Despite more of Bitcoin’s total supply having been “inactive” for more than a year, recent data revealed impressive growth in the number of investors holding onto their BTCs during the rally.

Bitcoin HODLing Gaps for Growth with Less Supply

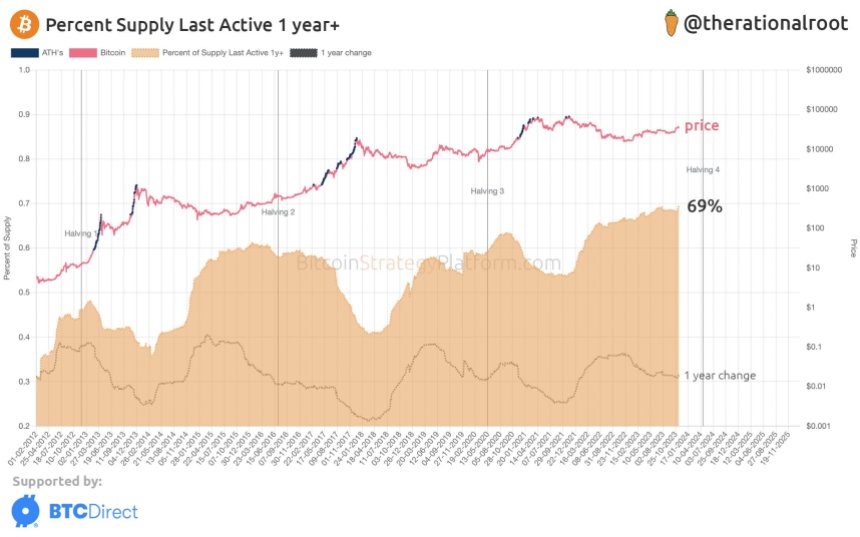

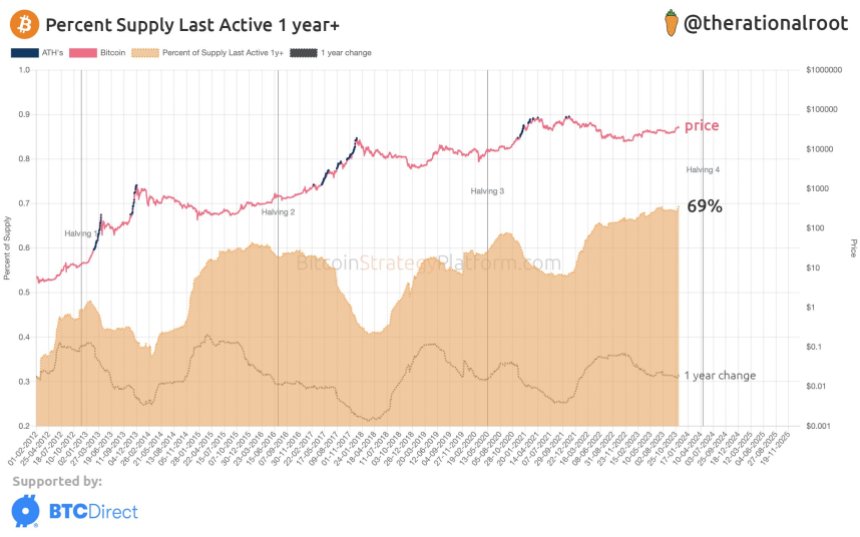

On Wednesday, November 15, a crypto analyst known as Root took to his official X account (formerly Twitter). part valuable data about Bitcoin. An annual BTC supply chart also accompanied the analyst’s X-post.

According to the analyst, a significant portion of BTC’s total supply has been inactive for over a year. Additionally, idle supply recently reached an all-time high (ATH) of 69%. The analyst stated:

A record high 69% of #Bitcoin supply has been inactive for over a year. Carrot mentioned.

This offer for a year or more is only part of a larger group known as long-term holders (LTHs). One of the two main groups of Bitcoin investors consists of these LTHs, while the other is known as short-term holders (STHs).

Investors who hold coins for more than five to six months are classified as long-term holders. Meanwhile, those who do not hold coins for more than this certain amount of time are classified as short-term holders.

Furthermore, those that have crossed the one-year mark would be considered “reliable gems” even among LTHs. However, this variety currently comprises most of the supply. This also seems to have increased significantly recently, as the chart indicates.

According to statistics, holders are less likely to exchange their coins the longer they remain inactive. This often makes LTHs the most committed segment of the market during periods of Bitcoin upside or downside.

The double top pattern resurfaces and drives the crypto into a downtrend

BTC recently formed a double top pattern near the $38,000 level, sending the token lower. The price is now below 100 per hour Simple moving average and the $36,500 limit.

However, it appears that the bulls settled around $36,500, allowing the token momentum to maintain between $36,000 and $36,500. After forming a low at $36,517, the price is currently correcting losses.

So far, there are no claims that the increase in Bitcoin HODLing has caused BTC price growth. Nevertheless, this recent development offers potential for the crypto asset over time if it continues.

Currently, the price of BTC stands at $36,422 at the time of writing, indicating a decline of 2.94% in the past 24 hours. The asset’s 24-hour trading volume has also experienced an 8% decline, valued at $26,113,638,790, according to CoinMarketCap.

Featured image by iShock, chart by Tradingview.com