Bitcoin vs. Gold: The Digital Currency’s Journey to $40,000

2020 was pivotal for Bitcoin and gold, with fiscal and monetary stimulus boosting their appeal. Bitcoin, however, is distinguished by its limited supply of 21 million coins, which contrasts with gold’s continued but modest annual supply growth.

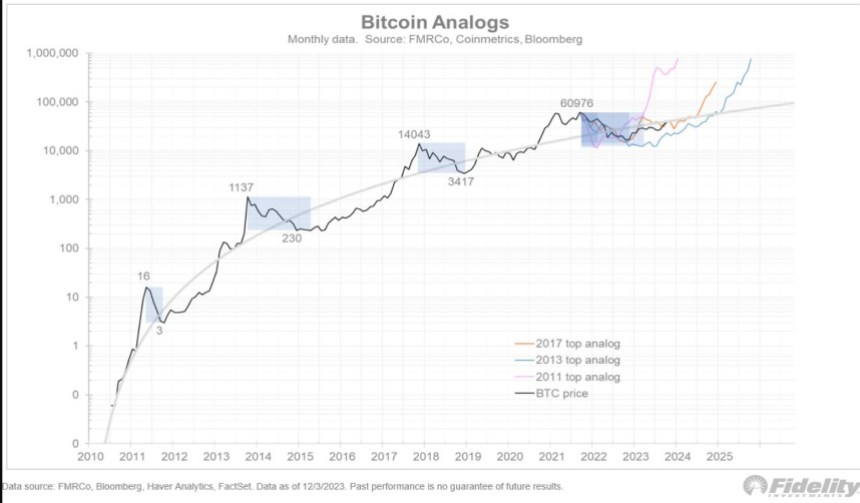

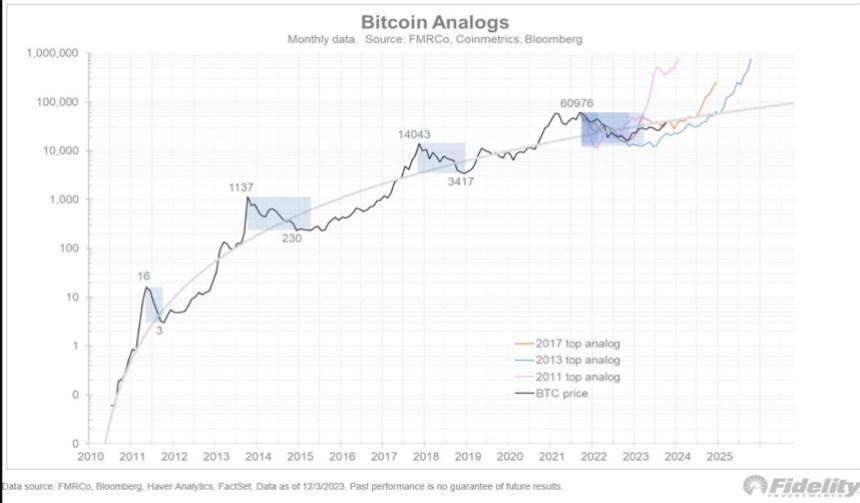

This limited supply has caused Bitcoin’s stock-to-flow (S2F) ratio to become significantly higher than that of gold. Moreover, Bitcoin’s journey reflects the classic S-curve path of technological innovations. The exponential growth trajectory reflects historic technology trends, from railroads to cell phones.

However, predicting Bitcoin’s future based on these S-curves is complex, as small deviations in these growth phases can “dramatically” change the outcomes, the expert claims.

SEC deliberations and institutional interests determine Bitcoin’s future

Timmer’s observations include a possible impact of the SEC’s expected decisions on the Bitcoin spot Exchange Traded Fund (ETF). He theorizes that pending product filings could attract new investors, but he remains cautious about whether this will trigger a sell-the-news event and a major pullback.

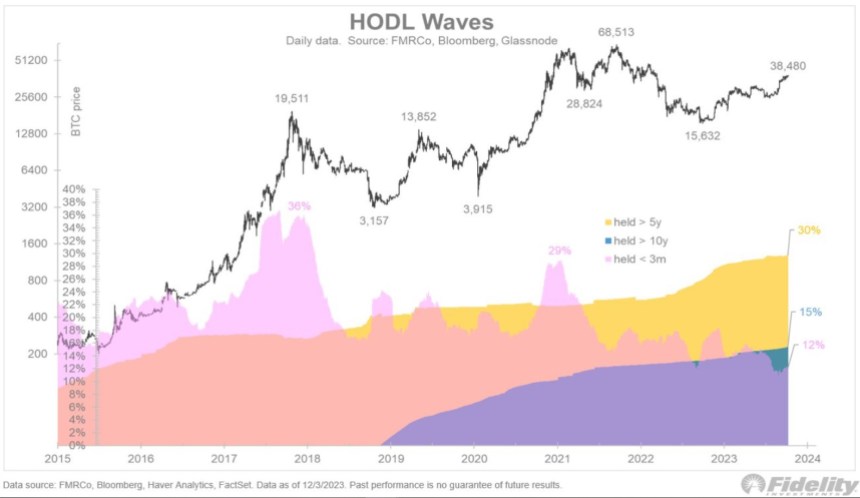

Interestingly, a small percentage of Bitcoin is holding for less than three months, indicating that the recent price rise is not purely ‘speculative’, and provides support for a longer bullish trend.

True believers in Bitcoin are unlikely to be swayed by short-term news, as evidenced by the growing percentage who have owned it for more than five or ten years. However, there is notable activity in the Bitcoin futures market, especially among asset managers, which could indicate anticipation of the SEC move.

Any updates from the SEC would come amid a transformed macroeconomic environment. In contrast to the liquidity-rich period of 2020-2021, the recent policy changes of the US Federal Reserve (Fed) have reversed the increase in monetary inflation.

This shift brings the current situation more in line with the post-World War II era than the inflationary 1970s, and impacts the urgency of the value proposition for gold and Bitcoin.

As BTC matures, its relationship with traditional financial markets and global economic trends becomes increasingly complex. With the SEC’s decision and a shift in the macro arena, the coming months are poised to impact the major cryptocurrency and emerging sector.

Cover image from Unsplash, chart from Tradingview