- Bitcoin has fallen by more than 1% in the past 24 hours.

- Market indicators looked bearish on the coin.

While Bitcoins [BTC] price gained upward momentum, short-term holders traded interestingly.

Therefore, AMBCrypto planned to take a closer look at the state of the king of cryptos to better understand where it was headed.

Short-term holders are piling up

Crazzyblokk, an analyst and author at CryptoQuant, recently posted analysis draw attention to interesting activities. Particularly meIn recent months, short-term holders have accumulated significant amounts of Bitcoin.

The said message,

“Based on this metric, 50% of the realized Bitcoin cap now belongs to short-term holders, who tend to hold their Bitcoins for longer periods.”

Apart from this description, the Bitcoin market, assessed by RC value, was approaching a risky area similar to the 2019 price cycle.

This can be tricky because it suggests that the increased value of short-term holdings may lead to a tendency to take profits or exit the market, creating market volatility.

The value of Bitcoin is falling

The analysis proved true as after a week-long bull rally, the value of the king of cryptos witnessed a slight correction. According to CoinMarketCapThe value of BTC has fallen by more than 1% in the past 24 hours.

At the time of writing, it was trading at $70,015.84 with a market cap of over $1.38 trillion.

The drop in value occurred at a time when the king of cryptos was expecting its next halving in just a few weeks. To be precise, the next BTC halving will take place in April 2024.

Despite the recent price drop, investors still seemed to have accumulated more BTC.

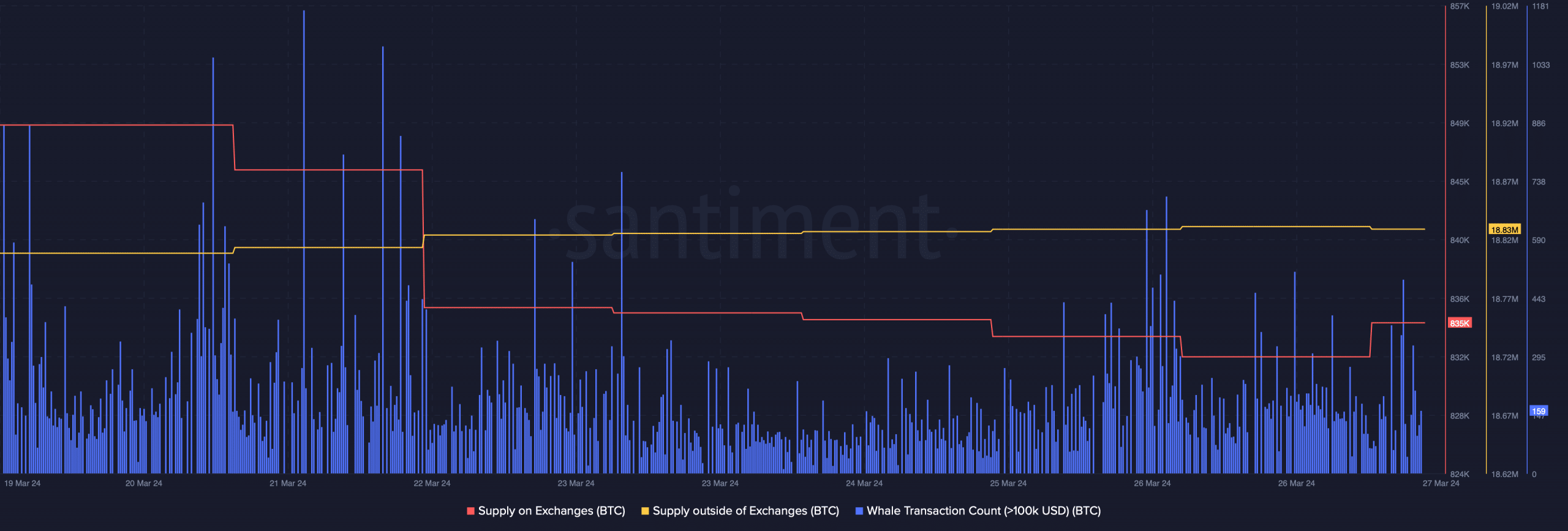

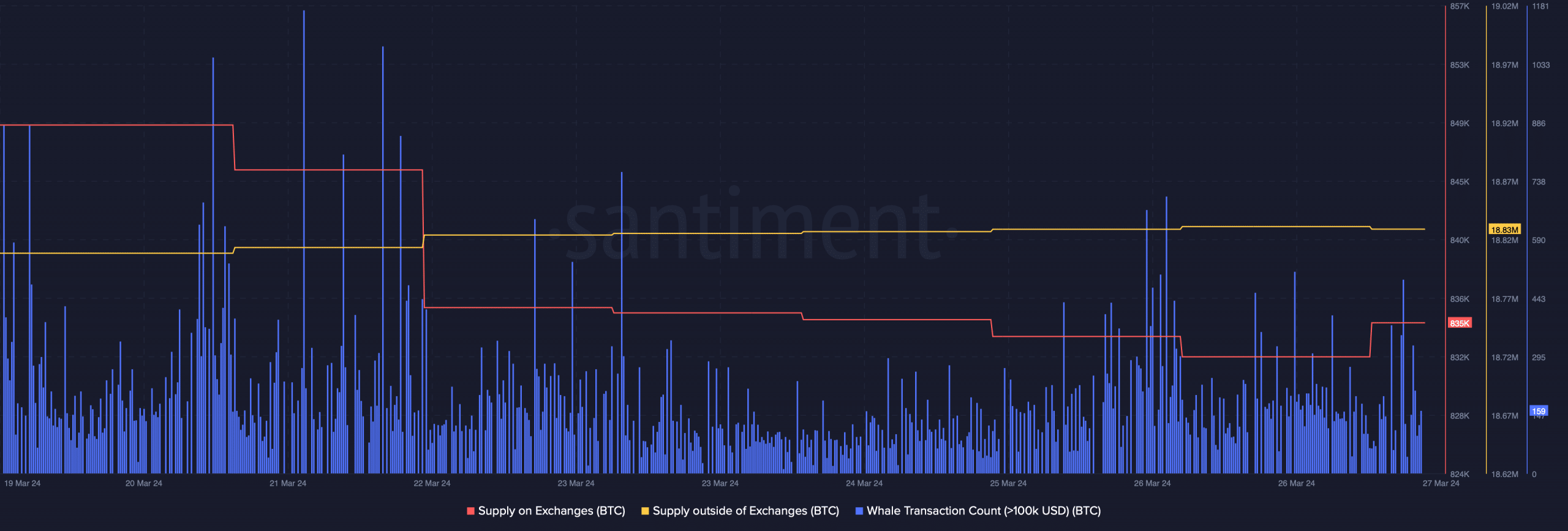

Our analysis of Santiment’s data showed that BTC supply on exchanges fell last week, while off-exchange supply rose slightly.

Whale activity around the coin was also relatively high, which was evident in the number of whale transactions.

Source: Santiment

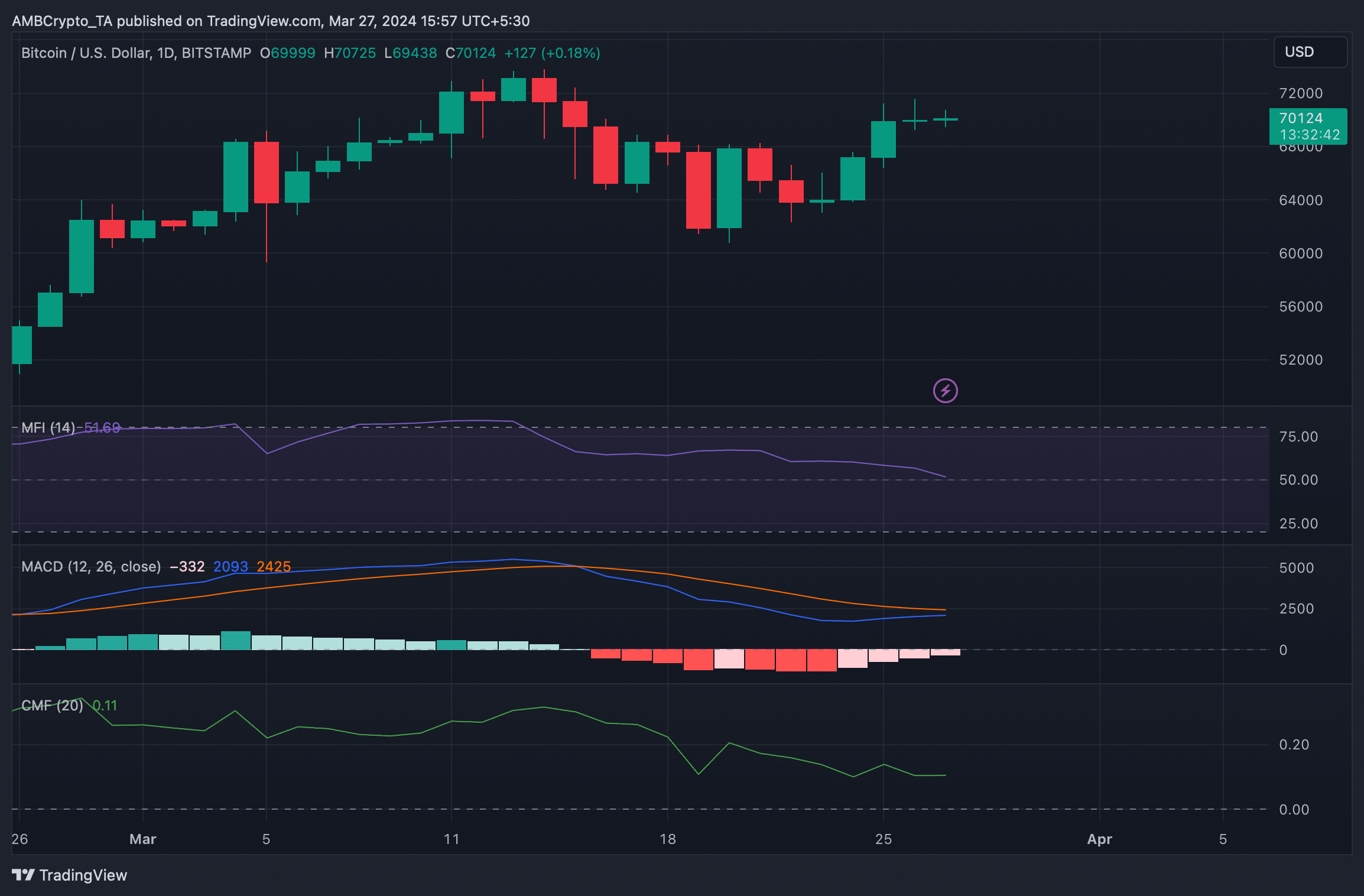

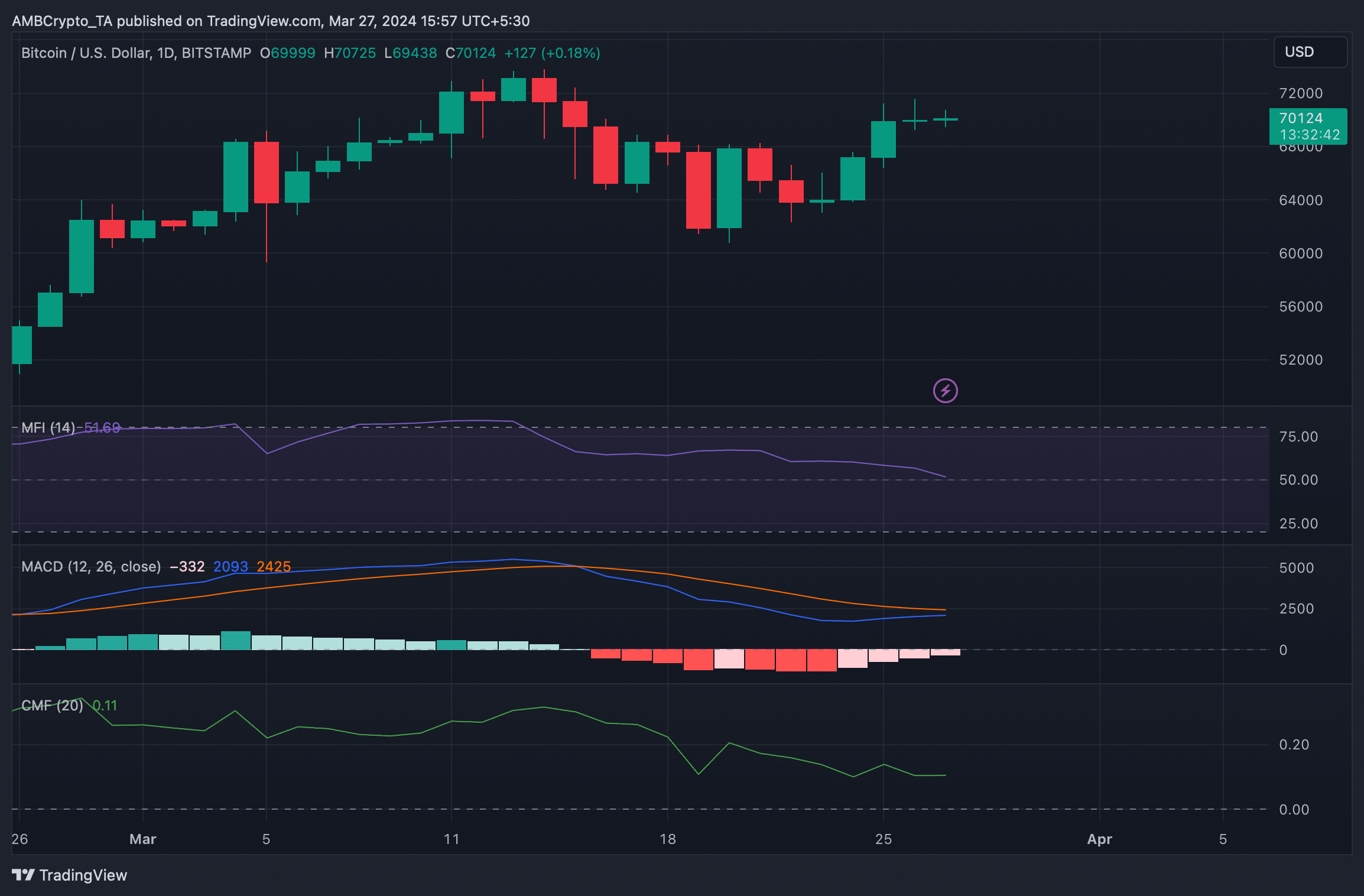

AMBCrypto then checked the coin’s daily chart to see if this downtrend would last longer. We found that Bitcoin’s Money Flow Index (MFI) registered a decline.

Read Bitcoins [BTC] Price prediction 2024-25

The Chaikin Money Flow (CMF) has also been moving sideways in recent days. These indicators suggested that the chances of a sustained price decline were high.

However, it was interesting to note that the MACD supported buyers as it showed the possibility of a bullish crossover.

Source: TradingView