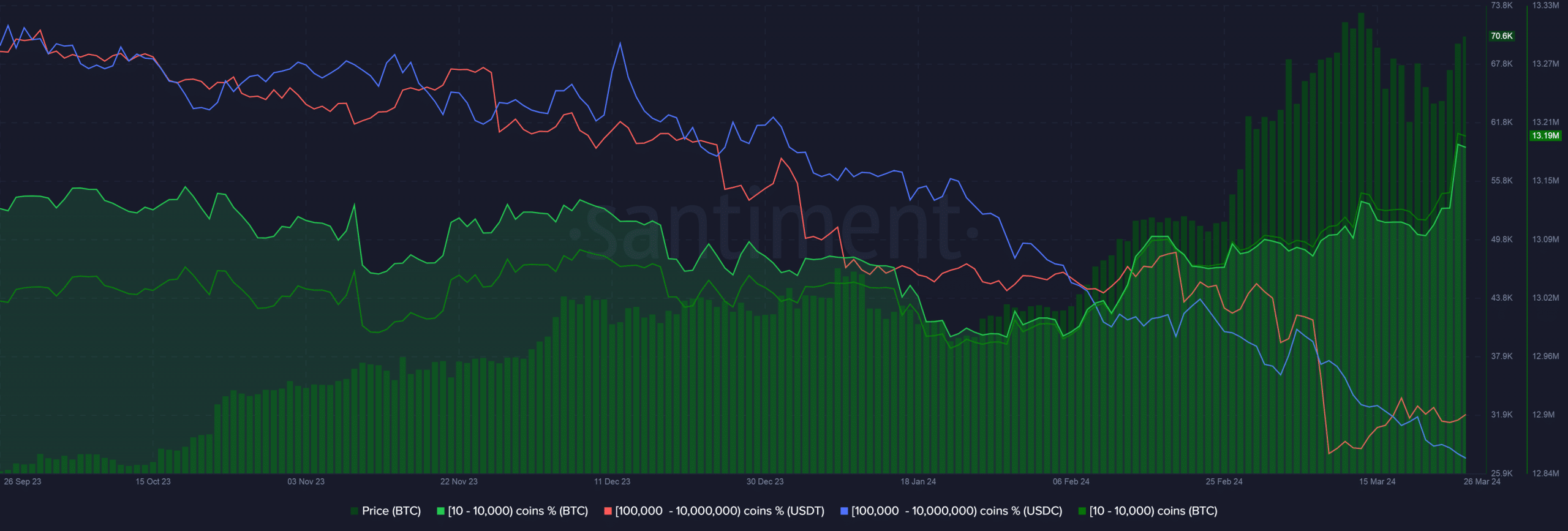

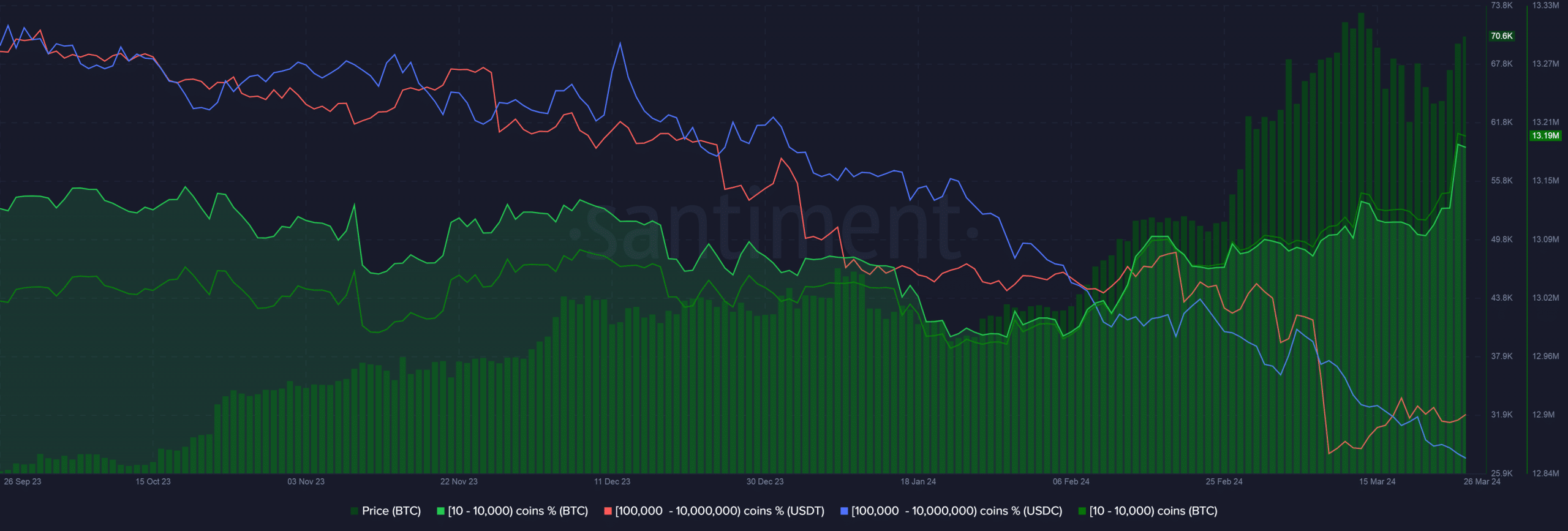

- Supply in coin wallets ranging from 10 to 10,000 coins rose to a 20-month high.

- One analyst noted that Bitcoin is more likely to reach $72.8k in the coming days.

Investors started to increase Bitcoin [BTC] exposure in their portfolios as the countdown to the economically significant halving event began.

Pre-halving bullishness is taking shape

According to an analysis company in the chain SantimentWallets holding between 10 and 10,000 coins accumulated a total of 51,959 BTCs on March 24, representing one of the largest accumulation days in recent history.

To put this into perspective, almost 0.263% of the total circulating supply of BTC was snapped up by this cohort in just one day.

Source: Santiment

With the latest grab, the aforementioned group’s total supply rose to a 20-month high of 13.19 million. Additionally, the cohort’s supply reached 67%, the highest since July 2023.

Santiment stated that it would be “not surprising” to see more accumulation activity from these portfolios as the halving was imminent.

This quadrennial event, which cuts block rewards by half and slows the creation of new coins, could be a major bullish trigger for the world’s largest digital asset.

The supply squeeze, coupled with growing demand from the new US spot ETFs, had the potential to further inflate Bitcoin’s price.

Ownership of stablecoins is falling sharply

Interestingly, the stablecoin reserves of these whales and sharks fell sharply. Portfolios holding 100,000 to 10 million USDTs saw their holdings fall to lows not seen since January 2023.

Similarly, the 100,000 to 10 million USDC cohort had the lowest amount since March 2023.

This implied that future accumulation activities would not be entirely driven by stablecoins. Instead, they could be used as a dry powder, allowing investors to use them for strategic investments or emergency situations.

Next goal: $72,800

At the time of writing, BTC was exchanging hands for just over $71,000 per CoinMarketCap.

Read Bitcoin’s [BTC] Price forecast 2024-25

According to the popular technical analyst Ali Martinezthe king could rise to $71,800 in the short term, provided support at $70,400 holds.

Moreover, in one of his previous predictions, he expected the price to reach $72,880 once it came out of the correction phase. It would be interesting to see how accurate his predictions turn out to be.