- Bitcoin still keeps above $ 80k, because investors are looking for safety in uncertain markets

- Statistics indicated that 77% of holders had a profit, with Netflows that support strong feelings

The global economy continues to step on shaky ground. Trade relationships evolve, inflation is not yet fully eliminated and the stock markets are just starting to show cracks. And yet hard assets such as gold and bitcoin steal the spotlight in silence.

Gold even went a new highest point of $ 3,300 in the charts. Hard on its heels BTC stays well above the price level of $ 80k. The two move synchronously and for a good reason are investors looking for safety.

Because traditional assets are losing their lead, Bitcoin seems to make his business as a serious Safe-Haven contender.

Investors look at BTC in uncertain times

Investors seem to respond to global uncertainty by moving capital to assets that retain value. Gold has traditionally played that role, but Bitcoin is quickly overtaking. The decentralization and global liquidity make it an attractive hedge.

With shares that are confronted with potential disadvantage and worldwide financial policy still restless, BTC is now considered by some to be ‘digital gold’. The performance during recent stock sales have further strengthened this sentiment.

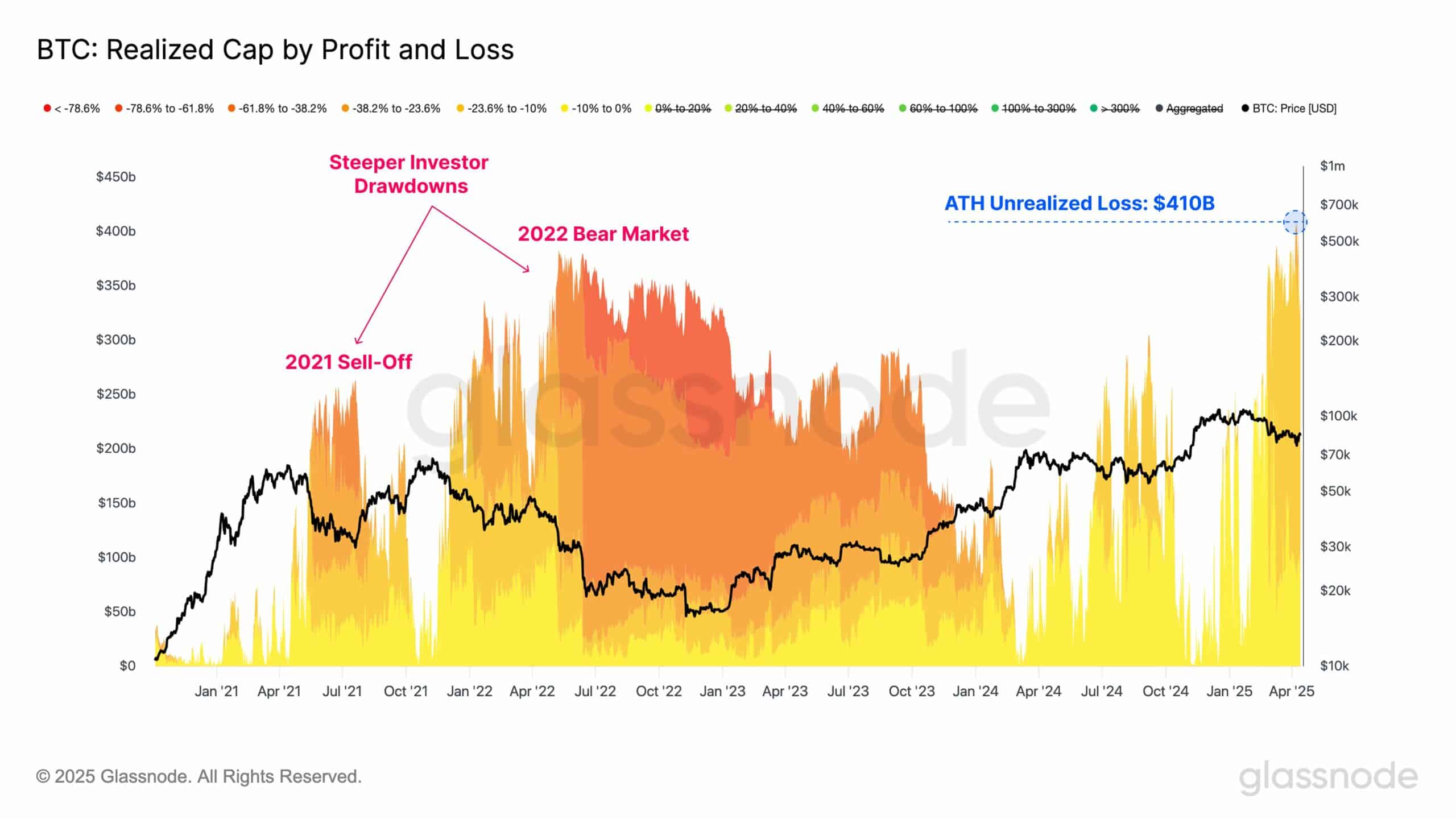

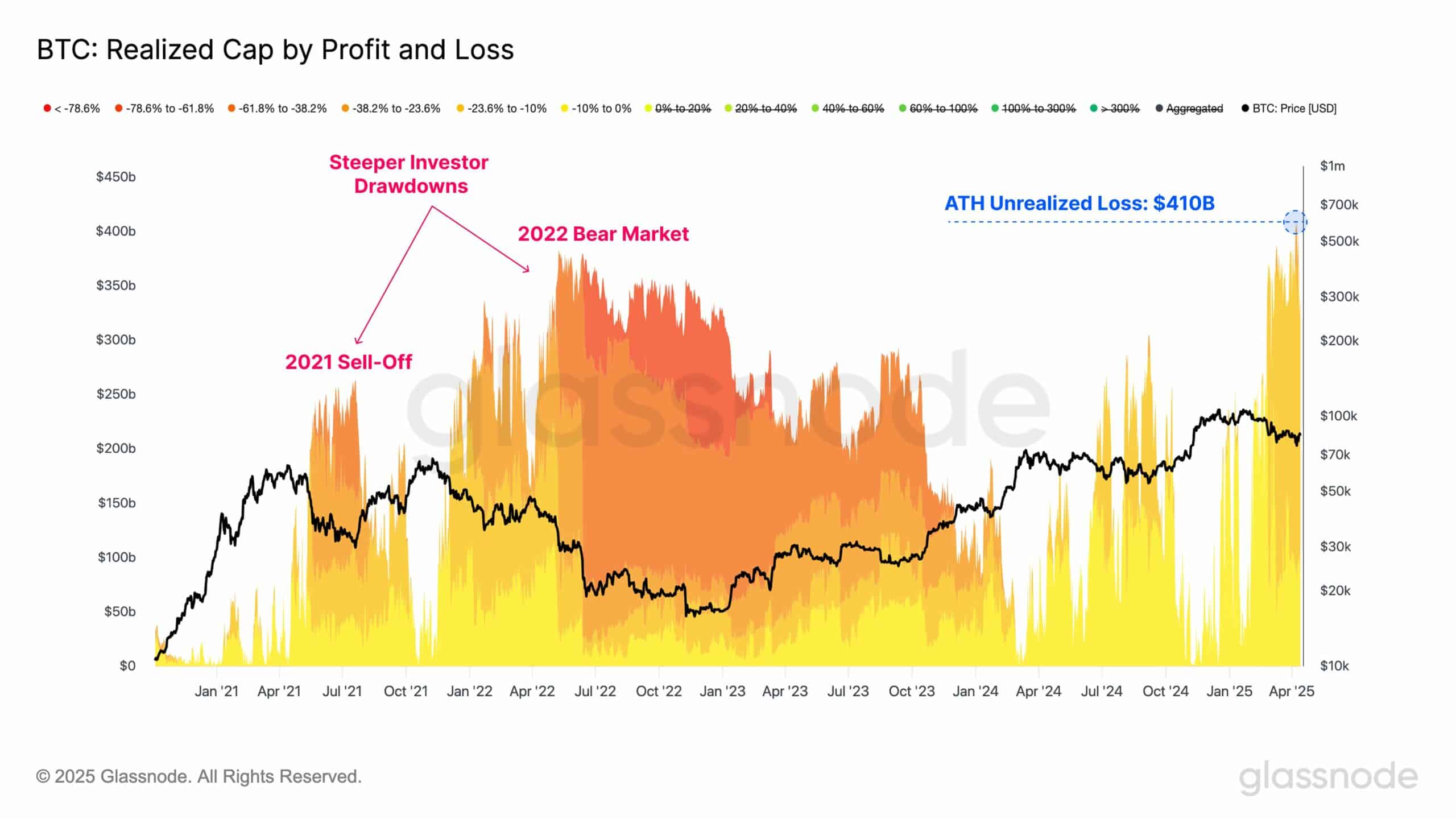

With the crypto that yields a high inflow and reduced non-realized losses, the number of large investments on the current dip could push prices higher. The last time Bitcoin was included in such a high number on non-realized losses during the sale of 2021 and 2022 Bear markets.

Both events were followed by an important bullish rally in the charts.

Source: Glassnode

Statistics back the bullish case

According to Intotheblock, chain statistics also indicated the growing trust. At the time of writing, Bitcoin’s Exchange Netflows was at 52%. That meant that more BTC is withdrawn from stock exchanges than deposited – a signal from investors who are the intention to keep instead of selling.

The data has even shown that 77% of all Bitcoin addresses can have a profit. This level of profitability often increases the holder sentiment and supports price stability, or even further upwards.

Source: Intotheblock

As long as there is economic uncertainty and belief in traditional markets, Bitcoin will continue to pick great. Staying above $ 80k is not just a matter of price – it’s sentiment. Buyers today just see value in BTC.

With gold and bitcoin both red-hot, builds the safe haven story of strength. If this continues, Bitcoin cannot stay in step alone, it can touch new highlights.