- The stable reserves and strong support of miners suggested that Bitcoin could maintain Opwaartum.

- Whale and institutional accumulation, including BlackRock, supported bullish sentiment for bitcoin.

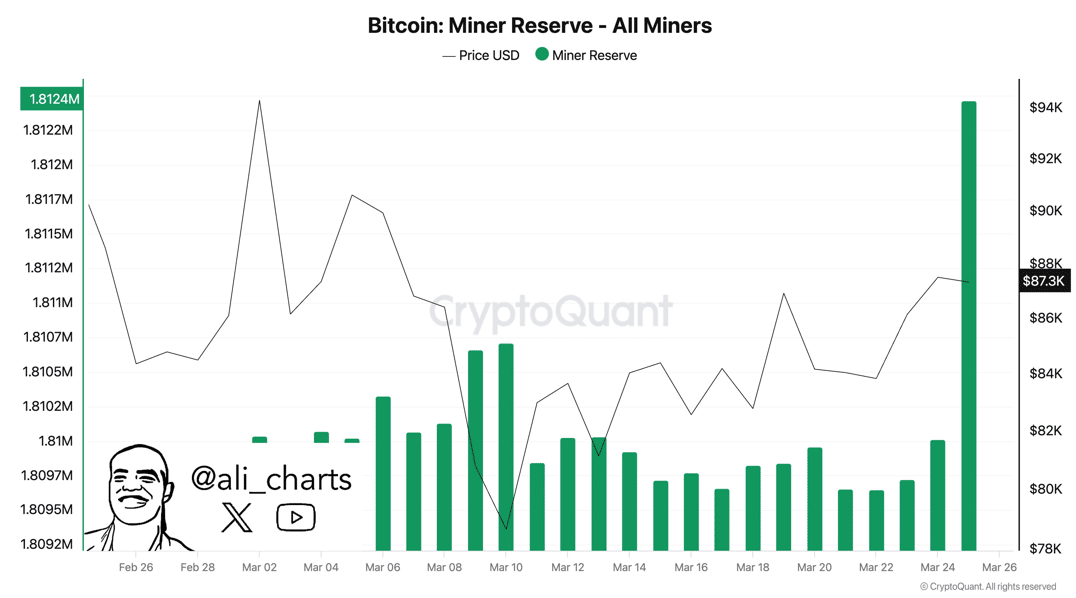

Bitcoin [BTC]S Miner Reserve has remained stableWithout significant sales activity that has been registered in the last 24 hours. This indicates that miners stick to their bitcoin, which indicates trust in future price movements.

Source: X

The stability in mining behavior could suggest that miners are waiting for favorable market conditions to sell at higher prices.

As a result, this steady behavior in the mining reserve is an important indicator to pay attention to possible shifts in market dynamics.

What does the Bitcoin price action look like?

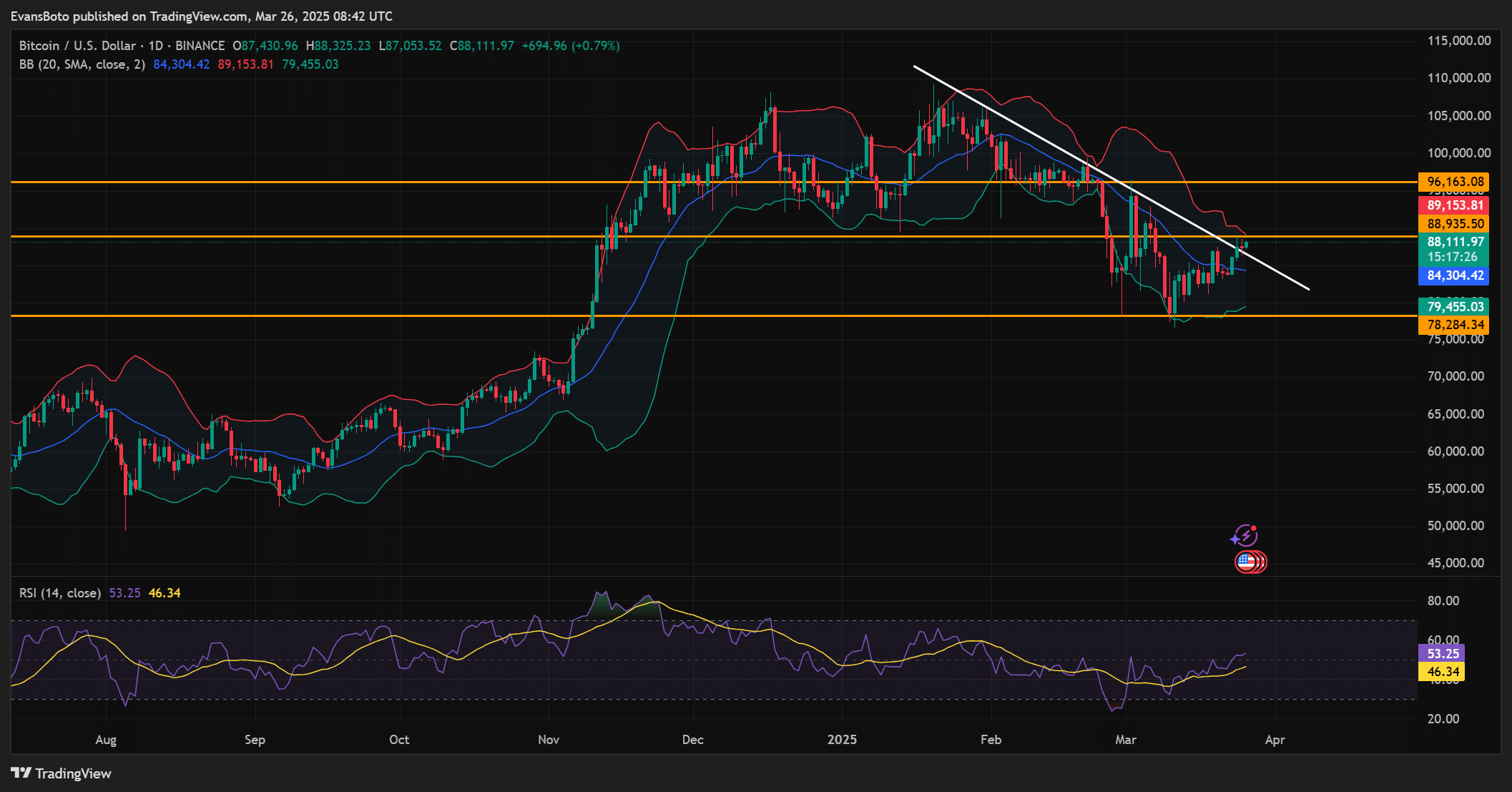

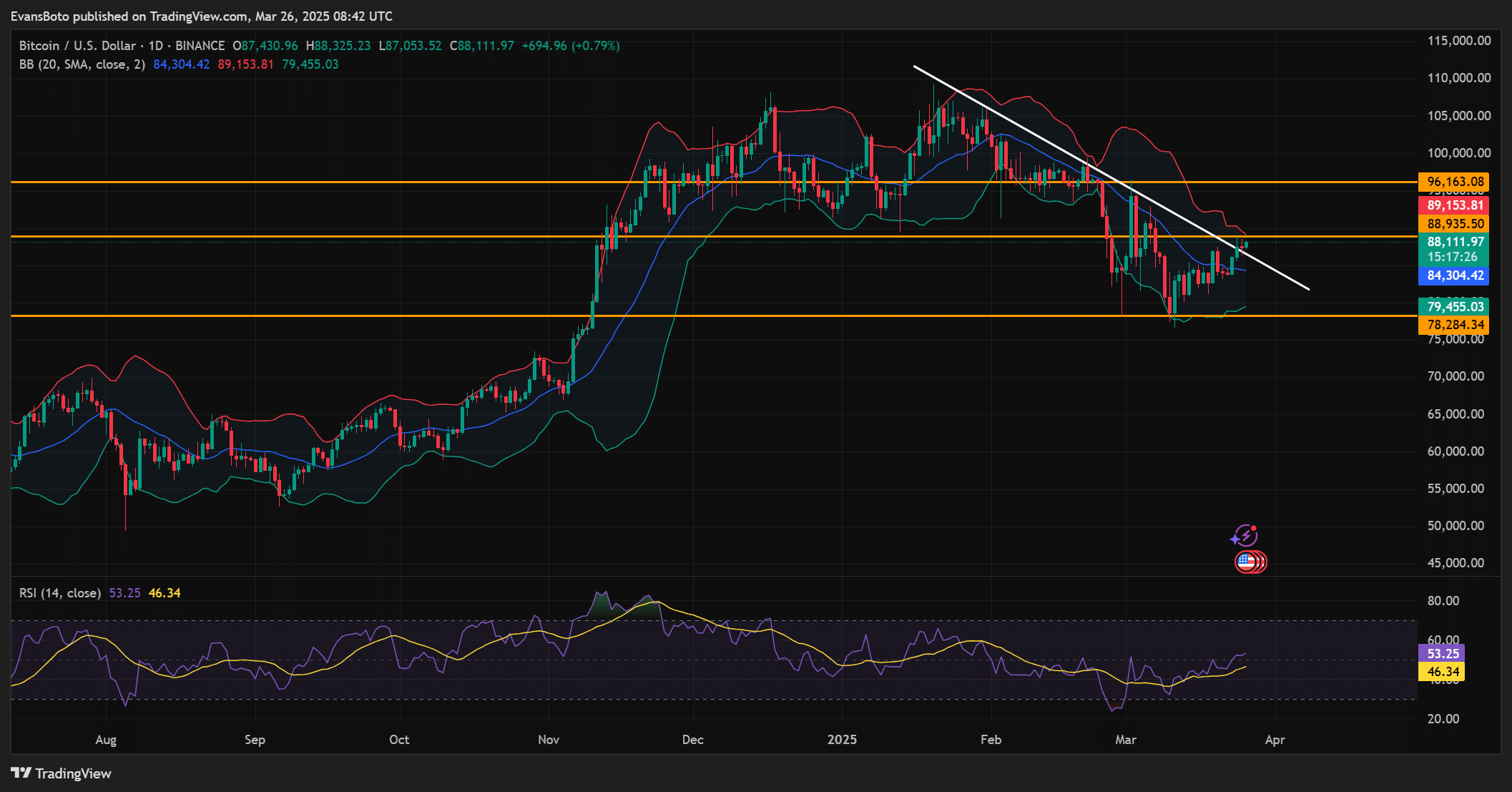

At the time of the press, Bitcoin traded at $ 88,020.88, an increase of 1.53% in the last 24 hours.

BTC was recently broken from a falling trendline and bounced from the demand zone. This suggests a strong purchase interest on these price levels, which could help to push Bitcoin higher.

The Bollinger tires indicated that BTC was approaching the lower range of its tires, which suggests that consolidation is involved or that an outbreak can be.

Moreover, the RSI lecture of 53.25 neutral market sentiment showed, which currently does not indicate overbought or over -sold circumstances.

Source: TradingView

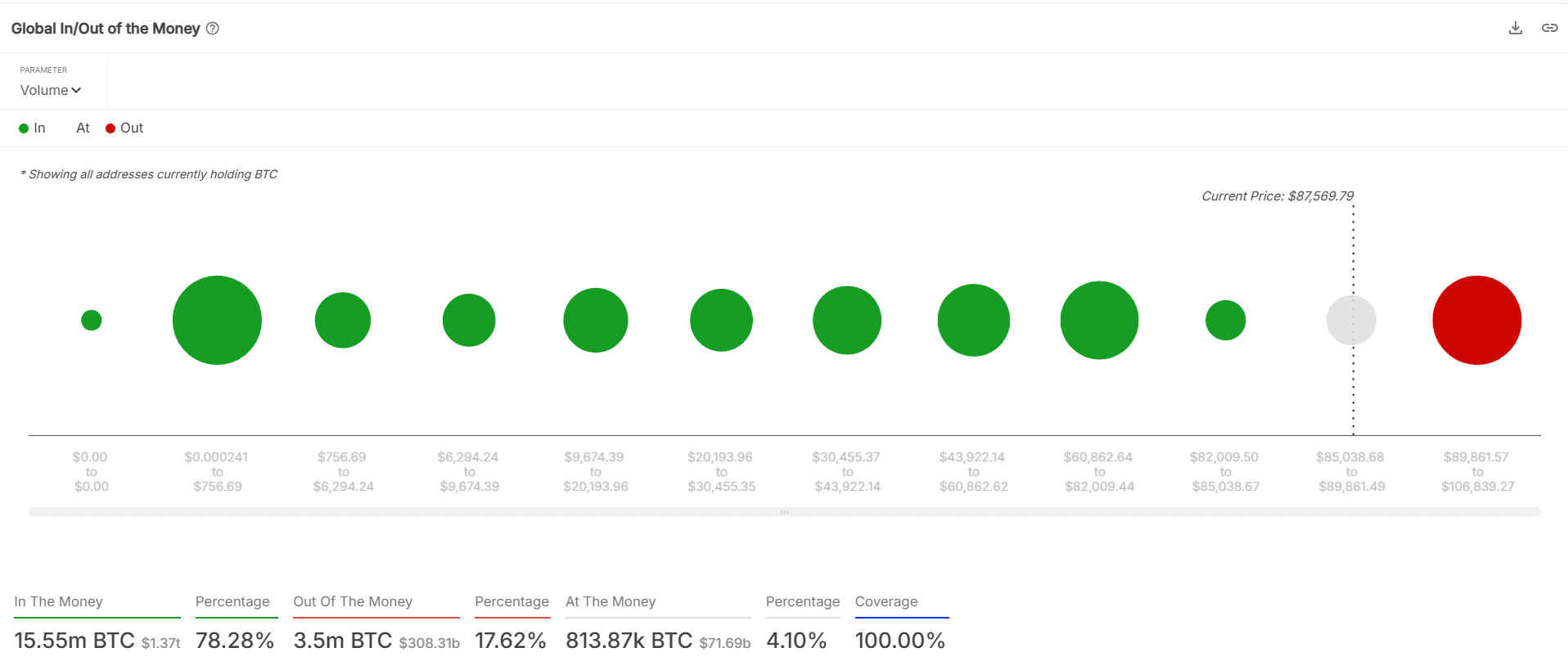

What does BTCs in/out of the money distribution tell us?

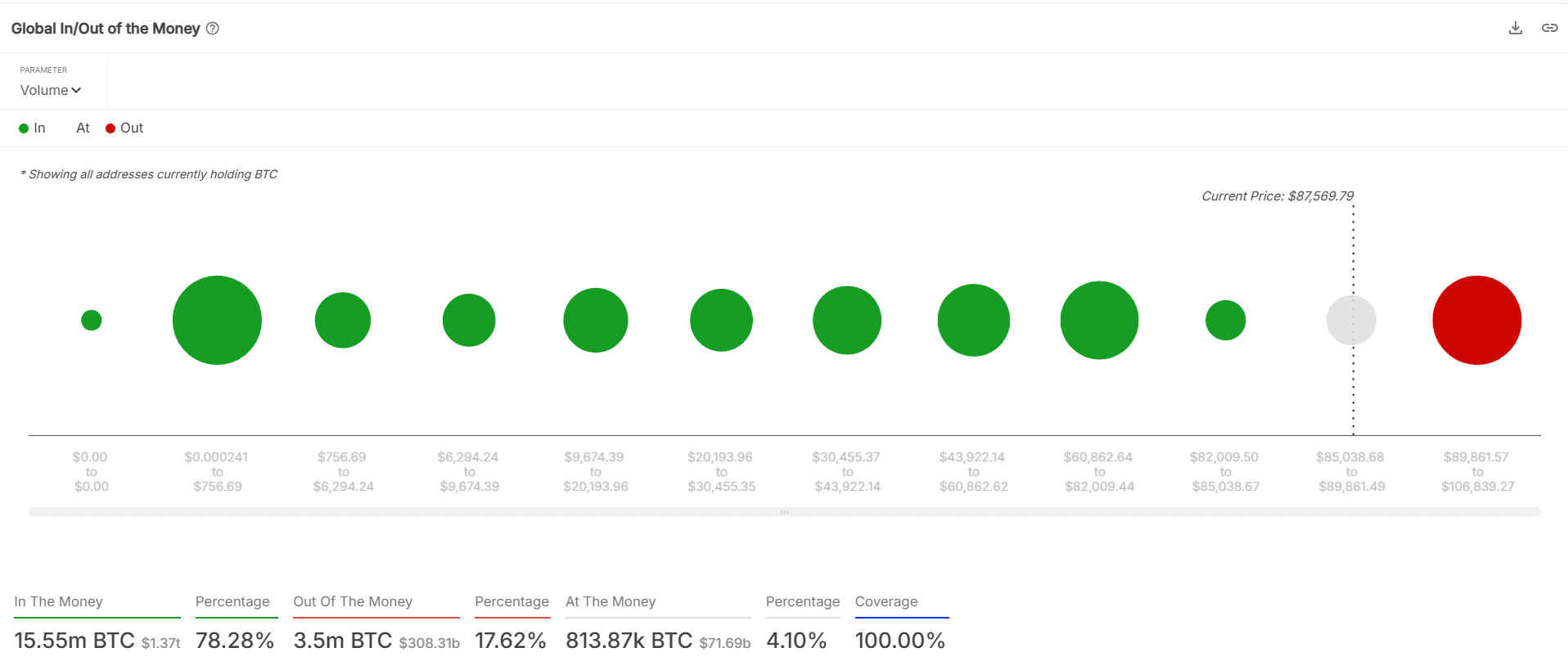

Looking at Bitcoin’s in/out of the money graph, the most addresses that BTC owns are, with 78.28% of the addresses “in the money”.

This distribution is important because it indicates strong support levels under the current price.

Moreover, it suggests that the market sentiment is generally bullish, because most holders have a profit. The absence of considerable losses in BTC companies can be a sign that the price has sufficient upward momentum to prevent a considerable withdrawal.

Source: Coinglass

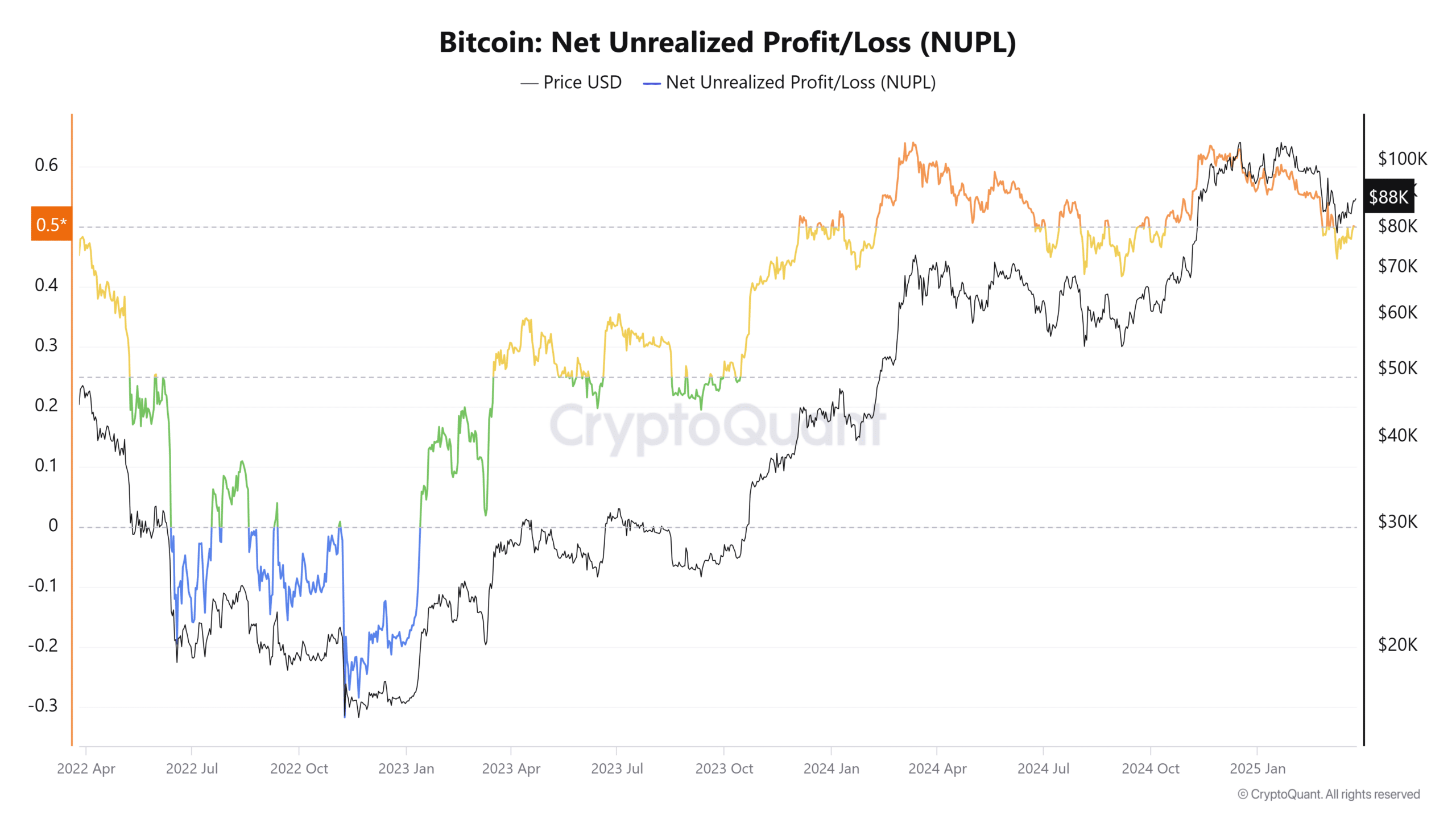

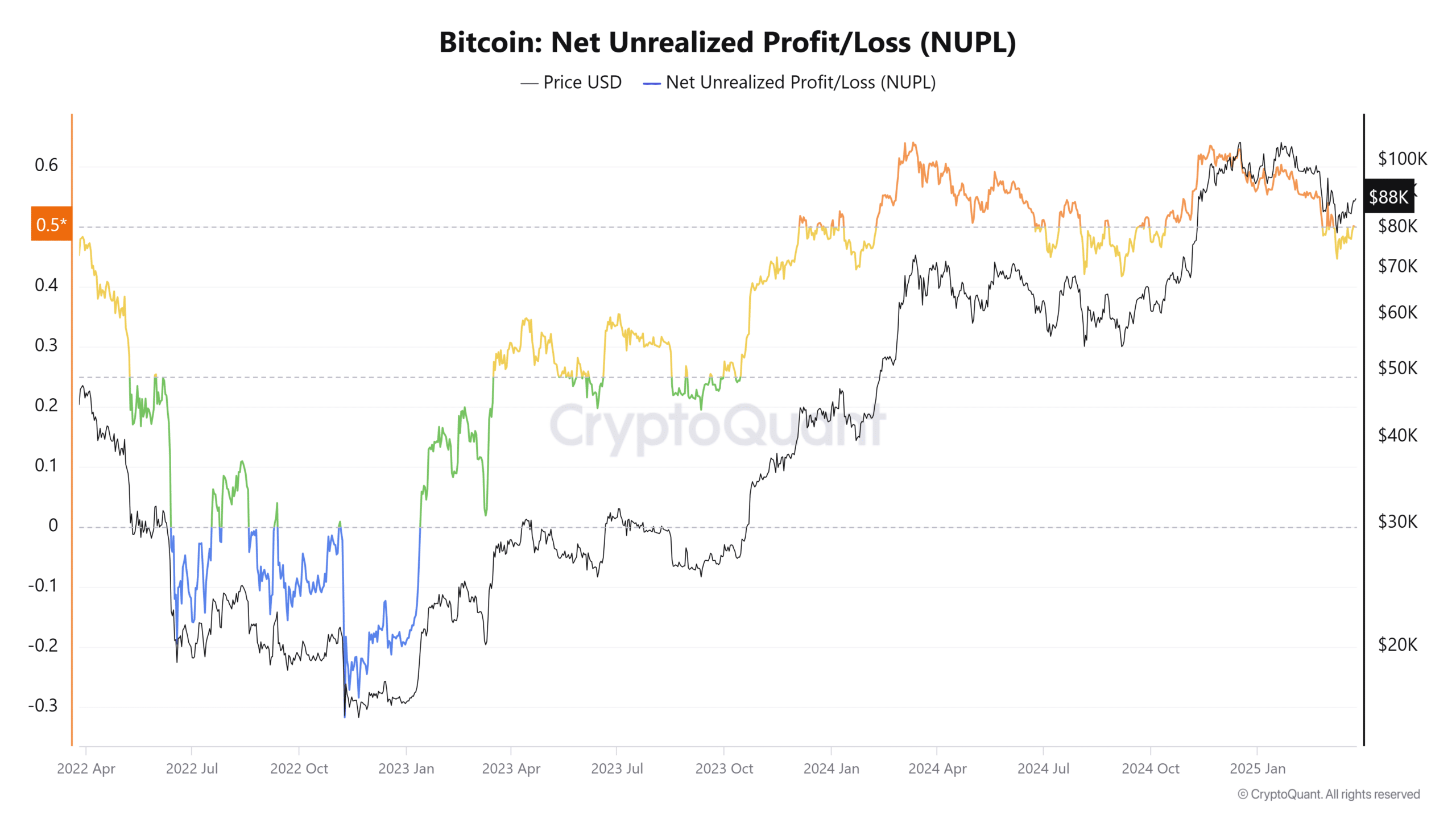

Has Bitcoin’s NUPP a positive trend suggested?

At the time of writing, Bitcoin’s Netto was not -realized profit/loss (NUPL) at 0.501, which shows that the market is in a profit zone.

A positive NUPL reflects a strong market sentiment, in which most Bitcoin holders enjoy non -realized profit.

Source: Cryptuquant

How are whale and institutional activity that influence the BTC market?

The whale activity of Bitcoin is remarkable, emphasized by the recent transfer of 2,760 BTC. Institutional investors, such as BlackRock, also collect significant amounts of Bitcoin.

Earlier this year, BlackRock bought $ 42 million from BTC, which strengthened the prevailing bullish sentiment. In combination with whale movements, this institutional activity indicates that important players are preparing for possible future price increases.

What for BTC now

With stable mining reserves, a positive NUPL and an outbreak of a falling trend line, Bitcoin appears for an upward movement.

Institutional accumulation, including BlackRock’s Bitcoin -purchase of $ 42 million, in addition to remarkable whale activity, adds fuel to this potential rally.

The coming days will be crucial to determine whether BTC can keep its momentum and solidify a stronger bullish trend.