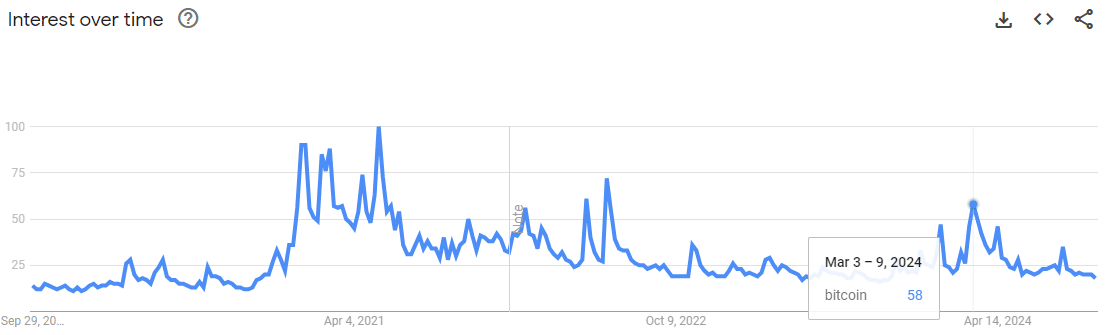

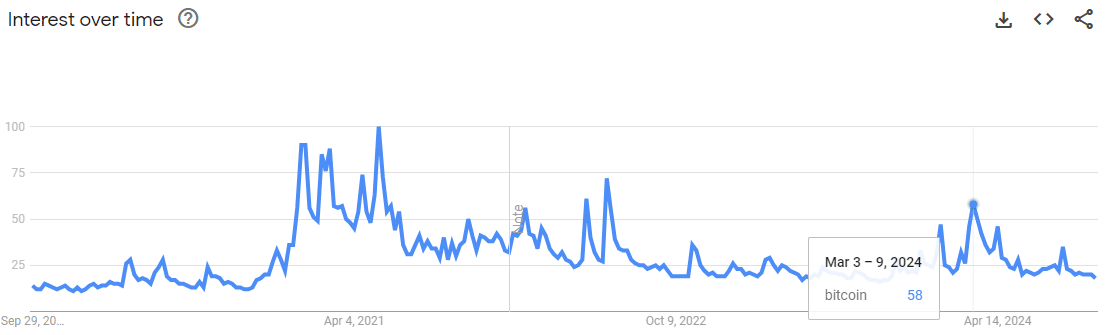

- Bitcoin’s popularity is still a small fraction of what it was in March 2024.

- The market cap charts gave bullish signals for the long term.

Bitcoin [BTC] Market sentiment started to turn bullish. The Crypto Fear and Greed Index stood at 63, showing that greed prevailed in the market after BTC raced past the $64,000 resistance zone.

In one message on Xuser Alex Becker noted that despite the excitement within the crypto community, interest from the broader market was minimal. It was just a fraction of the frenzy we saw during the 2020 run.

Source: Google Trends

A look at the popularity of the term ‘Bitcoin’ on Google Trends underlines this point. It reached the peak of its popularity in the first half of 2021. During the rally from October last year to March 2024, BTC’s popularity reached a score of 58.

In contrast, the score it achieved last week was 20. This meant that Bitcoin searches are just a third of what they were earlier this year, with the king of crypto trading just 11% below its all-time high.

AMBCrypto took a closer look at other charts to understand what this means for the broader crypto market.

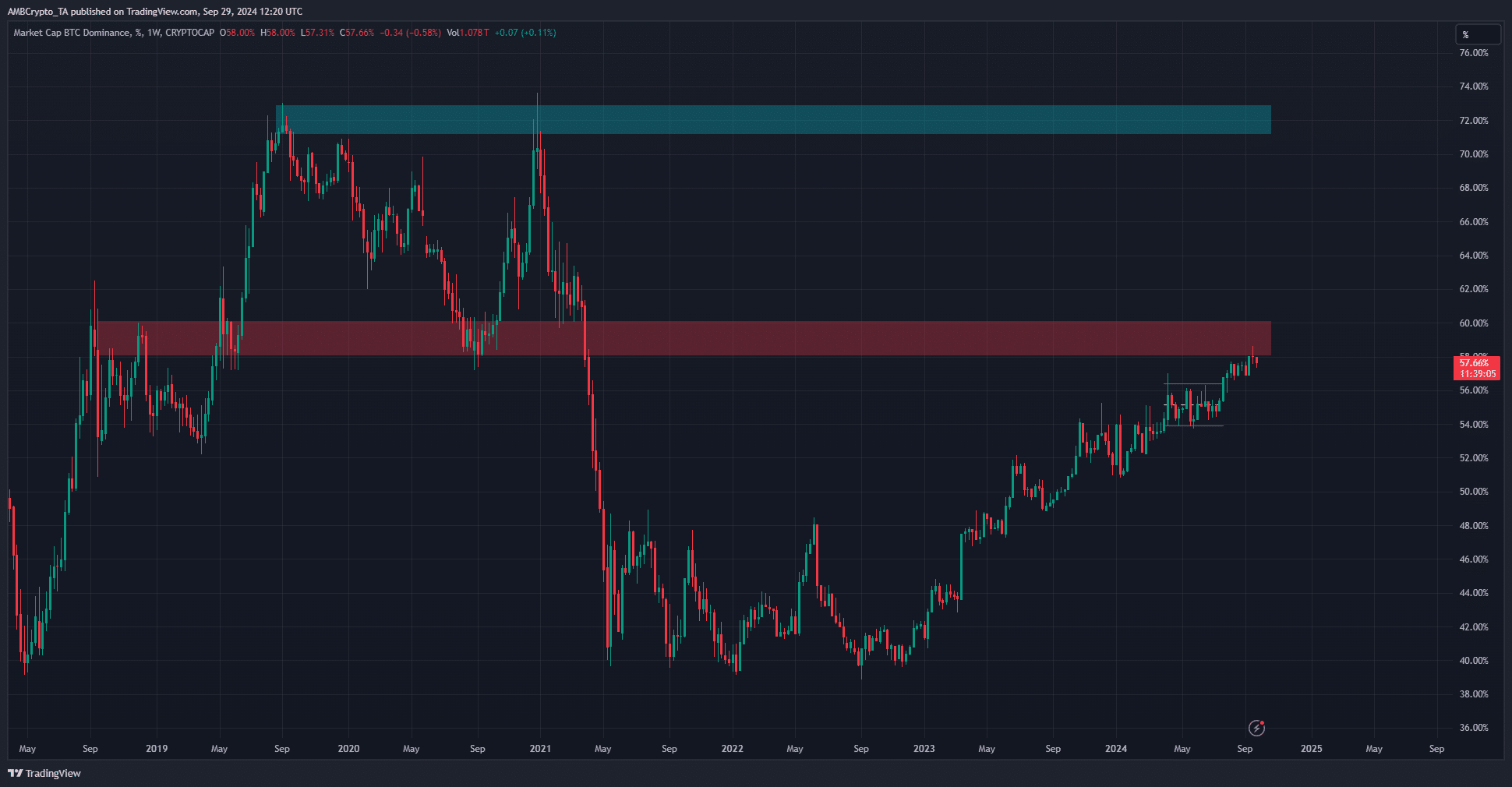

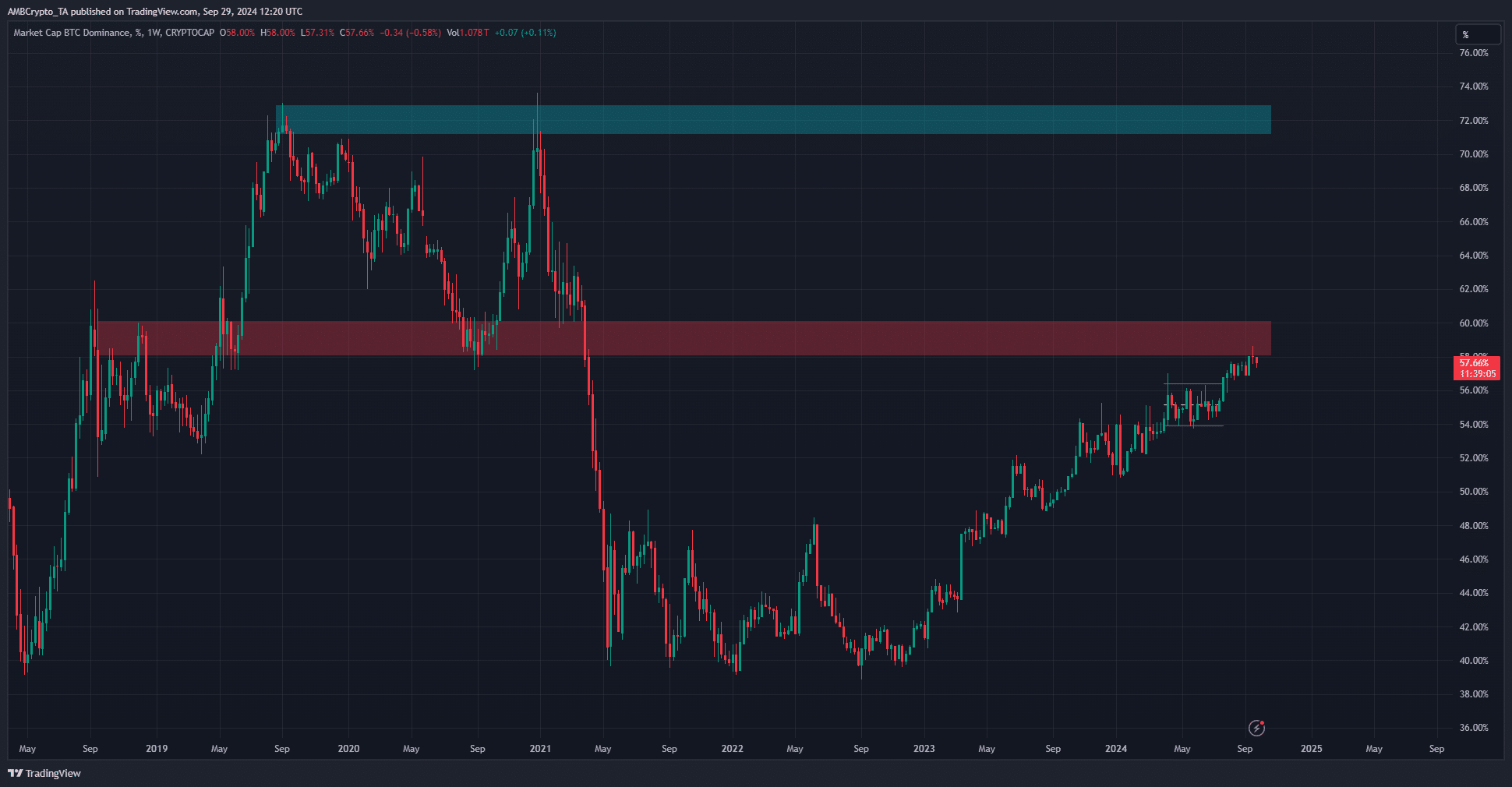

Bitcoin dominance is the key to understanding the flow of capital

Source: BTC.D on TradingView

At the time of writing, the total crypto market capitalization was $2.3 trillion. Bitcoin Dominance, or BTC’s share of the total market capitalization, stood at 57.66%. The weekly chart depicted the 60% area as a resistance zone.

The BTC.D chart generally has an inverse correlation with how well alts perform. A decline in BTC.D means that the market capitalization of altcoins will rise faster than that of BTC, which would be a positive development for the alt market.

However, compared to the 2020 cycle, we see that it would be ideal if Bitcoin can start a long-term upward trend to attract capital to the crypto market. Once it does, this capital can ‘rotate’ into other altcoin sectors, benefiting traders and investors.

Long-term investors can use this dominance chart to understand whether Bitcoin or the altcoins are the focus of the market at any given time.

Another positive sign for the alt season

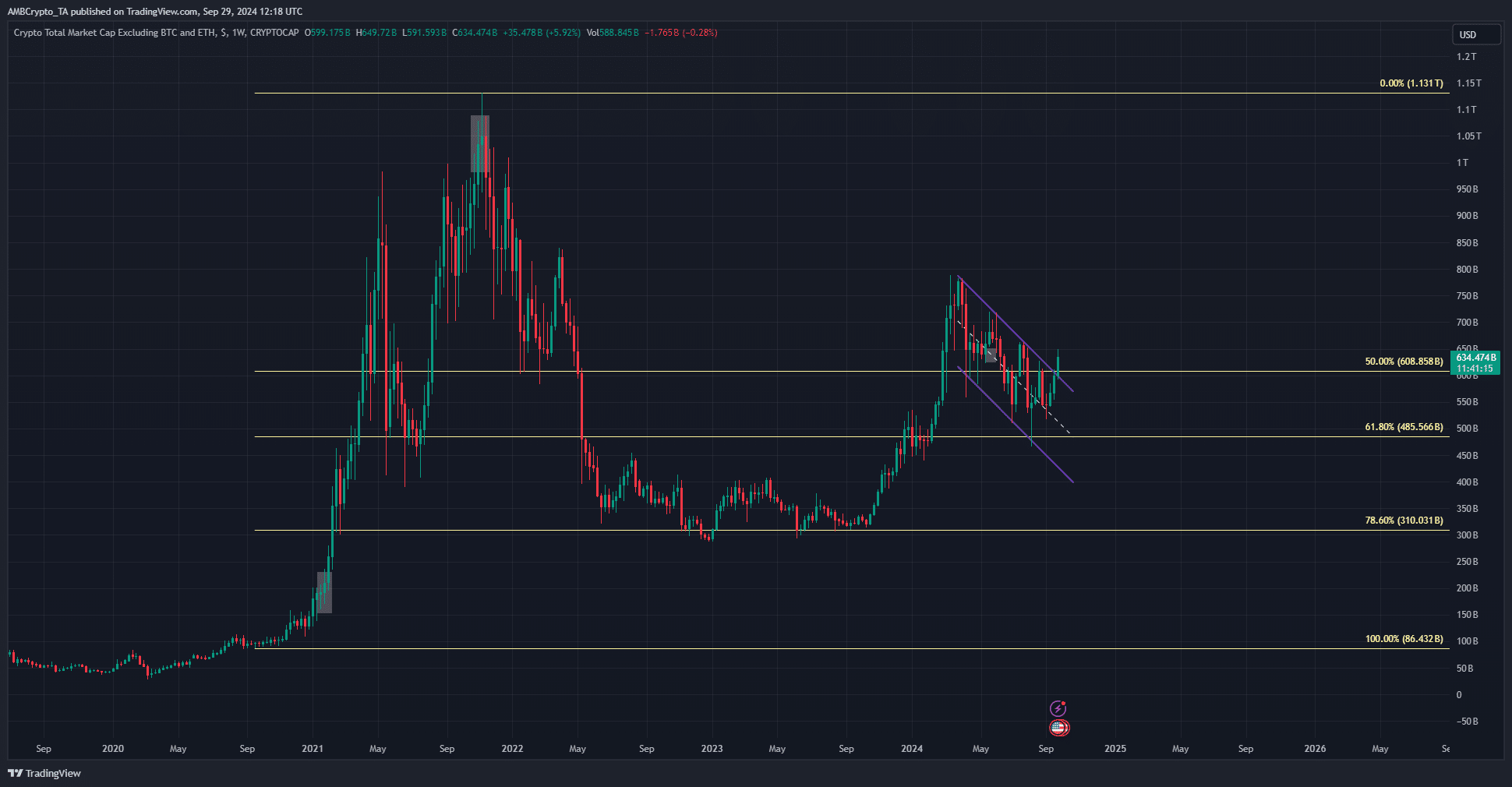

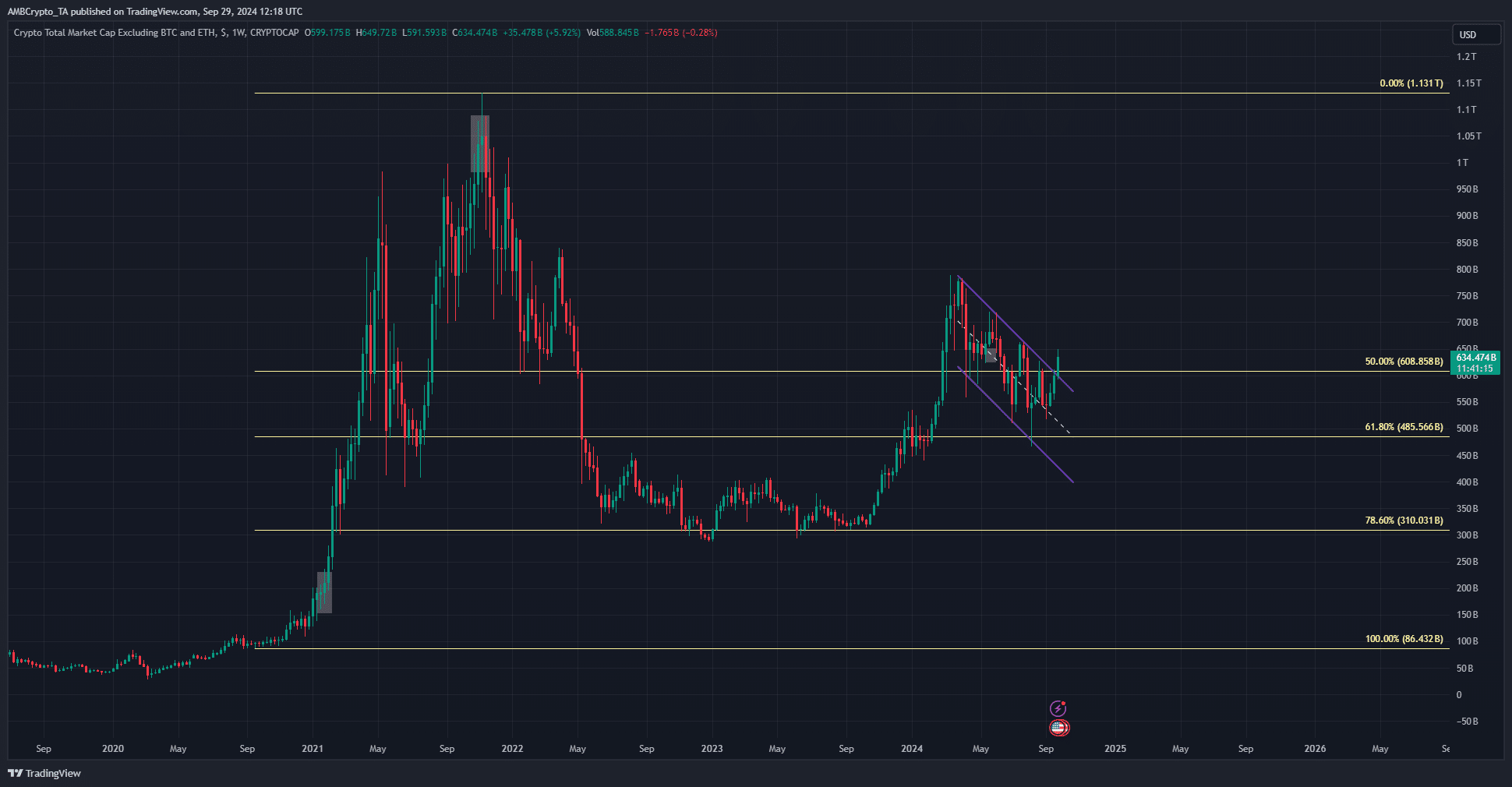

Source: TOTAL3 on TradingView

The market capitalization of the major crypto assets, excluding Bitcoin and Ethereum [ETH] are shown in the graph above. It broke out along a descending channel formation.

Read Bitcoin’s [BTC] Price forecast 2024-25

In doing so, it also breached the 50% Fibonacci retracement level of the 2020 bull run.

This set the stage for strong altcoin performance in the coming months. From a technical perspective and looking at historical trends, the only way the crypto market can develop is with an increase over the next three to six months.