- Bitcoin has been heavily exposed to leverage this month.

- A look at how heavy short liquidations have affected BTC’s performance this week.

Bitcoin[BTC] comfortably topped $65,000 during that day’s trading session. However, this came at the cost of heavy losses, especially for traders who expected the price to hover around $64,000.

Some traders expected Bitcoin to stage another retracement at or near the $65,000 level.

After all, BTC has been rising since the second week of September and profit-taking would likely manifest itself.

Such expectations led to the explosion of short positions, leaving them short-handed as prices continued to rise.

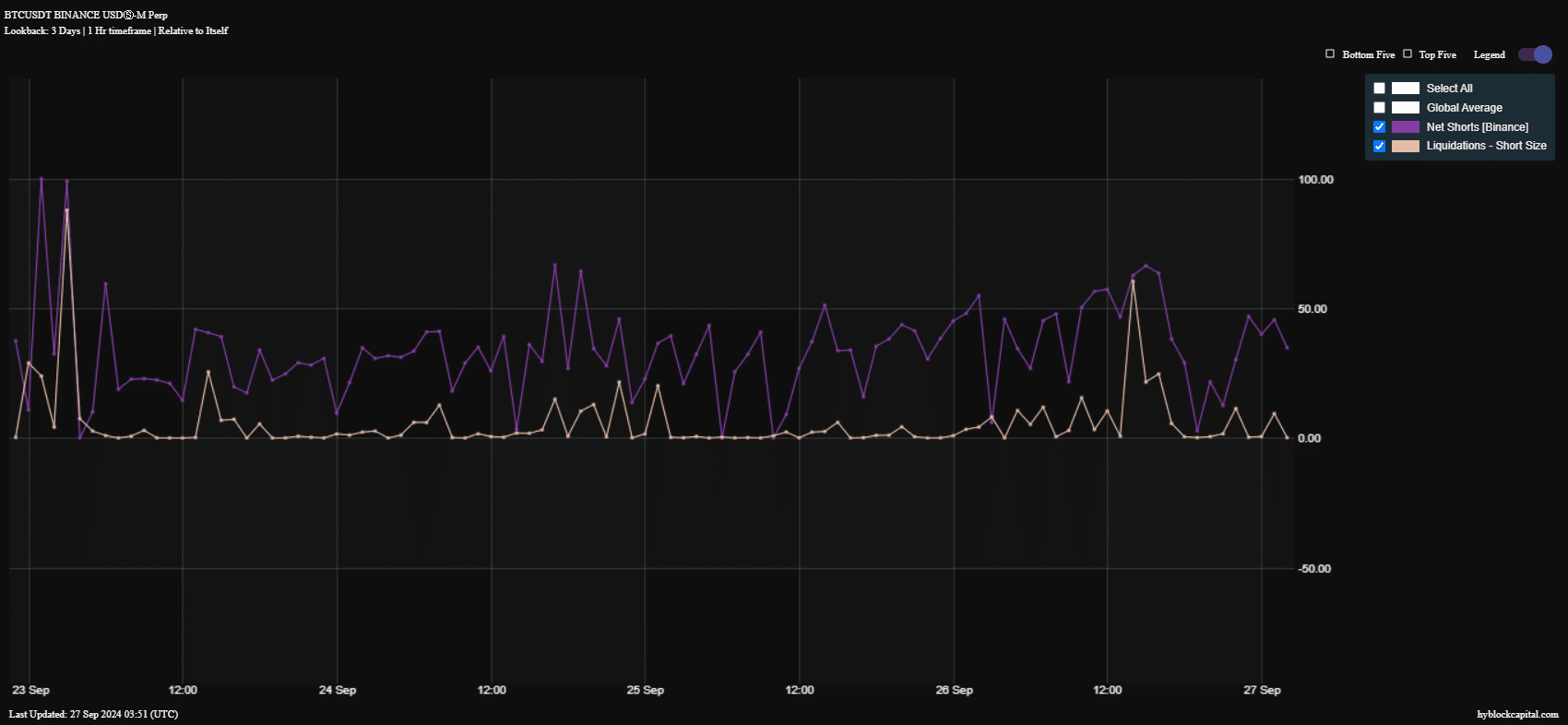

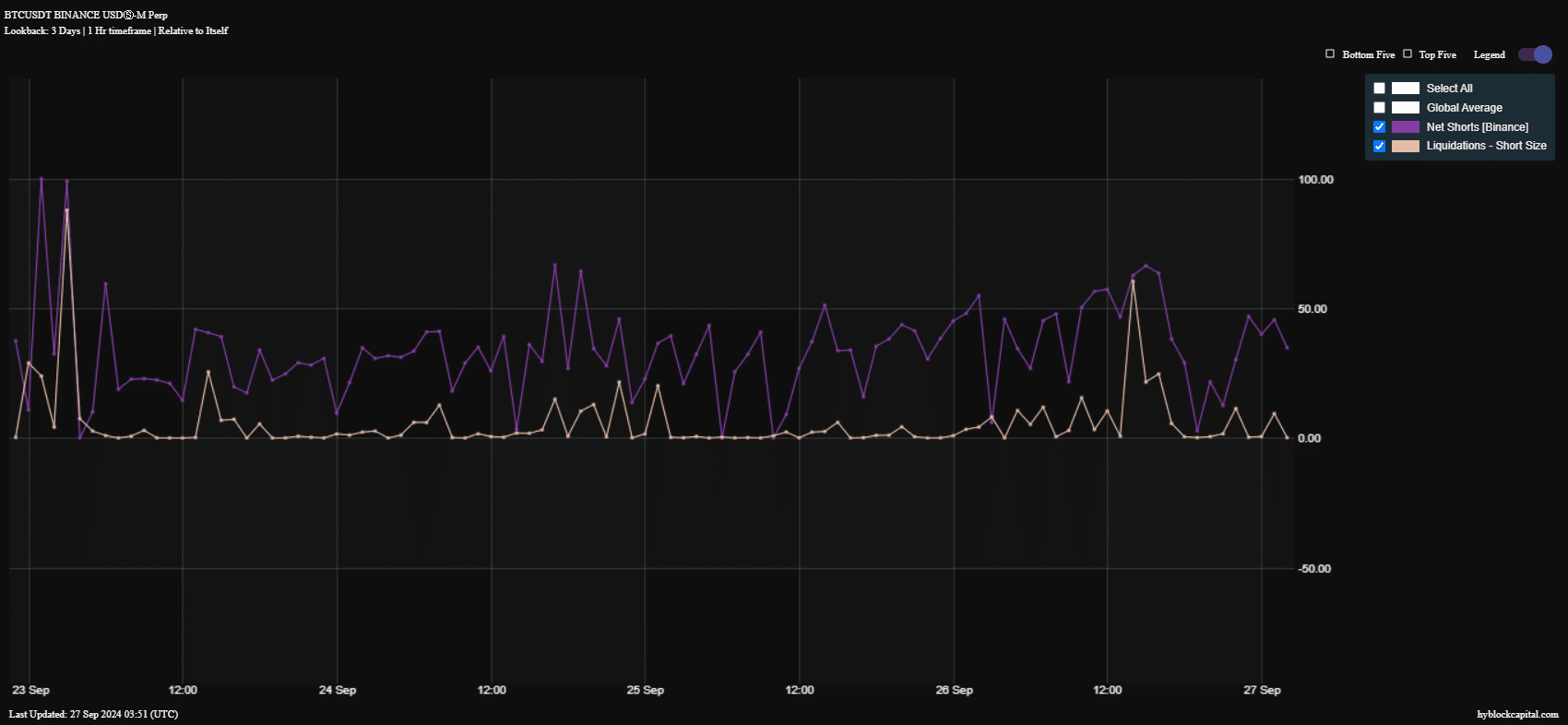

Data from Hyblock Capital shows spikes in short positions over the past three days. This was no coincidence, as Bitcoin bulls showed signs of waning momentum between September 20 and September 23.

Some may have taken this as a sign that the Bears were likely to take over.

On September 23, there was a large spike in net shorts on Binance, followed by a spike in shorts liquidations.

The next day there was another spike, but there were fewer liquidations.

Finally, AMBCrypto saw another brief spike on September 26, followed by a large increase in liquidations.

Source: Hyblock Capital

The Bitcoin liquidations during yesterday’s trading session occurred after the price unexpectedly moved in the opposite direction. This left shorts exposed, and thus the liquidations.

This was consistent with an earlier observation showing that long-term owners were not taking profits and miners’ reserves were growing.

Assessing Bitcoin’s Exposure to Leverage

The short positions may have been heavily indebted, causing liquidations to lead to a short squeeze situation.

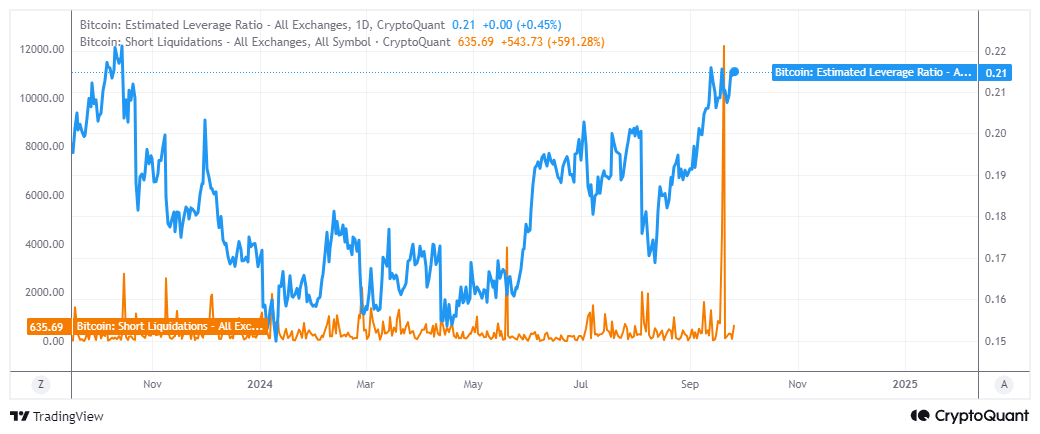

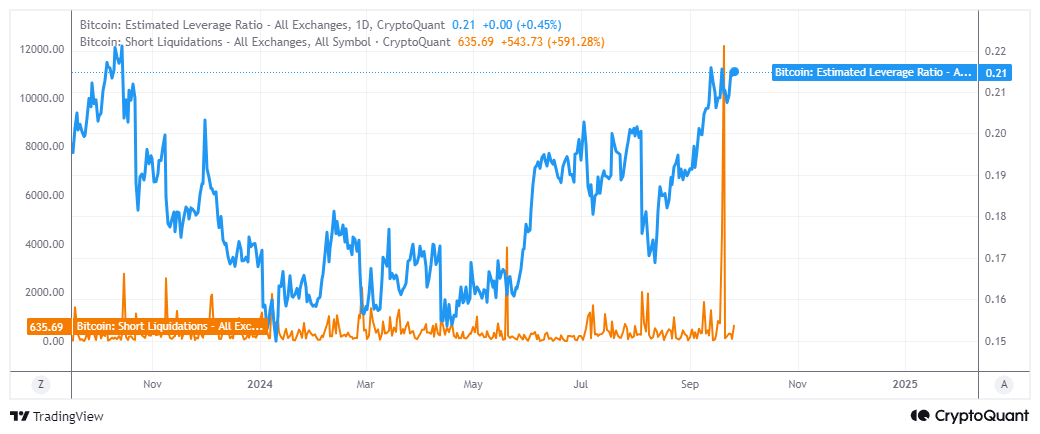

Data from CryptoQuant showed that the estimated leverage ratio recovered sharply after the August dip.

The last time Bitcoin’s estimated leverage ratio was this high was in October 2023.

Source: CryptoQuant

CryptoQuant’s short liquidation statistics showed that the number of shorts liquidated increased by 591% in the last 24 hours.

During this period, liquidations amounted to approximately 635 shorts. This pales in comparison to the number of shorts liquidated on September 20, which peaked at 12,118.

The short squeeze and subsequent liquidations underscore Bitcoin’s current level of exposure and sensitivity to leverage. As for the BTC price, the cryptocurrency may still be subject to potential downsides.

However, it will likely be limited if most long-term holders continue to use HODL.

Read Bitcoin’s [BTC] Price forecast 2024-25

Current sentiment remains bullish, but traders should proceed cautiously as markets can change at any time.

Bitcoin is still subject to high volatility, especially as the election period quickly approaches. This is the next big event that will impact the crypto market.