- Bitcoin’s 12-18 month UTXOs are not selling despite being close to the breakeven point.

- The average BTC holder was making profits at the time of writing, while more optimism was evident.

Long term holders of Bitcoin [BTC] show unwavering faith in the coin as BTC maintained its value above $27,000 as the new month began. This conclusion was the result of the new high of the realized limit.

Read Bitcoins [BTC] Price prediction 2023-2024

Support for BTC

On October 1, Glassnode revealed that Bitcoin’s realized limit hit a 30-day high of $395.65 billion.

#Bitcoin $BTC Realized Cap Just Reached a 1-Month High of $395,653,566,989.08

View statistics:https://t.co/C8JhD26mC1 pic.twitter.com/HXiL7C6TfH

— Glassnode Alerts (@glassnodealerts) October 1, 2023

The realized cap provides a macroeconomic view of the BTC price. This is done by calculating the value of each Unspent Transaction Output (UTXO) using the price when the coin last moved.

As a way of measuring the value of a coin, the increase in realized limit means that the majority of the last Bitcoins moved were acquired at lower prices.

Furthermore, the fact that the Bitcoin market cap is above the realized limit means that the market made a total profit despite some gains decline the past months. The confidence shown by long-term holders was also confirmed by on-chain analyst Lidja Jahollari.

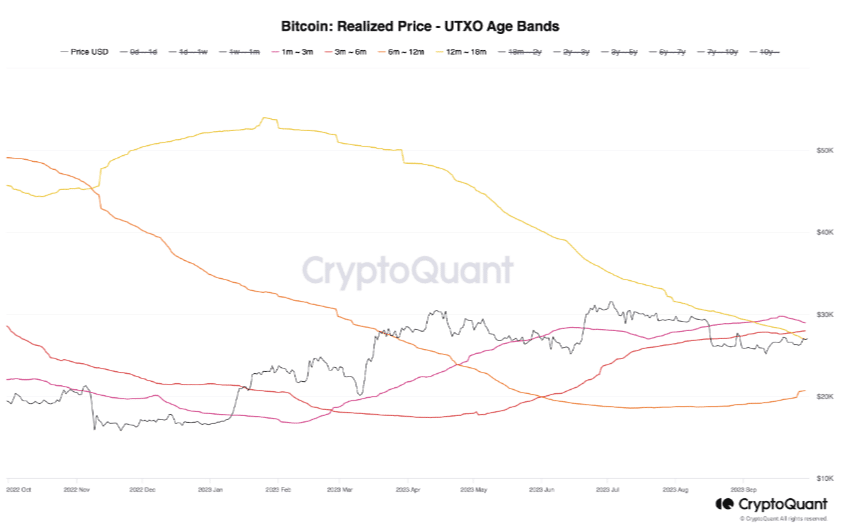

To do this, Jahollari compared the current price of Bitcoin with the realized price. The realized price is calculated as the realized limit divided by the total coin supply.

This value obtained from the calculation can be interpreted as the average price that market participants paid for their coins. It can also act as a support price or resistance in the chain.

Source: CryptoQuant

The former is more positive than the latter

The analyst at the time published on CryptoQuant, the realized price of BTC’s 12-18 month UTXO was $26,950. She also added that the 6 to 12 month cohort was $20,600.

In explaining both values, Jahollari noted that the 6- to 12-month cohort made much more gains in terms of profitability, as the first cohort was close to breakeven.

She wrote,

“The 12-18 month UTXO realized price indicates that holders have reached their average purchase price within this time frame. In contrast, the 6-12 Month UTXO Realized Price, lower than the market price, indicates profitability for this cohort.”

Another metric the analyst considered was the UTXO Age Bands of stock market inflows. This measure summarizes the behavior of long- and short-term holders in addition to the price action.

Source: CryptoQuant

The above data shows that the UTXOs with a maturity of six to twelve months are actively making profits through transfers on exchanges. However, the 12 to 18 month group chose not to sell despite a long period of unrealized losses.

Is your portfolio green? look at the BTC profit calculator

Due to this behavior, Jahollari said that BTC valued at $26,950 may not resist its true value. Instead, it tended to be the chain support.

She concluded that,

“Given the limited inflows of Bitcoin from the 12-18 Months UTXO cohort into exchanges, indicating low selling pressure, this suggests that their realized price may not serve as a resistance level for the Bitcoin price. This implies that Bitcoin has room to rise and possibly surpass this level.”