With today’s release of the Personal Consumption Expenditure (PCE) price index by the Bureau of Economic Analysis, the Bitcoin market just experienced the most significant macro event of the week. Ahead of the US Federal Reserve (Fed)’s Federal Open Market Committee (FOMC) on May 2-3, all eyes were on the PCE today.

The latter is known as the Fed’s inflation gauge of choice. (versus CPI). It measures the prices consumers pay for domestic purchases of goods and services and excludes food and energy.

The baseline was as follows: February’s core PCE index was +0.3% month-over-month, below the forecast of +0.4%. Analysts had expected an increase of +0.3% for March. Year-on-year (yoy) growth was expected to be 4.5%, down slightly from last month’s 4.6%.

Meeting expectations or any “positive” surprises was expected to be bullish for the Bitcoin market. Renowned Analyst Ted (@tedtalksmacro) mention in front: “Bulls want to keep seeing it leaning south!” and added, the chances of a bullish surprise were good: “CPI + PPI prints earlier in the month, at least for now, suggest the path of least resistance is for lower inflation rates.”

PCE has a slight impact on Bitcoin price

These expectations were not met. As reported by the Bureau of Economic Analysis, core PCE came in at 0.3% month on month as expected. On a year-over-year basis, core PCE fell to 4.6%, also delivering the expected number.

BREAKING: US PCE data is out!

Head y/y 4.2% vs 4.1% expectation

Head m/m 0.1% versus 0.1% expectation

Core y/y 4.6% vs 4.58% expectation

Core m/m 0.3% versus 0.3% expectation

— Markets and Chaos (@Mayhem4Markets) April 28, 2023

Bitcoin price reacted in line with expectations. At the time of writing, BTC was holding at the price level around $29,300.

The big question, however, will be whether progress in the fight against inflation is enough for Fed Chairman Jerome Powell. In a phone joke with fake Ukrainian President Volodymyr Zelenskyy yesterday, Powell acknowledged that at least two more rate hikes are on the way, followed by a long period of high interest rates with significant negative effects on the US economy and the US labor market.

Powell also stated that a recession in the United States is likely. “This is what it takes to bring inflation down. Cooling down and cooling down the economy causes inflation in the labor market to fall. We don’t know a painless way to bring inflation down.”

In a prank call with a bogus Zelenskyy, Federal Reserve Chairman Jerome Powell admits that at least 2 more rate hikes are on the way, followed by a long period of high interest rates with significant negative effects on the US economy and the US labor market. https://t.co/vDb19Ed5ux

— Kim Dotcom (@KimDotcom) April 27, 2023

What will the Fed make of the data?

Following the latest macro data, Fed Funds Futures traders are expecting a greater than 80% probability for a 25 basis points (bps) rate hike next Wednesday. The probability according to the CME FedWatch Tool was 88% before the release of the PCE and has remained at this level since.

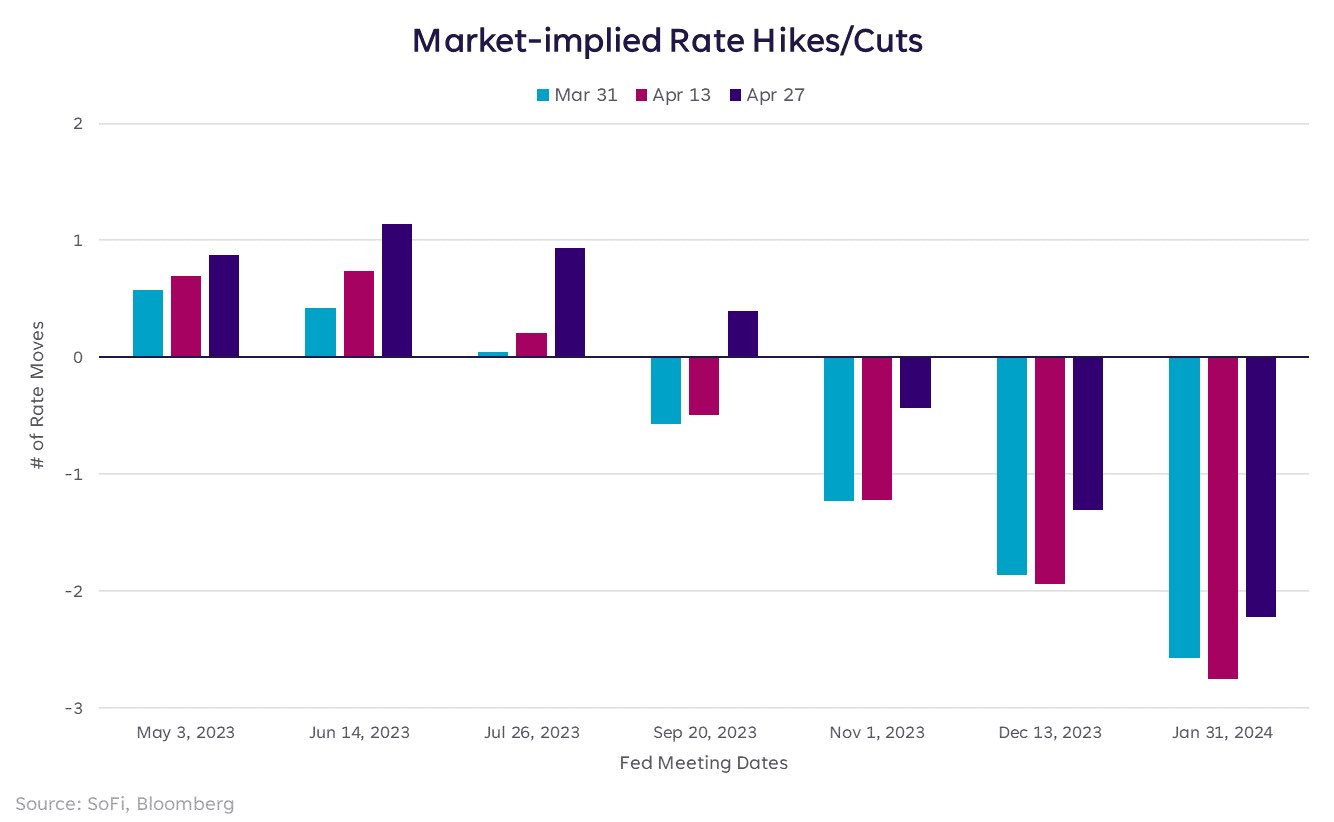

Still, the market is calling off Powell’s bluff. Liz Young, head of investment strategy at SoFi, shared the chart below and mention prior to PCE release:

Market prices imply an 88% chance of a rate hike next week, higher than earlier in the month. Some traders are also starting to bet on a June increase, but that is less certain. Regardless, the markets still think we’re going to have multiple cuts later in 2023 and early 2024.

Today’s release is not expected to change that. On the other hand, a second wave of bank failures is currently brewing in the US. Higher interest rates are likely to push more regional banks to their limits. Bitcoin could again be the beneficiary as the Fed cannot rise as high as it would like.

At the time of writing, Bitcoin’s price was at $29,314.

Featured image from iStock, chart from TradingView.com