Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin continues to act within a tight reach, consolidates below $ 85,000 and keeps it above the $ 81,000 support zone. Bulls are making efforts to reclaim higher levels and generate a recovery rally, but continuing macro -economic uncertainty and growing concern about global trading tensions continue to weigh on market sentiment.

Related lecture

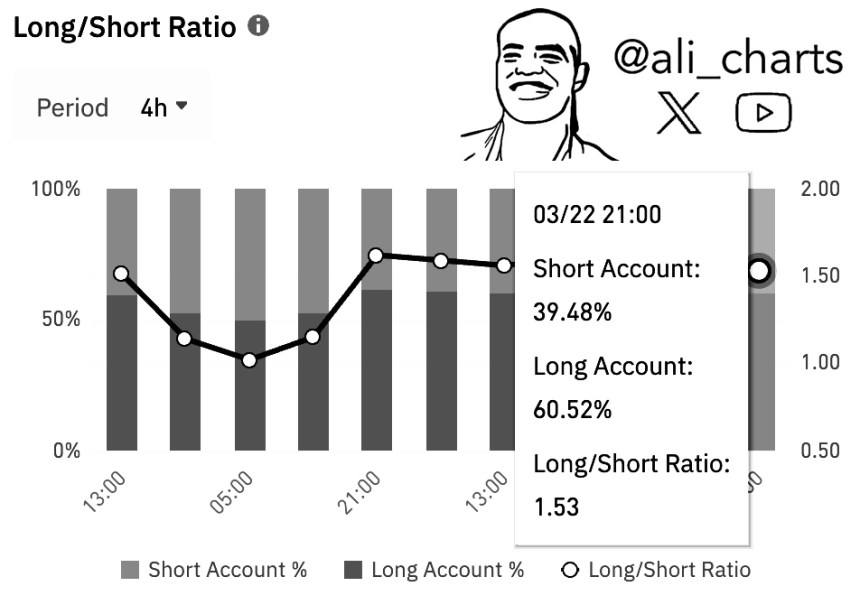

Bitcoin has bound the lack of Momentum in both directions for the past different sessions. However, optimism remains with Futures traders. According to recent data, 60.52% of traders with open bitcoin position positions on Binance Futures currently hold long positions, which suggests that a majority still believes in an upward outbreak.

This bullish leaning between leverage traders emphasizes the growing expectations that Bitcoin could recover as soon as it improves broader market sentiment. Nevertheless, the consolidation pattern remains in its place until BTC can decide above the level of $ 85k and focuses on $ 88k or higher.

If bulls do not quickly regain resistance, the risk of a breakdown of less than $ 81k increases, which may activate a deeper correction. Because uncertainty dominates the headlines, Bitcoin continues to keep a close eye on traders for a catalyst to stimulate the next major movement.

Bitcoin investors split on market feature as long positions dominate the futures

After months of volatility and a sharp correction of Bitcoin’s January of all time, some market participants prepare for a long -term Bear market. Sentiment among this group is driven by persistent macro -economic uncertainty, irregular global policy shifts and increasing concern about recession, all of which have shaken confidence in both crypto and traditional markets.

However, there remains a more optimistic vision of analysts who claim that the current price promotion is simply a healthy correction within a larger bull cycle. They believe that Bitcoin undergoes a standard consolidation phase after the parabolic movement at the end of 2024 at the end of 2024. The structural fundamentals that support Bitcoin – including growing institutional importance and wider adoption – intact.

To support this display, top analyst Ali Martinez shared one Most important metric on x: The Bitcoin long/short ratio between Binance Futures. Martinez revealed that 60.52% of traders with open BTC positions are currently leaning, which indicates a bullish sentiment among Futures traders.

This bullish direction in lifting tree positions suggests that a potential outbreak can be on the horizon. If bulls can regain resistance levels near $ 88k and be able to push above $ 90k marking, this can confirm the start of a recovery rally and help restore confidence.

Related lecture

Until that time, indecision continues to dominate the market, and Bitcoin remains trapped in a tight reach where both scenarios – a deeper correction or a bullish breakout – are on the table.

BTC -Price range narrower if key resistance is strong

After a few days of tight consolidation, Bitcoin (BTC) acts between $ 87,000 resistance and the support level of $ 81,000. Despite recent attempts to push higher, Bulls have difficulty breaking the key resistance, making the price range bound and vulnerable to sudden volatility.

BTC is currently approximately 4% below the 4-hour 200-day advancing average (MA) and exponentially advancing average (EMA). These indicators, who now act as dynamic resistance around $ 87,300, are generally viewed by traders as crucial trend signals in the short term. Reclaiming this zone as support could be the catalyst for a recovery rally in the direction of the $ 90,000 marking, so that sentiment is traced back in favor of the bulls.

Related Reading: Investors spend 360,000 Ethereum out of stock markets in just 48 hours – accumulation trend?

The failure to break above this technical ceiling, however, shouts worries. If the price promotion remains weak and the 200 MA and EMA does not re -seize in the upcoming sessions, the risk of a drop in a drop under support of $ 81,000 increases. Such a movement would not only cause a new sales pressure, but could also send BTC to a deeper correction area.

Featured image of Dall-E, graph of TradingView