- An expected temporary drop in US bank reserves could give BTC a boost.

- Price action looks good as BTC’s dominance continues.

Bitcoin [BTC] is poised for higher prices as market conditions point to a potential boost to liquidity.

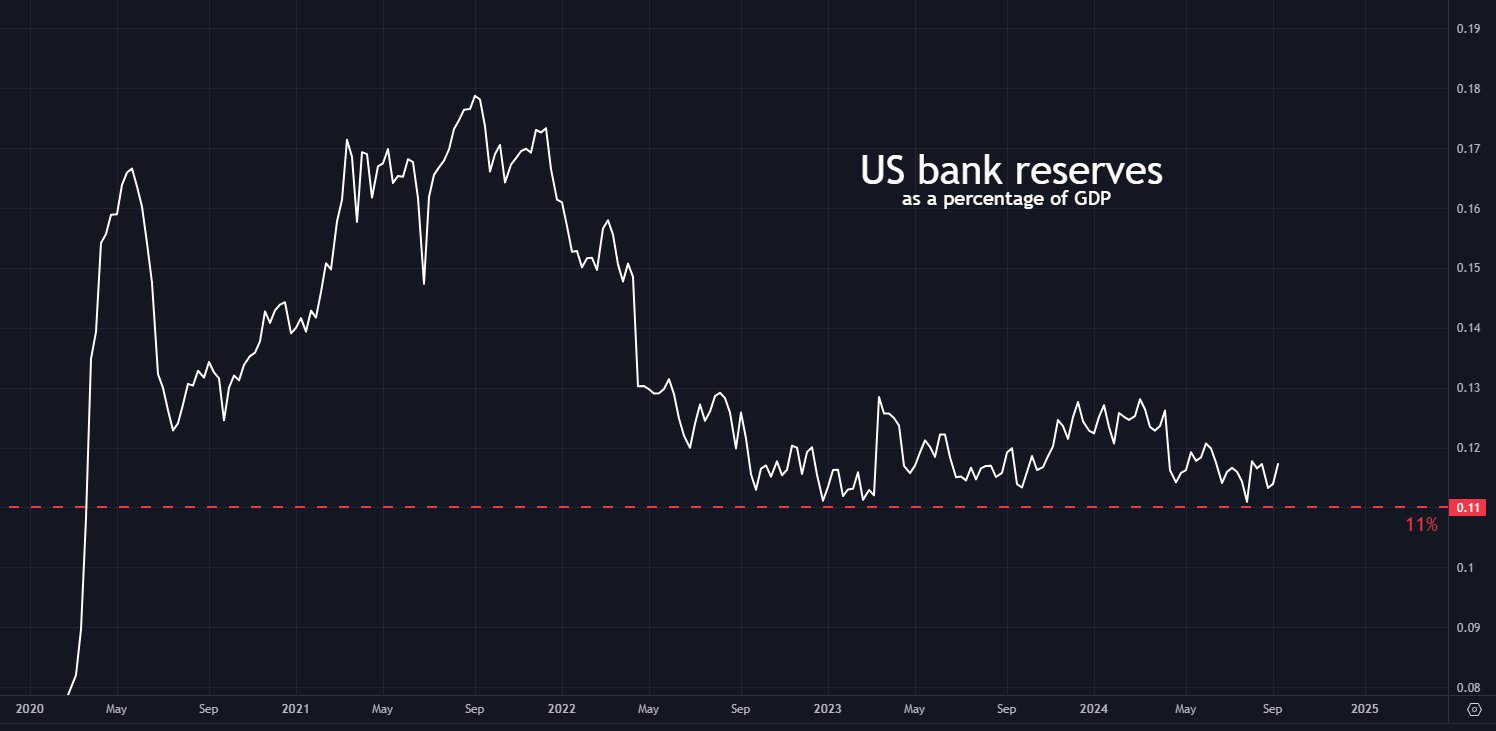

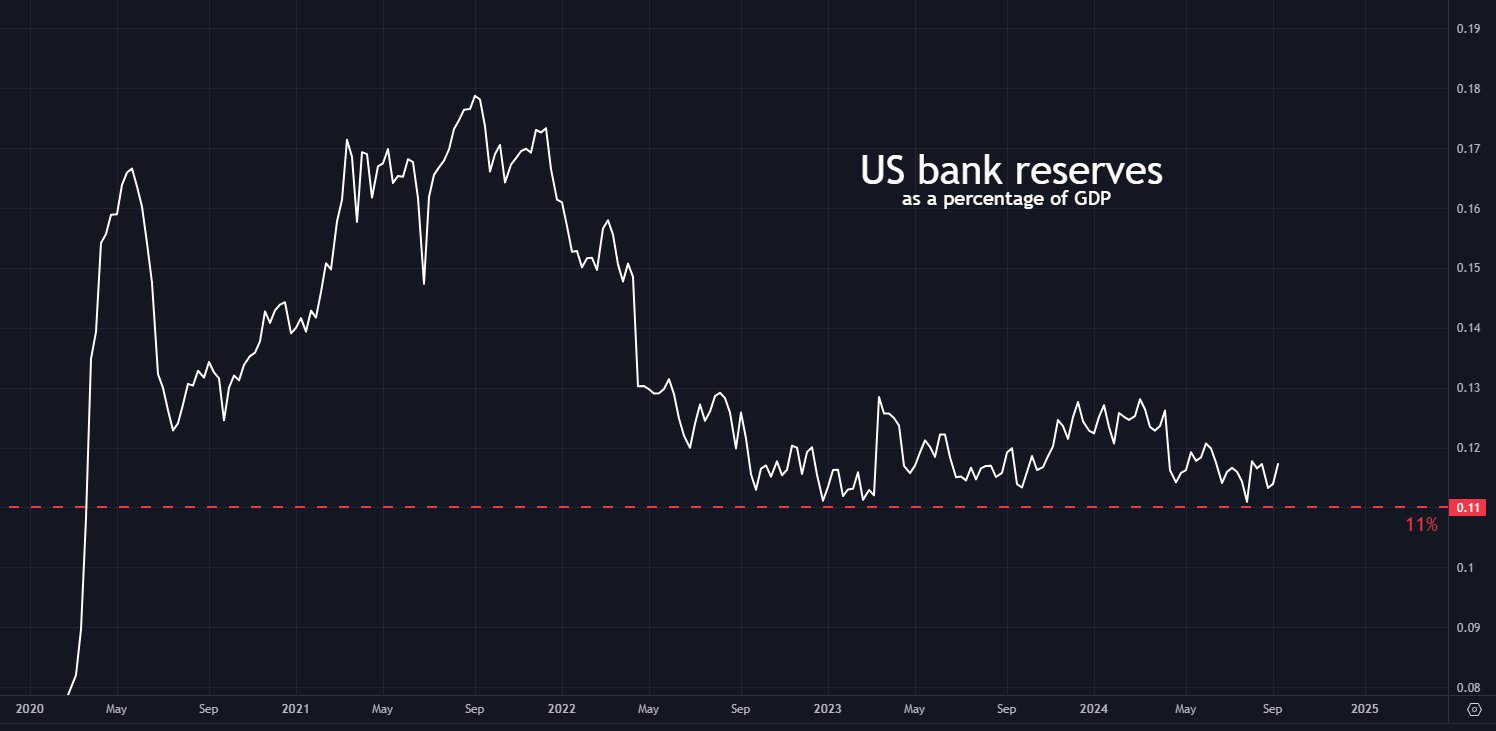

Analyst Tomás on X predicted a temporary decrease in American bank reserves to the lowest level in more than four years, which could lead to the Federal Reserve stopping the quantitative tightening (QT).

When QT ends, it is expected to lead to a significant increase in liquidity, which will likely benefit risky assets including Bitcoin.

This possibility has sparked optimism, with many expecting BTC to move higher as the Federal Reserve adjusts its policies in response to economic shifts.

Source: Tomas/X

When we examine the shorter time frames, such as the 15-minute chart, Bitcoin continues to show mixed signals.

The TD Sequential indicator has issued a sell signal for BTC/USDT, while the Relative Strength Index (RSI) and Stochastic RSI are showing overbought conditions.

This suggests that even though a potential correction is imminent, Bitcoin could still find support if it can close and stay above the $60,000 level.

The recent range between $53,000 and $62,000 highlights the volatility in BTC’s price movement over the past six weeks. Traders are eyeing a continued breakout that could push Bitcoin’s price higher.

Source: TradingView

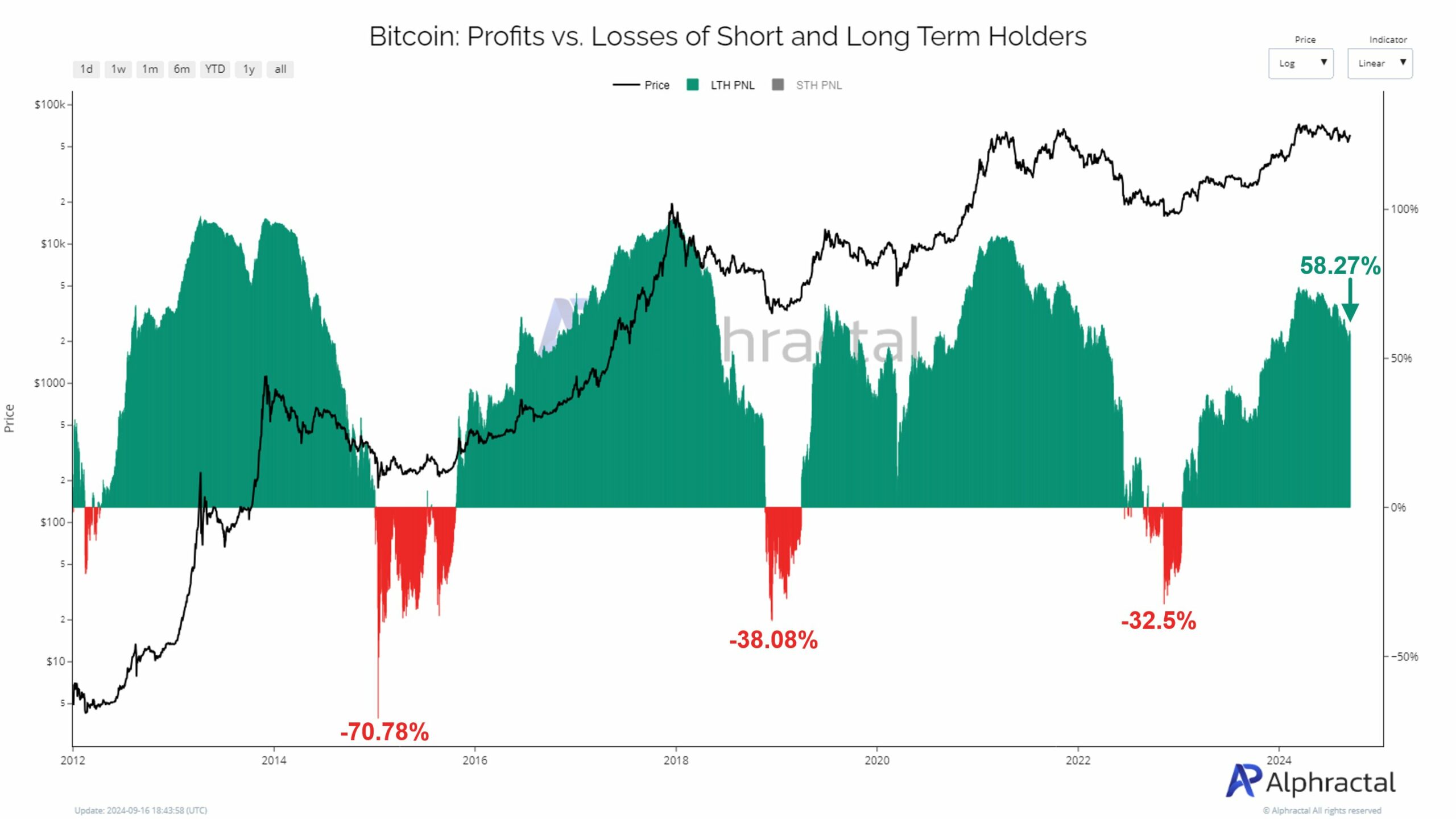

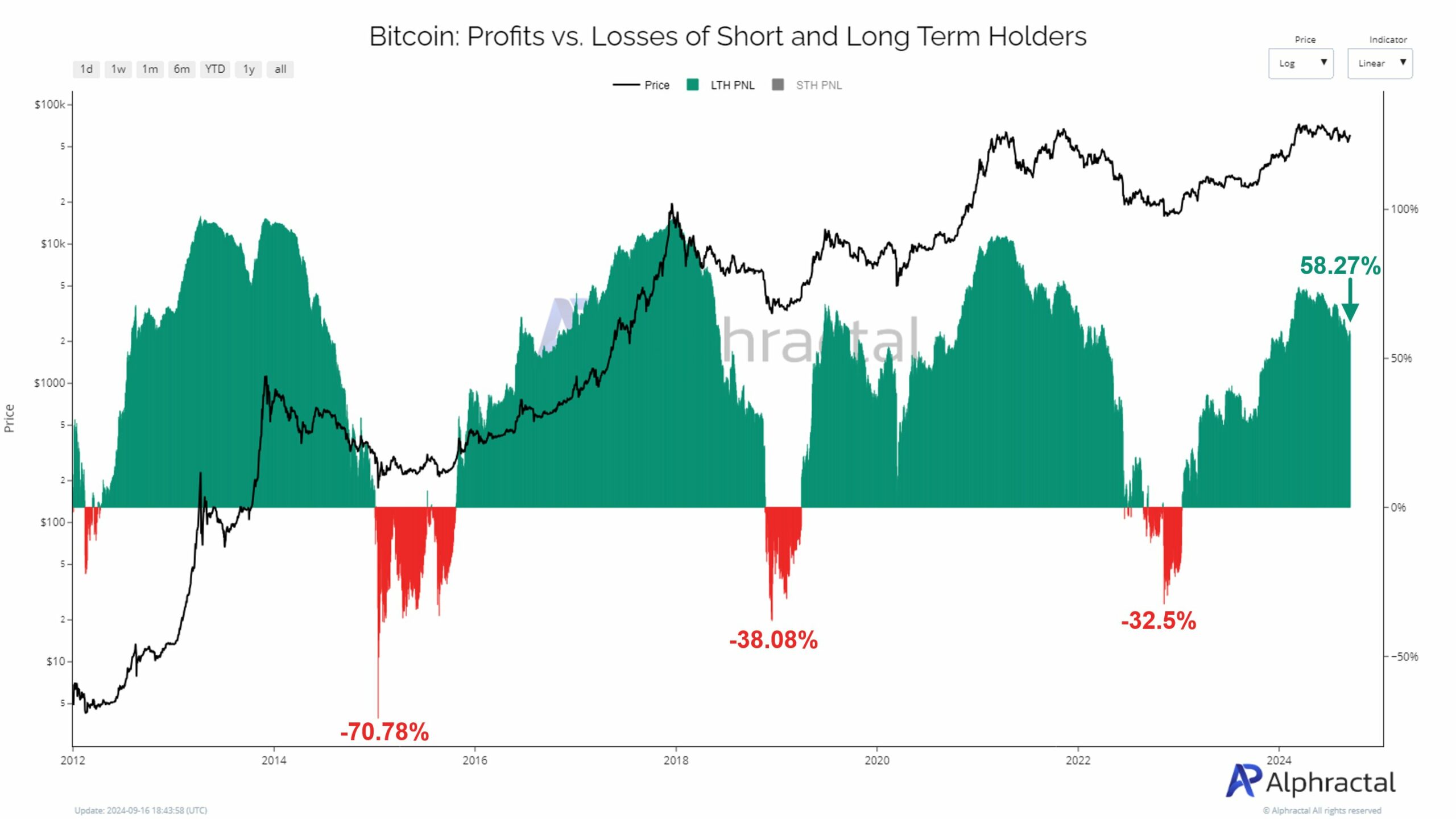

Short- and long-term gains versus losses of holders

Moreover, short-term bonds are currently showing resilience, with only a 4.46% loss, indicating no signs of immediate capitulation in the market.

Historically, local bottoms in the price of Bitcoin have tended to occur when this percentage reaches around -60%.

The low loss rate among short-term holders indicates market stability without panic or forced selling.

Source: Alpharactal

On the other hand, long-term holders have seen a decline in their overall profit margin, with 58.27% still making a profit, compared to a peak of 74% in March.

This decline may indicate that while Bitcoin remains profitable for many, a potential bearish trend could emerge in the future if profit margins continue to weaken.

Bitcoin Basic Cost Analysis

As for market participants, new whales and Binance traders have been actively purchasing Bitcoin, while older whales remain holders.

The buying interest of new investors and old whales suggests the market is positioned for potential price growth.

A potential drop in bank reserves could result in a liquidity pump, benefiting Bitcoin and similar risky assets. This combination of factors points to a favorable environment for Bitcoin’s future growth.

Source: CryptoQuant

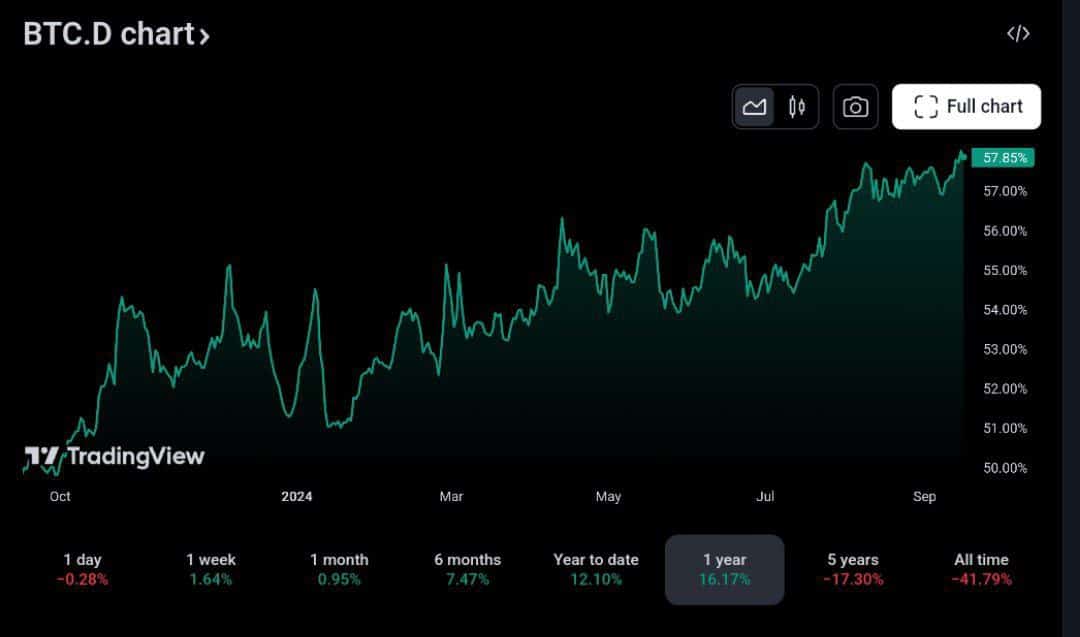

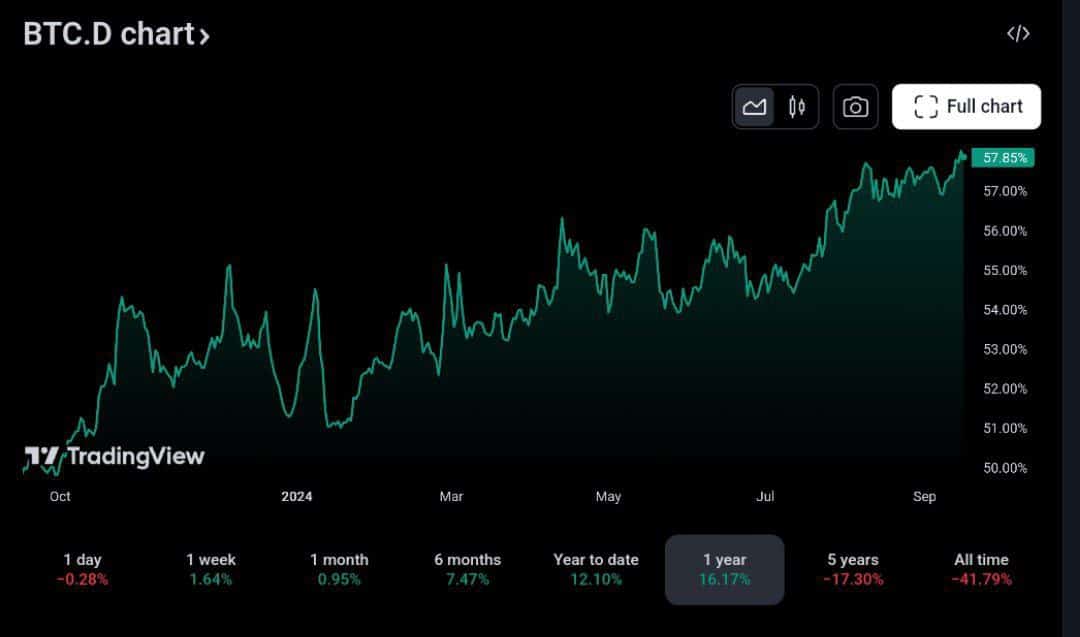

Bitcoin’s dominance continues to rise

Bitcoin’s dominance of the cryptocurrency market has risen to over 57.86%, marking the highest level since April 2021.

This increase in dominance is a strong indicator that BTC is leading the market and may be poised for a significant rally.

Read Bitcoin’s [BTC] Price forecast 2024-25

As Bitcoin continues to outperform other cryptocurrencies, this shift could also have a significant impact on the broader crypto ecosystem in the long term.

Source: TradingView

Investors are closely watching this crucial moment, looking for signs of further movement in Bitcoin’s favor. Bitcoin’s growing market share could set the stage for future gains and push prices higher soon.