Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disphonible and Español.

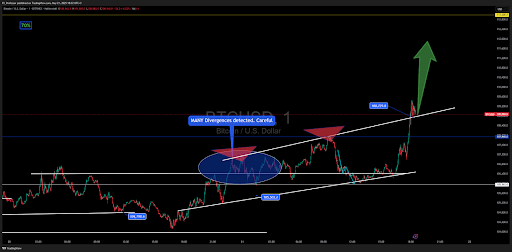

The price promotion of Bitcoin in the last 24 hours was nothing less than remarkable. After consolidating for several days in a tightening, the market broke past $ 105.503 support that the resistance has achieved earlier in the week and started a steep climb in the earlier trading day. This has been able to push Bitcoin in a new high level of all time, And shows no signs of delay.

Interestingly, the technical analysis shows that the rally is gone An approach to a golden cross Between the 50 and 200-day progressive averages, but FX_Professor offered a different view of the much celebrated Golden Cross.

Analysts disputes Golden Cross -Hype as late signal

In a recent Analysis published on TradingViewFX_professor discussed a different view of Bitcoin’s Golden Cross. While most market commentators interpret this crossover of the 50-day simple advancing average above 200 days as a strong bullish confirmation, the analyst rejected it as a delayed indicator. The analyst described it as the afterparty where retail investors appear on the scene.

Related lecture

Instead of waiting for the golden Cross to flash greenFX_Professor noted pre-indication pressure zones as the real signal of value. In the case of the Bitcoin price action in recent months, the analyst in the region of $ 74,394 and $ 79,000 pointed as the zone of accumulation and early positioning, well before the Golden Cross became visible. As such, by the time the cross appeared recently, the price action of Bitcoin had already risen considerably.

The Golden Cross is often used by traders as a signal to introduce a long position, because it suggests that the price of the asset is likely to continue to rise. However, this analysis follows a trend with experienced traders who consider Golden Cross as more a lagging confirmation than a trigger of a rally.

Zones and structure of early input matter more, says Analyst

According to FX_Professor, indicators such as EMAs or SMAs can be useful, but they should never come before they understand the price structure, trend lines and real -time pressure zones. He shared a snapshot of his own Bitcoin price diagram that combines adapted EMAs with a characteristic parallelogram method to detect where the price voltage starts to build. Visible on the graph are submissions that are already in April when Bitcoin bounced with support about $ 74,000Long before the crossover confirmation.

Related lecture

Now, with Bitcoin push To the next target zone Almost $ 113,000, the strategy of the analyst continues to validate himself in real time. Nevertheless, the confirmation of a Golden Cross is still bullish for the Bitcoin price action, even if the price rally is already halfway through the peak level.

At the time of writing, Bitcoin acts at $ 110,734. This is a slight withdrawal of the new of all time of $ 111,544, which was registered only three hours ago. The Bitcoin price has still increased by 3.1% in the last 24 hours, and new highlights of all time are possible before the weekly closure.

Featured image of Getty Images, Chart van TradingView.com