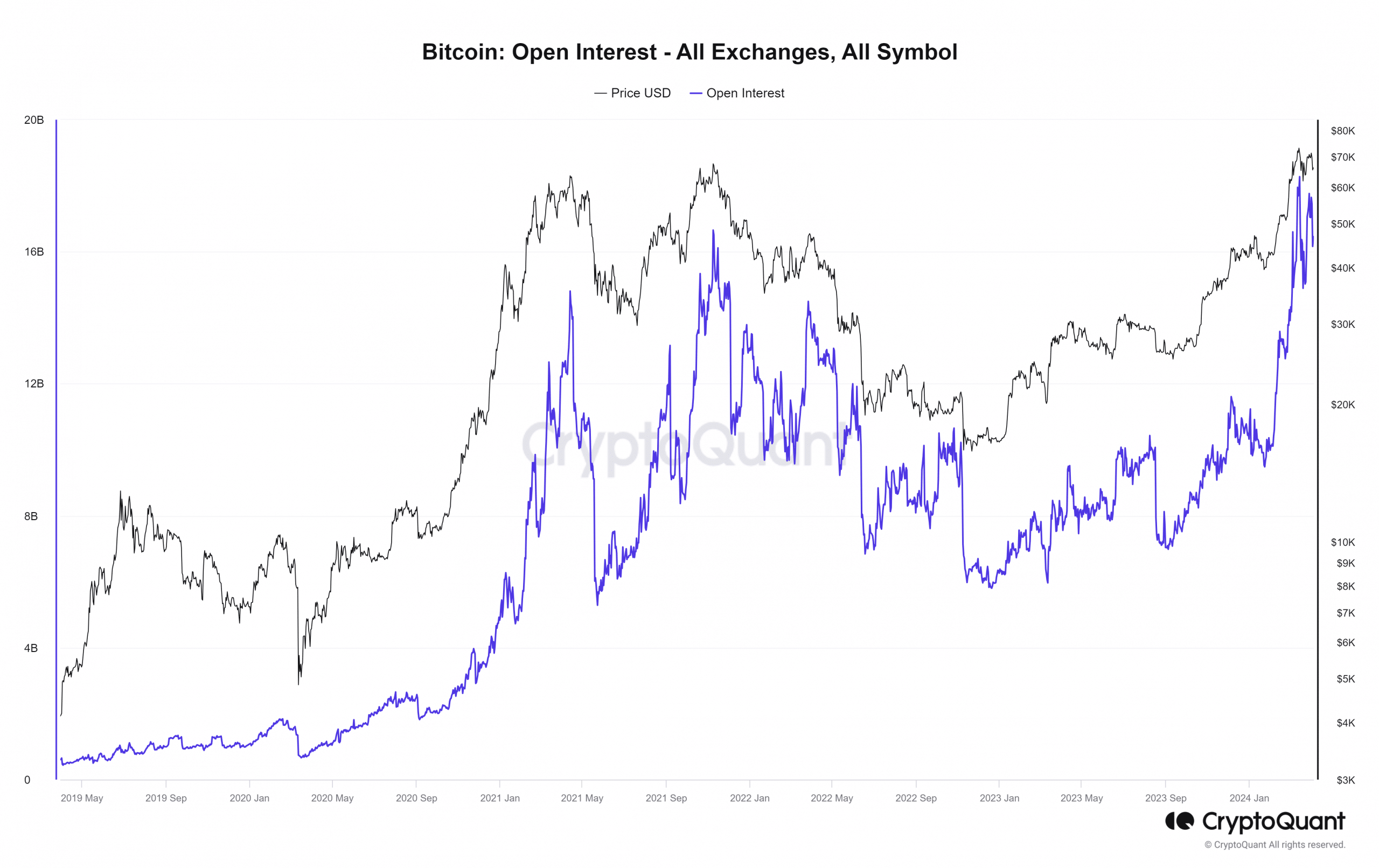

- Historically, Bitcoin has recorded a 50% correction after reaching a new high in Open Interest.

- It is the beginning of a new cycle. Is this reason enough for Bitcoin not to repeat history?

Bitcoin [BTC] posted a 6.8% decline over the past two days, even after taking into account the jump from $64.5k to $66.5k. A Insights post on CryptoQuant drew attention to the fact that every time the Open Interest (OI) crossed the $13 billion mark, the Bitcoin market witnessed significant corrections.

The OI reached $17.7 billion on March 28. This was followed by the losses we saw in recent days. Now a large part of the retail participants from the futures marketsWill BTC see a recovery or a downtrend in the next two months?

Bitcoin Open Interest passes the $13 billion mark again

As the Insights post indicates, we see a major correction when BTC OI rises above $13 billion. This was because the extreme highs in OI are reached when the market is in a state of euphoria or has expanded significantly.

The 2021 Open Interest peaks reached $14.8 billion in April 2023 and $16.6 billion in November 2021. Both times, BTC witnessed a 50% retracement in the subsequent 70 days.

The recent increase in OI was $18.2 billion, but that doesn’t necessarily mean we would see a 50% drop in the next two months. During the 2020 rally, the OI convincingly exceeded previous highs. This implied that capital inflows were many times greater than before.

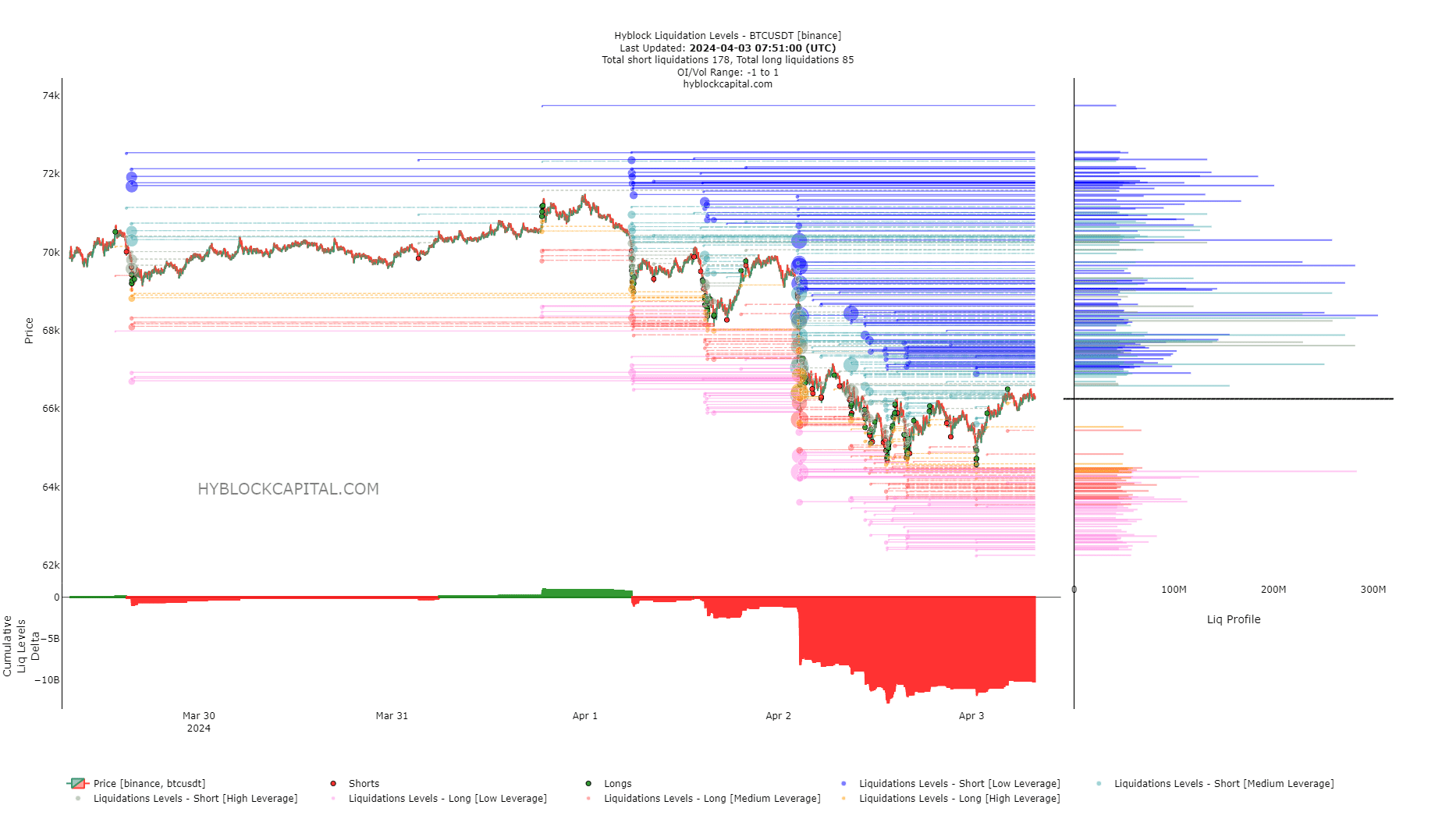

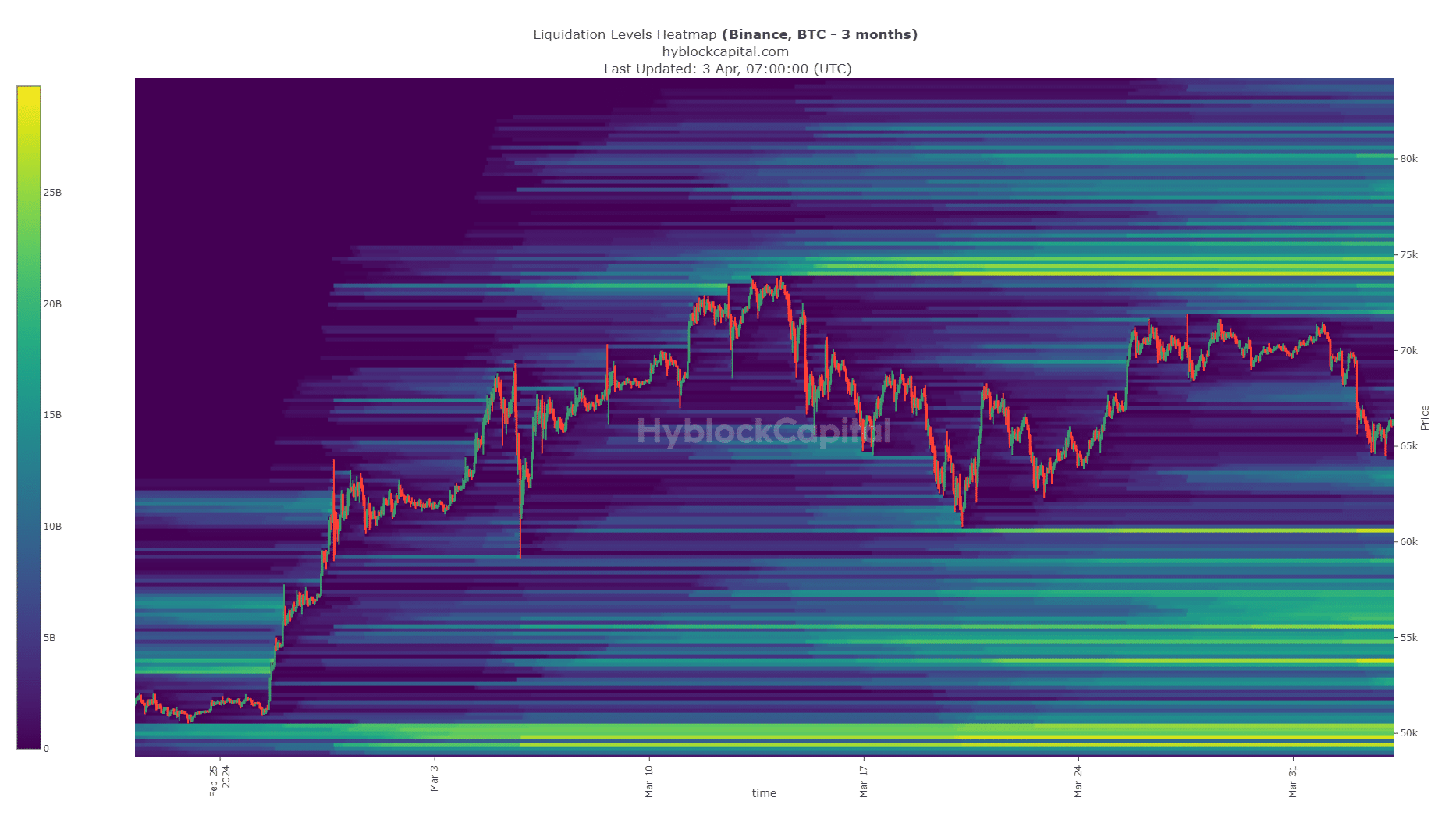

The liquidation charts argue for a bullish reversal in the short term

The reason high OI sees high volatility is because price is attracted to liquidity. When a market is supported by spot market demand, significant volatility in a short period of time is difficult due to the spot market orders.

When the market is near a local top and prices are pushed up by interest in the futures market, but much less demand in the spot market, the likelihood of liquidation increases dramatically. This is something participants should be aware of.

At the time of writing, the cumulative delta of the fluid levels was very negative. The number of short liquidations is far greater than the number of long liquidations. Therefore, prices could gravitate higher to wipe out the bears.

The $68.2k, $69.6k, and $70.3k are levels that BTC could rise to in the coming days. There was a huge concentration of short liquidations at these levels that could be wiped out.

Is your portfolio green? Check the Bitcoin Profit Calculator

The longer-term outlook for Bitcoin highlighted two areas of interest. In the south this was the $60.6k region, while the $74k-$74.6k zone in the north would prove crucial.

With the Bitcoin halving taking place in just under three weeks, we could see more volatility before the real bull run begins.