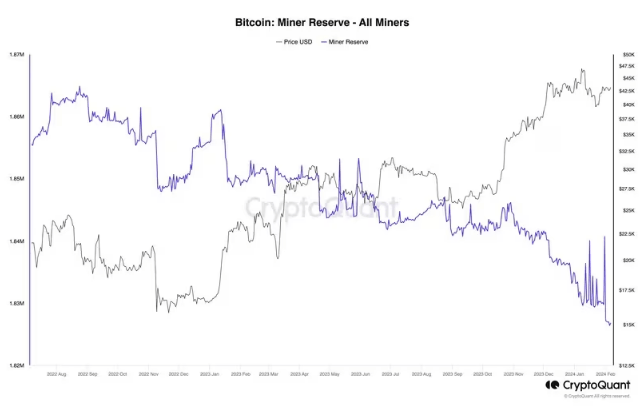

What led to this fiery comeback? Analysts at Bitfinex had initially pointed this out increased miner sales as a potential culprit for the recent price drops. However, the story changed when whales, those enigmatic holders of vast Bitcoin supplies, started gobbling up the digital gold.

Crypto sleuth Ali Martinez, analyzing data from Glassnode, revealed a multi-month record of 73 wallets holding more than 1,000 Bitcoins (about $44 million each). This whale activity signaled renewed confidence in Bitcoin’s long-term potential.

#Bitcoin whales are gathering more and more $BTC! About 73 new whales now total 1,000 whales #BTC or more, which means an increase of 3.66% in two weeks. pic.twitter.com/VFArJYTQZl

— Ali (@ali_charts) February 7, 2024

Adding fuel to the fire was the record performance of the US stock indices. The S&P 500, Dow Jones and Nasdaq Composite all flirted with record highs, creating a positive ripple effect that supported riskier assets like Bitcoin. This synchronized rise suggested broader risk appetite among investors, encouraging cryptocurrency bulls.

Bitcoin currently trading at $44,504 on the daily chart: TradingView.com

Thailand: VAT abolition boosts cryptocurrency adoption

Meanwhile, Thailand’s Ministry of Finance announced the abolition of the 7% value added tax (VAT) on Bitcoin and cryptocurrency trading.

This groundbreaking decision positions Thailand as a leader in digital asset adoption, aiming to attract investment and establish the country as a regional hub for innovation.

This bold regulatory shift injected a powerful dose of optimism into the already bullish trend, demonstrating government recognition of the potential of cryptocurrencies.

As Bitcoin navigates its next move, technical indicators and the supporting trend of the Simple Moving Average suggest continued upside potential. However, the cryptocurrency market remains inherently volatile and investors should be cautious.

Nevertheless, Wednesday’s surge, fueled by several factors, paints a promising picture for Bitcoin’s future, leaving many wondering if this is the start of a new bull run. Only time will tell, but one thing is certain: the Bitcoin bulls are back and they are roaring loudly.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.