- Bitcoin shows signs of a potential local top, with important momentum indicators that indicate overloading.

- Is there still a pullback on your hands?

On March 2, Bitcoin [BTC] 9.44% rose in one day-the highest one-day profit in three months.

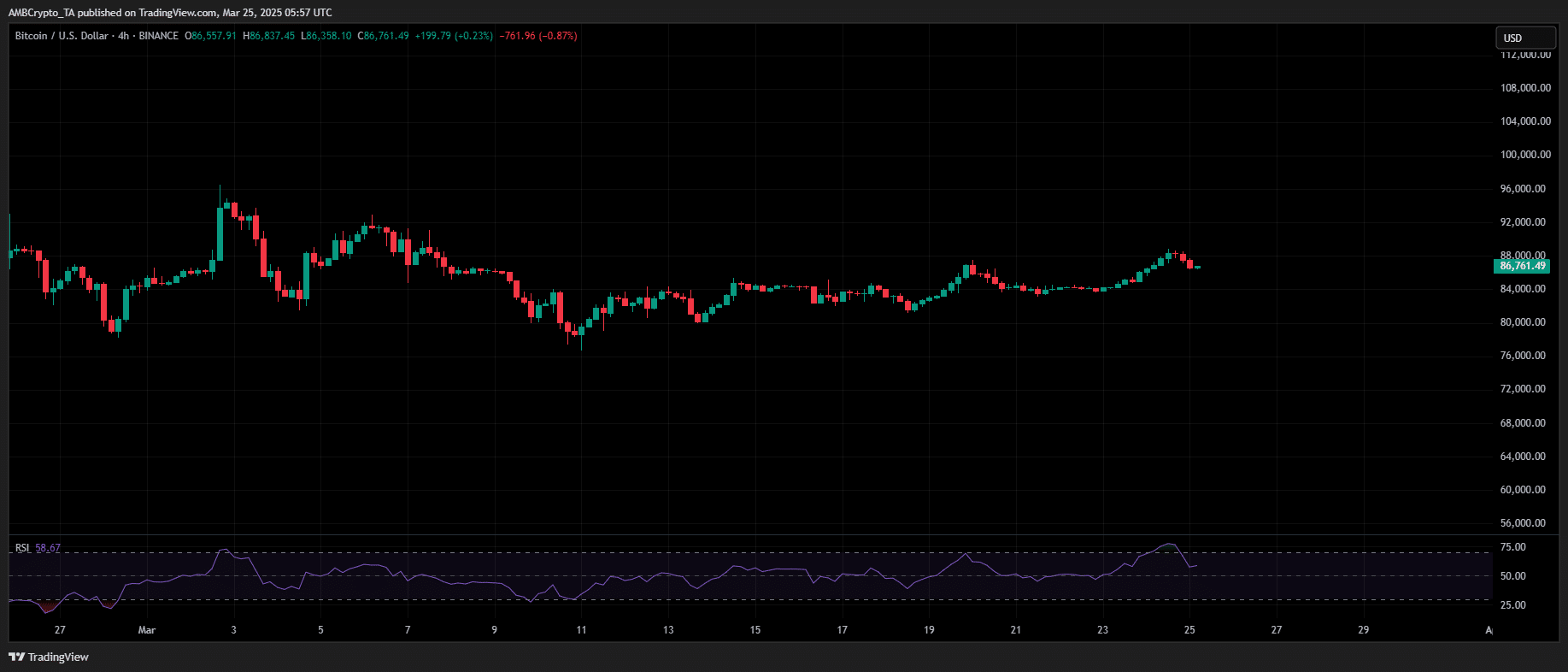

Because the 4-hour RSI reached a peak at 70, the price action returned, which led to a decrease from 14.13% to $ 81,500 within 10 trade sessions.

Source: TradingView (BTC/USDT)

The last time Bitcoin saw a comparable capital inflow during the election run, when BTC reached its then high of $ 88,400 on 11 March, which pushed the 4-hour RSI to the Overboughtre area.

Despite the overhead lecture, Bulls absorbed the liquidity on the sales side, rinsed weak hands and pushed BTC two days later to a peak of $ 92,647.

In the future, the relative strength index (RSI) is a momentumoscillator that measures the speed and change of price movements on a scale of 0 to 100.

Traditionally, a RSI above 70 indicates that an active overbough can be, which suggests that it is potential for a pricebackback, while a RSI under 30 suggests that it can be sold over, which points to potential for a price -repellent.

Historically, when Bitcoin’s 4-hour RSI Overbought enters territory, this indicates a strong bullish momentum, but has often preceded this at competitive price corrections.

Now, three months later, Bitcoin has recovered $ 88k for the first time in 17 days. However, RSI has risen again on the 4 -hour graph.

By taking a profit probably, can bulls absorb the sales-side pressure, or is another correction in March style imminent?

Bitcoin ready for a pullback

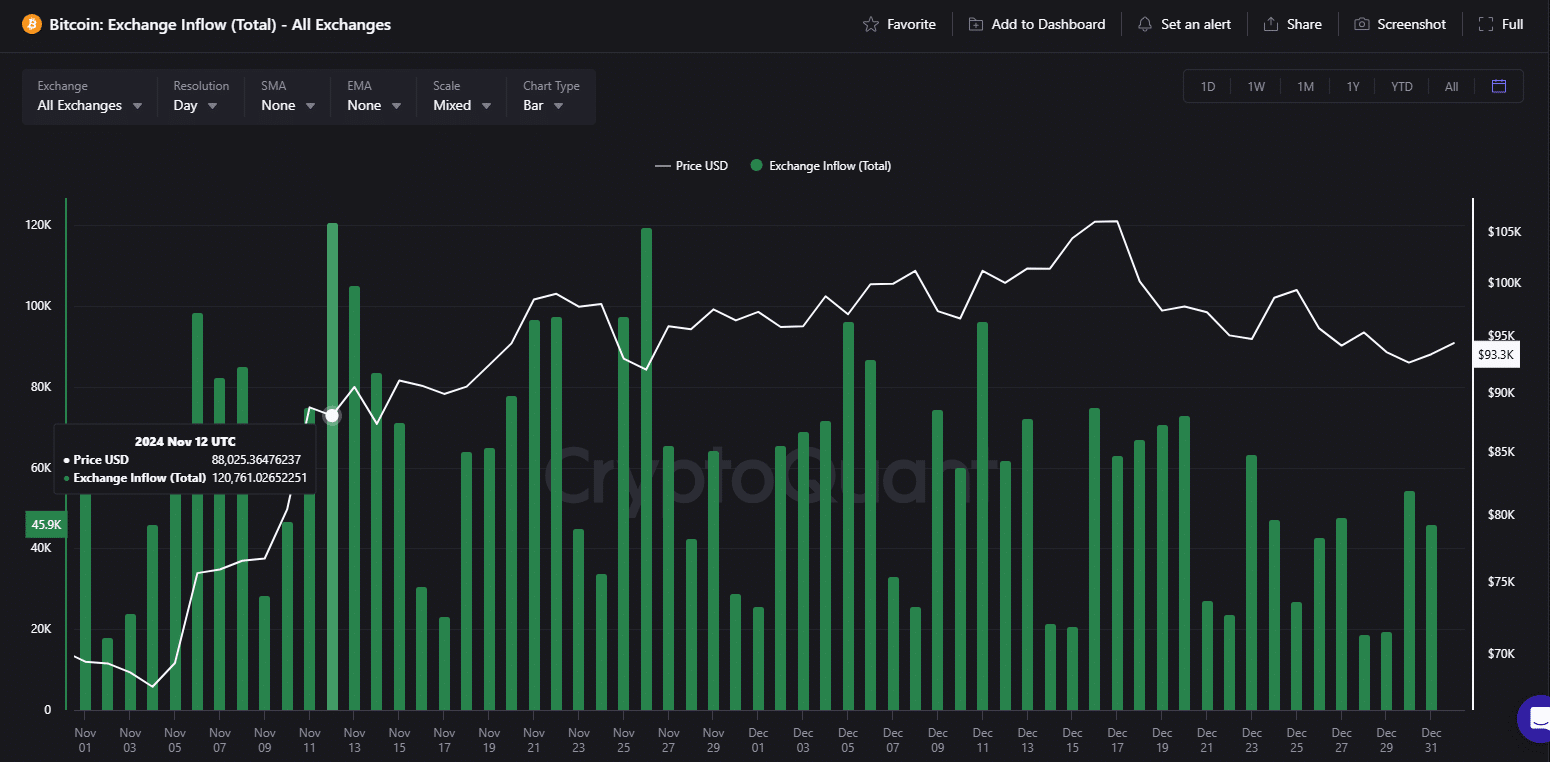

Ambcrypto discovered an important pattern. On March 12, as Bitcoin’s RSI signaled overload, Bitcoin ETFs registered Their second highest inflow and record of $ 1.114 billion.

This suggested that persistent institutional question played a crucial role in absorbing the impact of 120,761 BTC, worth $ 10.67 billion, who flooded in a single sale.

Source: Cryptuquant

At the moment, Binance Mockery Remains strong, with net outflows that indicate continuous Bitcoin accumulation. The derivaten market also reflected bullish positioning.

Meanwhile, both long and short-term opens (best output profit ratio) reversed Above 0, affirmative that holders now have a profit.

With the 4-hour RSI of the Bitcoin in an overbought territory, the pressure of profit could escalate, which may cause volatility in the short term. For Bitcoin to push to $ 90k, the persistent momentum of buying is crucial.

But with “mutual” rates that come into effect on 2 April, market uncertainty remains high. If the resistance is in force, a corrective movement to the range of $ 82k – $ 83k probably seems in the short term.